The rally on Wall Street reasserted with the benchmarks rebounding and the Russell 2000 small/mid-caps leading. The rotation towards the laggards and more cyclical sectors of the market continued. The stock market appears to be pricing in a Trump win at the election.

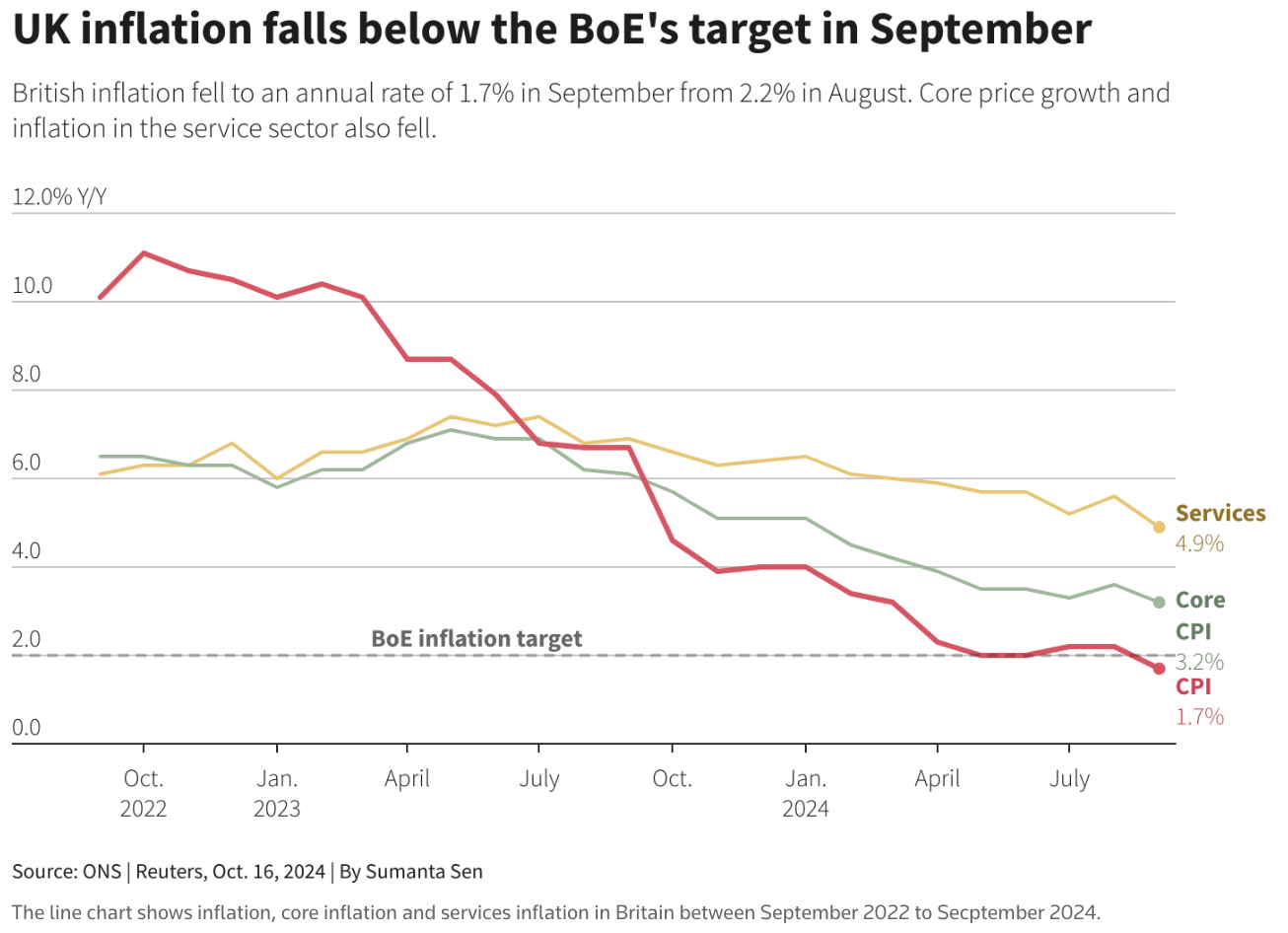

Investors presently see a Republican victory as being more a favourable outcome for the economy. Precious metals also rose on Wednesday, despite a stronger dollar, with a Republican win potentially more inflationary. The UK reported an inflation rate of just 1.7% in September down from 2.2% in August, in yet another sign that central banks are at the beginning of an aggressive easing cycle.

