Benefits of Investing in Fat Prophets Managed Accounts:

Personal Diversified Share Portfolio – Diversification without giving up the benefits that shareholders enjoy from holding individual shares.

Professionally Managed Portfolios – your portfolio is overseen by our investment team.

Transparency – online access that offers a full breakdown of shares contained in your separately managed account.

Independent & Accountable – Our portfolio managers are totally independent and accountable for providing returns back to investors in the portfolios.

Tax Reporting – The investment platform provides a fully audited tax report for all investors in our portfolios. Tax position is not affected by other investors as each investor attracts their own cost base.

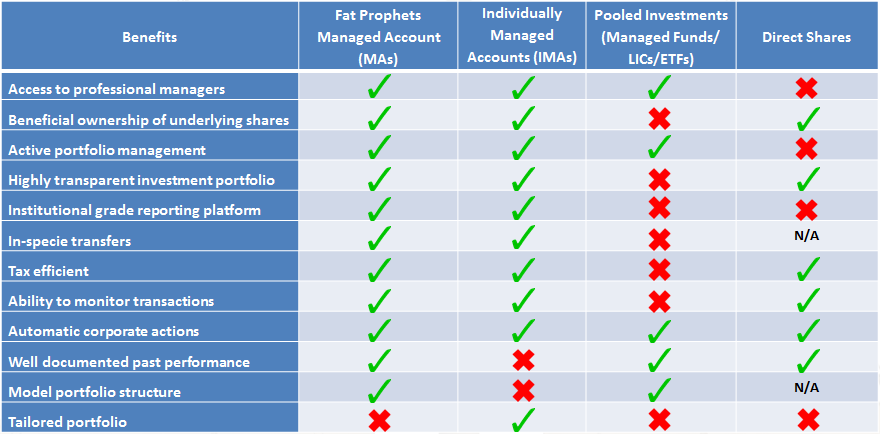

Benefits

A Fat Prophets Managed Account allows you to have exposure to the stock market whilst you have the comfort of knowing that your portfolio is professionally managed by the Fat Prophets Wealth Management investment team.

When forming the Wealth Management division, Fat Prophets had the choice of a wide variety of vehicles through which to offer clients a fully managed investment solution. We landed on Managed Accounts due to the clear benefits to our clients.

