Sandfire Resources (ASX: SFR)

Sandfire Resources (Sandfire) announced on 18 November 2022 that it was raising up to A$200 million, by way of an accelerated non-renounceable entitlement offer to shareholders. Sandfire is raising capital to ensure a strong balance sheet and fund ongoing growth initiatives. The following image shows the locations of Sandfire’s global operations:

Source: Sandfire

Sandfire has successfully completed the institutional component of its entitlement, raising a total A$147 million at an issue price of A$4.30 per share and a ratio of 1 new share for 8.8 existing shares. The take up was approximately 91% of eligible participants and settlement occurred on 28 November 2022 (this is NOT the settlement date for the retail entitlement offer).

The retail entitlement offer is on a ratio of 1 new share for every 8.8 shares already held and the issue price has been set at A$4.30 per new share. The eligibility date to participate in the entitlement offer was 22 November 2022. Sandfire expects to raise the remaining A$47 million from its retail shareholders. Members eligible to participate will have received the Retail Offer Booklet that was forwarded on 25 November 2022. The Retail Offer Booklet contains details of the entitlement offer including other eligibility criteria.

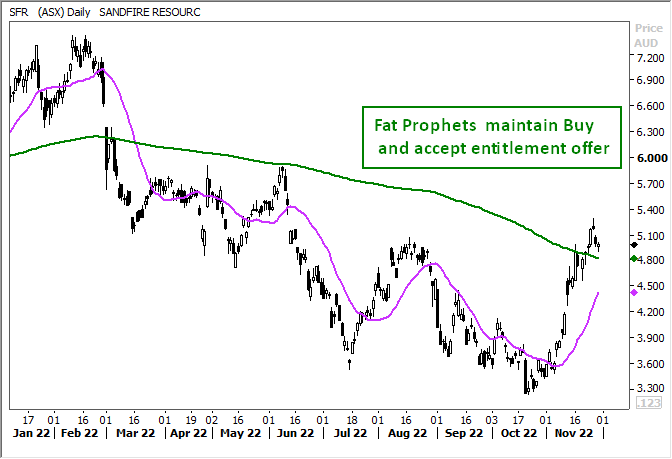

The daily view chart of SFR indicates the price has made a significant breakout across the 20 period simple moving average

The offer period opened on 25 November 2022 and will close on 8 December 2022. Entitlements taken up will settle on 14 December 2022, with holding statements, to reflect the new shares taken up, will occur on 14 December 2022. Trading on the Australian Stock Exchange in the entitlement shares, under the code “SFR,” will commence on 15 December 2022.

The entitlement is non-renounceable, so entitlements cannot be sold on the ASX. Eligible Members who do not take up their entitlement, by the close date of the offer, will lose all value in the entitlement. The entitlement offer is however underwritten to ensue Sandfire receives the full funding it is seeking. At the time of writing, Sandfire’s shares were trading on the ASX at A$4.98.

