US equity benchmarks posted modest advances on Monday as traders mulled economic data and commentary from Fed policymakers. The commentary tilted dovish, with Chicago Fed President Austan Goolsbee saying that the focus should shift to the labour market, which “likely means many more rate cuts over the next year.” The boss at the Minneapolis Fed, Neel Kashkari, espoused his view that the Fed can lower rates by another 50bps before year-end. Raphael Bostic from the Atlanta Fed took a more middle-of-the-road approach, saying policymakers shouldn’t commit to large moves.

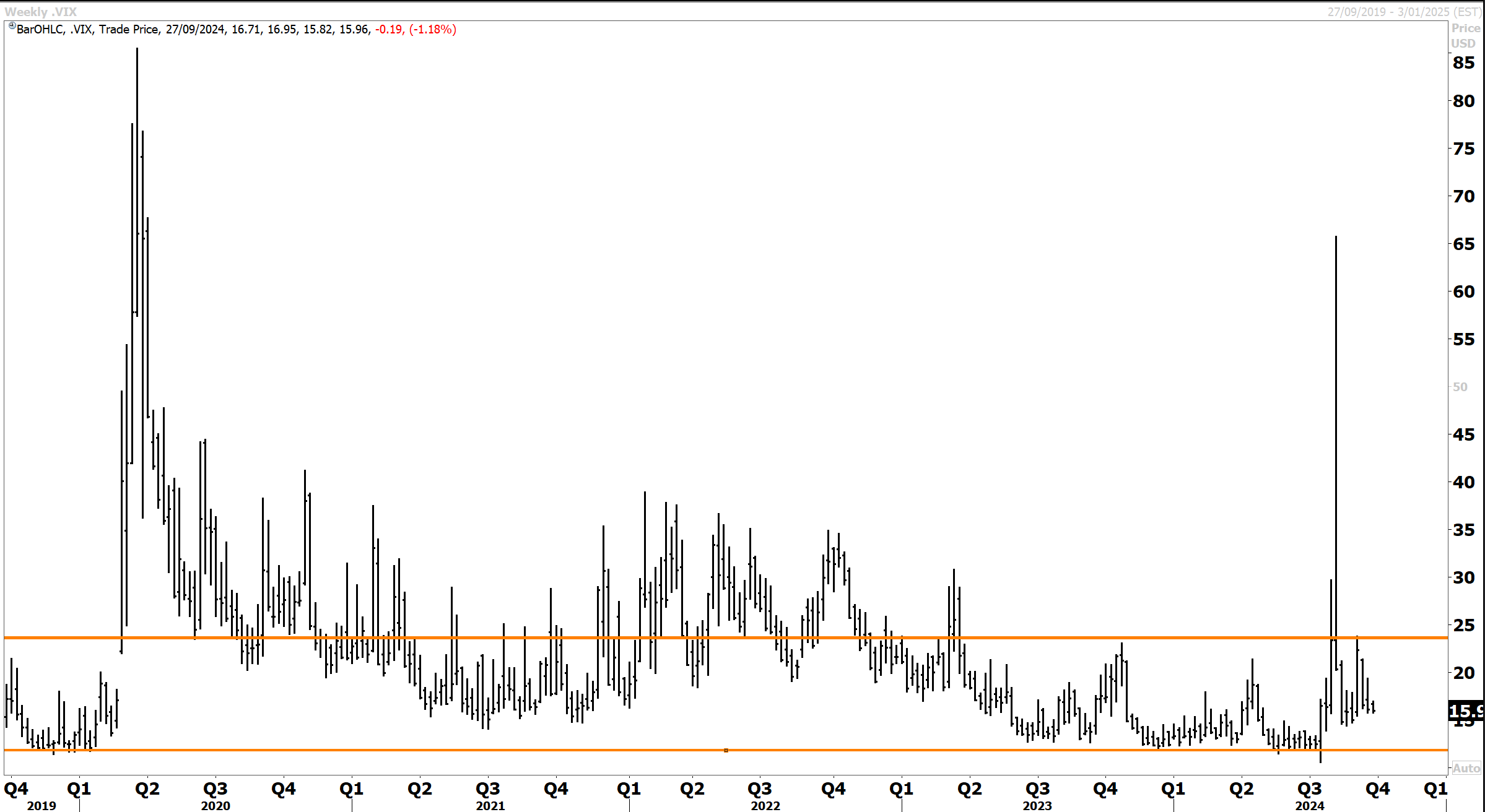

While the core equity benchmarks were higher at the close, there was a notable underperformance from the small/mid-caps, which headed lower. The Dow Jones added +0.15%, the S&P500 gained +0.28% to 5,718, while the Nasdaq rose 0.14%. The Russell 2000 declined 0.3%. At the time of writing, the yield curve continued to steepen, with the 2yr falling 2 bps to 3.57% while the 10s were steady at 3.75%. Commodities were mixed with oil lower by 1%, while gold firmed 0.3% to 2,638oz. Soft ag was higher with the grains all higher. Copper was steady. Volatility continued to decline, with the VIX falling 1% to 16.

With the US indices near record highs and valuation for the S&P500 once again at the top end of the historical range, incoming data must support and live up to expectations. The narrative that the economy is tracking towards a “soft landing” must hold together. Inflation will also need to continue on a downward trend.

This week, the market will look at several prints on manufacturing, consumer confidence and durable goods, and the key PCE price gauge, the Fed’s preferred inflation gauge. Whilst a bad print could instigate volatility, there is nothing to suggest that the US economy wont make a soft landing in the coming months.

Stocks are priced for perfection in the US. The S&P 500 now commands a PE ratio of 21.4 forecast earnings, well above the long-term average of 15.7. What we can say about the US market is that new record highs and additional upward extension beyond 5,700 in the absence of near-term catalysts are unlikely over the coming weeks. But we might not see much in the way of downside volatility either, now that the Fed is easing, with more rate cuts likely on the way.

The VIX is settling down into a lower range. I think the highs seen in August will not be repeated anytime this year.

When September corporate earnings get underway later next month, they will be closely watched. Consensus estimates are for S&P 500 earnings to have climbed 5.4% from the prior year and then jump nearly 13% in the fourth quarter. If this plays out, then we can expect a strong finish to year end, particularly so if the Fed comes in with one or two more rate cuts.

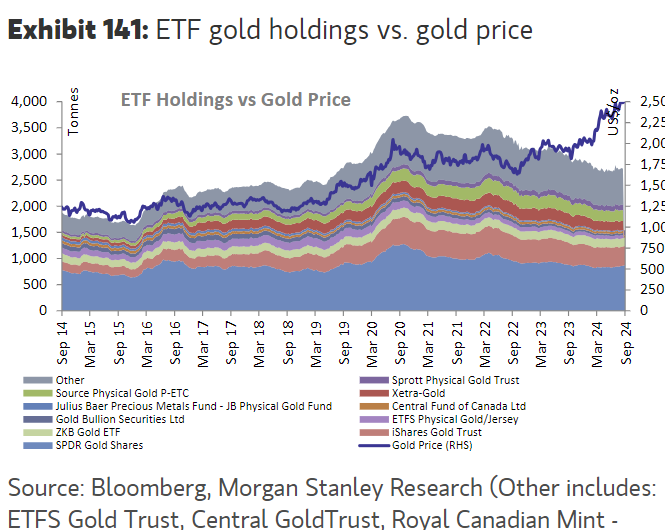

Gold hit a new record high last week, with Comex futures surging past the $2600 level. Dollar weakness after the outsized rate cut and tensions in the Middle East offset muted physical demand in Asia, leading to the surge. Physical gold is headed for its biggest rise since 2010 and is now outperforming most asset classes, including the S&P500.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters