Good morning,

Wall Street got hammered on Friday leading to the S&P 500 having the worst two-day decline since the early days of the pandemic, shedding a massive $5.4 trillion in market value. The S&P500 index fell -5.97% to put in an 11-month low and nearing bear territory, as did the Dow Jones which declined -5.5%. The Nasdaq Composite slumped -5.82%, officially entering a bear market. The Mag 7 names have all slid more than 20% from highs with Apple -7.3%, Nvidia -7.4% and Tesla -10.4% the hardest hit on Friday. For Thursday/Friday, Apple fell the most due to its China-centric manufacturing.

Market insights

Friday’s aggressive selloff was sparked by the combination of Beijing’s retaliatory tariffs and comments from Fed Chair Jerome Powell, who warned that Trump’s sweeping new tariffs would likely have a higher inflation impact than earlier anticipated. Mr Powell also suggested that the Fed needs to keep inflation expectations anchored, suggesting that rate hikes aren’t imminent – despite mounting pressure from Trump to cut rates. However, markets are now betting heavily on rate cuts with into US credit markets this year. Futures markets are now fully pricing in at least four cuts by year-end, with growing odds of a fifth. That pushed 10-year Treasury yields below 3.9%, the lowest level since before the 2024 election.

Volatility surged after China hit back with a 34% tariff on all US imports, and some other more targeted measures, escalating the trade war. Economists scrambled to increase recession risk probability. Investors now fear a recession is coming fast. JP Morgan pivoted on Friday and now expects a 60% chance of recession by the 3rd quarter in the US after China retaliated. The VIX surged 51% to 45, in the most volatile session since the 2020 pandemic.

They weren’t alone in revising outlooks, with strategists downgrading year-end views for key indices. Bloomberg reported that RBC’s Lori Calvasina has already lowered her S&P500 year-end target to 5,550 from 6,200, while Oppenheimer’s John Stoltzfus, who had the highest target of 7,100 is also reviewing his forecast in light of the market’s sharp reaction to Trump’s trade policy.

The S&P500 broke below the 5,200 level to close at 5,074, with the support level at 5,400 definitively breached on Friday. The historic support level at 4,800 now comes into focus with the SPX now within 274 pts. Support should be significant at this level where the stock market could find a floor. But this is difficult to determine given the technical damage sustained since Thursday.

During times of turmoil, it is very important to have perspective from a historical context.

I have been through a number of stock market panics in my life time and investing career, including the big ones in 1987, the dot-com crash, September 11, the GFC and the Covid pandemic. This too will pass, I am most certain of that. But more pain could arrive for the financial markets before the dust settles and the stocks find a bottom. The good news is that bear markets and times of panic are often over quite quickly.

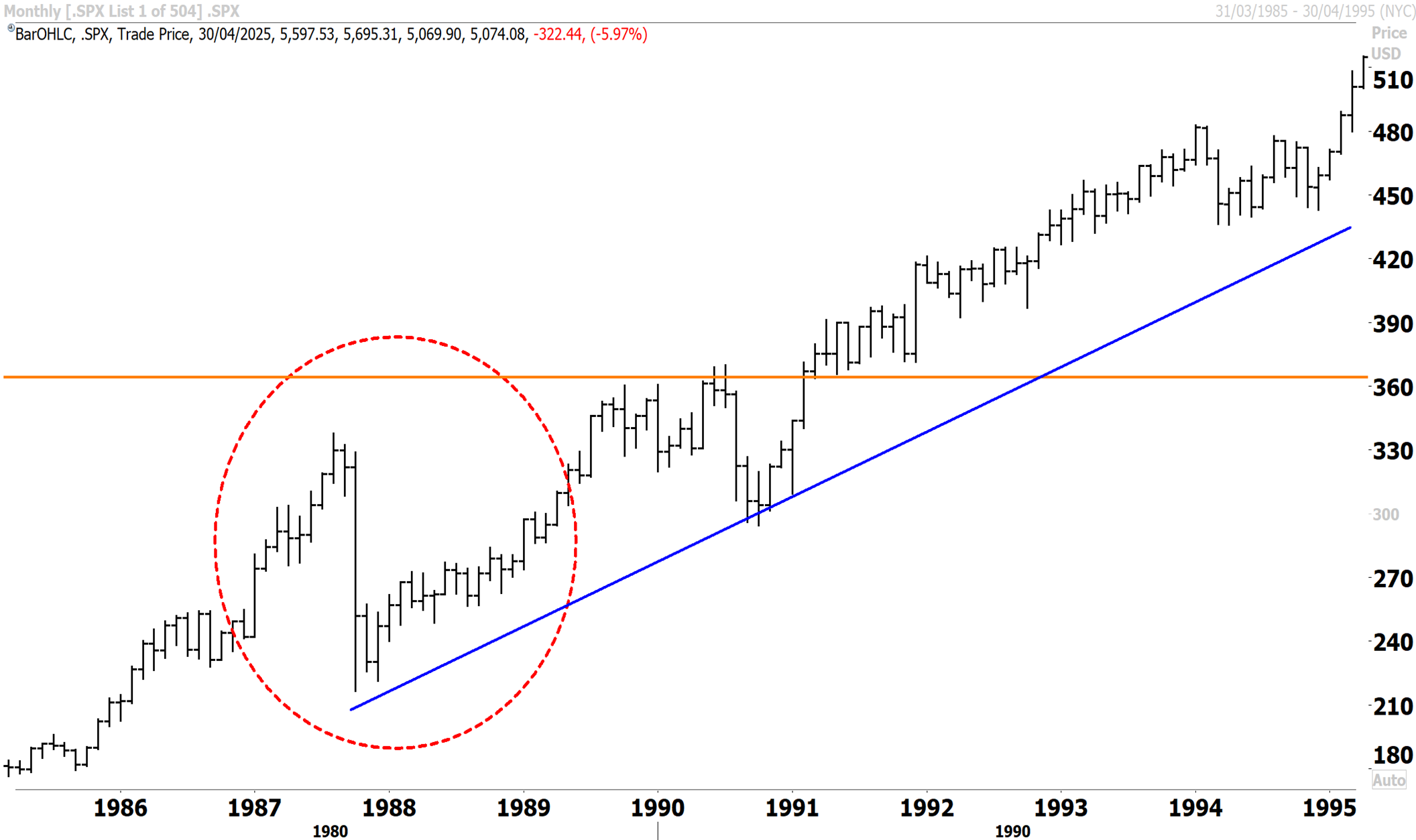

In 1987, the S&P500 made a final low shortly after the biggest one day decline in history when the index lost 20%. At the time, investors were dazed by the size of the decline, which was unprecedented. The Fed immediately responded under Alan Greenspan with rate cuts, and the S&P500 recovered quickly. The Fed under Jerome Powell will likely not respond immediately, but when the US economy begins to deteriorate later this year.

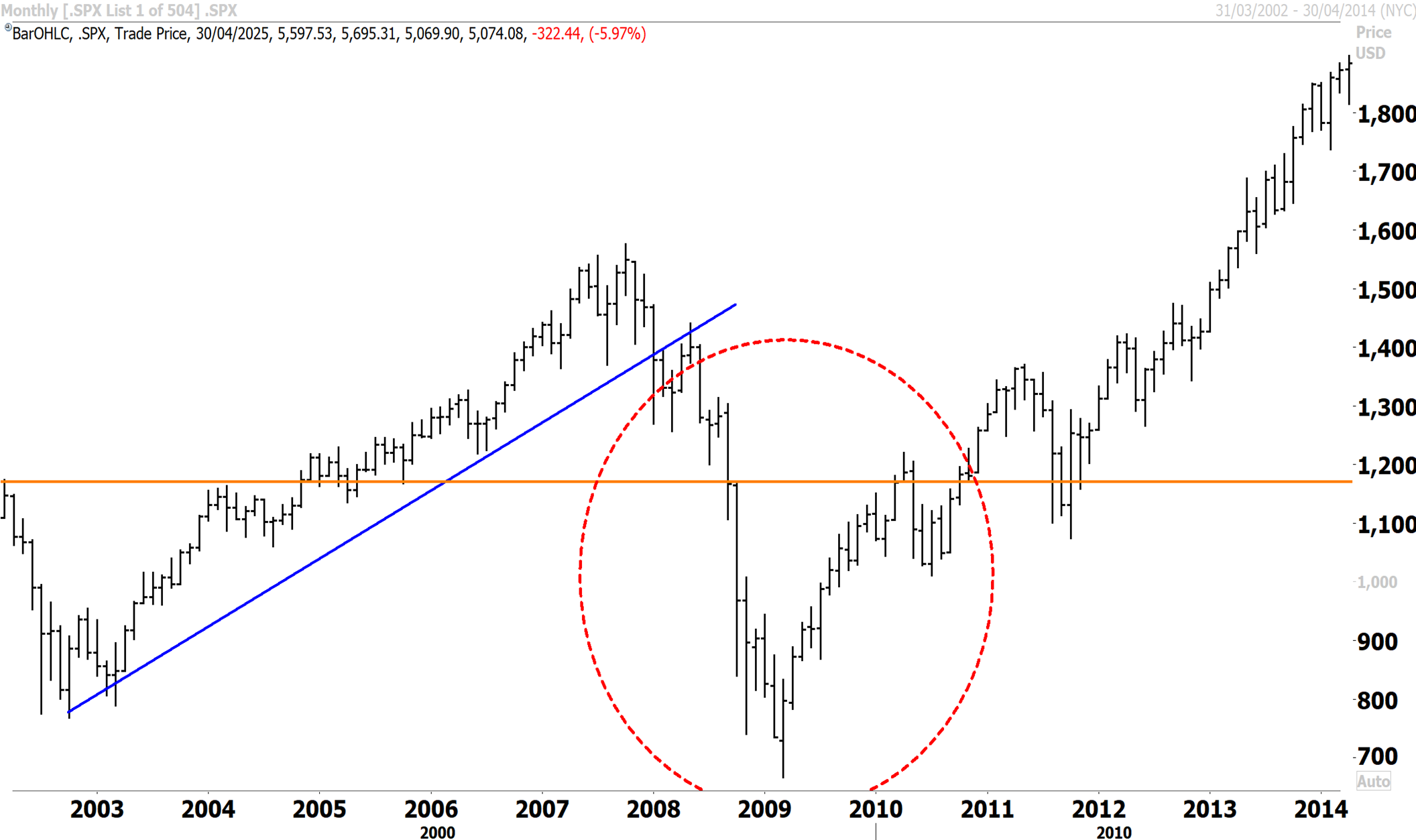

During the GFC in 2008, panic set in during September after several high profile collapses of major investment banks, related to the housing credit bubble. At the time, the world worried that the US banking sector was going to collapse and take the rest of the world with it and enter another depression. This didn’t occur, common sense prevailed, and central banks stepped into the breach and pulled the global economy back from the abyss. The S&P500 declined by 40% from September levels, making a final low six months later in March. The VIX surged to historic highs at the time near 50. This was a life-time defining event for those in financial markets at the time. I don’t believe this will be repeated in 2025, as the events around trade is unlikely to come close to matching the solvency of the US and global banking system which was questioned at the time.

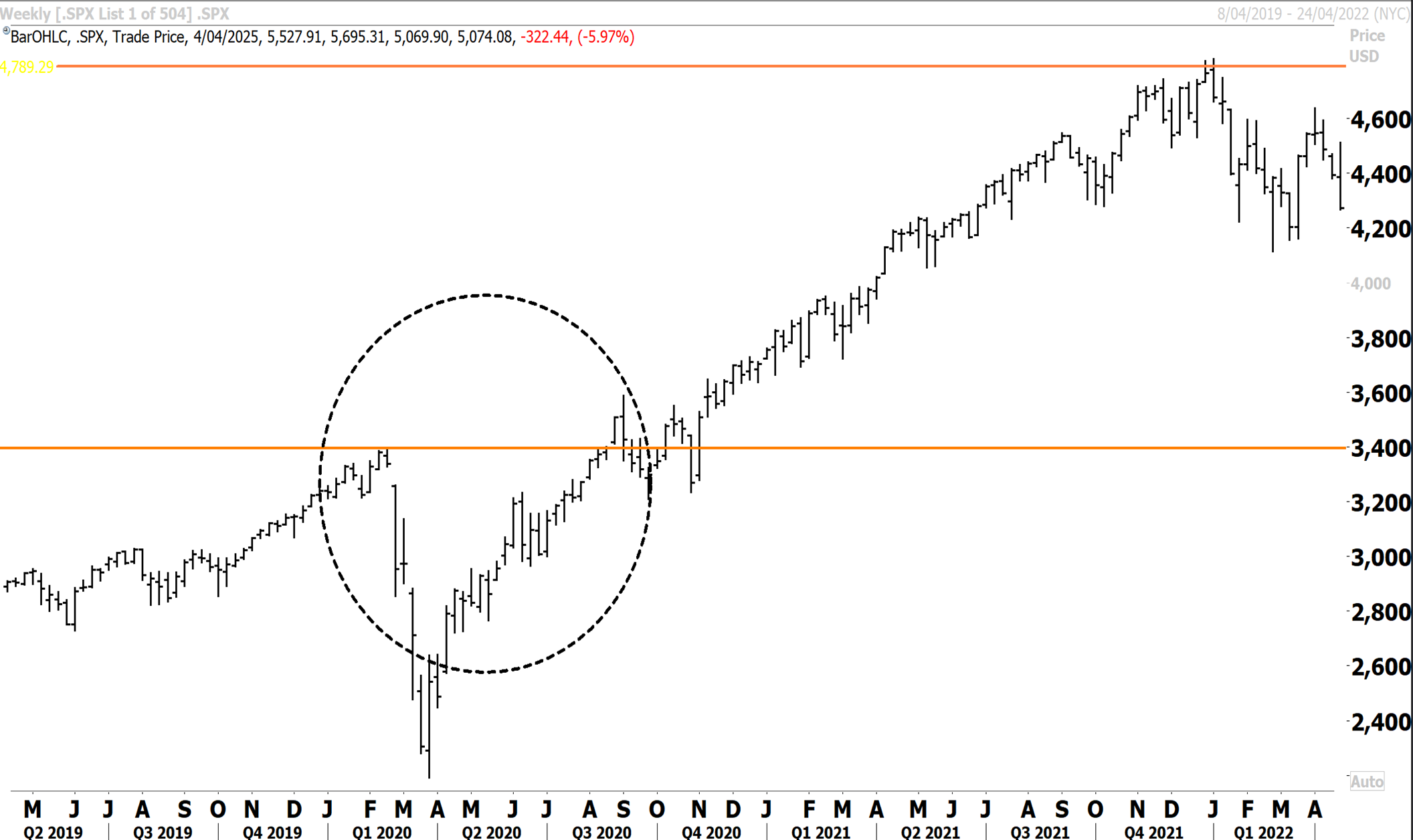

The pandemic during 2020, (which not many saw coming) triggered the most acute spike in volatility of all time. The S&P500 fell around 35% in February and March as the world faced a deadly new virus. At the time, there was no roadmap or precedent for the events that transpired. Central banks, the Fed and governments unleashed unprecedented monetary and fiscal policy stimulus. The S&P500 made a final low in March with the acute panic phase lasting about 4 weeks. A V shaped recovery then quickly followed with the S&P500 making a new record high by December.

The current state of acute volatility will also pass. Order will return and uncertainty will diminish over time. The stock market will also recover, but uncertainty is likely to continue over coming weeks.

A lot of what is occurring with the Trump Administration is difficult to make sense of. There is no historical precedent for the a sitting US President to willingly push the economy towards recession within the first 90 days. Given the unpredictable nature of the Trump presidency, it also difficult to determine what the end game is. Markets hate uncertainty, and so the volatility is likely to persist until there is more clarification on the extreme trade measures.

To put this perspective, the US Reciprocal tariffs have taken the effective US tariff rate above levels not seen in over 100 years, which is driving global recessionary fears. China is likely not to be the only country that responds to the extreme measure. Europe will also most probably counter with their own measures, and here US services including Mag 7 companies could be targeted. Microsoft, Alphabet and most of the Mag 7 companies run huge surpluses with the rest of the world, and as mentioned last week, the US is vulnerable here. An extended period of heightened global trade tensions is now under way.

A US recession (that drags the rest of the world down with it) is not my base case. However, the Trump Administration needs to temper the extreme measures announced to date and roll back some of the tariffs. Donald Trump also needs to demonstrate a willingness to avoid a recession. Common sense needs to prevail, but this outcome remains uncertain, which markets now have to live with. Where we go from here depends on the durability of the tariffs and whether the Trump administration dials up or down the tariffs.

A number of countries including Brazil, India, Vietnam, Japan and the European Union have all signalled the need to start bilateral discussions on trade. But it takes two sides to come to the negotiating table. President Trump, at this point, also appears to be firm in his policy stance “that trade policies will never change.” It is hard to work out just how much negotiating room there is left and whether is an off-ramp for a trade conflict that could quickly spiral out of control.

The one bright spot on Friday was the reaction in the credit and bond markets. Unlike the GFC and the Covid panic, the fixed income markets have been well behaved and have not reacted as badly to tariffs or mirrored the volatility storm in equities. This contrasts with 2008 and 2020 when credit markets came under a lot of pressure ahead of the recessions that hit. But it is still early days in terms of how the trade conflict that is brewing all plays out.

Gold also took a hit on Friday, falling 2.4% as the US dollar rebounded. But as we saw 100 years ago, gold performed strongly and it is hard not envision continuing outperformance in today’s environment, regardless of whether Trump rolls back the harsh trade measures. Near term, there is a good probability that gold will consolidate after the big run this year, but I have conviction the primary trend is higher and that we will see new highs this year.

Returning to market momentum, the S&P 500 has now dropped more than -17% from the February peak, falling in six of the past seven weeks. Fund managers pulled $4.7 billion from US equities in the week through April 2, extending a streak of outflows. The Cboe Volatility Index or VIX (the so-called fear index) jumped above 45 after China’s move, reflecting extreme investor fear, while credit risk spiked to levels last seen during the 2023 regional banking turmoil.

The VIX surged 50% to 45 on Friday. We have seen 8 significant vol spikes in the past 20 years. So far, the latest surge in volatility is yet to match 2008, 2020 and last year when the short yen carry trade unwound. Events over coming weeks and decisions made by Trump will have a direct bearing over where vol goes. One key point is that stock markets often bottom on extreme swings in the VIX. The VIX moving above 50 would therefore be a sign that the acute phase of the panic is potentially nearing an end.

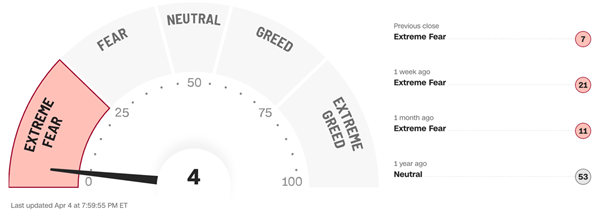

CNN’s Fear & Greed Index was also pointing to extreme fear with a 4 reading. The last times the Fear & Greed index was this low occurred during September 2008 (the GFC) and March 2020 (the early pandemic days).

Finally, China will have to make some big decisions soon on fiscal stimulus – and stabilising domestic consumption. Exports have been the main driver of growth for the world’s second largest economy. The last time these exports came under significant pressure was during the GFC. This resulted in Beijing launching powerful stimulus measures. Given the government’s decision to launch counter tariffs, and the disruption that is being caused to global trade, I would expect significant fiscal stimulus to soon arrive.

In 2008/09 when the US housing market crashed and the credit bubble imploded, Beijing took huge measures to shore up the domestic economy. The seismic shock to global trade is therefore likely to draw a similar response soon. Unlike most of the world, Australia avoided recession during the GFC largely because of those measures and the boost to commodity prices.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1095.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.