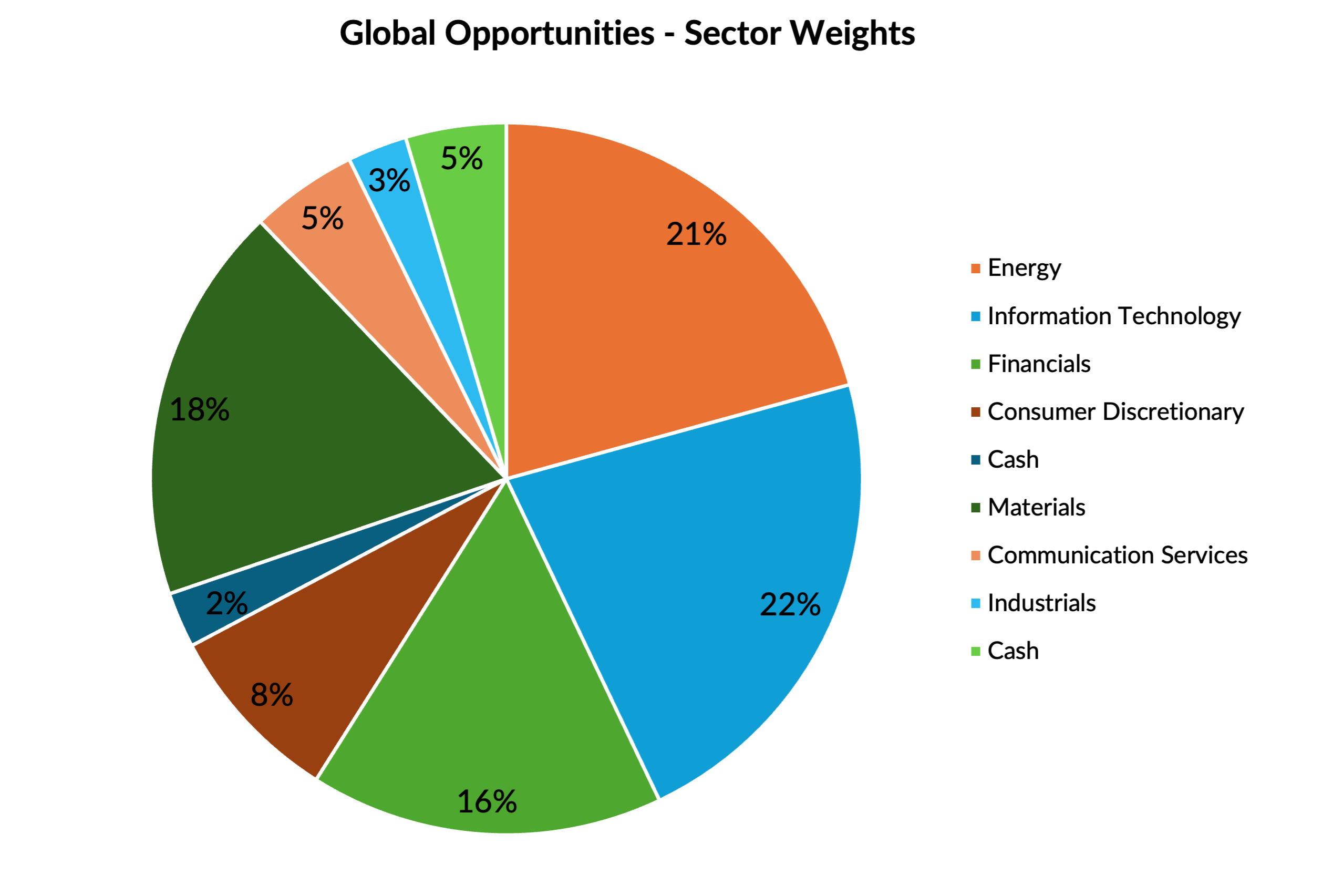

Global Opportunities Model Portfolio

For those investors who already have exposure to Australian equities, an investment in our Global Opportunities Portfolio may suit. International equities should generally be held in some proportion in a balanced portfolio to improve diversification and consequently reduce volatility.

The Global Opportunities Portfolio was launched in March 2013 to give clients exposure to the many opportunities that exist overseas. There are several barriers to entry when it comes to international investing. Purchasing international stocks can carry high costs and high risks due to lack of expertise in foreign markets. Fat Prophets draws on years of experience and deep market insights to deliver a truly unique international investment offering.

The current allocation of the Fat Prophets Global Opportunities Portfolio reflects our contrarian view toward China and Japan, as well as our cautious outlook toward the Unites States’ stock market that we believe is fully valued.

After identifying what we believe to be the key macro trends (on a 3-5 year horizon), we then use our bottom up approach to selecting individual companies with high prospects for future growth. The Global Opportunities Portfolio, like our other portfolios is influenced by our value bias and has a focus on top-50 companies on international exchanges for a more conservative approach.

The GOP model is a higher risk portfolio that our CAS and ASI models due to the additional exposure to global currencies that are unhedged, which may work for or against you.

Please see recent performance of this portfolio:

| Term | 1 Month | 3 Month | 6 Month | 1 year | 2 years |

| Fat Prophets Global Opportunities Portfolio | 5.55% | 5.91% | 7.03% | 15.09% | 15.49% |

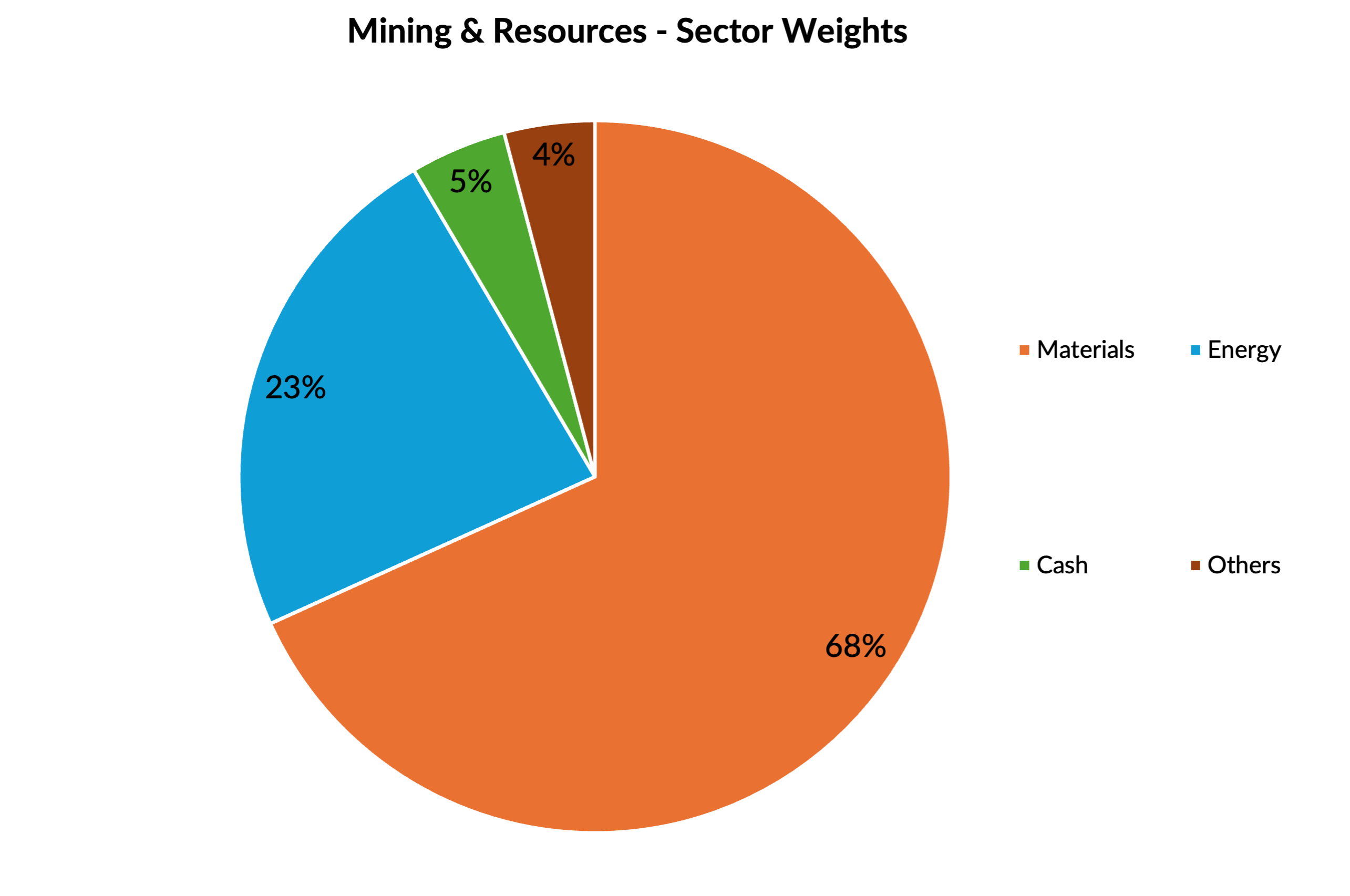

Mining and Resources Model Portfolio

For those with an appetite for risk, our Mining and Resources Portfolio offers focused exposure to Australia’s diggers and drillers. This model is not intended to comprise our clients’ entire equities exposure; rather to provide means by which they can obtain high quality exposure to the mining and resources space and have that exposure actively managed by Angus Geddes and the Fat Prophets team.

The Mining & Resources portfolio is our oldest portfolio and following the impressive rise from late 2008 to early 2011, the sector has since been under significant pressure.

Not for the faint of heart, it takes a brave soul to go against the crowd and pick up the shares that have been out of favour for so long.

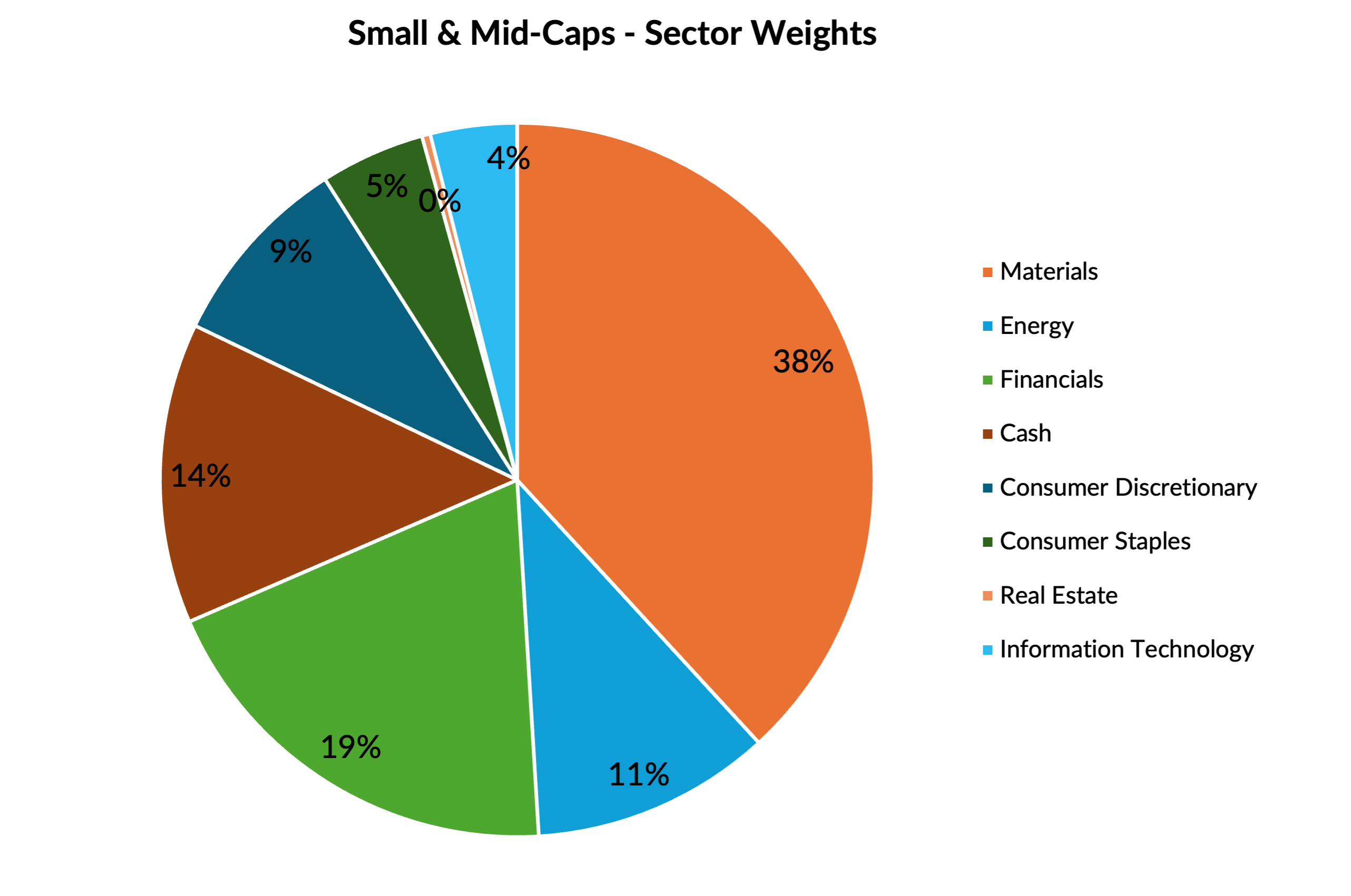

Small and Mid-Caps Model Portfolio

Picking small to medium cap companies can be a mugs game. Most such Companies are poorly covered by the investment banks and brokers making it hard to find reliable analysis on them. Finding truly objective research is even harder as in many cases what coverage exists is either linked to the provision of past or future corporate advice or directly paid for by the Company. Also the numbers are only part of the story. Often the future success of these companies has more to do with the people who are running them rather than their past trading performance so getting to know them is often key to picking the best stocks.

There is no doubt that an investor is taking on additional risk when investing in small and medium cap stocks compared to putting their money into well-known blue chip stocks like Woolworths or Commonwealth Bank.

Please see recent performance of this portfolio:

| Term | 1 Month | 3 Month | 6 Month | 1 year | 2 years |

| Fat Prophets Small & Mid Cap Portfolio | 7.63% | 7.10% | 2.57% | 11.71% | 7.16% |

