Bond markets came under pressure at the long end of the curve. While the 2yr remained flat at 4.76%, the 5yr, 10yr and 30yr all rose 5 bps to 7 bps to 4.43, 4.47%, and 4.63%. This followed a selloff in Europe, where German and UK yields were all sharply higher. Fed New York President John Williams noted he continues to believe price pressures are moderating back to the 2% target. Market consensus is for the Fed to start easing in September with two cuts priced by year-end.

The technical set-up for the US10-yr bond continues to screen bearish. The yield on the 10s has continued to coil up within a triangle range above the primary uptrend, which still favours a topside breakout and resumption of the upward trend. The rally in the 10-yr bond and decline in yield to 4.2% has run out of momentum. Only a break below the primary uptrend (at 4.2%) refutes the bearish outlook for bonds.

Source: Thomson Reuters

Crude oil surged on Monday, with WTI and Brent jumping 2% to $83.39 and $86.70. Comex gold edged higher to $2341 while silver added 1% to $29.50. Copper added 0.6% along with all the base metals which were higher. Soft ag commodities and the grains were also higher. Lumber on the other hand was lower.

First up, the International Monetary Fund has singled out the US on trade policy and consistent deficits. While the IMF acknowledged a “remarkable performance from the world’s largest economy with further growth to come,” some issues are becoming too pressing to ignore.

“The fiscal deficit is too large, creating a sustained upward trajectory for the public debt-GDP ratio. The ongoing expansion of trade restrictions and insufficient progress in addressing the vulnerabilities highlighted by the 2023 bank failures both pose important downside risks.”

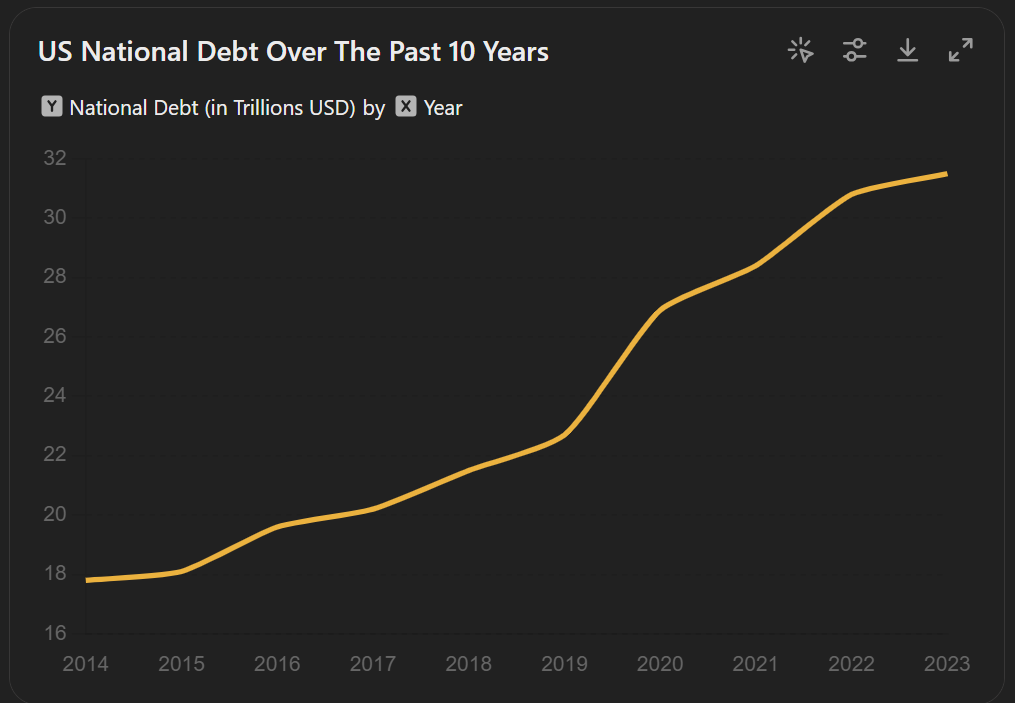

Clearly, the IMF is concerned about the rising indebtedness in the US. Ongoing deficits are steering the debt-to-GDP ratio of 140% by 2032, according to the IMF, which is a “situation that needs to be addressed urgently”. The US national debt today stands at $34 trillion, which, by the Government’s own estimates, will balloon to $56.9 trillion by 2034, a steeper increase from earlier projections. However, this might even prove conservative, given that the US debt has doubled every 10 years since the mid 1990s.

The upward trend will be exacerbated by higher interest rates as it becomes more expensive to service that debt. Above, I have included a graph of the US10yr bond yield and the bearish technical setup. There is a similar pattern with the US30yr yield, which also appears on the cusp of breaking out. With inflation trending down, what is driving the bear case for US bonds where the consensus continues to see fixed income outperforming in the year ahead?

Source: Thomson Reuters

The US national debt has been steadily increasing over the past decade due to a number of factors. Number one is government spending, which is showing no signs of slowing down. Neither the Republicans nor Democrats, regardless of who is elected in November, are likely to make much of a difference. As the population ages, social security and Medicare are also set to balloon. The US also maintains a large defence budget, which has continued to grow over the years. If Trump is elected, tax cuts are going to be likely implemented.

However, the big issue is going to be servicing the debt as the pile grows. Rising interest payments are going to surge as the national debt grows, creating a cycle where more debt leads to higher interest costs, further increasing the total debt. If the 10yr and 30yr bond yields breakout in coming months, which at this stage is the base technical case (and not what the consensus sees), then the markets are going to be concerned about this – particularly if the US dollar declines in parallel.

This is also one factor why gold has done well this year, where a stronger dollar has not been a roadblock to record highs. I expect gold to really accelerate, along with commodities (and copper) and energy when US dollar weakness finally arrives when the Fed commences easing.

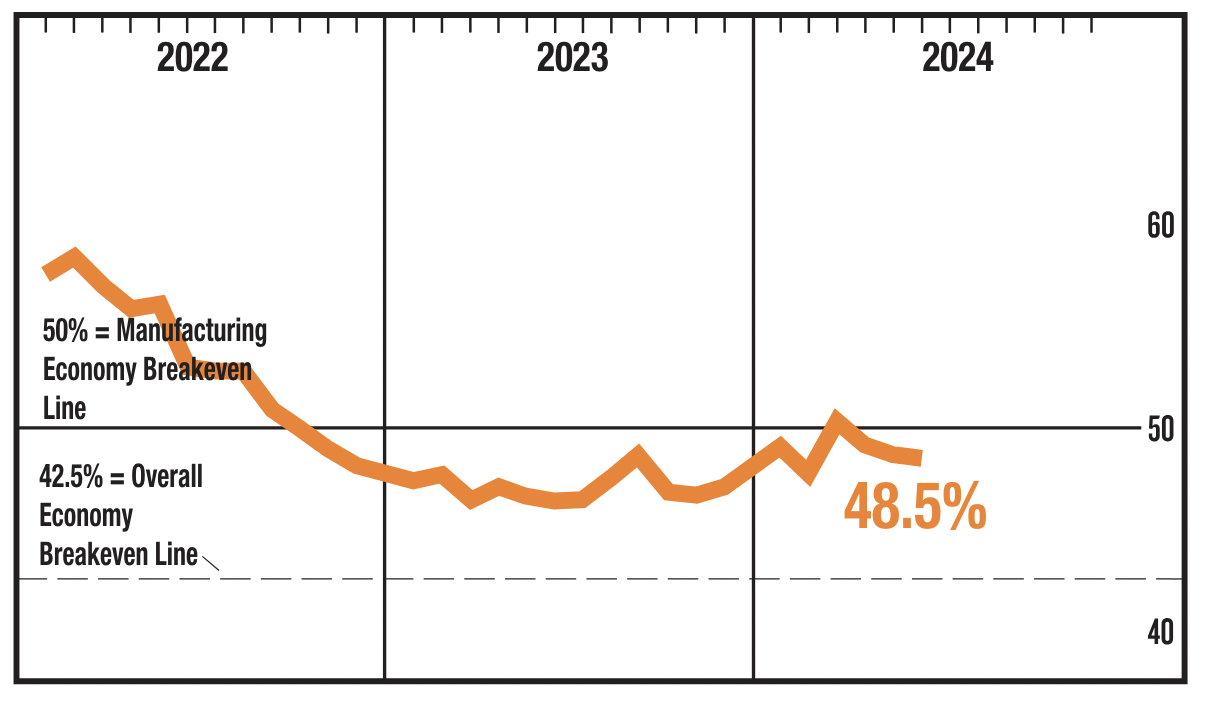

Turning to data, the closely watched Institute for Supply Management’s manufacturing PMI dipped by 0.2 points to 48.5% in June. New orders were marginally in contraction, while pricing pressures eased slightly. ISM noted that “US manufacturing activity continued to contract at the close of the second quarter. Demand was weak again, output declined, and inputs stayed accommodative.”

Manufacturing PMI – sluggish

Meanwhile, S&P Global’s manufacturing PMI was revised slightly lower, but in contrast to the ISM’s survey, the headline reading remained above 50 at 51.6 in June, indicating expansion. There are some differences in the underlying survey data, but the market gives the ISM report more weight.

Economic data was outweighed by traders continuing to monitor political events after President Biden’s debate performance last week was widely criticised, improving the odds that Trump will return to the land’s highest office. Treasuries have since fallen with yields rising.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Share The Webinar

Related Posts

Throwing a wrench

Gold made a new record high at US$2,734. The Dollar Index rose to 104 and has now rallied 4% off last month’s lows at 100. Whilst the technical setup still…

Read More