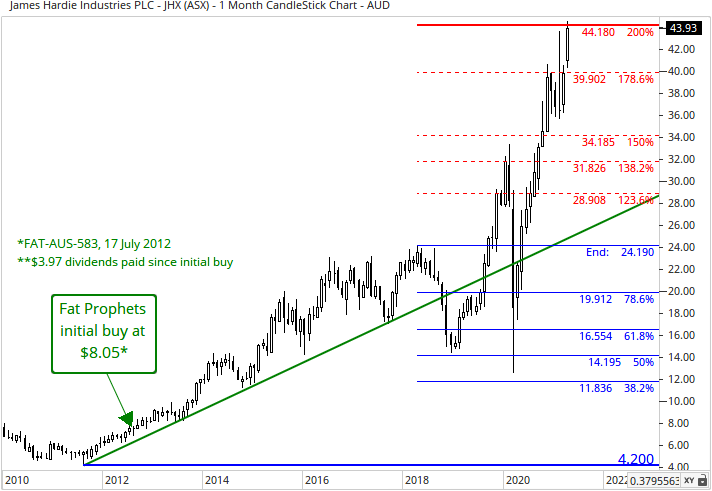

James Hardie (ASX: JHX)

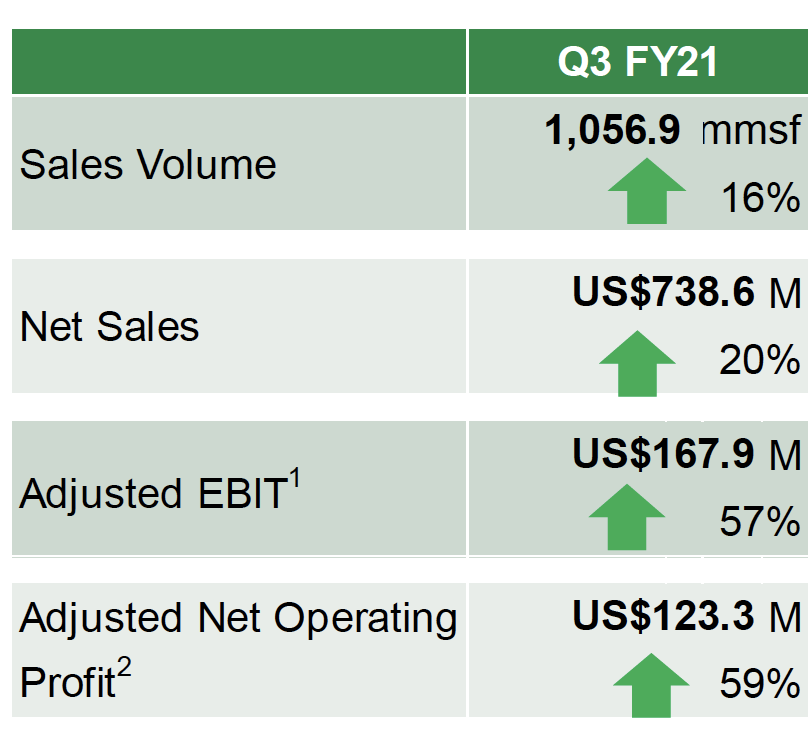

Shares of James Hardie Industries have continued to advance year-to-date, extending the strong rebound after last March’s pandemic induced sell off and hitting fresh new highs. We view the rise as justified as the core US housing market continues to look robust and James Hardie has continued to pick up market share, with more likely to come.

Under CEO Jack Truong, the operational and financial performance has continued to impress, with cost-out manufacturing initiatives combined with strong sales boosting margins. New product initiatives should boost sales further in upcoming years.

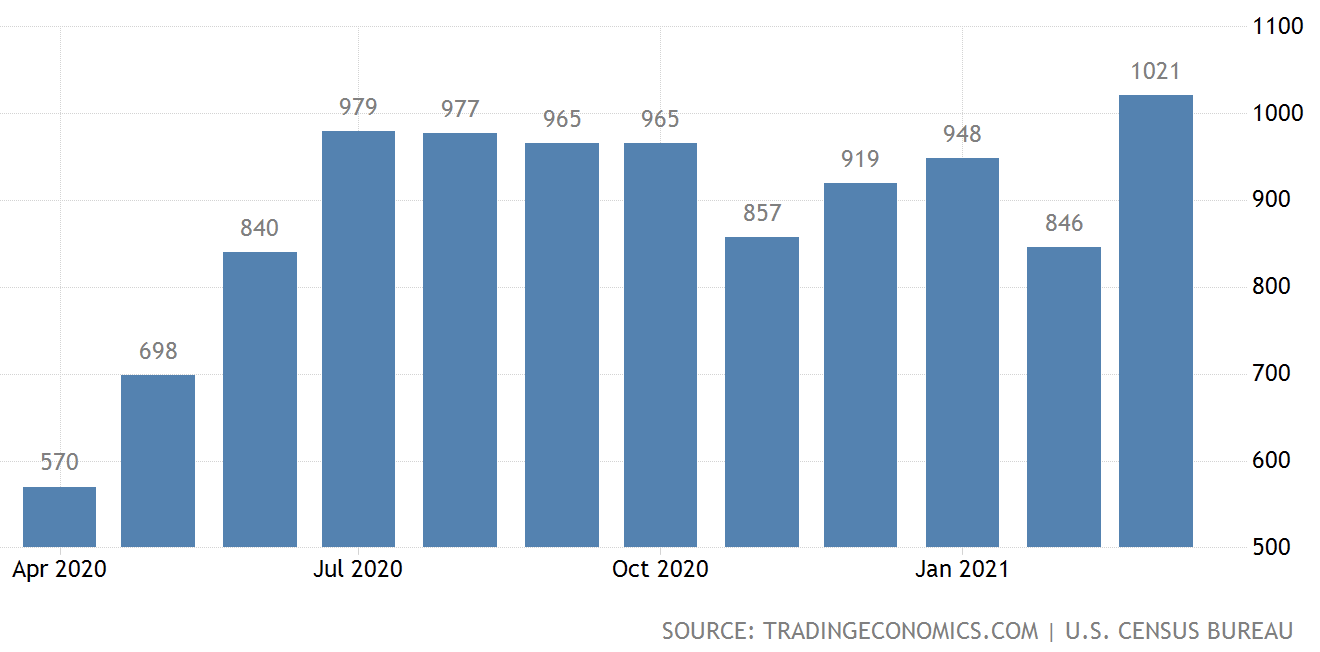

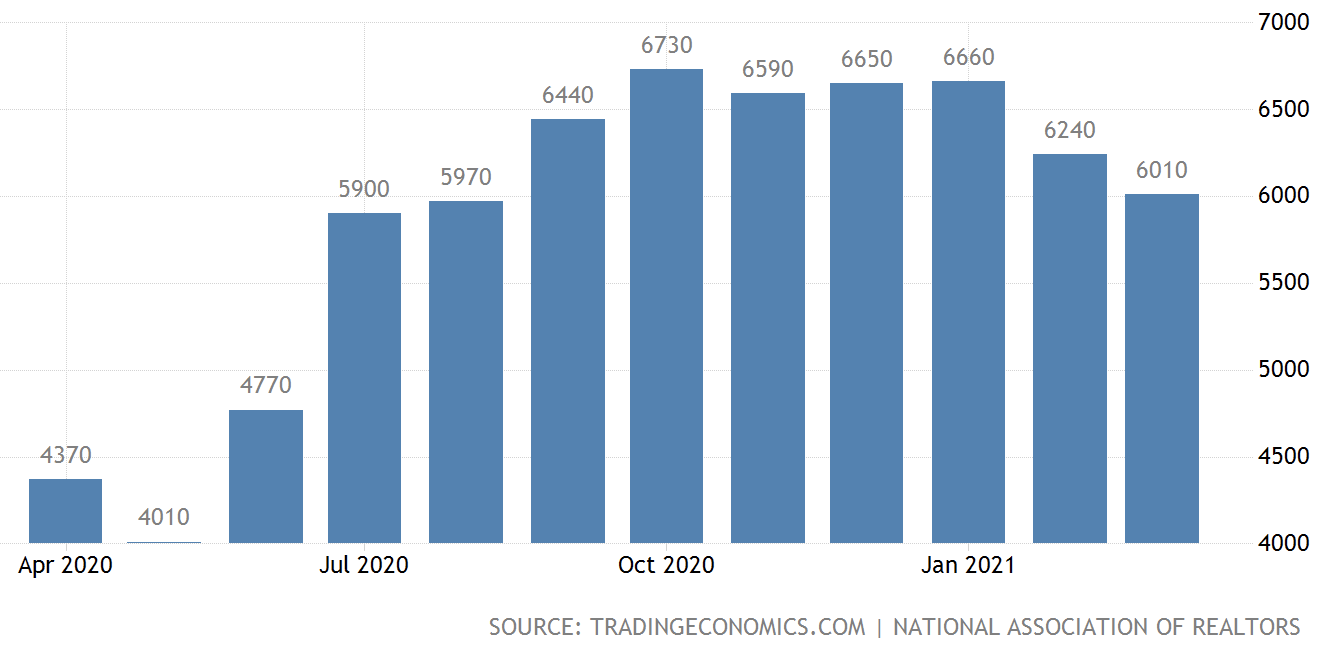

Of the major sectors of the US economy, the housing sector has been one of the brightest spots and most resilient amid the pandemic, quickly recovering from the interruption last April. Record low interest rates along with a shift in housing preferences continue to be supportive. Now we have the jobs market staging a strong recovery and huge amounts of stimulus have been pumped into the economy. The rise in housing prices is a risk for new sales but supports the upgrading of existing homes, which also benefits James Hardie sales. There is a huge inventory of aged homes in the US alone.

Positively, for the prospects for a robust housing market over the next couple of years, unlike the previous housing boom, credit scores are high across the board this cycle, reducing risk. Finally, additional government support and possibly more from the central bank for the broader economy is likely on the horizon.

We continue to believe in the quality of the business and the long-term market opportunity for fibre-cement. James Hardie’s fibre-cement product should continue to win market share, with its niche outpacing the broader building materials market. James Hardie has cited fibre-cement’s advantages as being “ more durable than wood and engineered wood, looks and performs better than vinyl, and is more cost effective and quicker to build with than brick.” Positively, with its dominance in the niche, it has strong pricing power (leading to relatively high margins within the industry) and has exhibited this through past cycles.

The Fermacell acquisition has diversified the business and provides a growth platform in Europe, where previously James Hardie has had comparatively little traction.

Looking at recent macro data from the US housing market and sales of new single-family homes jumped 20.7% month-on-month to a seasonally adjusted annual rate of 1.021 million in March, coming on the heels of an upwardly revised 846,000 in February and well above economists’ expectations for 886,000. It was the highest reading since August 2006 and a strong rebound after cold weather chilled buying activity in February. There is limited inventory.