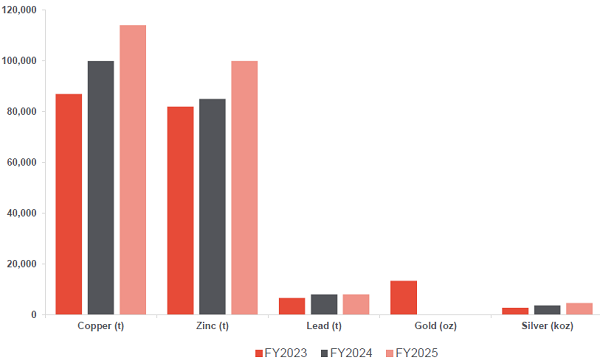

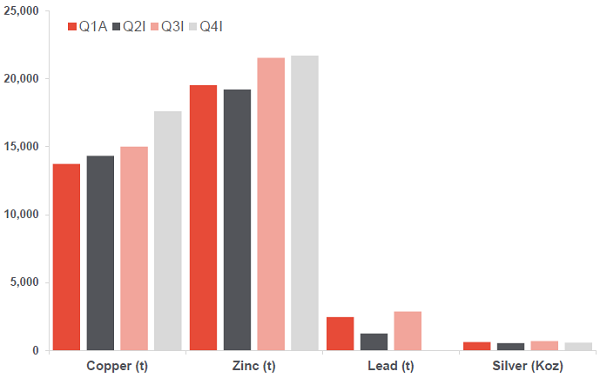

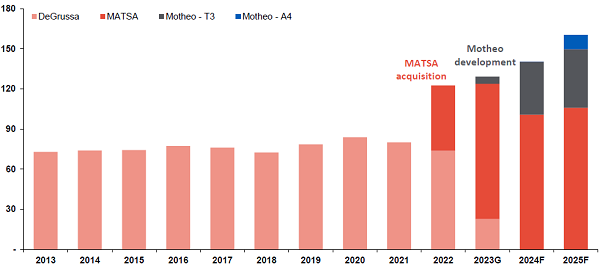

We recommend eligible Members Sandfire has a significant pipeline of growth opportunities, with the MATSA copper acquisition in Spain a major game changer in our view. The acquisition has reinforced Sandfire’s growth profile over the coming years in copper especially, zinc and lesser lead, gold and silver. The following chart shows forecast total production out to 2025 for copper, zinc, lead, gold and silver: Source: Sandfire The MATSA acquisition does diversify Sandfire’s product offerings and geographic locations, while weighing up in copper. We are pleased with this nearside growth profile with copper trending higher in the three years ahead and are of the view there is more to come beyond 2025. On MATSA specifically, operations in 2023 are expected to produce 60,000 to 65,000 tonnes of copper, 78,000 to 83,000 tonnes of zinc, 6,000 to 10,000 tonnes of lead and 2.0 to 3.0 million ounces of silver. The following chart shows MATSA’s quarterly production profile for 2023: Source: Sandfire Not only has MATSA changed Sandfire’s future production profile, but the mine has brought with it an excellent cost structure. C1 cash costs for 2023 are forecast to be US$1.78 a pound, making MATSA a low cost copper producer. Copper is currently priced around US$3.55 per pound, which delivers sound operating margins for the mine in 2023. Sandfire expects to spend US$80 million to US$90 million in 2023 on further development activities. We are of the view, the nature of the ground at MATSA lends itself to ongoing brownfield development. A key takeaway is MATSA sits in a region (Europe) that has learnt the hard way to be self-sufficient. Sandfire’s other key development is its Motheo copper mine in Botswana, with the following image showing a concept of the Motheo mine and infrastructure: Source: Sandfire Motheo has a base case capacity of 3.2 million tonnes of ore per annum and a definitive feasibility study on expanding capacity to 5.2 million tonnes per annum is schedule to be handed down in the June 2022 quarter. The peak forecast is for production of 55,000 tonnes of copper per annum over a life of ten years. Production is forecast to commence in the June 2023 quarter and is on track to hit this start date. The following chart shows forecast annual production for the Motheo mine: Source: Sandfire The mine is expected to produce 440,000 tonnes of copper over its life and around 18.4 million ounces of silver. Life-of-mine all-in sustaining costs (AISC) is forecast to be US$1.79 a pound. At this ASIC, operating margins will be significant given the current copper price (a reminder US$3.55 per pound). The mine carries a cost of US$397 million with an additional spend of US$47.9 million to lift capacity to 5.2 million tonnes. We are comfortable with Sandfire’s growth profile and the opportunities additional cash on hand will deliver, given the nature of the ground at both MATSA and Motheo. The following chart shows Sandfire’s forecast annual copper equivalent production out to 2025: Source: Sandfire Sandfire certainly has, in our view, the growth opportunities going forward to further expand production and we believe in the current environment equity capital is a prudent funding source. We have a favourable view of the MASTA acquisition, which will set the base for Sandfire’s future production. On the balance sheet, we are comfortable with its structure, post the MATSA acquisition, and again consider it prudent management to use equity funding to stiffen it further, given the current interest rate cycle. Sandfire will provide greater clarity around its financials with the reporting of its half year result to 31 December 2022, during April 2023. The monthly view of SFR indicates price support at $3.50, current price movements have risen strongly and are currently testing the 12 month simple moving average. Overall, the price remains within a trading range between support at $3.50 and resistance shown at $8.50 New Chief Operating Officer and Managing Director Brendan Harris joins Sandfire at an opportune time and brings with him, we believe, the experience to navigate its fortunes. His experience in a multi mine operating environment will be invaluable. We believe Sandfire Resources is well-positioned, operationally to generate future shareholder value. The capital initiative will allow Sandfire Resources to settle its balance sheet and provide funds for growth. We consider this initiative as prudent financial management. Consequently, our recommendation for Sandfire Resources as a buy for Members with no exposure remains unchanged. Members should also note our recommendation earlier in this review regarding the entitlement offer. Disclosure: Interest associated with Fat Prophets holds shares in Sandfire Resources.