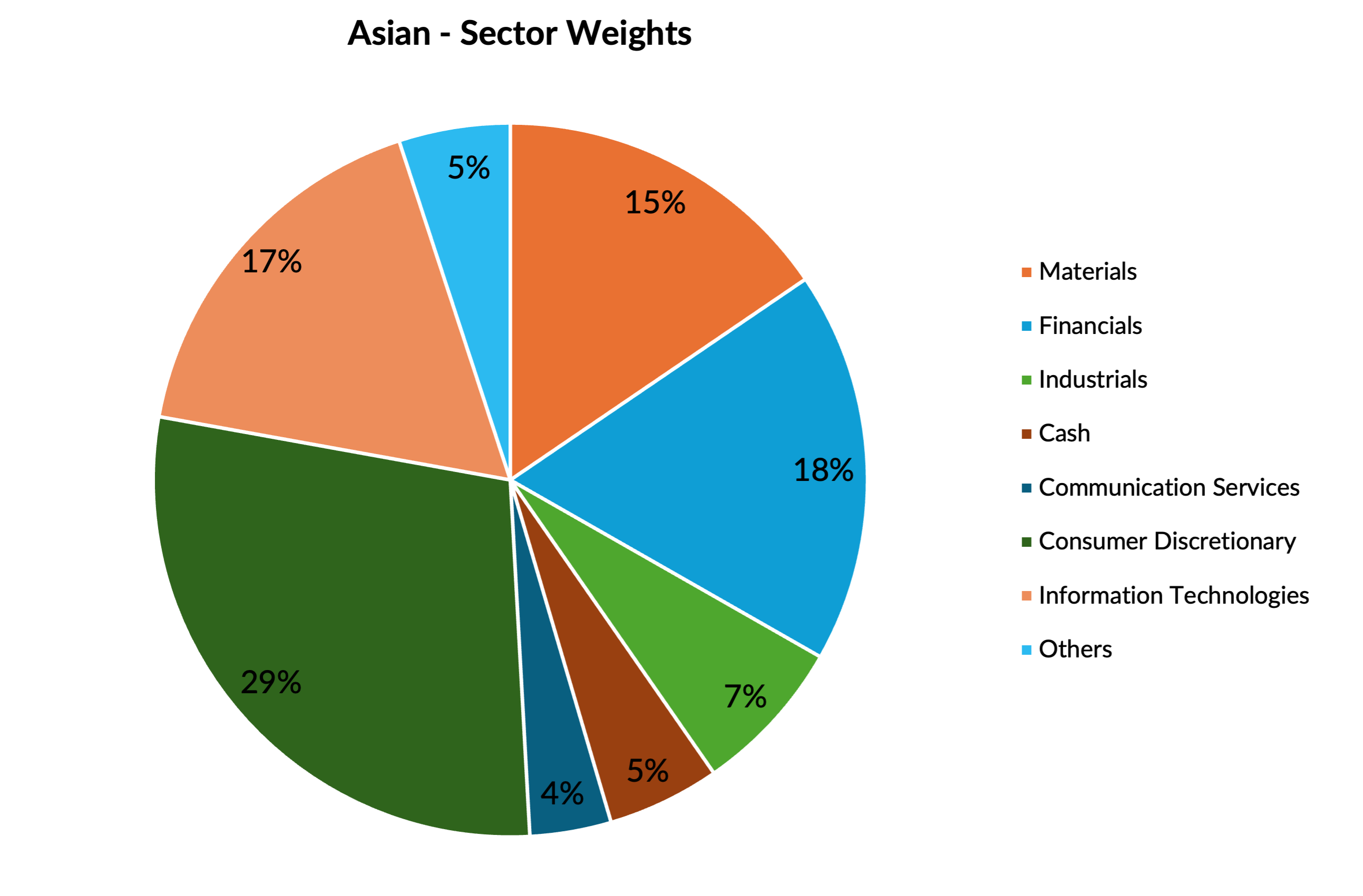

Asian Model Portfolio

For investors seeking to diversify beyond traditional markets, the Asian Portfolio provides access to one of the world’s fastest-growing regions. Asian equities offer significant growth potential and valuable diversification benefits for a balanced portfolio. The region’s low sensitivity to US interest rates provides added stability amid monetary policy changes, making it an attractive option for long-term investment.

The portfolio focuses on high-growth sectors such as internet and consumer markets, which have consistently demonstrated robust performance. Additionally, rising consumer confidence, supported by regional stimulus measures, continues to drive increased economic activity and spending.

Aligned with our contrarian investment philosophy, the portfolio includes carefully selected stocks from top-performing Asian markets and sectors, offering a unique opportunity to capitalise on the region’s dynamic growth potential.

Please see recent performance of this portfolio:

| Term | 1 Month | 3 Month | 6 Month | 1 year | 2 years |

| Fat Prophets Asian | 5.99% | 2.54% | 2.75% | 8.88% | 14.77% |

Wealth Management

Frequently Asked Questions

Flagship offering

The Fat Prophets Managed Account Service allows investors to create a well diversified andactively managed portfolio. The platform’s comprehensive tax reporting assists in ensuring that SMSF Trustees remain compliant with ASIC requirements. 24 hour a day access to your portfolio is provided, so you may view your investments at any time, rather than having to wait for reporting from your fund manager or accountant months down the track.

“Boutique” investment service

We are in a unique situation to be able to serve our clients with what we consider to be the best of both worlds – in house and external research. From our close relationship with the Fat Prophets analysts in Sydney, and around the world, we have access to in-depth expert opinions on a day to day basis for both economic and company specific news. We also have the freedom to generate ideas for clients from external relationships and we believe in finding the best ideas for our clients within the whole market, not just from our own team. We spend our day looking for ideas to bring to you, while you are busy doing your day job or enjoying your retirement.

Benefit from our varied experience

We have seen good and bad markets. Companies come and go. Investors make and lose money. And that experience is never lost, always remembered. It helps us to , read and analyse market movements, time buys and sells, recognise market themes, make early stock selections, and formulate risk management.

Proven investment strategy

We believe that the best bargains tend to be in stocks that are completely neglected by the broader market. Our approach is to analyse a range of large and smaller capitalised companies, with a view to isolating securities trading at significant discounts to their intrinsic value. Our Australian equities investment process is therefore active and valuation driven. We believe that superior investment returns can be achieved by identifying and exploiting opportunities where securities are mispriced. Every security has an intrinsic or fair value, however in our opinion; security prices do not always reflect their fair value.

Why Us

There are two foundations to Fat Prophets investment philosophy:

- The ability to formulate and articulate a long-term outlook and;

- Having the correct structural composition within a portfolio.

We believe that superior long term returns can be achieved by combining a value driven fundamental assessment of a stock’s future prospects, with underlying key trends and a top down appraisal of key macro-economic factors.

Underpinning this is a strong contrarian approach to stock selection and a fundamental bias towards value.

Are the shares held in my name?

This is a common misconception. Investors have beneficial ownership through a custodial agreement. In other words, the custodian holds the shares on behalf of the investor. Therefore the shares are actually held in the name of the custodian, under their HIN. Investors retain most rights of direct ownership, such as franking credits. However, company correspondence and information about corporate actions will be sent to the custodian and relayed by the platform operator to Fat Prophets who will make decisions judged to be in the best interest of the model portfolio as a whole.

Some providers of managed investments choose to also act as the custodian. The platform operator does, and always has chosen to appoint large, reputable providers of custodial services such as J.P. Morgan and HSBCwho are members of the Australian Custodial Services Association (ACSA).

Please refer to ASIC’s regulatory guide relating to this topic and/or ACSA’s institutional investor services information.

Where can I see historical performance?

To receive information about the past returns of our portfolio models, please contact our team on (02) 9024 6788 or email us at wealth@fatprophets.com.au

Is the Australian Shares Income portfolio model the same as the ‘Income Report’ I can see in the Members Area?

No, the ‘Income Report’ is a hypothetical portfolio containing a selection of income stocks from our ‘Australasian Equities’ recommendations. The managed accounts are independant of the recommendations, however the Investment Team does rely heavily on the research reports. The team also conducts its own research and utilises a broad range of external research.

What is a ‘model portfolio’?

Portfolio models allow Fat Prophets to manage a large number of investors’ portfolios in line with a model, or ‘master’ portfolio. Any change we make within a model is automatically reflected in the portfolios of all clients within that model. For example, if the Fat Prophets investment team decides that the Concentrated Australian Shares Model should take profits on stock XYZ, they might decide to reduce the weighting by 2%. A 2% sell-down will then take place for all clients in that model, regardless of the size of their portfolio. There are two key benefits to the model portfolio structure, the first is wholesale brokerage, the second is a focused approach to portfolio management (we don’t need to manage hundreds of tailored portfolios).

How are fees and expenses paid?

When your account is set up, the responsible entity will also open a cash management trust, which will earn the standard overnight rate. A two percent cash holding will be maintained in the CMT and used to cover fees that come due.

How can I track the performance of my portfolio?

You will be able to view online all the relevant details such as your current holdings, transactions, tax positions, brokerage etc. on a 24/7 basis. At financial year-end you will be able to access an annual report and summary of all these items presented in user-friendly formats. The consolidated tax reports are usually released a few months after the end of financial year.

How are dividends paid?

Currently all dividends are reinvested back into our clients portfolios.

Can I make withdrawals?

Yes, at any time and without penalty. Not guaranteed, please see PDS for further information.

Can I make additional investments into my Separately Managed Account?

Yes, you can add funds from your nominated bank account to use to invest in our managed accounts.

Can I change my model portfolios?

Yes, any time you wish. You can move from one model to another or change the mix between all available models via the platform.

Who makes the investment decisions?

The Fat Prophets Investment Team, headed by Angus Geddes, constantly monitors the model portfolios making changes as they are necessary. The team will utilise research produced by the Fat Prophets Analyst Team as well as external research and conducting internal research and due diligence.

How easy is it to set up a Managed Account?

It’s very straightforward. Just read the product disclosure statement and fill in the online application form or call us on 1300 88 11 77. As your nominated representative, Fat Prophets will oversee your application and provide any assistance you require.

What is the main difference between a Managed Account and a Managed Fund?

A Managed Account is a portfolio of stocks managed by an investment professional that is entirely owned by an individual investor, unlike a managed fund which pools the assets of different investors.

If your question hasn’t been answered please email us at wealth@fatprophets.com.au or call our Wealth Management Team on 1300 881 177.