The S&P 500 added 0.47% to 5,842, the Nasdaq Composite climbed 0.28% and the Dow Jones added 0.79%. Both the Russell 2000 index and the S&P600 Small Cap index climbed around 1.5%, continuing the recent run of outperformance against the major benchmarks. This is a clear sign the bull market is broadening. Financial stocks also had a strong run led by Morgan Stanley, which surged 6.5% on strong earnings. The Nasdaq Golden Dragon Index of major China tech stocks rebounded +1.5% as the recent corrective reversal looks to have run its course with support now being found.

After leading for such a long period, gains in mega-cap tech and mag 7 stocks are slowing given very expensive valuations. Gains in the so-called Magnificent Seven group of tech stocks have driven most of Wall Street’s record-breaking run this year, and we are now seeing the baton being passed to smaller/midcap companies. This is encouraging and reinforces

the bull market, which could have a strong finish into yearend depending on the election outcome.

The more rate-sensitive Russell 2000 and S&P600 SmallCap index jumped on Wednesday with expectations now cemented that the Fed will cut aggressively in the year ahead. Following a multi-year ranging consolidation, the SPDR S&P600 SmallCap ETF (which mirrors the S&P600 Small Cap Index) is on the cusp of an important topside breakout. A breakout and sustained advance above $46 would raise the scope for a significant upside extension next year. (Watch this space. Next week I will unveil an exciting new opportunity for Fat Prophets members).

While bonds managed to sustain this week’s rally with yields edging lower, the US dollar index rose 0.3% to 103.6. The VIX was lower by 5% to 19.5. Despite dollar strength, precious metals also managed to rally, adding to this week’s gains. Gold was higher by 0.4% to $2,690 while silver and platinum added 1% to $31.93 and $997. Copper added 0.6% to $4.36 while the soft ag complex was also higher. WTI and Brent crude were flat.

While gold has hit new record highs this year and with silver also confirming a new bull market, the other PGMs which are platinum and palladium have severely lagged and underperformed. Platinum now appears poised and positioned in my view, for a significant topside breakout and exit from a multi-decade bear market. If this outcome is confirmed, the bull case for the precious metals will only be reinforced and cemented.

Platinum’s primary bear market downtrend in place since 2007 is now being pressured and tested at around $1000oz. Similar to China’s CSI300 and Hang Seng index, I would expect the bear market in platinum to not end with a whimper but a very loud bang. The question is timing and just when? A Republican victory (which will see fiscal spending and national debt levels accelerate and taxes lowered) might just prove to be the catalyst.

Regardless, I believe a significant breakout is coming in platinum with precious metals once again being seen by the investment community as an age-old hedge against rising government indebtedness and money printing.

Firstly, the US election. The stock market seems to be pricing in a Republican victory next month, which is presently perceived as being the most favourable outcome. Billionaire investor Stan Druckenmiller said in a Bloomberg TV interview “during the past 12 days, the market is seemingly “very convinced Trump is going to win. You can see it in the bank stocks, you can see it in crypto.” (I would also add gold and the PGMs). Whether the election outcome proves to be a red wave, remains to be seen.

Stanley said he won’t vote for either Trump or Vice President Kamala Harris. He dismissed Trump as a candidate and also said that a Harris presidency would be bad for business. “I’ll probably write in someone when I go to the polls. But the market and the inside of the marketis very convinced Trump is going to win,”

Stanley Druckenmiller is a legend in hedge fund circles and managed money for George Soros for more than a decade. The pair famously helped break the Bank of England in the early 90s when a defensive effort to hold up the pound collapsed in spectacular style and their fund made billions from a huge short position.

Mr Druckenmiller is now retired but predicted that it’s “extremely unlikely that Democrats will gain control of Congress even if Harris were to win the presidency. If there were a so-called blue sweep, equities may be troubled for three to six months. A red sweep is probably more likely than a Trump presidency with a blue Congress.”

Stanley also said that the Fed’s half-point cut in September “was a mistake”, and that his family office (one of the largest in the US), shorted bonds after the announcement. “The market needs to temper its expectations about the pace and extent of central-bank easing”. I wouldn’t be surprised if the next batch of 13F filings in the US, reveal that Stanley has been a recent buyer of precious metal miners as a hedge.

Moving on, billionaire investor David Einhorn said that investors are driving the most expensive stock market in decades and highlighted Warren Buffett’s huge cash position. “Equities are the most overvalued since the firm’s founding in 1996. Now is likely not a good time for high equity exposure. While Mr. Buffett routinely points out that it is impossible to time the market, we can’t help but observe that he has been one of the best market timers we have ever seen.”

Berkshire Hathaway has cut equity positions (with Japan being a notable exception) on valuation grounds and holds a record cash pile of $190 billion. David Einhorn was careful not to interpret Buffett’s actions as a prediction of a coming crash but cited that the “Oracle of Omaha has a talent for reducing exposure at the right time. One could argue that sitting out bear markets has been the underappreciated reason for his outstanding long-term returns. It is therefore noteworthy to observe that Mr. Buffett is again selling large swaths of his stock portfolio and building enormous cash reserves.”

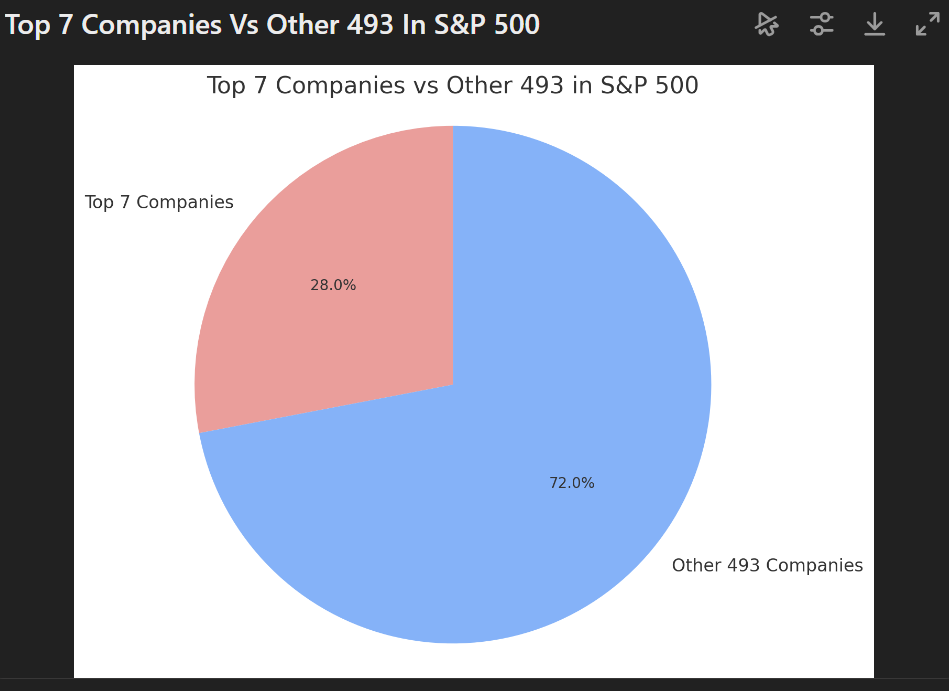

David Einhorn makes a solid point about the US stock market which is expensive with the PE on the S&P500 at 21.5X/22X being near the top of the historical range. The long-run average is around 15X to 16X. However, this valuation is skewed towards the mega-cap tech and mag 7 names. Over 28% of the S&P500 market cap is comprised of just seven very large and expensive stocks.

The other 493 companies that make up the index are much more cheaply priced. I have been encouraged by the broadening out of the rally to some of the laggard sectors in the market. Small and mid-cap stocks have not done much in the US for over five years. So, the bull market in US equities could have a way to go, albeit the leadership is likely to change. Mr Einhorn’s Greenlight Capital is a notable investor in gold miners.

On a quiet day for data, mortgage demand saw a sharp decline last week, according to the Mortgage Bankers Association. Applications dropped 17%, the steepest weekly fall since 2015, excluding the pandemic period, The slump came as mortgage rates spiked, driven by strong jobs data and persistent inflation, which pushed up yields on the benchmark 10-year Treasury note. Still, D.R. Horton gained +1.6% and Zillow added +0.3%. Mortgage rates will continue to fall in the coming quarters despite the recent mini-spike.

