Notable Stocks

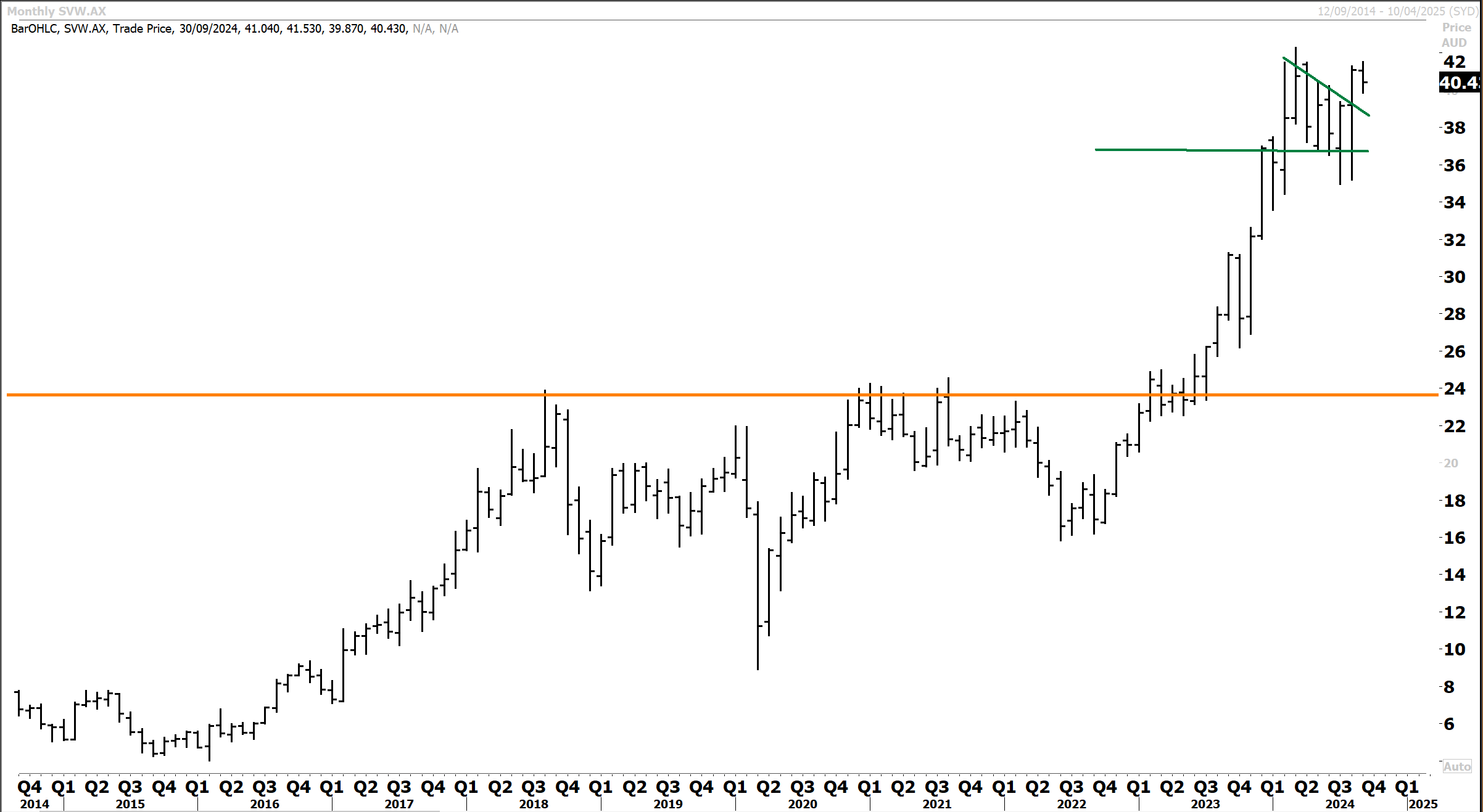

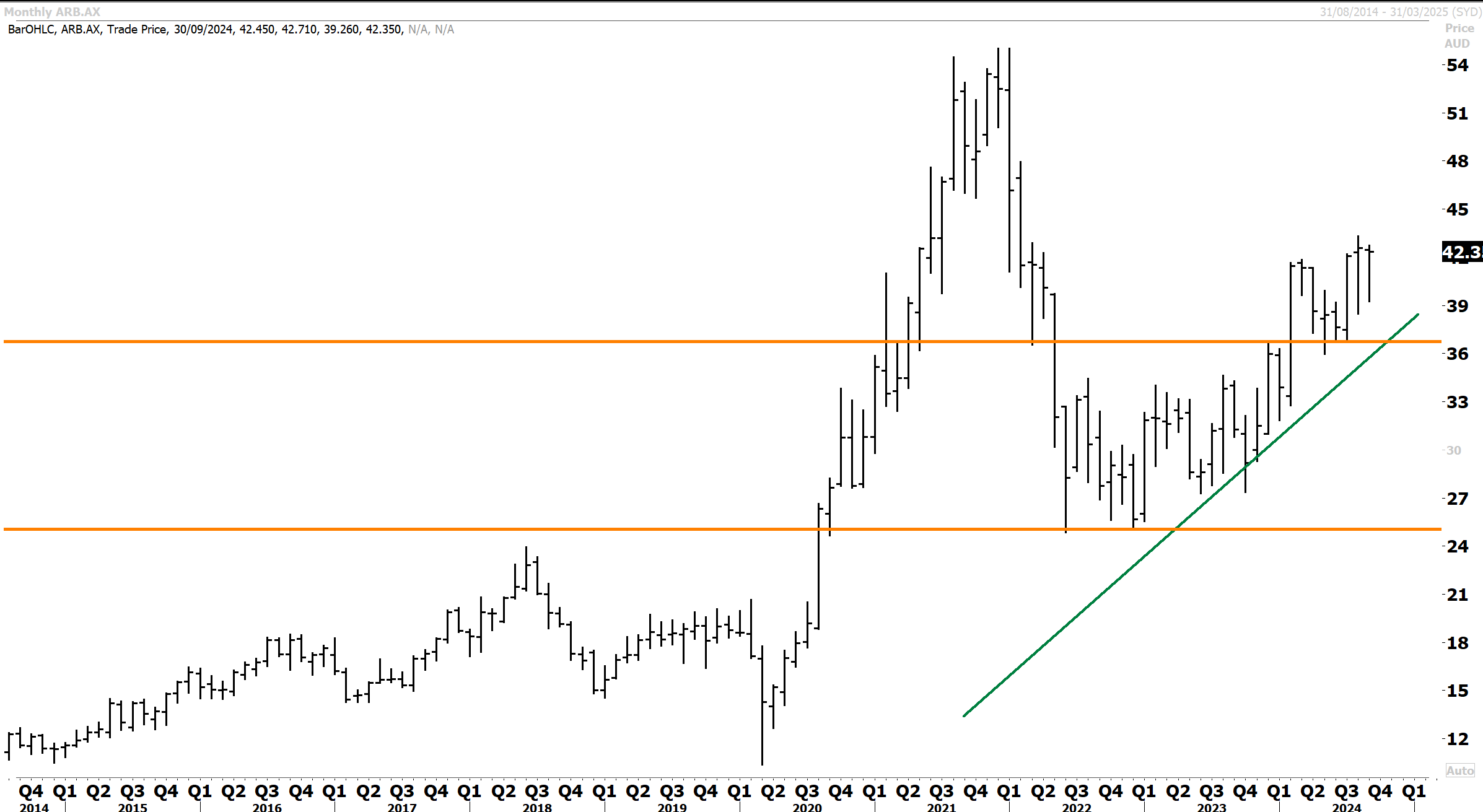

- Australia Market: Stockland, Wisetech, CSL, Westpac, Domino’s Pizza, Seven Group, Qantas & ARB Corp.

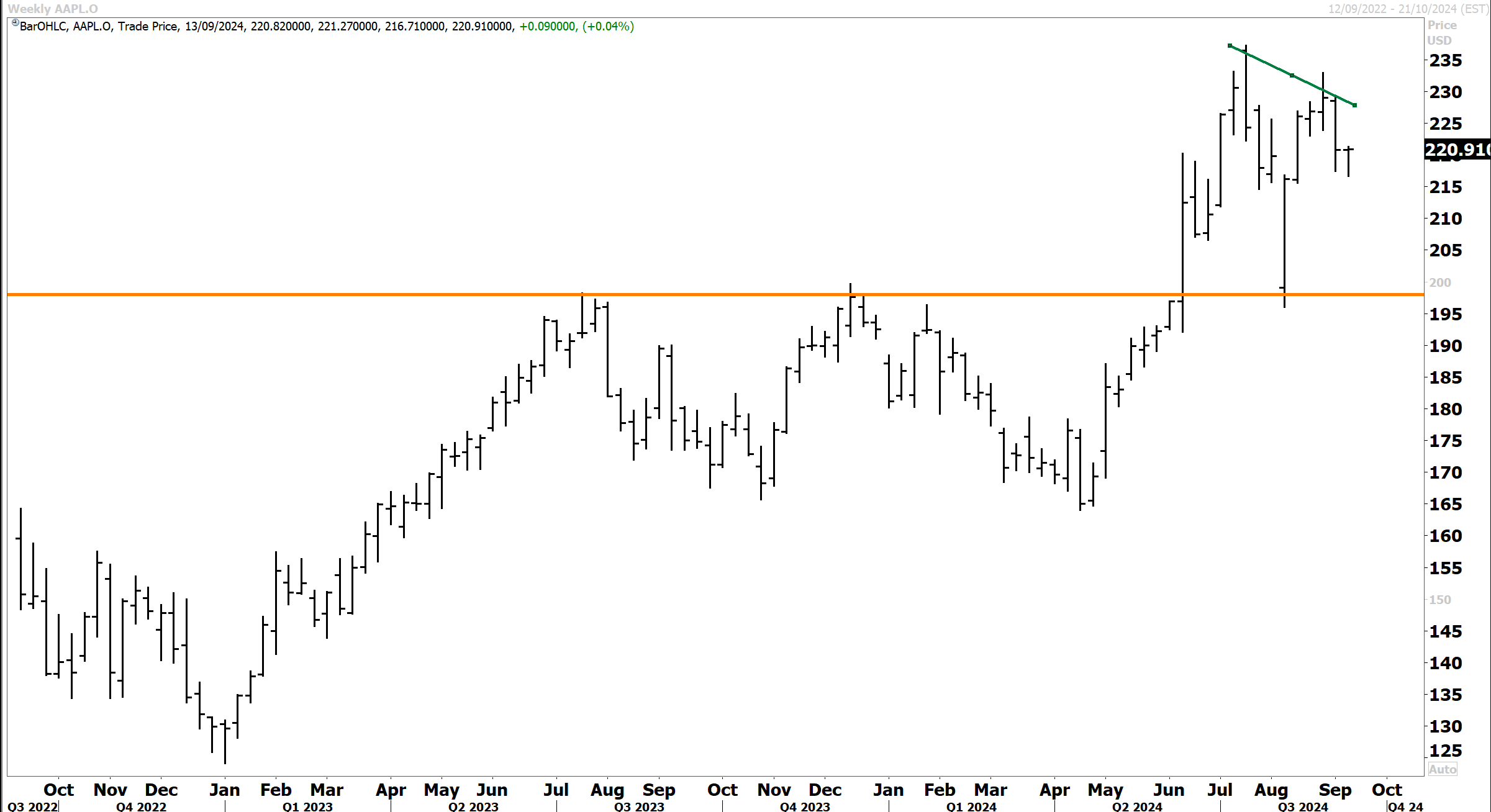

- US Market: Microsoft, Alphabet, Apple, Palantir Technologies, JetBlue Airways, Arm Holdings & Cannabis stocks.

- Other Global Markets: Fresnillo – Mexico, Pernod Ricard – France, Rightmove – UK, Burberry – UK, Entain – UK & Seven & I Holdings – Japan.

1. Australia Market

Five ASX sectors advanced, led by real estate +0.87%, technology +0.4%, consumer staples +0.26% and utilities +0.17%. These groups are typically viewed as beneficiaries of lower interest rates. The materials sector just squeaked into the green by adding +0.03%. Consumer discretionary -0.82%, energy -0.78% and healthcare -0.68% led the six falling groups.

Advances were broad-based for the REITS, with Goodman Group, Scentre Group, Mirvac, and Vicinity Centres posting gains from +0.7% to +1.9%. Stockland climbed +2.1% and confirmed it is in discussions with the competition watchdog about the divestment of a residential community. The expectation is that this would pave the way for a broader deal to acquire multiple communities from Lendlease. Meanwhile, Hotel Property Investments (HPI) surged +7.5% after Charter Hall Retail REIT +0.7% and super fund Host Plus submitted an acquisition bid for HPI.

A +2% gain for Wisetech offset modest declines for other tech stocks, and the sector closed modestly higher. At the other end of the spectrum, Premier Investments dragged on the consumer discretionary sector. Premier fell -3.9% after a soft trading update and the news that Smiggle CEO John Cheston’s employment was immediately terminated upon misconduct allegations. Mr Cheston is due to shift to the CEO role at Lovisa -4.5% in June next year. Super Retail fell by 7.35%, which was another drag, although the decline was primarily due to going ex-dividend. This was significant, including a 37c ordinary and 50c special dividend.

CSL declined -1.2% as the stock traded ex-dividend, weighing on the broader healthcare sector. The energy sector struggled due to the sharp fall in oil prices over the past few weeks. Woodside slipped -1%, while Santos dropped -0.6%. The coal producers were mixed. Whitehaven -0.7% dipped, New Hope Corp added +1%, and Yancoal rallied +4.5% as the latter will join the ASX 200 upon the rebalancing on 23 September. Uranium exposures found some bidders after the recent hammering the sector has endured. Paladin Energy +0.5%, Boss Energy +0.8% and Deep Yellow +1.6% closed in the green.

Technically, CSL is poised to break above topside resistance at $310 following a multi consolidation with a broad range. The topside breakout will likely define the next upward leg in CSL, with the scope to reach a price target of $400 over the coming year. This is one stock to place on the buy list in the coming weeks when equity markets bottom during the incumbent correction.

The financial sector saw early losses but pared back most declines by the end of the session.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters.