Key themes and stocks discussed today:

- Financial markets had a monumental day on Wednesday. Two important central bank decisions triggered huge rallies in equities, bonds, and commodities and a selloff in the US dollar against the yen. Geopolitical tensions surged in the Middle East between Iran and Israel, boosting Comex gold futures up to near-record highs.

- Fed Chair Jerome Powell gave the “green light” for rate cuts, mentioning September multiple times at the press conference. Only a seismic shock will get in the way of rate cuts now, and I continue to see a solid case for three by year-end. This was catnip to the markets with a big rally in equities. The Nasdaq came roaring back, and Meta Platforms reported a beat after the market closed.

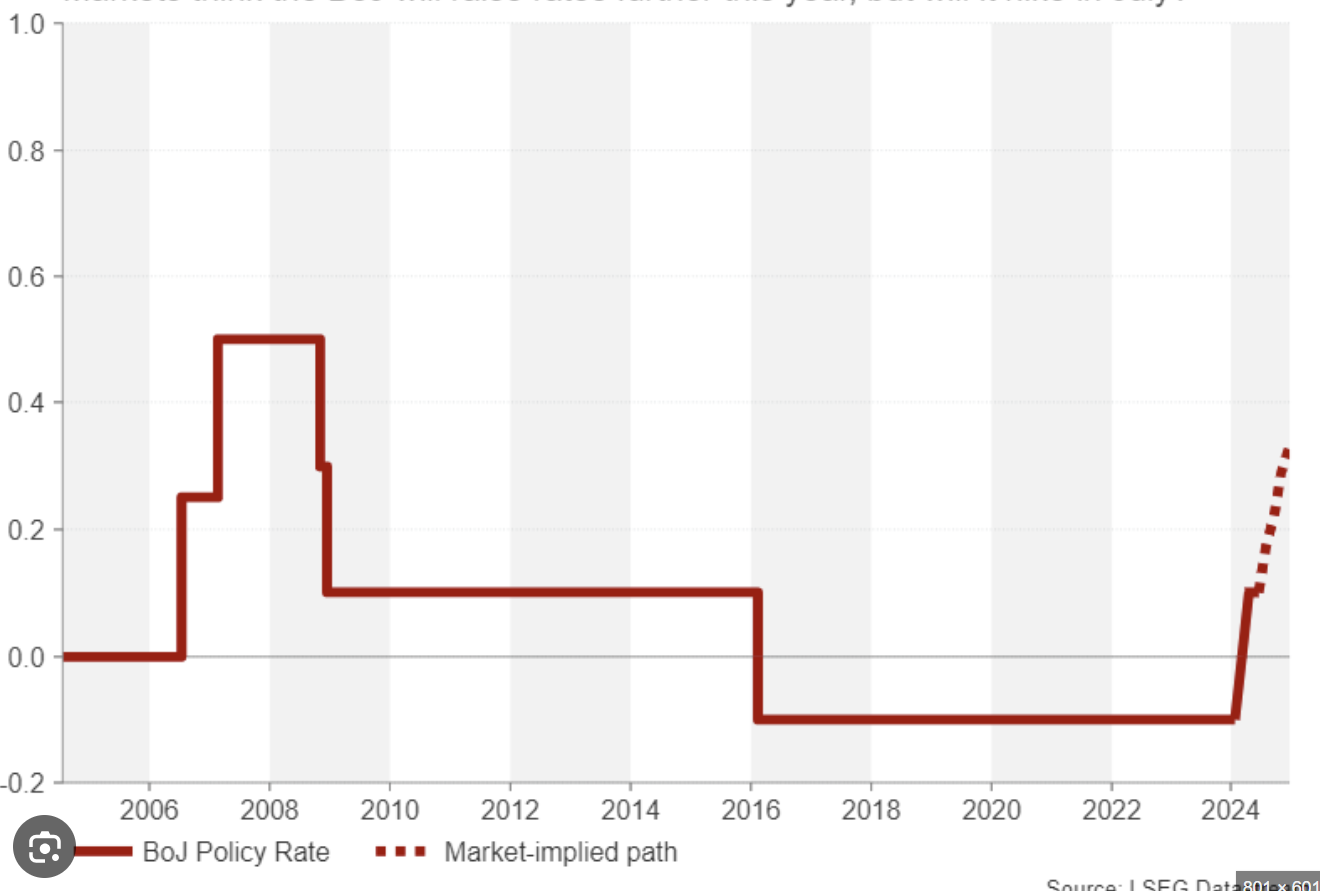

- The BOJ raised rates for the second time since 2007 (both times were this year), which was the catalyst for a large drop in the dollar/yen. Australia also had good news on the inflation front, and Commonwealth bonds rallied strongly after yesterday’s print, which boosted equities.

- Goldman Sachs CEO David Solomon has changed his mind about no rate cuts this year – and now sees two as consumer spending habits change.

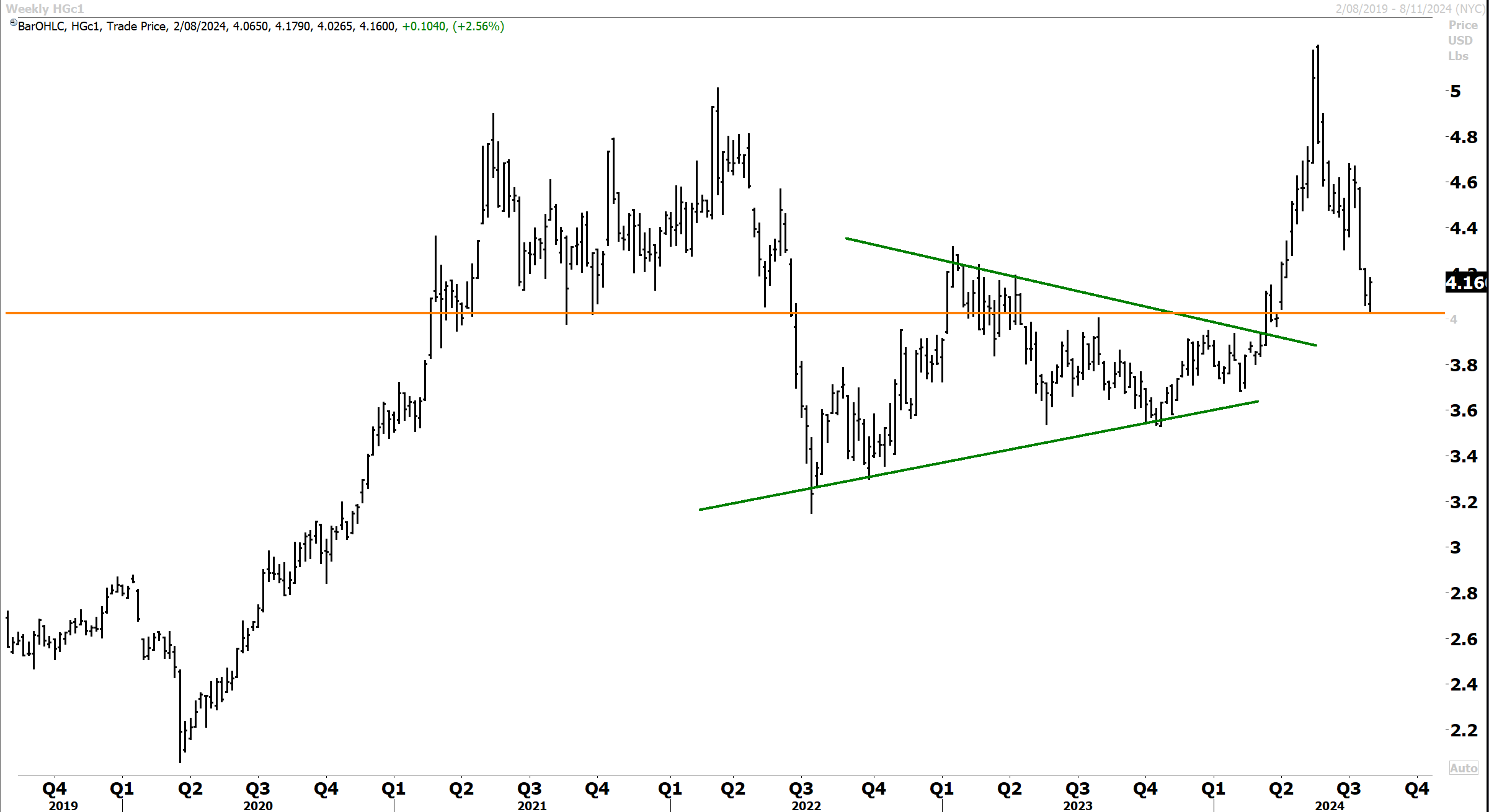

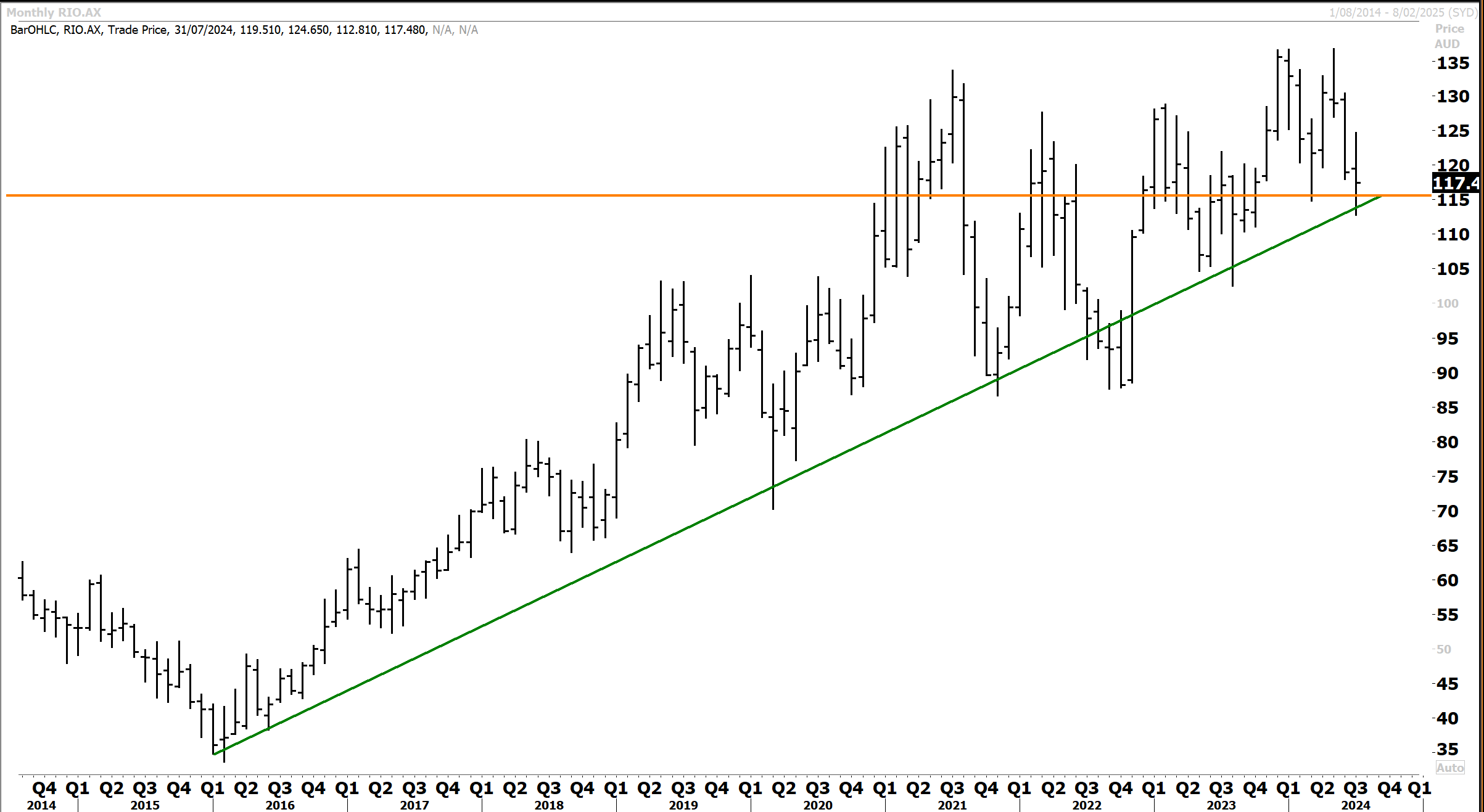

- Rio’s CEO was upbeat on China in an interview yesterday with the AFR and sees the economy continuing to hold together. Steel demand in the ailing housing market is being replaced by other sectors. BHP has also gone again to expand copper production, which is telling so soon after the failed Anglo bid.

- While overshadowed by the Fed decision and commentary, the data released on Wednesday suggested the US labour market cooled in July, bolstering the case for a rate cut in September.

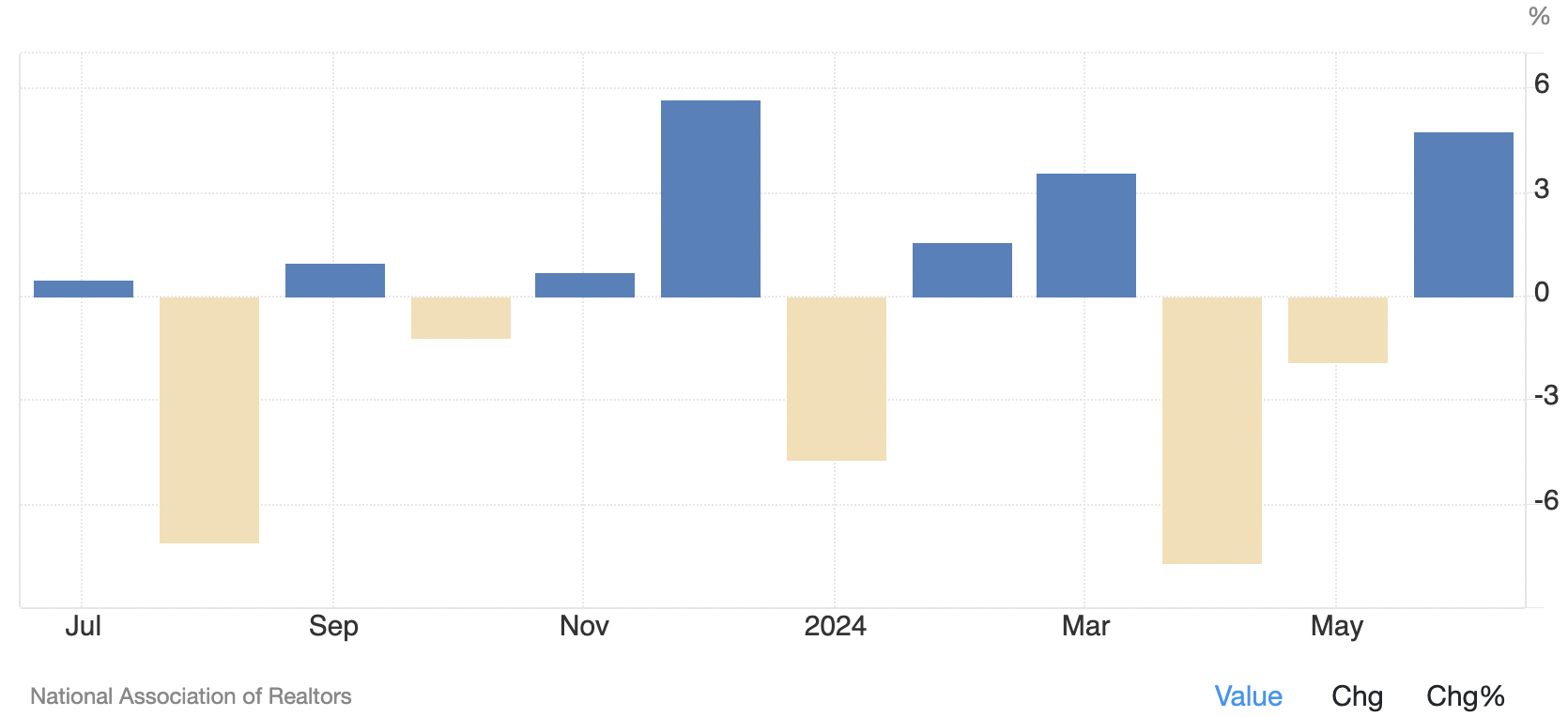

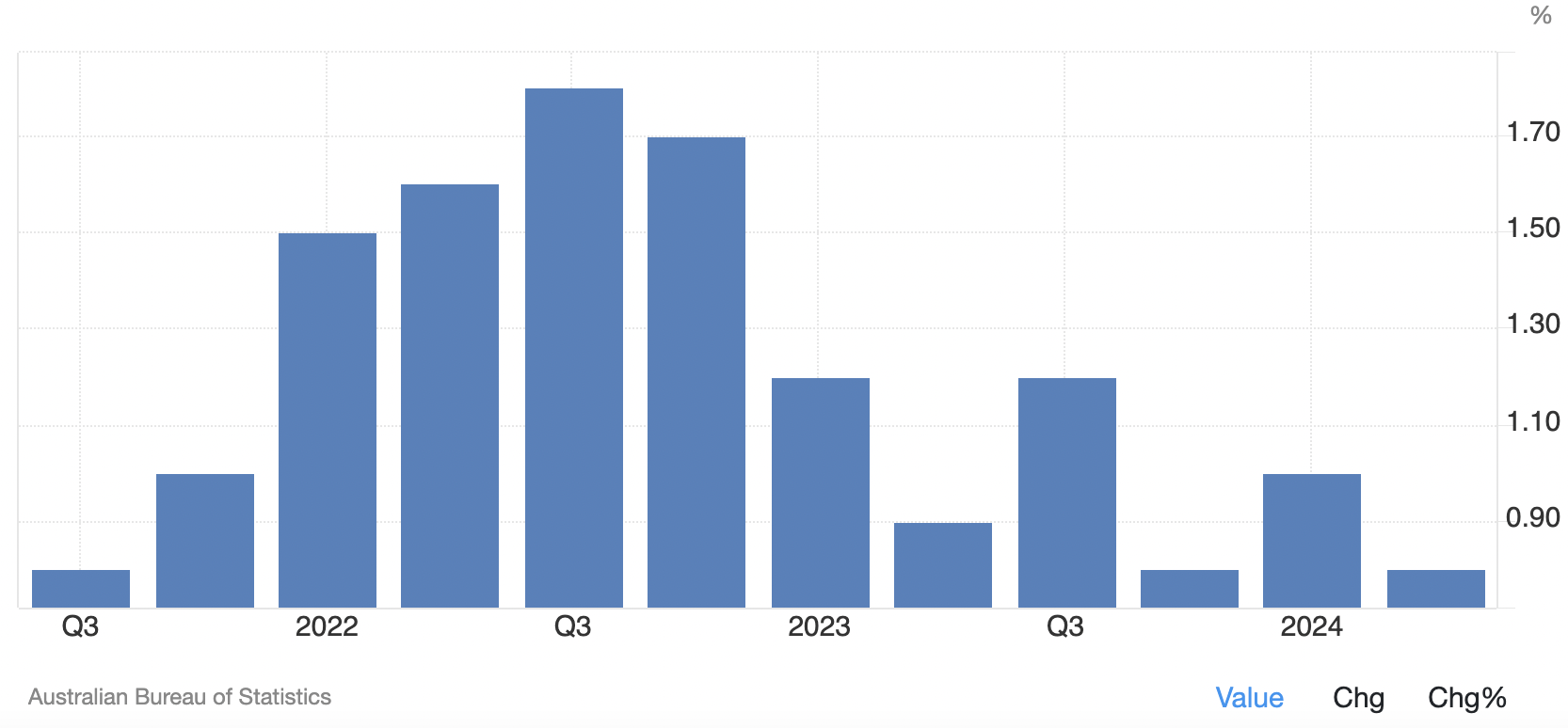

- The ASX 200 enjoyed a broad rally on Wednesday, reaching an all-time high of 8092. Screens glowed bright green as CPI data was cooler than expected. Traders quickly shifted bets, with rate hikes off the table now and growing hopes for rate cuts before year-end. Bonds and equities staged the best rally in months while the A$ fell. Meanwhile, A$ spot gold is testing record highs on ME instability.

- The BOJ came out swinging on Wednesday, hiking rates and announcing a gradual reduction of bond buying. Equities climbed even as the yen firmed dramatically. Financials, including banks, were stellar performers on the day, leaping +4% to 5%.

- Benchmarks in China and Hong Kong posted firm gains after soft PMI data, bolstering hopes for more policy support from Beijing.

- UK benchmarks gained, supported by corporate results and hopes the BOE will cut tomorrow.

- Higher-than-expected headline inflation in Europe dampened hopes that the ECB would cut again at its next meeting. Regional bourses closed mixed.

- Notable charts and stock mentions today include S&P500, Dollar/Yen, Dollar Index, Gold, A$ spot gold, Copper, Iron ore, Van Eck Junior Gold Miners ETF GDXJ, Hang Seng, Meta, Nvidia, Microsoft, AMD, Arista Networks, Starbucks, Kraft Heinz, Global X Uranium ETF, VanEck Junior Gold Miners ETF, Glencore, Anglo American, Rio Tinto, CBA, Harvey Norman, Charter Hall, Chalice Mining, Origin Energy, SiteMinder, Nomura and HSBC.

Good morning,

Financial markets had a monumental day on Wednesday. Two important central bank decisions triggered huge rallies in equities, bonds, commodities and a selloff in the US dollar, notably against the yen. Geopolitical tensions also surged in the Middle East between Iran and Israel. The Fed left rate settings unchanged, but Chair Jerome Powell mentioned September multiple times in the press conference, which was taken as a green light for when easing commences.

The BOJ raised rates for just the second time since 2007 (the first was ending NIRP in March), which was the catalyst for a large drop in the dollar/yen. Australia also had good news on the inflation front, and Commonwealth bonds rallied strongly after yesterday’s print, which boosted equities.

The Nasdaq Composite led the indexes higher with a gain of 2.64%. The S&P 500 gained 1.58% to 5,522 but was down on intraday highs. The Dow Jones and Russell 2000 lagged with rises of +0.24% and 0.51%. Meta delivered a beat on earnings after the market closed and was higher in the aftermarket. In Asia, the ASX200 was higher after a lower CPI print that was the catalyst for a big rally in bonds. Japan added +1.5% after the BOJ hiked the benchmark rate to “around 0.25%,” the highest since 2008. The previous range was 0-0.1% after the BOJ ended NIRP in March. The BOJ move notably lifted the financials. China and Hong Kong benchmarks also surged on stimulus hopes after weak PMI data.

The bull market reasserted on Wednesday, with the S&P500 rebounding off the primary uptrend. The Fed met the markets’ expectations on Wednesday, leading to a broadening in the US stock market rally, and the big rally in bonds, record highs above 5,600 on the S&P500 now look vulnerable.

Jerome Powell said an interest-rate cut “could come as soon as September” after the Fed left the fed funds target rate unchanged at 5.25/5.5%. Mr Powell said that “the question will be whether the totality of the data, the evolving outlook, and the balance of risks are consistent with rising confidence on inflation and maintaining a solid labour market. If that test is met, a reduction in our policy rate could be on the table as soon as the next meeting in September.”

The focus now turns to the upcoming non-farm payrolls data and unemployment data due on Friday, but even if this comes in higher than consensus, the Fed is “locked and loaded” and ready to go with the first cut next month. A weaker data set will likely see the market begin to factor in three cuts before the end of the year. And confidence is growing that the Friday print will be soft. Data released early Wednesday showed July US private payrolls increased far less than expected, pointing to a softening labour market. The unemployment rate has inched up in each of the past three months, reaching 4.1% in June, the highest level since 2021. Friday’s labour print is going to be influential.

Bonds had a huge day which was kicked off by a big rally in Australia following the lower-than-expected CPI print. Australian bond yields tumbled across the curve, with the 2yr down 22 bps to 3.87%, and the A$ fell sharply. US bonds rallied after the press conference with the 2yr and 10yr down 9 bps to 4.27% and 4.05%. The 5yr yield fell below 4% to 3.95%. Aside from growing conviction the Fed will now ease quickly, escalating tensions between Israel and Iran also likely had something to do with the move.

The yield on the US 5yr now has a 3% handle after falling below 4%. Since breaking the uptrend, the 5yr bond has continued to rally with the yield now likely to settle into a lower range with a floor at 3.3%. I believe similar fate awaits the 2yr and 10yr with Friday’s key labour print being the next important catalyst.

In FX markets, the Bank of Japan hiked rates for the first time in over a decade, with the short-term policy rate lifted from 0 to 0.25%. The yen surged against the dollar by over 3% in a massive intraday move. Short positions are being unwound at a rapid clip. The BOJ will also halve monthly bond buying, which will keep upward pressure on the 10-year yield. Japanese stocks surged, but this was led by the Banks, which had their best session in some time. The major Japanese banks soared between 4% and 5%. Governor Ueda did not rule out another rate hike this year and will “keep raising rates” if inflation remains on track.

The Bank of Japan’s Policy rate was lifted to the highest level since 2008, triggering a big surge in Japanese banks and financials, which outpaced the broader market yesterday by a significant degree.

The dollar/yen had one of the largest intraday moves in a year,