Mega-caps were mixed. Nvidia rebounded +3% and is nearing all-time highs again on bullish commentary from CEO Jenson Huang and analysts. The market cap is sitting around $3.3 trillion, poised to overtake Apple -0.9% in the coming weeks/months. Tesla crept higher, while the other Mag 7 names dipped.

United Airlines surged +12% to the top of the S&P 500 following an impressive Q3 earnings and revenue beat. The airline also announced a $1.5 billion share buyback, its first since before the pandemic, and projected a solid Q4 outlook.

Morgan Stanley jumped +6% after exceeding Wall Street’s expectations, driven by gains in its wealth management, trading, and investment banking divisions, a common thread in the big banks’ Q3 numbers. U.S. Bancorp rose almost +5% following a Q3 earnings beat, overshadowing a slight revenue miss.

J.B. Hunt Transport Services climbed +3% on a strong Q3 performance, with earnings and revenue surpassing expectations. The company noted increased demand for its intermodal services during the quarter. The company is a bellwether for the logistics industry, providing insight into how the real economy is fairing.

Cisco Systems rallied +4% to reach a 52-week high after Citi upgraded the stock to “buy,” citing potential growth from AI integration into its business. General Motors advanced +2% after announcing a joint venture with Lithium Americas Corp., involving a $625 million investment to boost Canadian mining operations.

ASML fell -6%, extending a -16% drop from earlier after the company mistakenly released its Q3 earnings early and lowered its 2025 sales outlook, citing a slow recovery outside of AI segments. Novavax shares tumbled -17% after the FDA placed a clinical hold on its applications for a COVID and flu combo shot.

The Global X Uranium ETF (US:URA) rallied +7% as Amazon became the latest mega-tech firm to announce an investment in nuclear SMRs, after Google earlier in the week. Big tech is going all-in on nuclear to power AI ambitions.

In our last technical update in late June, we highlighted that “URA, on the 10-year monthly chart, continues to respect the near-term uptrend in place since early ’23. Whilst the resistance level at $35 is likely to prove formidable, the technical setup favours a retest of these highs over the coming year. Historically, URA is well down from the 2011 highs above $130, with significant scope for recovery over coming year with uranium prices now in a secular bull market.”

Following the steep corrective selloff, URA found support at the primary uptrend at $23. The rebound and upward dynamic has been swift with URA now reencountering resistance at the record highs. The technical setup favours an eventual topside breakout and new record highs over the coming months. Further consolidation might be required near term with lingering resistance around the record highs.

Gold prices ticked higher, supporting precious metal exposures. Harmony Gold surged +5%, also benefitting from some positive broker coverage.

The benchmark ASX200 pulled back on profit-taking Wednesday after a soft lead from Wall Street overnight. Gains for gold miners (Evolution Mining stood out with a +6% gain) and a lift in the banks offset weakness elsewhere. The index close lower by -0.41% to 8,284. SPI futures are pointing to a 0.7% gain today.

The energy sector was dragged down by the drop in oil prices overnight. Santos slipped -2%, although Woodside managed to buck the trend, adding +0.6% after issuing upbeat guidance for full-year production. Coal miners continued to face headwinds; Whitehaven Coal fell -3.2% and New Hope dropped -2.7%. Meanwhile, uranium stocks succumbed to some profit-taking after their recent recovery. Paladin Energy was down -3%, Boss Energy slipped -4.2% and Deep Yellow retreated -4%.

I have a lot of confidence in the uranium sector and see a bull market continuing within the sector for some time on the back of rising demand for nuclear power. Last week Google parent Alphabet confirmed its commitment to having datacentres located near six new modular reactors in the US. The rollout of AI is going to have a profound impact on power usage, and here nuclear is going to play a significant role for many countries.

Amazon said on Wednesday it had signed three agreements to develop small modular reactor (SMR) nuclear power technology to meet surging electricity demand from data centres. Amazon is undergoing feasibility studies for an SMR project in Washington and a couple of other locations in the US. MD Matt Garmen said “our agreements will encourage the construction of new nuclear technologies that will generate energy for decades to come.”

Nuclear power, which generates electricity virtually free of greenhouse gas emissions and provides high-paying union jobs, is now getting wide support from both Democrats and Republicans. Political change is unlikely in Australia any time soon, but for many countries, renewables are not a backstop option. Australian uranium miners could therefore remain in a bull market for many years to come, with not much new supply coming on, and production from Russia a key risk.

Yesterday, the rally in the gold miners continued defying weakness elsewhere in the resources sector. Evolution Mining jumped 6.8% after a well-received quarterly production update, while Regis Resources climbed +6.7% after presenting at the Citi investment conference. Gains were broad-based for other gold miners, playing some catch-up with elevated gold prices. Northern Star added +1.8%, and Newmont rose +2.6%. Genesis Minerals gained +5.3%. We hold all these stocks in our portfolios.

Evolution delivered a well-received September quarter update, raking in $429 million in operating mine cash flow. FY25 looks promising for EVN, and I continue to see the stock and other Australian gold miners as being very unrepresented in most investor portfolios.

In our last technical update on Evolution in late September, we highlighted that “Since exiting a primary downtrend in early 2023, Evolution Mining has finally broken out above key resistance at $4.20. This followed numerous tests and setbacks, albeit with a series of higher lows traced out over the past 18 months. Given the lengthy consolidation, upward momentum could now return quickly. Scope is now raised for retests of the next big resistance levels at $4.80 and $5.40.’

Evolution Mining has managed to break through resistance at $4.80 and sustain an advance to $5.01 yesterday. Upward momentum is clearly reasserting. This is encouraging with scope now raised for a retest of the next important resistance levels at $5.50 and the record highs at $6.40 over the coming year. Support is now well defined at $4.80 and below.

Copper specialists Sandfire Resources -0.3% and 29Metals -3% declined, despite the positive update from Evolution (which has a growing copper profile). The iron ore majors were flat to lower, with Fortescue (flat) faring best, while BHP slipped -1.1%, as did Rio Tinto -1.1%, recovering from an earlier deeper loss. Rio’s quarterly update was marred by guidance for iron ore costs to end up towards the top of the guidance range of US$21.75-23.50/t in FY24. These still place Rio very low down on the cost curve (BHP’s costs are even lower), and management noted that they are seeing some high-cost producers paring production. Rio shipped more low-grade iron ore during the quarter. Rio is launching a “future product strategy” review of iron ore, which could see changes in its sales mix.

In our last technical update on Rio a couple of weeks ago, we noted that “Rio Tinto looks to have completed a correction from the record highs above $135. Support is now being encountered at the primary uptrend, which has been consistently respected since 2016. An upward dynamic and resumption of topside momentum now looks to be underway.”

Rio Tinto has sustained the advance and upward dynamic off the key primary uptrend in place since 2016. The technical setup now favours a retest of the record highs above $135 over the coming year. We also have conviction that both copper and iron ore prices will reassert to the topside following recent respective corrections.

The financial sector was the lone broad ASX sector to advance. The big banks gained +0.4% to +0.8% and look to be regaining their mojo, tracking advances for international peers. Bank of Queensland surged +6.5%, a welcome respite for suffering shareholders. The regional bank more than doubled its annual profit from a low base.

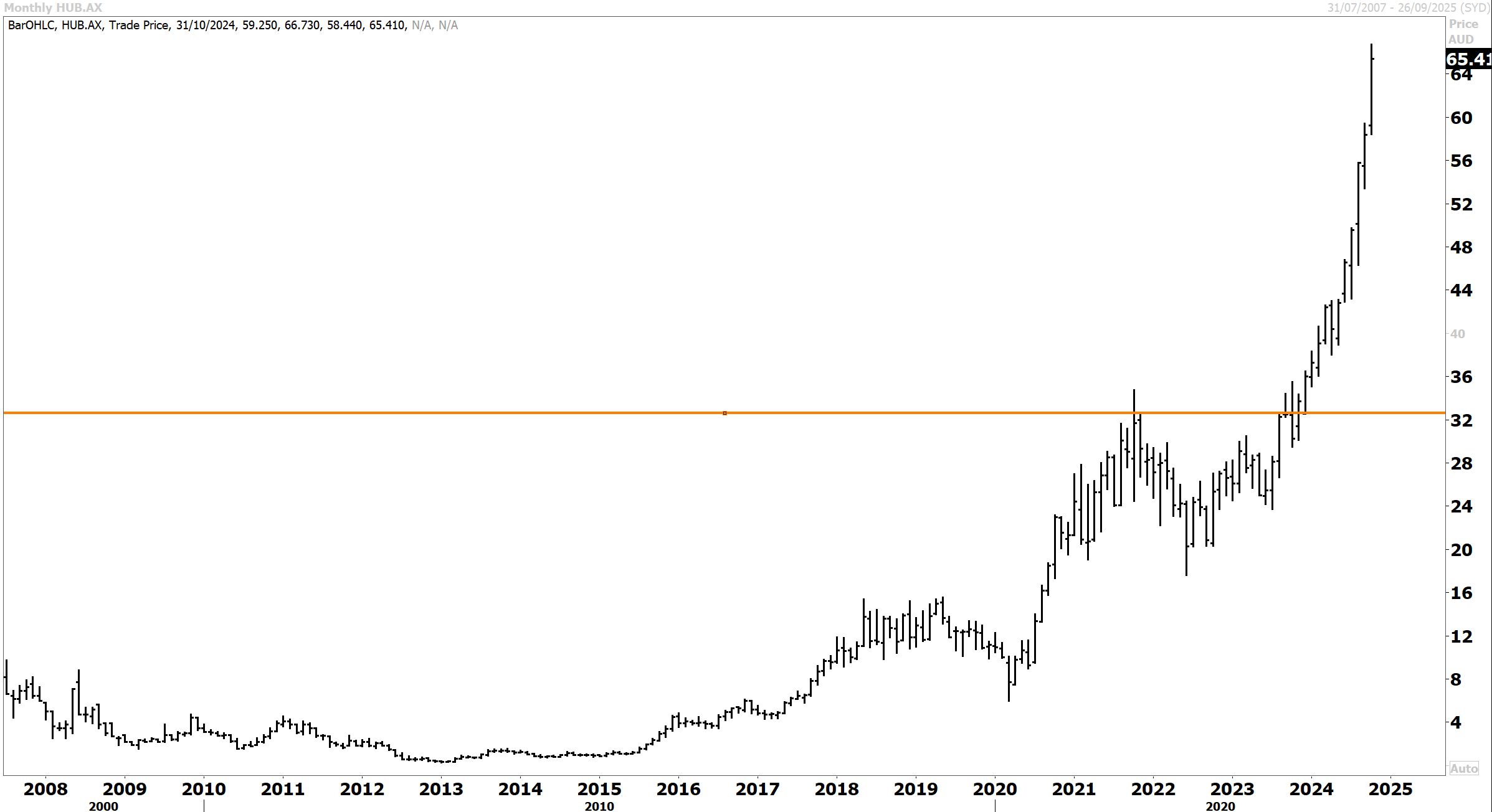

Elsewhere in the broader sector, wealth management platform HUB24 +0.5% extended gains. This week, HUB reported a solid start to the fiscal year, thanks to $4 billion in net inflows. The company also added 195 new advisers, signing 44 new distribution agreements. Total FUA reached $113 billion, up 37% from the prior year, as HUB24 continues to gain market share, ranking first for quarterly net inflows.

In our last technical update we highlighted that “HUB24 continues to exhibit a bullish technical setup after making new record highs above $51. Whilst near term risks a corrective pullback, the primary uptrend remains intact. We anticipate new record highs over the coming year.”

HUB24 has continued to advance upwards and make new record highs. The scope is open for further upside with no obvious resistance levels and with the uptrend yet to show any sign of deterioration. At some point a corrective setback will ensue, but for the now the upward trend remains intact.

In other news, Challenger tumbled -4.6% after a disappointing update. Orora was in the same boat, down -3.5%, as the company noted European demand was still soft. DroneShield fell -8.4% on no major news, instead being caught up in the sell-off in growth stocks.

Turning to Asia, Japanese equity benchmarks slid on Wednesday, snapping a four-day winning streak as political uncertainty ahead of Japan’s general election and concerns about semiconductor demand prompted selling. The Nikkei fell -1.83% to 39,180, while the broader Topix index declined -1.21%. Precision equipment and electric appliances paced the declines.

The yen saw some brief strength after Bank of Japan policymaker Seiji Adachi, known for his dovish stance, suggested conditions were right for the central bank to normalise monetary policy. However, the dollar soon regained ground to trade at the mid-149 level against the yen. The 10-year JGB yield declined 2bps to 0.95%. Financials were mixed, with megabanks Mizuho Financial +0.4% and Mitsubishi UFJ +0.2% posting slight advances. SBI Sumishin -2.3% and Concordia Financial -1.3% led the decliners in the group.

