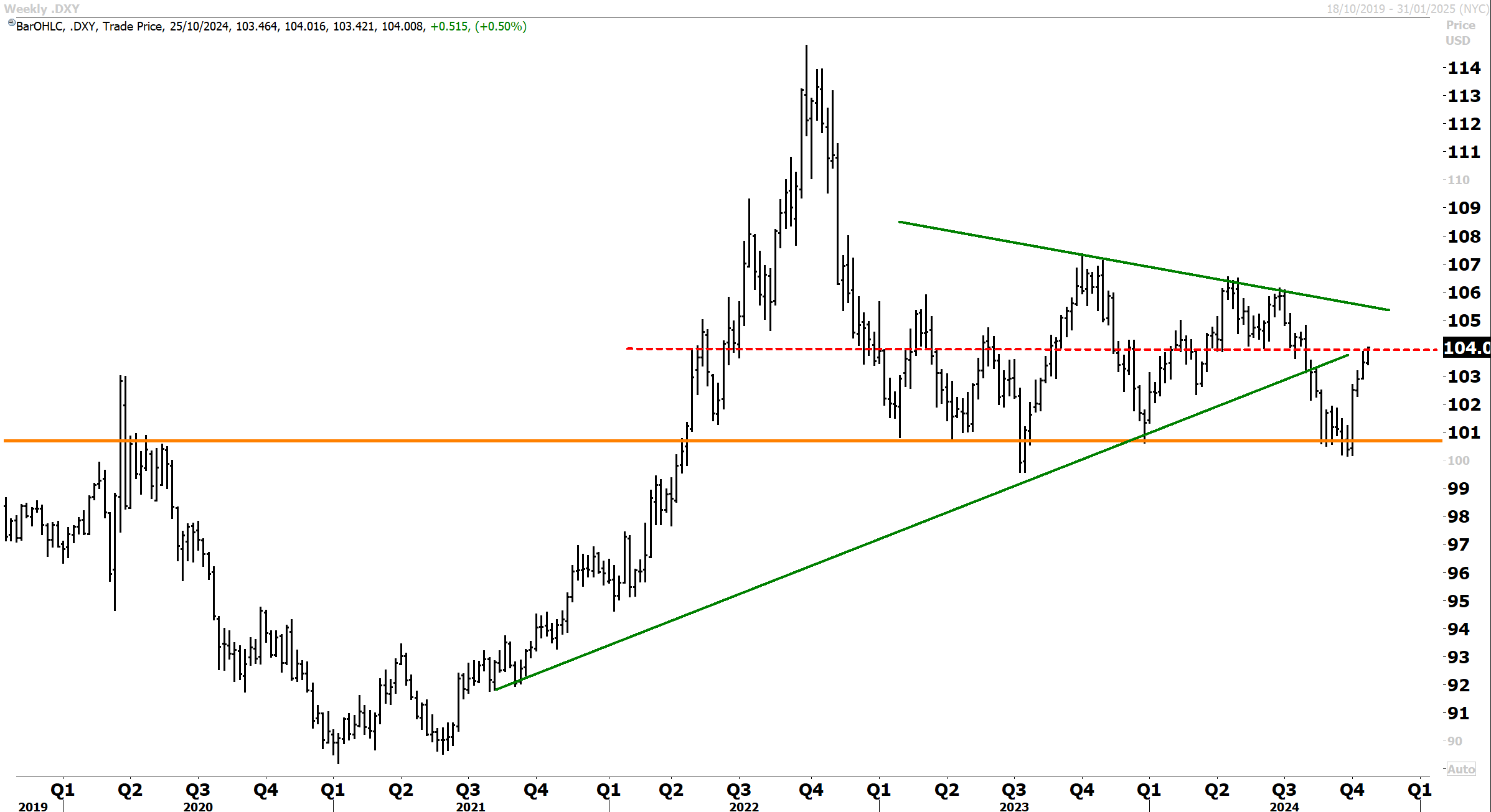

Gold made a new record high at US$2,734. The Dollar Index rose to 104 and has now rallied 4% off last month’s lows at 100. Whilst the technical setup still skews to the bearish side on a near-term basis, further upside could ensue over coming weeks if the DXY breaks above 104 as rate differentials once again favour the US. My base case is for the dollar to soon run into resistance and resume a downward path, but clearly, rising bond yields and pushback on the rate cut narrative are bullish supports on a near-term view.

What has been notable is the breakdown in gold’s inverse relationship with the US dollar. Gold and now silver are both rising in tandem with a stronger greenback, with the historical negative correlation breaking down. Interestingly, a good friend of mine who runs one of the largest gold funds in the world said that they are still incurring outflows and redemptions (which has been going on all year).

Gold has made new record highs despite the Dollar index lifting 4% since last month. The historical inverse relationship between gold and the dollar is breaking down.

Morgan Stanley’s top US equity strategist Mike Wilson said in an interview with Bloomberg last week that he is eyeing one risk in particular that could threaten the stock market’s big rally: a stronger US dollar. According to Mike Wilson, a dollar re-strengthening could hinder the stockmarket and he highlighted that “the greenback weakened as markets prepared for steep rate cuts, but that move has reversed in recent weeks” as strong economic data makes more aggressive policy easing less likely.

“One of the things that could cause the rally to kind of slowdown is if the dollar were to strengthen again. And that’s starting to happen. So that’s probably the one thing we’re watching for now that could kind of throw a wrench in this pace of new records every day.”

Mike Wilson is right and a stronger dollar would likely be underpinned by higher bond yields and rate differentials that once again clearly favour the US after recent rate cuts in Canada, Europe, UK and NZ. Mr Wilson went on to say “US dollar liquidity, or dollar supply growth, has started rising rapidly in the last month or so after bottoming out almost two years ago, mostly due to expanded balance sheets in China and Japan and a weaker dollar. A stronger dollar would thus interrupt the rally”.

I think near term, risks are to the topside for the US dollar if rates continue to climb, however, structural risks are becoming more prominent. Investors are increasingly reluctant to hold bonds (given fiscal and inflation risks that will follow the election) and the “clearing price” is having to rise in terms of yield for supply to be absorbed. However, the same argument could be made for the US dollar – where I expect the “clearing price” will have to fall significantly to entice foreigners to hold. This “structural shift” could really get underway next year. US equities are also richly priced compared to international stock markets.

On this front, Mr Wilson said “almost all of the returns in the last year have been a result of multiple expansion, rather than higher earnings revisions. Multiples are now 22 times the index level, which has happened only a few times in recent history. Even though the big stock rally is fiscally driven, it isn’t threatened by the upcoming results from the presidential or congressional elections. Neither party has really shown any willingness or ability to slow the freight train on fiscal spend. I think the bigger concern is how do they fund it.” Great point and one I have been making for some time now.

Mr Wilson said that “a bigger risk will emerge when the bond market starts feeling pressure from the size of fiscal deficits, but it’s tough to say when that might happen. Maybe they can pull it off. Maybe we can inflate our way out and we can get better growth next year. That’s the game that we’re playing, and right now that’s a bull market.” Clearly, Mike Wilson is becoming more concerned about the state of the bond market and the deterioration in sentiment.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters