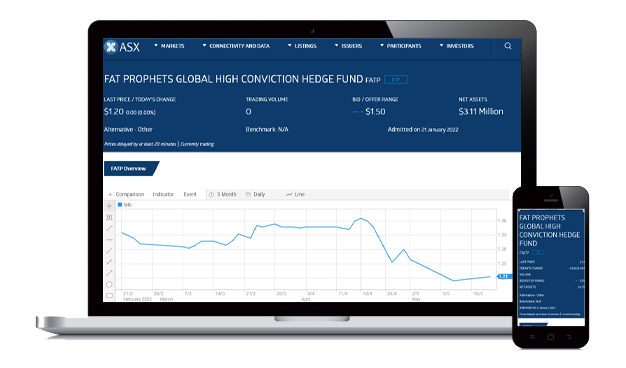

The Fund was admitted to quotation on a Securities Exchange, units in the Fund are traded on a Securities Exchange like any listed security. Investors application monies are pooled together with other investors’ money. Fat Prophets pools the application monies of all unit holders to buy investments and manage them on behalf of unit holders in accordance with the Fund’s investment strategy. By investing in the Fund, unit holders have access to investments they may not be able to access on their own and benefit from the investment capabilities of Fat Prophets’ investment team. The Fund serves as an efficient mechanism to invest on behalf of all unit holders.

The investment process combines top down fundamental qualitative and quantitative research with company valuations based on an analysis of forecast future cash flows. Stock weightings typically range from 2% to 10% depending on risk weights applied. That results in a diversified portfolio with the number holdings in the range 20 – 50.

Investment risk is primarily managed through close analytical attention. Capital preservation can be managed by holding up to 100% cash. Index and currency options and futures exchange traded funds and spot FX transactions may also be used to manage risk. Forward foreign exchange contracts may also be used to manage currency risk.