Tech stocks were among the hardest hit, mirroring declines on Wall Street. Tokyo Electron plunged -9.2%, while peers Lasertec -13.4% and Screen Holdings -9.3% followed suit.

China’s CSI300 dipped -0.63%, while the Hang Seng declined -0.16%, as investors awaited more details on Beijing’s fiscal stimulus. However, it was interesting to see a Bank of America report showing fund managers are becoming more upbeat about China’s economic and stock market prospects. The survey reported a net 61% of fund managers expect China’s economy to strengthen over the next year, a sharp turnaround from the previous survey, which has been driven by Beijing’s more aggressive policy stance.

In Hong Kong trading, property developers surged on policy optimism. Hong Kong’s Chief Executive John Lee Ka-chiu announced measures to ease borrowing for homebuyers. China Vanke rallied +18.9%, Longfor gained +7.8%, and China Overseas Land & Investment added +3.8%. Big tech names were mixed, with Meituan +1.4% and NetEase +0.2% advancing, while Sunny Optical -3.9%, JD.com -3.1% and Baidu -1% were among the fallers. Gold miner Zhaojin surged +5%, tracking elevated gold bullion. Consumer-facing Yum China -3.1% and Budweiser APAC -2.6% closed in the red.

London’s equity benchmarks gained on Wednesday, as investors welcomed a sharp decline in headline UK inflation, which dropped to its lowest level in over three years. The FTSE 100 index rose +0.97%, closing at 8,329 points, while the mid-cap FTSE 250 gained +0.89%.

The key driver behind the rally was the drop in CPI to 1.7% for September, down from 2.2% in August, and well below the consensus forecast of 1.9%. This marked the first time inflation fell below 2% since April 2021, with the decline largely attributed to lower airfares and petrol costs. Core inflation eased to 3.2%, while services inflation, a key BoE measure, dropped to 4.9% from 5.6%. Cooling inflation provides some fiscal leeway for Finance Minister Rachel Reeves at her first budget on October 30.

The pound weakened against both the greenback and euro, as interest rate futures now indicate a 90% chance of two BoE rate cuts by year-end. The cooling inflation data lifted consumer-focused sectors, particularly housebuilders, as lower mortgage rates are now anticipated. Persimmon and Taylor Wimpey advanced +3.5%, while Barratt Redrow climbed +4.7%. Retailers also performed well, with early Christmas shopping and Halloween purchases helping supermarket sales grow by +4.7% in September, according to NIQ data.

The pound weakened against both the greenback and euro, as interest rate futures now indicate a 90% chance of two BoE rate cuts by year-end. The cooling inflation data lifted consumer-focused sectors, particularly housebuilders, as lower mortgage rates are now anticipated. Persimmon and Taylor Wimpey advanced +3.5%, while Barratt Redrow climbed +4.7%. Retailers also performed well, with early Christmas shopping and Halloween purchases helping supermarket sales grow by +4.7% in September, according to NIQ data.

Mining stocks posted a solid performance, buoyed by production reports. Antofagasta rose +1.3%, Anglo American added +1.6%, and Fresnillo gained +2.2%. Whitbread surged +6.1% after the Premier Inn owner announced a £100 million share buyback and a 7% increase in its half-year dividend, despite reporting a 22% fall in pre-tax profit.

Other notable movers included the landscaping firm, Marshalls, up +10% after reporting an easing contraction in sales.

Conversely, motor insurers such as Admiral Group fell -2.2%, Aviva dipped -0.3% and Direct Line slipped -3.3% following regulatory scrutiny. Mony Group tumbled -7.8% after reporting weaker revenue from its travel and home services segments. Elsewhere, Powerhouse Energy slid -7%.

On the continent, the larger bourses generally declined as tech and luxury stocks slipped after downbeat updates from ASML in tech and LVMH in luxury. At the close, the pan-European Stoxx 50 was down -0.77%, Germany’s DAX shed -0.27%, while France’s CAC-40 declined -0.4%. Italy’s FTSE MIB advanced +0.24%, while Spain’s IBEX 35 added +0.56%.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters