1. Australia Market

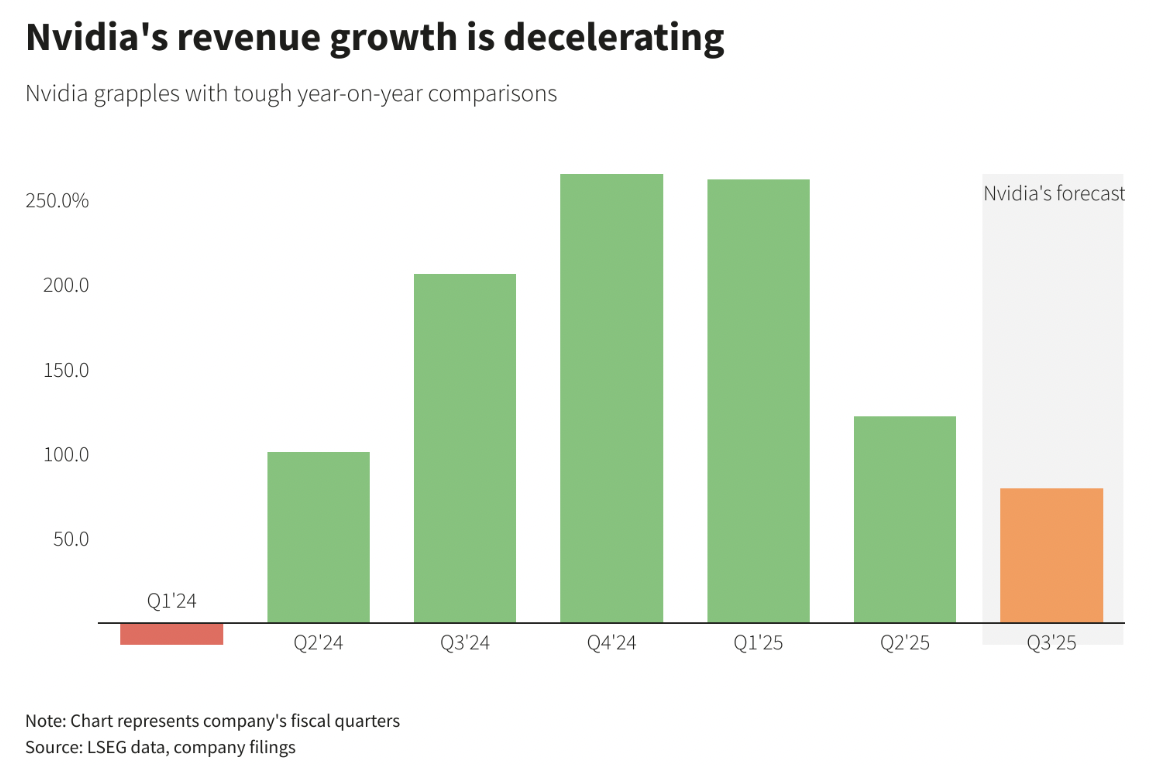

The ASX 200 slid -0.33% on Thursday as traders digested another wave of corporate reports, with significantly more misses than hits. The benchmark opened underwater following a weak lead from Wall Street and Nvidia’s sharp fall in after-hours trading. The index fell deeper in early trading but enjoyed some buy-the-dip support in the afternoon to finish only modestly lower. Most sectors declined, and at the individual stock level, decliners outnumbered advancers by about 1.5 to 1 in the broader ASX 300. SPI futures are pointing to a 0.64% gain on the open.

Only three broad ASX sectors closed in the green, and not by much. Financials gained +0.32%, followed by industrials +0.28% and tech +0.07%. The three sectors that fell the most were energy -2.15%, consumer discretionary -1.95% and consumer staples -1.14%. Among the financials, the big four banks rose +0.2% to +0.8%, with further support from Macquarie +0.7% and Suncorp +0.7%, offsetting modest declines from QBE -0.6% and IAG -0.5%. Tech stocks were mixed, but advances from Wisetech +0.8%, and Xero +1.05% outweighed declines from NextDC -1.4%, Technology One -0.2% and Life360 -1.5%.

The energy sector fell sharply as Brent crude prices dipped below the $80 per barrel mark amid ongoing concerns about demand in China. Santos shed -2.7%, and Woodside Energy dropped -1.7%. Coal miners were also hit hard, with Whitehaven Coal and New Hope Corporation sliding -2.4% and -2.6% respectively. The uranium exposures had a tough day as traders punished Boss Energy -8.3% and Bannerman Energy -9.2% after updates. Paladin Energy’s -3.75% decline was modest in comparison.

A -4.1% slide from Wesfarmers dragged the discretionary sector lower despite reporting a higher 2024 profit and dividend. An impressive performance from Kmart offset weakness in its energy, chemicals, and resources businesses. Traders opted to take some profits off the table after an impressive upward run YTD as the valuation looks lofty. Meanwhile, online luxury retailer Cettire was another notable mover. The stock dived -20% after warning about soft trading and that the auditor has not yet signed off on its numbers.

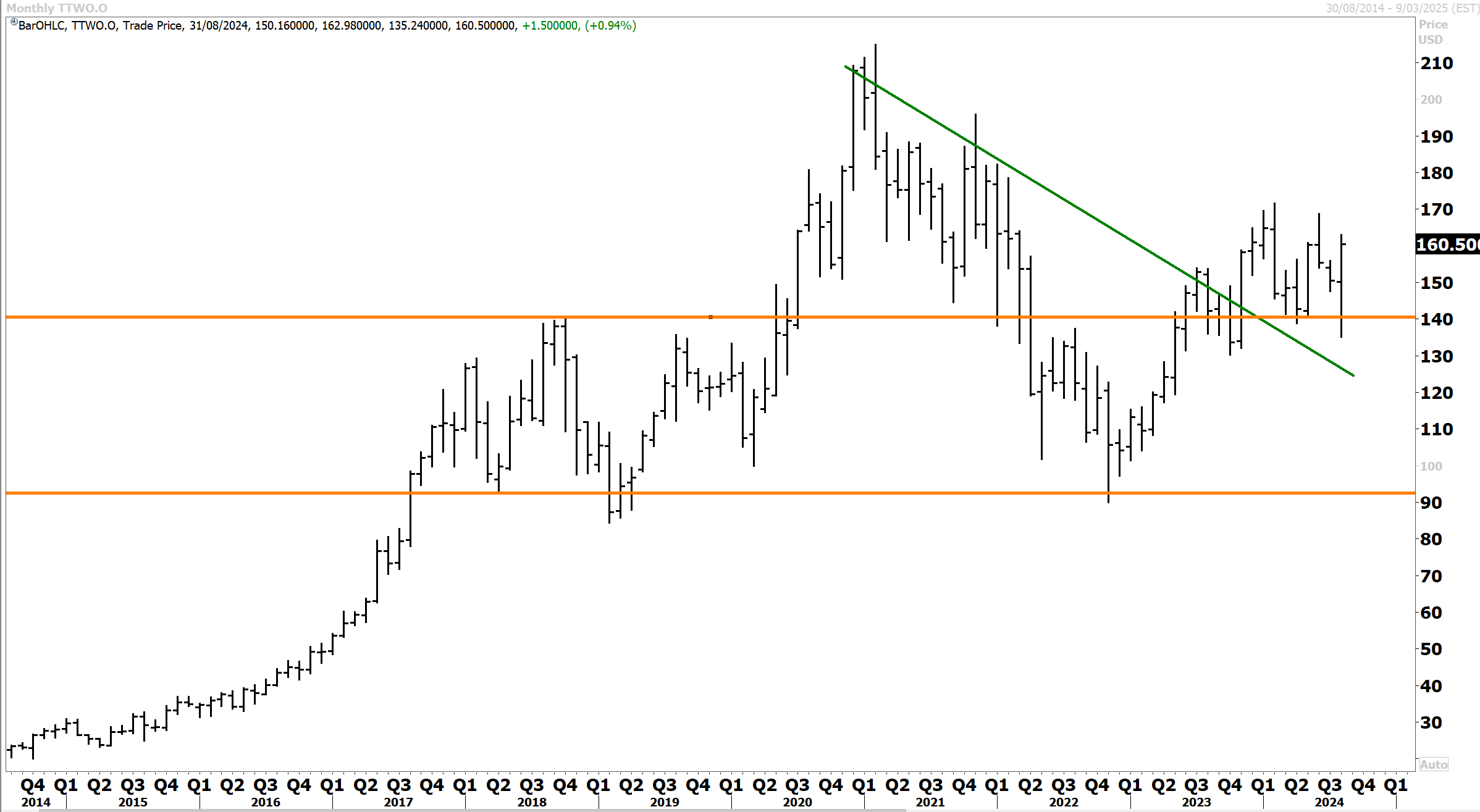

Bega rallied +9.4% to a two-year high after the dairy firm returned to profitability. This was insufficient to rescue the consumer staples sector as Woolworths -2.4% and Treasury Wine Estates -1.9% fell. Reports from consumer-facing companies have been downbeat this week, which adds to my belief about the widening cracks in retail, which will push the RBA towards providing some interest rate relief before year-end.

The Materials sector slipped -0.67%. BHP edged down -0.6%, while Rio Tinto fell -0.8%, dragged lower by softer iron ore prices and broader market weakness. However, Fortescue managed a +0.7% gain. South32 also bucked the downward trend, adding +0.7% after delivering a robust FY24 result. The diversified miner beat earnings expectations and announced a dividend above consensus estimates. A $200 million share buyback was the cherry on the top.

The gold sub-index performed poorly, falling -1.1% despite firmer gold prices. The large caps were broadly lower, with Northern Star -0.5%, Newmont -0.3%, and Evolution Mining -2.1% in the red.

Red 5 was a drag, tumbling -12.3% after disappointing guidance. FY24 gold sales surged 35% to 223,498 ounces, underpinned by a surge from the King of the Hills mine in its second year of operations. The merger with Silver Lake was completed on 19 June 2024, so Red 5’s FY24 results only include 12 days of contribution from Silver Lake. Revenue jumped 47% to $620 million thanks to more ounces and higher prices, but Red 5 posted a statutory loss of $5.4 million due to one-off merger costs. Underlying profit rebounded to $48.5 million from a $1.5 million loss last year. However, the market reacted negatively to the company’s weaker-than-expected FY25 guidance, forecasting lower-than-anticipated gold sales and higher all-in-sustaining costs.

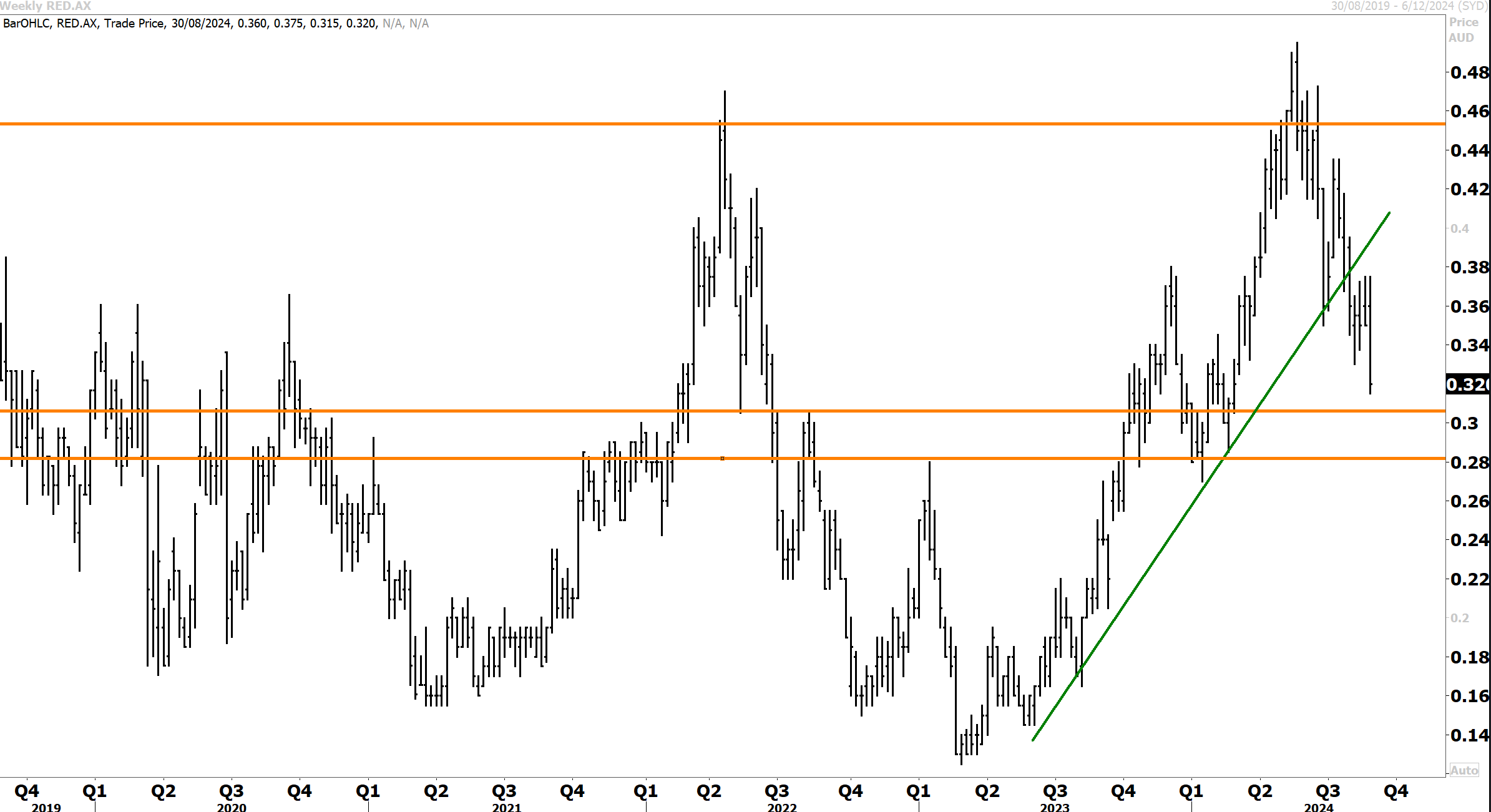

In our last technical update on August 1st, we highlighted that “Following the recent corrective pullback, Red 5 has found support at the primary uptrend and has reasserted itself on topside. A retest and eventual breakout above the 46c high remain the base technical outlook in the coming months.”

Resistance has proven significant above 46c, with RED 5 correcting sharply after breaking below the near-term uptrend and falling back towards support at 30c/32c. This support level is also significant and should hold the shares and provide the foundation for a decent recovery from oversold levels.

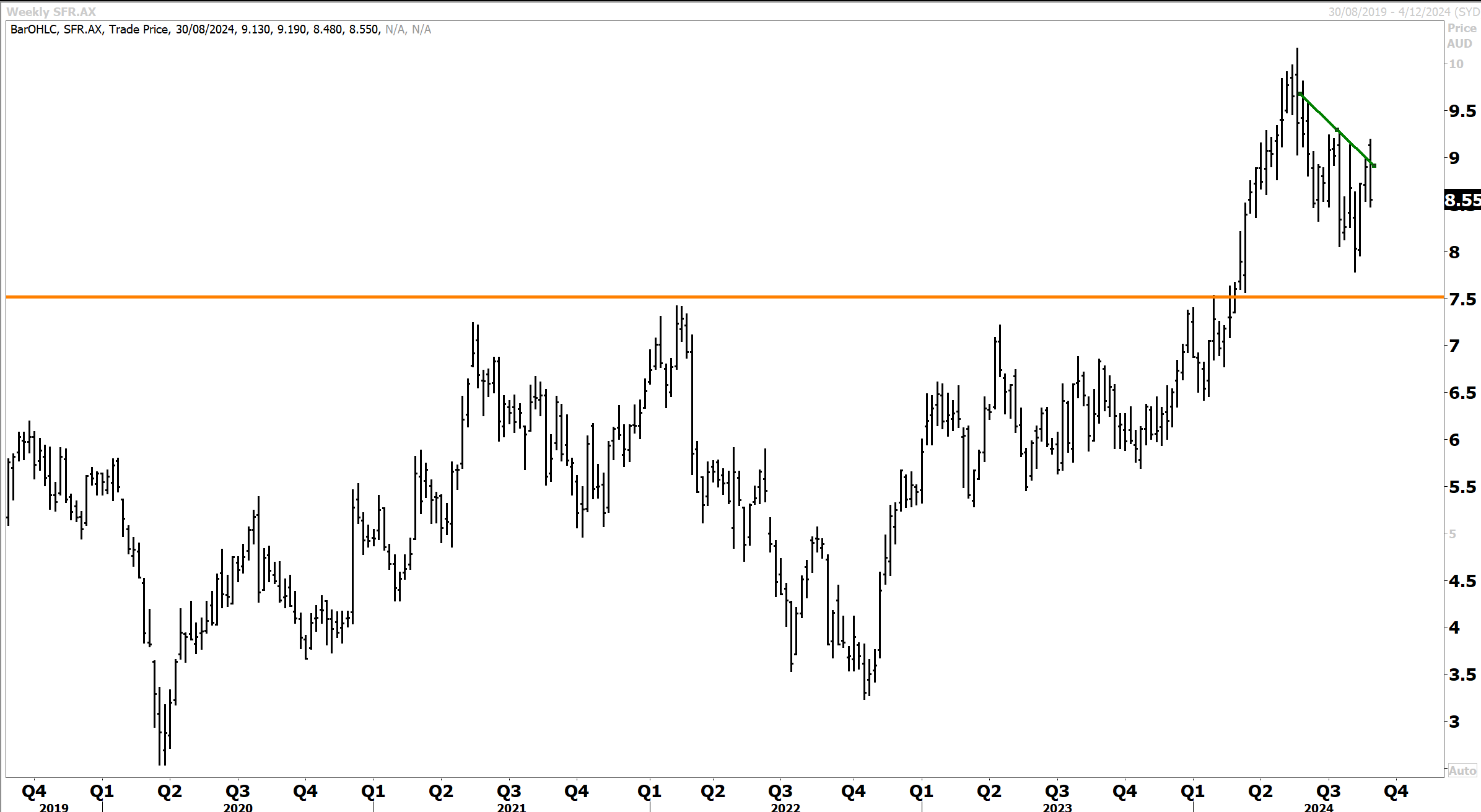

Weaker copper prices and overnight falls in peers dragged on Australian-listed exposures on Thursday. 29Metals retreated 2.8%, and Sandfire fell 3.1%. Sandfire had already pre-released significant information before

Have a great weekend.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters.