A key part of the Fat Prophets investment strategy and service is to adopt a top down investing approach. Throughout our 20-year history, we have made the big picture calls and pride ourselves on getting far more right than wrong. These have also shaped our sector and stock selection. Below is a chronological review of our Hall of Fame with respect to our big picture macro calls.

Hall of Fame

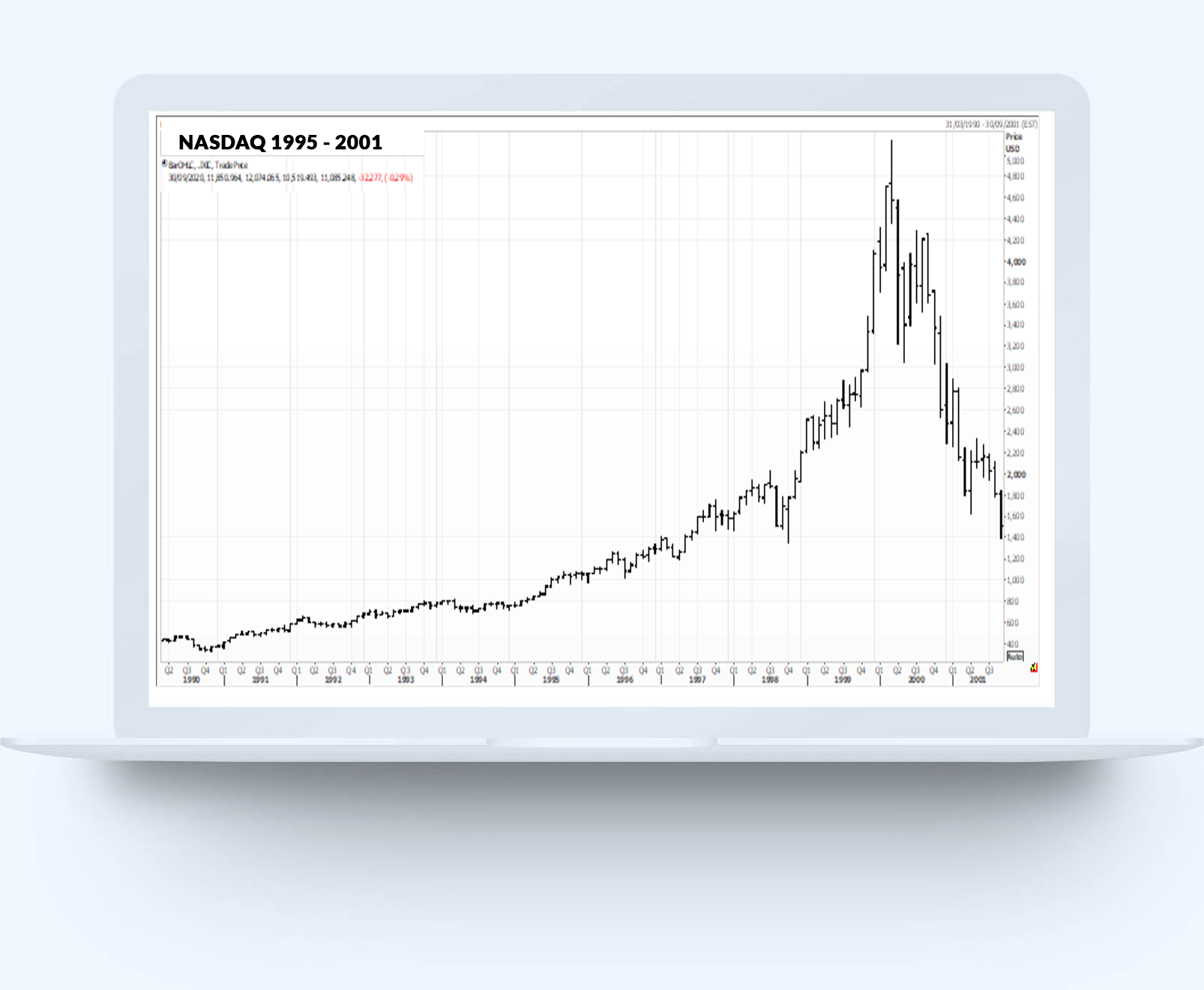

March 2000

It was in March 2000, just 6 months prior to Fat Prophets being established, and CEO and founder Angus Geddes made the call to avoid internet and technology stocks, which by then had become massively overvalued in what was a classic bubble. He recalls having conversations with clients about the tech bubble and the coming crash, many of which fell on deaf ears. He then decided to leave broking and swap the “spoken word” over the phone for the “written word” where members could take it or leave it. That was pretty much the inspiration for establishing the firm two decades ago.

First cab off the rack was the “Tech Wreck”. When we first started out we aimed to make the tough calls on the markets that were not universally accepted or consensus at the time. In many cases we were laughed at – such as the call on the tech bubble crashing. We were told repeatedly in 2000 that “the world was different, had changed and was in a new paradigm”. And then the crash happened and the Nasdaq went down 80%. Fat Prophets rose from those embers.

Year 2000

Fresh out of the bursting of the dotcom bubble, one of Fat Prophets’ early calls was to buy gold at around US$262 an ounce. This was on the basis that the ensuing monetary easing by the Fed would erode the intrinsic value of the US$. Such was to prove correct, with the precious metals sector surging, as gold surged in the ensuing years to reach a peak of almost $1900 in 2011.

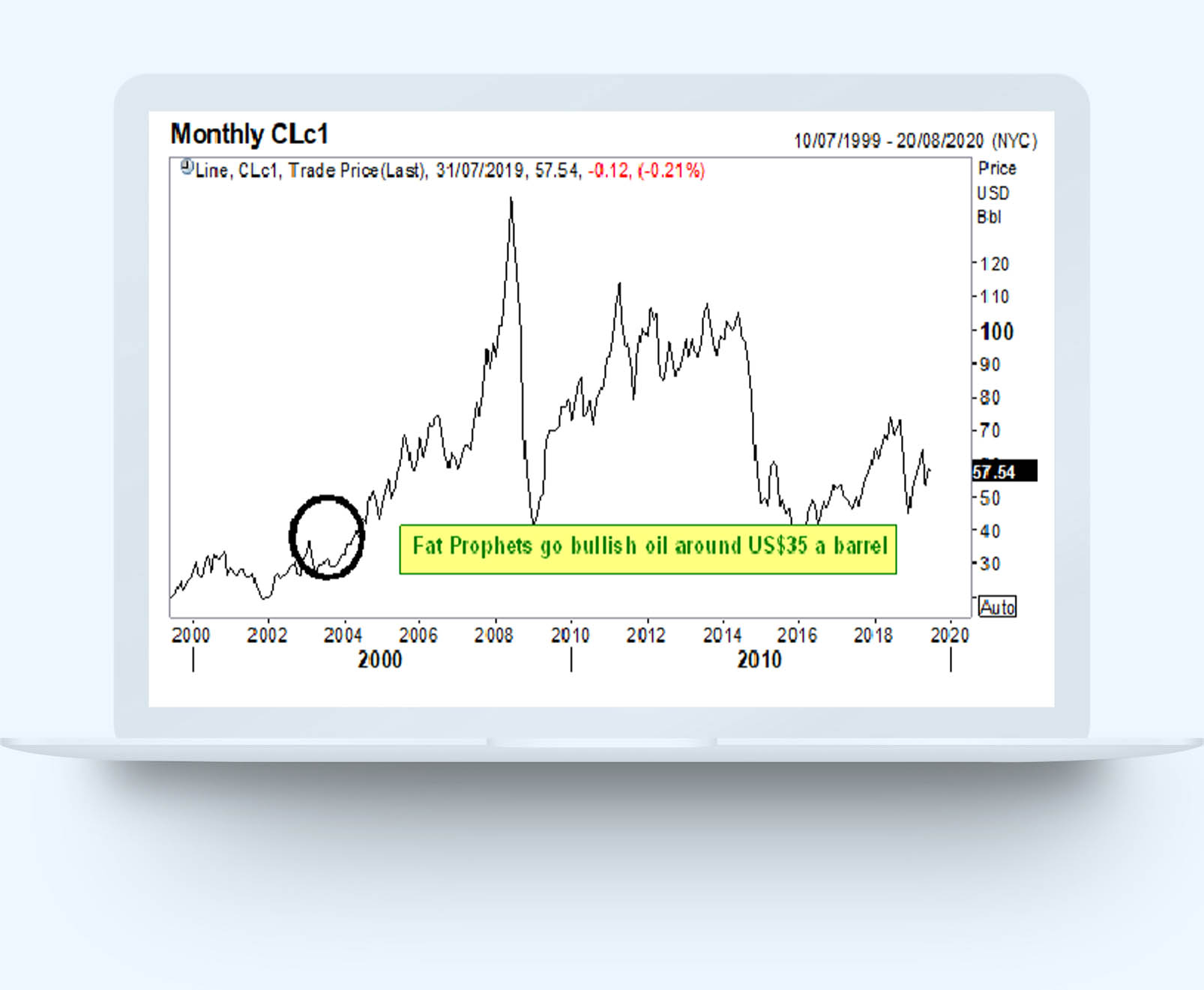

Year 2003

Fat Prophets goes bullish Oil at US$35 a barrel

Back in 2003, the oil markets were in significant focus as the United States invaded Iraq. This drove fears that oil prices would collapse as a glut of Iraqi oil arrived to the market. Many investment banks and institutions were basing their valuations of energy companies on an average forecast oil price of around $20 to $25 per barrel. Some had even more bearish forecasts.

We took the opposite view, and believed that prices were likely to head the other way on the back of rising demand, with the easy money policies of central banks set to propel global industrial activity and the world’s thirst for oil. In addition, we expected an ongoing lift in consumption from China, which had emerged as the world’s second largest oil consumer, and this would keep upward pressure on prices.

We made a bullish call on oil at US$35 a barrel, and recommended a number of high quality energy producers to Members in the months following.

Year 2008

Fat Prophets says to avoid financials, just prior to the GFC

While not predicting the full extent of the Global Financial crisis, Fat Prophets’ was very vocal that the level of housing market write-offs was set to accelerate for the US banking sector. We said that the banking sector globally should be avoided and was a ‘no-go.’ The sub-prime disaster was of course what ultimately brought down a number of banks, and also ushered in the GFC.

Year 2014

Fat Prophets calls an inflection point for the airline sector, and put a buy on Qantas at $1.31

Going back to 2014, and Qantas was the stock that the market loved to ‘hate’ with intense price competition, rising costs, and overcapacity. Fat Prophets however believed that a number of tailwinds were emerging with an ending of the domestic price war, and with a credible turnaround program under CEO Alan Joyce. After the airline turned a billion-dollar loss into a billion-dollar profit, the market started to agree. Brokers have subsequently started putting buys on QAN around the $6 mark. Fat Prophets has taken the exit for a gain of over 300%.

Year 2015

Fat Prophets predicts a Trump election victory

Not many were giving Donald Trump much of a chance of securing the Republican nomination let alone the US Presidency. Fat Prophets believed that a backlash against the establishment would see Donald Trump go onto be the 45th President of the United States. We all know what happened next.

Year 2015

In late 2014, early 2015, the majority of the investment community were bearish on iron ore, with a wide expectation that China was about to implode, and iron ore was going to US$20. Fat Prophets’ was on the contrarian side, calling a bottom around US$60, on the basis of a still strong Chinese economy, supported by stimulus, urbanisation, and with supply constraints emerging. Iron prices ultimately bottomed around US$50 and went onto surge past the US$120 mark.

Year 2018

Fat Prophets calls a bottom in oil around US$50 a barrel

With the trade war raging on and concerns over a global recession, oil prices plummeted in the fourth quarter of 2018. Fat Prophets took the view that OPEC would act to stabilise pricing by agreeing an output cut. Such was to prove the case, and with the cartel extending, and complying, with supply curbs well into 2019.

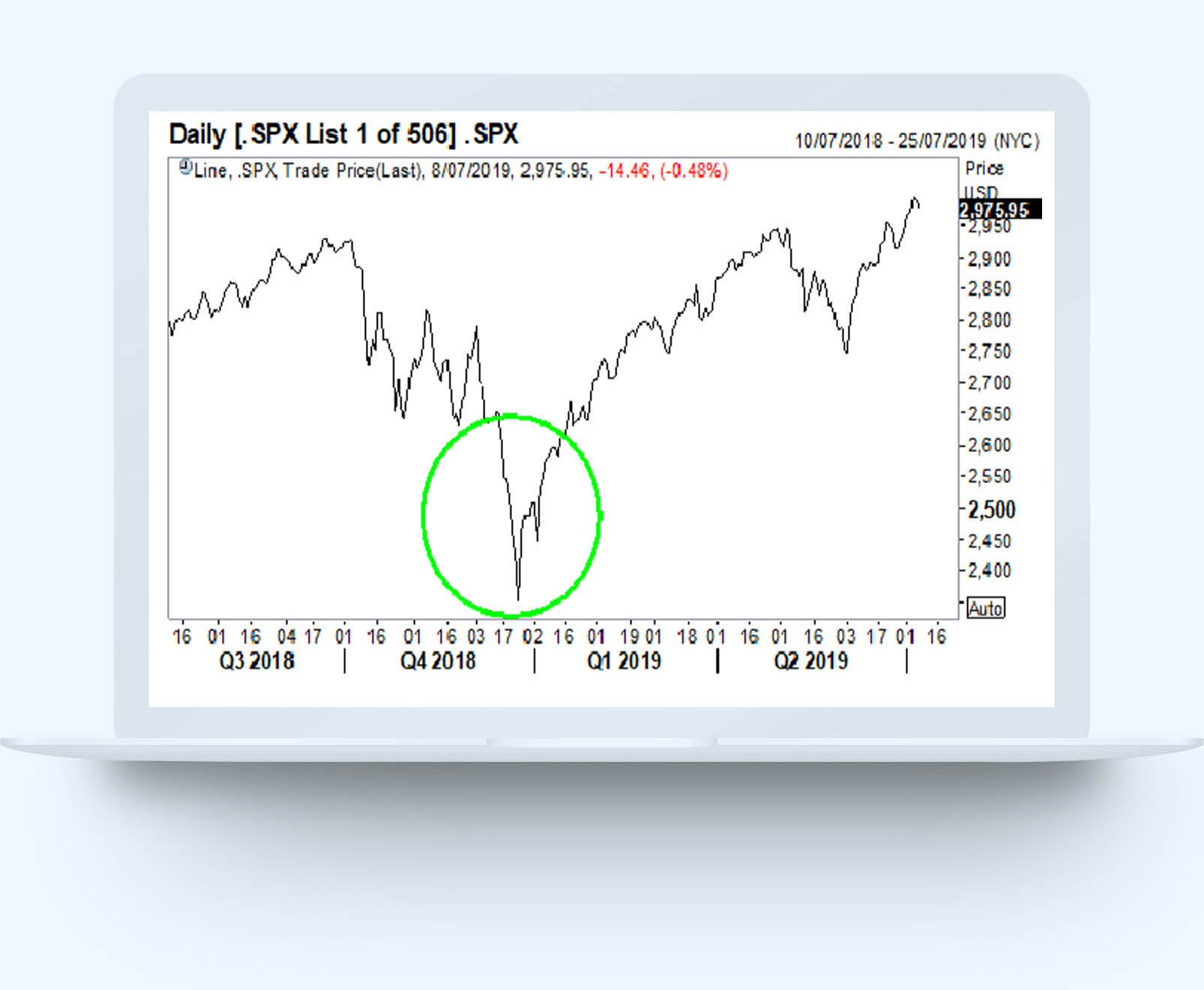

Year 2018

Fat Prophets calls a turnaround in sentiment after a traumatic sell-off in Q4 2018

The fourth quarter of 2018 saw a traumatic sell-off, the likes of which had not been seen before, even in the GFC. An ongoing trade war and the prospect of Fed rate rises, had the markets fearing the worst. Fat Prophets took the opposing view and believed that investors would recalibrate their pessimistic expectations as 2019 got underway. The S&P500 did indeed stage a powerful rally in the first half of the year.

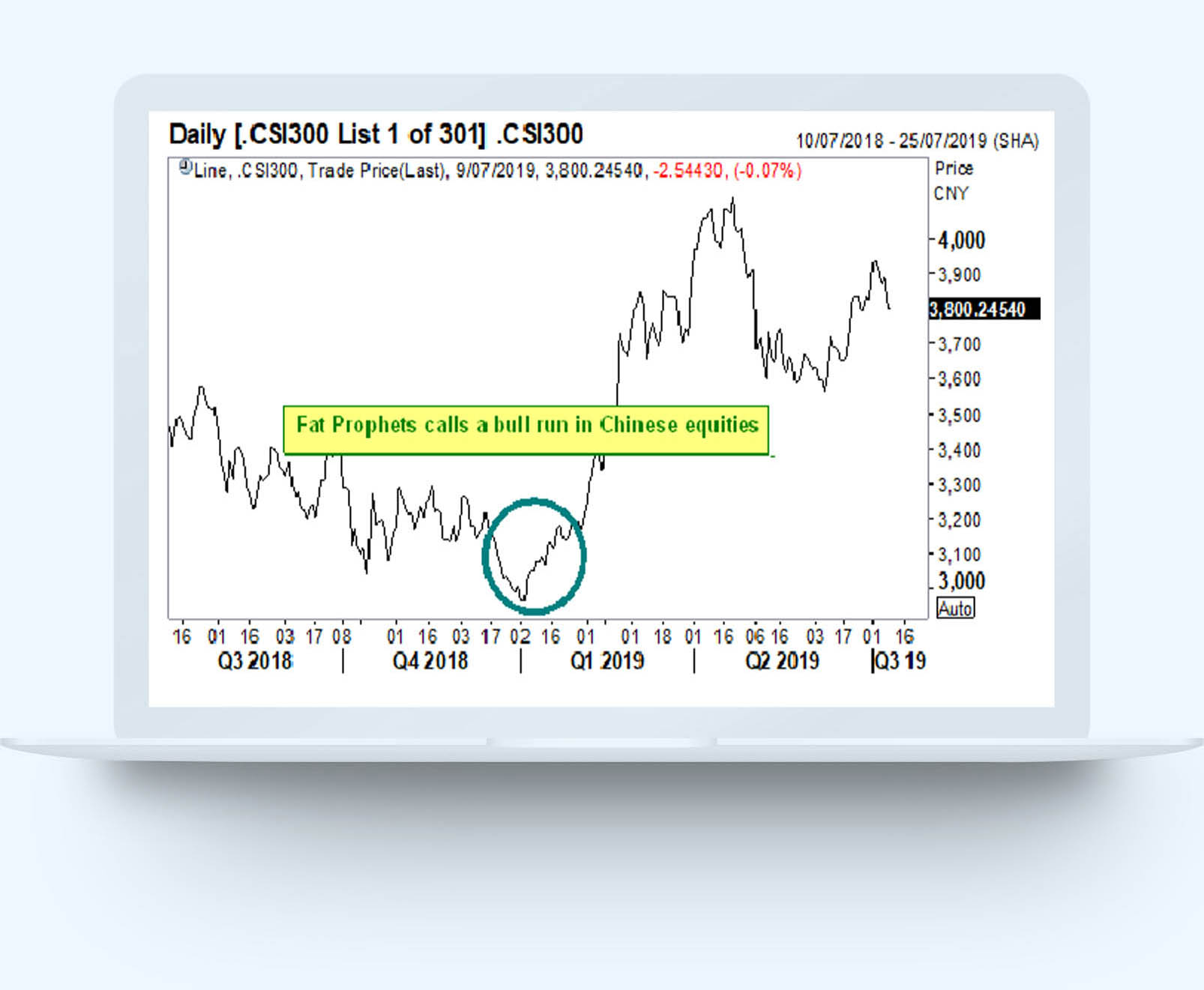

Year 2019

Fat Prophets calls a period of outperformance for Asian markets

With the trade war weighing on sentiment, the Chinese stock market had a tough time in 2018. Fat Prophets however believed that both sides (the US/China) were motivated to ‘do a deal’ and saw the selling in China as excessive, given the market (CSI300 above) was trading on a PE of around 7 times. With China appearing to seize the upper hand in negotiations, the Chinese stock market has since gone onto perform strongly.