Sonic Healthcare (ASX: SHL)

Although Sonic Healthcare shares have pulled back from 52-week highs, they have staged a nice ascent in 2023 and we believe the recovery has much further to go, with a solid fundamental outlook.

The earnings ‘hole’ from lapping those bumper results amid the pandemic has faded and we foresee a robust earnings outlook for the coming years. Surgeries and GP visits have further to recover, with positive implications for Sonic’s business, adding to what are already positive secular trends. The Federal budget was an incremental positive.

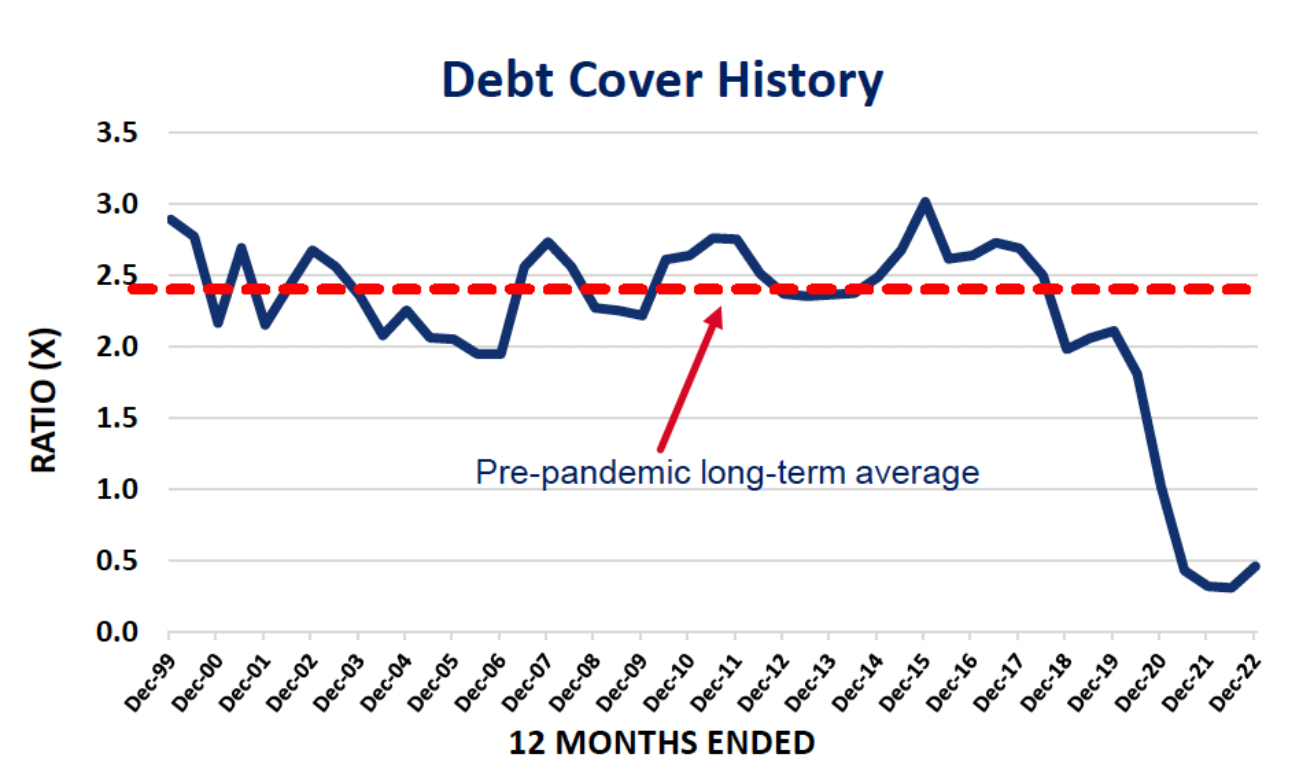

Sonic is in a great position to continue to bolster organic growth via acquisition as covid-testing was a cash bonanza helped Sonic deleverage the business materially, leaving Sonic with plenty of dry powder for new deals. Indeed, since our last review, Sonic has announced another bolt-on (more on that below). Meanwhile, the defensiveness of the broader healthcare industry is likely to attract more investor interest in the tough economic times looming. Sonic is one of the higher-quality businesses within the sector.

We continue to have confidence in the long-term prospects for Sonic, with the business very well managed. We upgrade our rating on Sonic Healthcare to a buy for Members with no exposure.

Turning to the charts, SHL had an impressive run surging from 52-week lows in mid-February to 52-week highs in just two months. Since peaking in April (see above), SHL has seen some profit-taking with the shares trading in a downward trading channel. Still, SHL is forming a ‘bull flag’ – typically a continuation pattern where profit-taking activity pushes the stock lower before breaking out to the upside. A prudent buying strategy would be to attempt to enter either (i) at the bottom of the flag (i.e. support levels) or upon breakout of the upper band.

Since our last coverage (in early April), Sonic announced in late April that it had signed a binding agreement[subscribe_to_unlock_form] to acquire one of the leading clinical laboratories in Duesseldorf, Medical Laboratories Duesseldorf (MLD). Sonic noted the “highly efficient” hub-and-spoke infrastructure (we like this feature as well) of the business around its 24/7 Duesseldorf central laboratory.

MLD is expected to generate revenues of approximately €50 million in FY2024 and employs about 300 staff, including 13 pathologists. The acquisition price tag of €180 million is reasonable, in line with similar transactions. Sonic continues to exercise solid financial discipline with these acquisitions, key for the business model. The transaction is being funded through a combination of existing cash and debt facilities. A benefit is that Sonic reported most of the purchase price is tax-deductible in Germany over a 15-year period as goodwill amortisation.

The deal is expected to be immediately accretive to earnings per share (EPS), with a return on invested capital (ROIC) that exceeds Sonic’s cost of capital. The financial benefits are set to increase thanks to multiple synergy areas across infrastructure and operations. We note that this deal follows closely on the heels of the earlier announced deal to acquire Diagnosticum, one of the largest clinical and anatomical pathology laboratory groups operating in Southeast Germany, around the city of Dresden. That €190 million deal had many similar characteristics, and it seems Sonic is continuing to make a big push in Germany.

The low levels of gearing provide a strong platform to boost M&A when appropriate and Sonic has been finding some modestly sized deals that fit the bill.

Source: Sonic Healthcare

We believe in coming quarters the likelihood of at least a significant economic slowdown in Australia will see more investors attracted to the defensive nature of the core Sonic business, with healthcare being among the least cyclical sectors – when one has a healthcare problem, they tend to address it, if possible.

The underlying drivers for the base business remain structurally positive and organic growth will continue to be bolstered by acquisitions going forward.

We rate Sonic Healthcare as a buy for Members without exposure.

Disclosure: Interests associated with Fat Prophets hold shares in Sonic Healthcare.

[/subscribe_to_unlock_form]