Key themes and stocks discussed today:

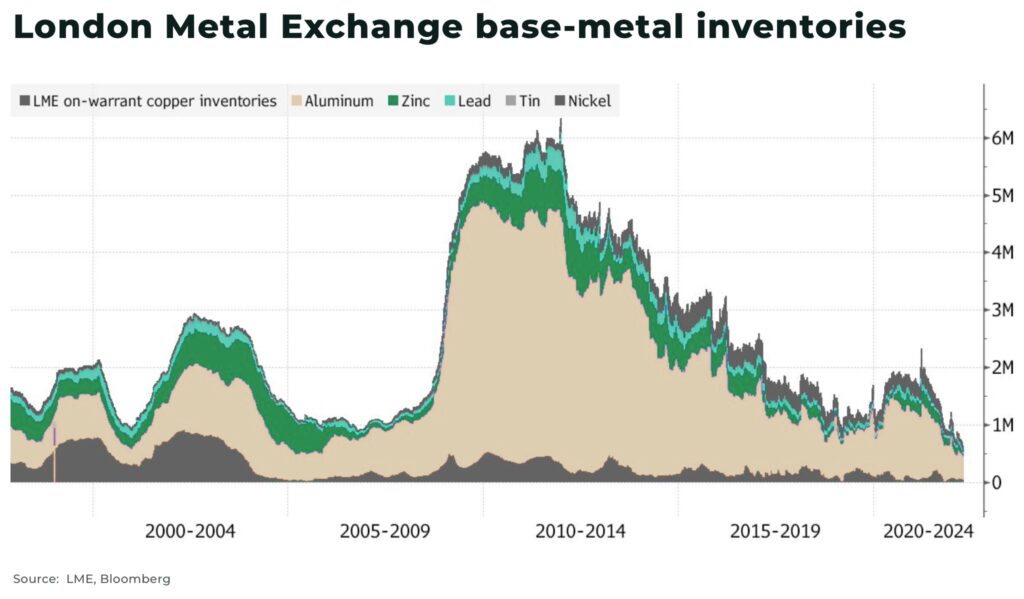

- The major US benchmarks closed mixed on Monday ahead of the key FOMC decision tomorrow. A rate cut is all but a certainty; the only question is by how much. Fed funds futures are pricing in a 59% chance for a 50 bp cut. The US dollar continued to weaken into the decision, which propelled gold to a new record high, with the other PGMs also having a decent catch-up rally. Commodities are also looking firmer following the “risk-off” move in the past few weeks. The “risk-off” move seen in early September might be already over.

- Morgan Stanley’s Mike Wilson believes the Fed might want to cut by 50 bps, given the bond market indicates that monetary policy is behind the curve (if interest rates stay higher for longer, they risk rupturing something in the economy). Wednesday could be a pivotal one for the markets.

- Conservative tech billionaire Peter Thiel, who co-founded PayPal and was the first outside investor in Facebook made an unusual prediction on the upcoming election “and that the outcome will not be close”. Theil sees either the Kamala bubble bursting or Trump voters getting really demotivated and not showing up. “One side is simply going to collapse in the next two months.”

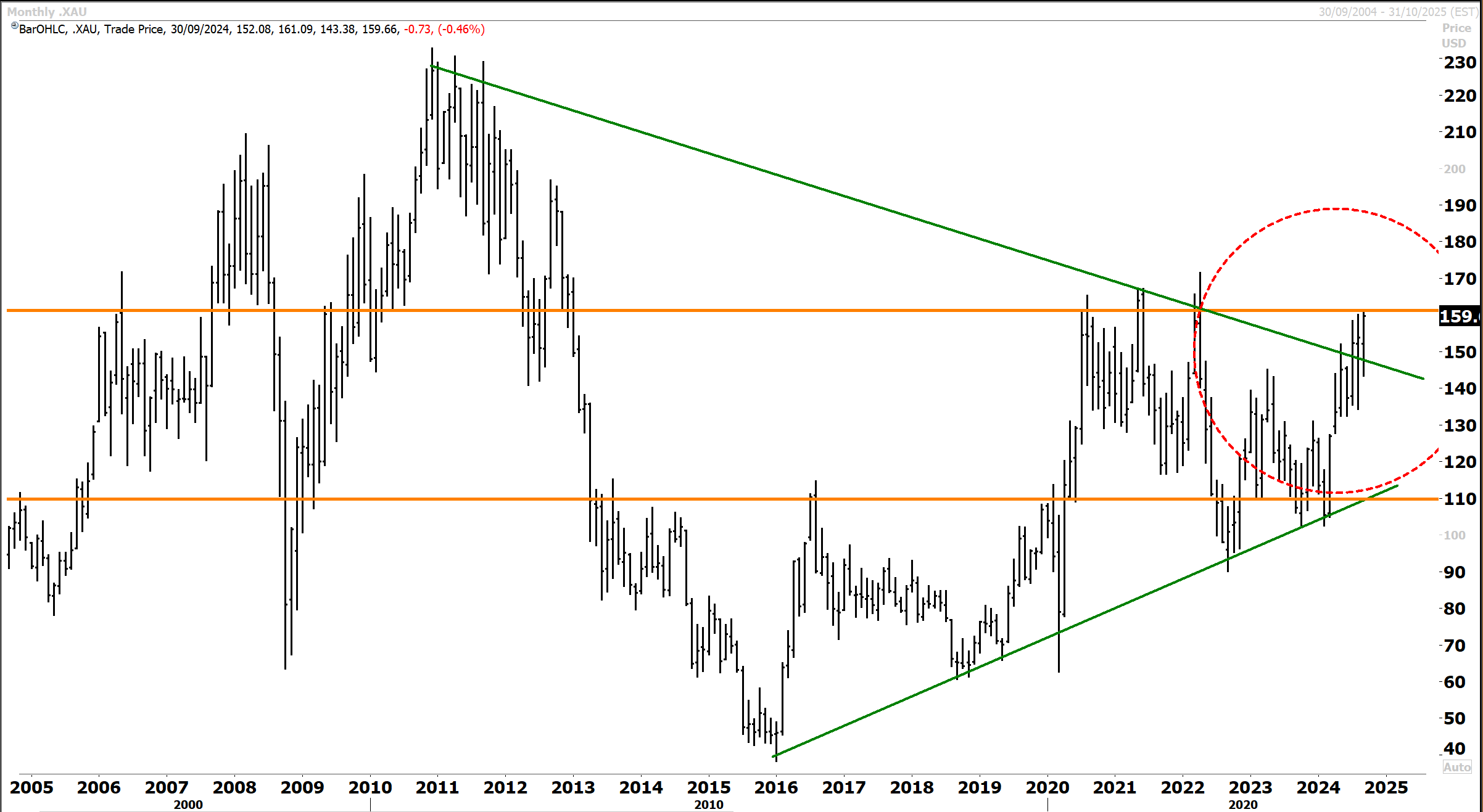

- The bull market in precious metals is reasserting. Citibank is looking for $3000oz for gold and $45oz for silver under their bull case scenario. Rising retail and institutional flows into ETFs could be the next key driver.

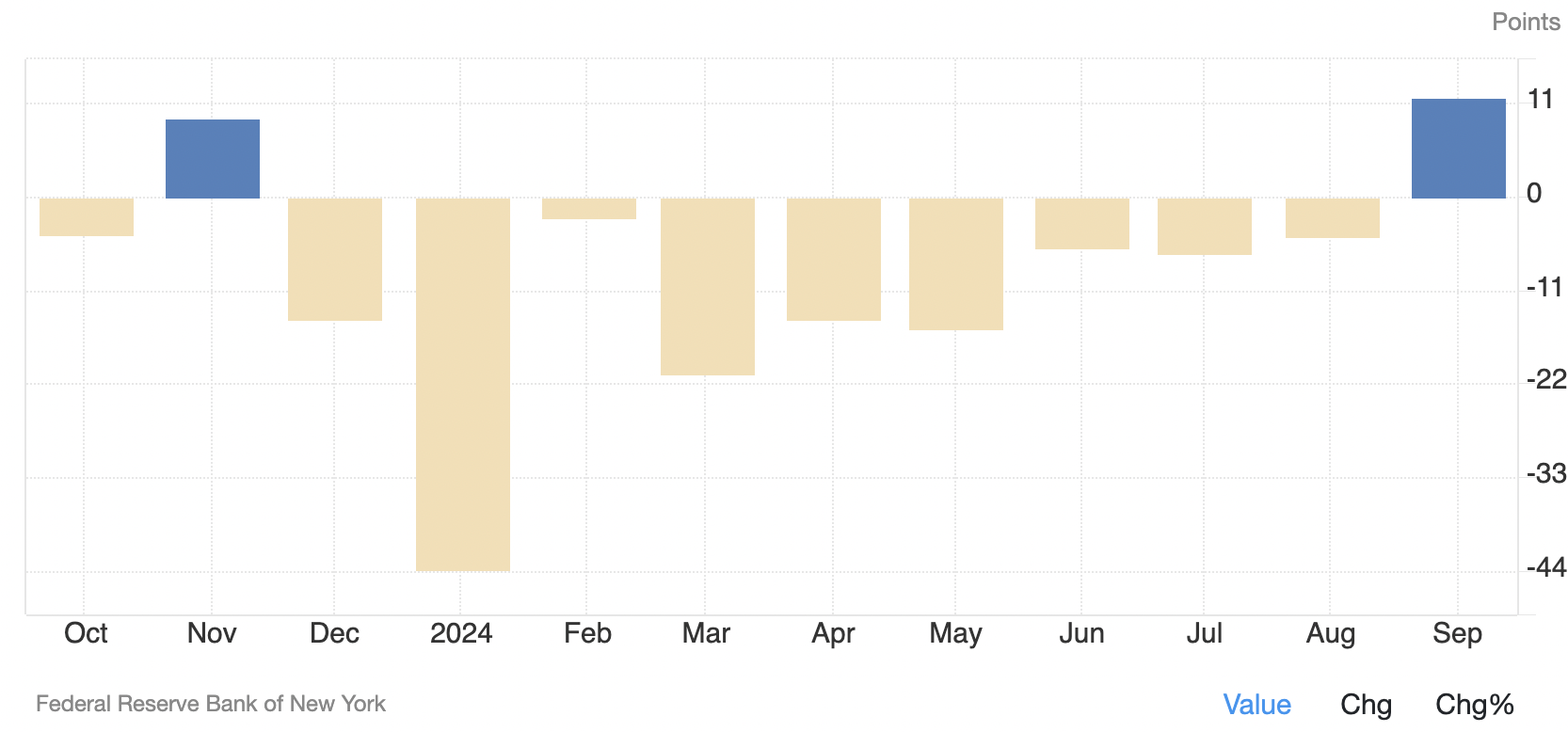

- The New York Empire State Manufacturing Index jumped in September to its highest since April 2022, surprising analysts who had expected a decline.

- UK house prices rose, while the manufacturing sector was mixed. London benchmarks edged higher. The BoE reports later in the week and is expected to make no change. European benchmarks mostly tilted slightly lower in a cautious mood ahead of the Fed, BoE, and BOJ rate decisions.

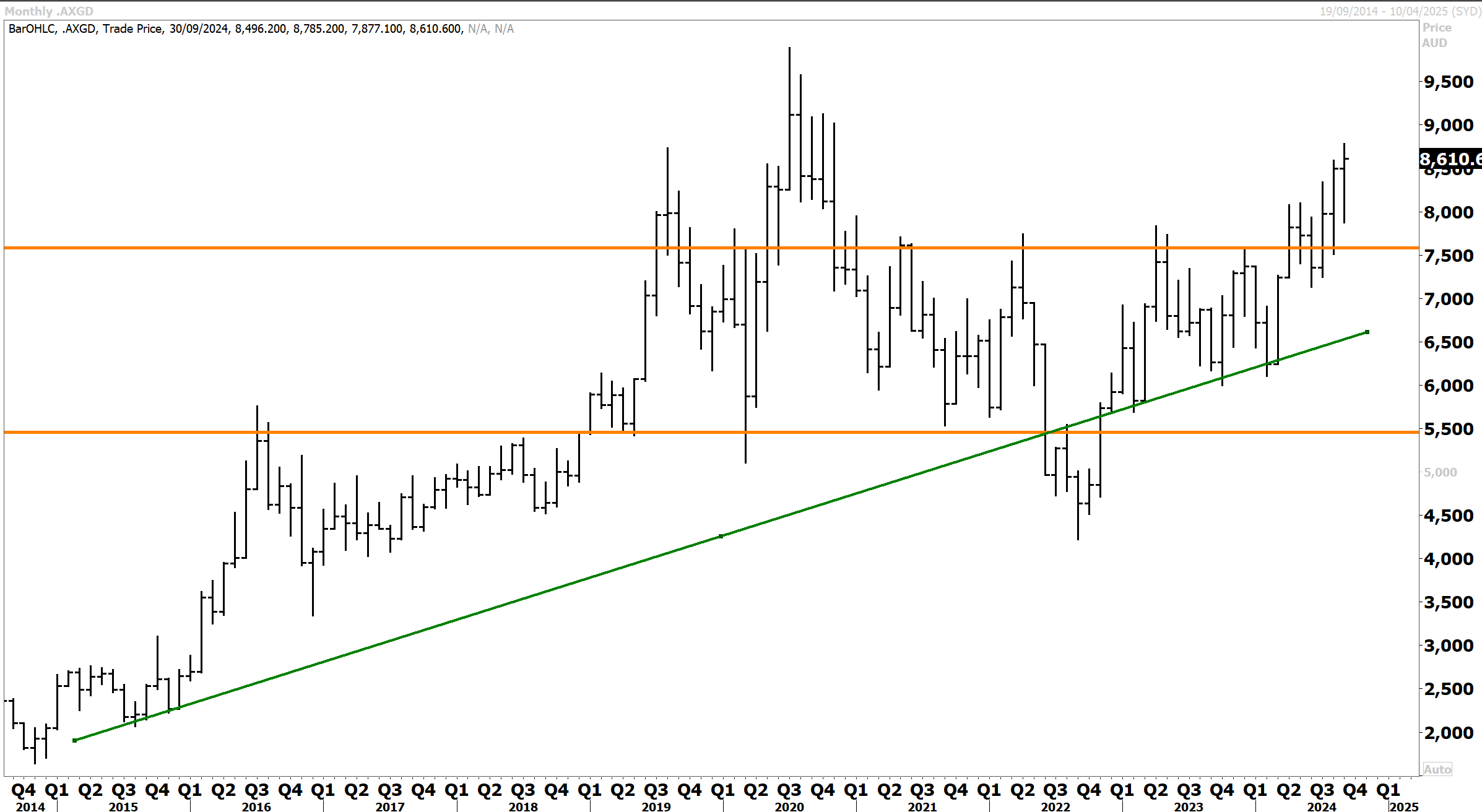

- The ASX 200 crept upward to a record closing high, albeit down from intraday highs. Interest rate-sensitive sectors provided support, with bank and gold mining stocks standing out. After breaking out, the All Ordinaries Gold Index looks set to challenge the record highs.

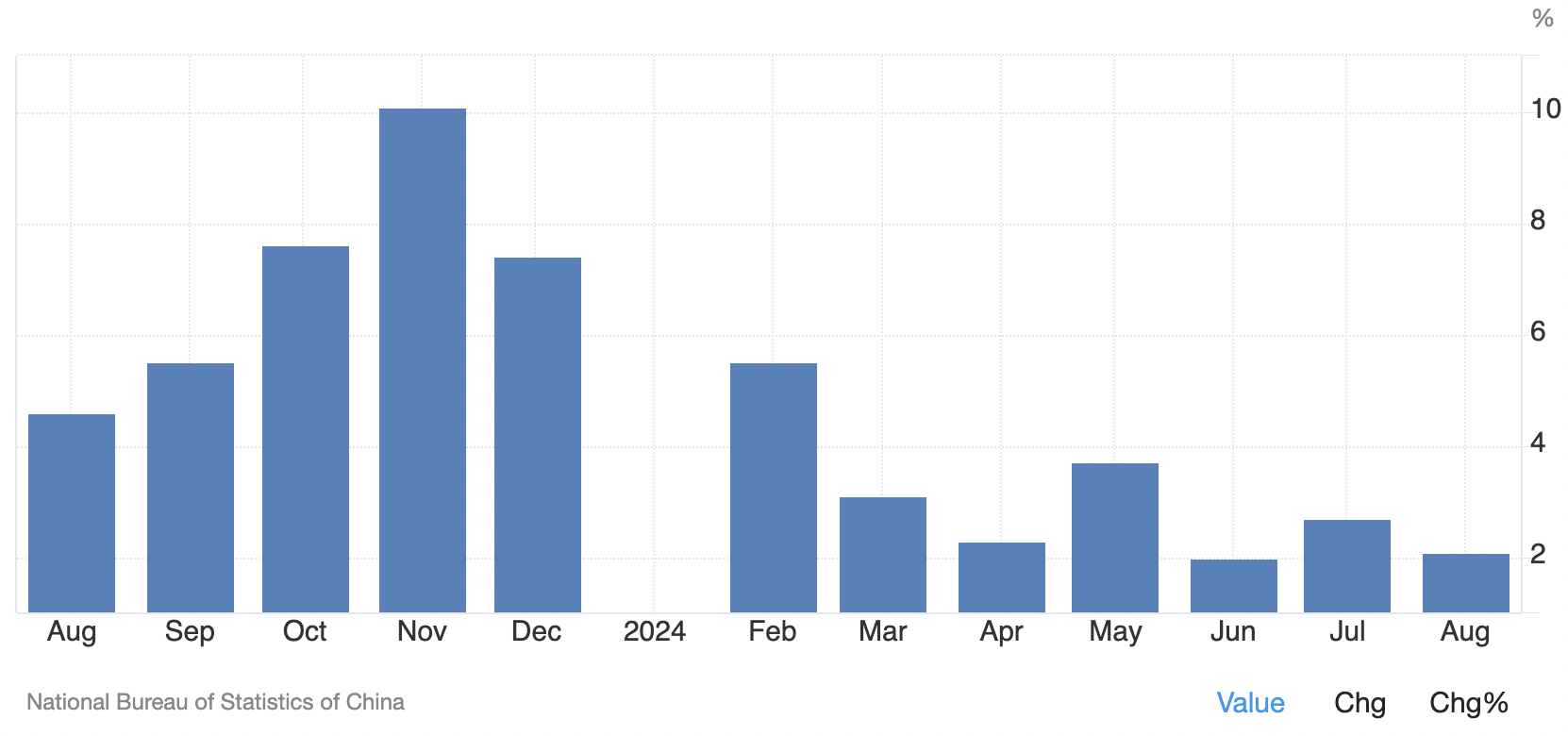

- China’s economic data over the weekend highlighted ongoing struggles, which spurred hopes for more stimulus from Beijing. This buoyed the Hang Seng, although stock markets on the mainland were closed for a holiday.

- Japanese stock markets were also closed, although the yen firmed sharply in the FX market due to the prospects of narrowing interest rate differentials between the Fed and the BOJ.

- Notable charts and stock mentions today include the S&P500, Dollar Index, VIX, Philadelphia Gold & Silver Miners Index, Gold A$, Silver, Australian All Ords Gold Index, Copper, Apple, Zillow, Micron Technology, Coeur Mining, Auto Trader, Shell, Diageo, Gold Road, Alcoa, Austal, Paladin Energy, St Barbara, Meituan, Yum China & Rio Tinto.

The major US benchmarks closed mixed on Monday ahead of the key FOMC decision tomorrow. A rate cut is all but a certainty; the only question is by how much. According to CME, Fed funds futures are pricing in a 59% chance for a 50 bp cut. The US dollar continued to weaken into the decision, which propelled gold to a new record high, with the other PGMs also having a decent catch-up rally. Commodities are also looking firmer following the “risk off” move in past weeks. The risk-off move seen in early September might be already over.

The S&P 500 gained 0.13% to 5,633, the Nasdaq Composite was 0.52% lower, while the Dow Jones rose 0.55%. The Russell 2000 added 0.35%. Technology was the weakest sector, with the S&P technology index down by 1%.

Up until last Friday, the odds were tilted towards a 25-bp cut. However, reports by the Wall Street Journal and the Financial Times cited comments from former New York Fed President Bill Dudley arguing for an outsized cut late last week. This triggered a pivot in market expectations, which were anchored at 25 bps. On Monday, Mr Dudley reiterated his stance on the need for the Fed to do a big cut on Wednesday. In an opinion piece on Bloomberg News, he said “the Fed’s dual mandate of price stability and maximum sustainable employment has become more balanced, which suggests monetary policy should be neutral, neither restrictive nor boosting economic activity.Yet short-term interest rates remain far above neutral. This disparity needs to be corrected as quickly as possible.”

Whether the Fed goes with 50 or 25 bps, it doesn’t really matter. I expect the markets to focus on where the Fed Funds rate is going, and on this front, 100 bps are priced between now and December. I don’t expect Fed Chair Powell to contradict that narrative. Volatility could return if the Fed runs with a 50 bp cut where concerns could quickly mount that the FOMC has some information that investors don’t have and that recession risks are more likely than currently priced in. A 50 bp cut couched in language that assures the markets that the US is tracking towards a soft landing is, therefore, my base case for Wednesday.

On this front, Morgan Stanley’s chief US equity strategist Mike Wilson wrote in a note this morning that a 50 bp cut would be the best possible outcome for stocks. Still, the caveat is that this would only be provided no concerns emerge on economic growth. In the very short-term, we think the best case scenario for equities this week is that the Fed can deliver a 50bp rate cut without triggering either growth concerns or any remnants of the yen carry trade unwind ahead of macro data that is assumed to stabilize.” In Mike’s view, the Fed might want to cut by 50 bps given the bond market indicates that monetary policy is behind the curve (if interest rates stay for higher for longer, they risk rupturing something in the economy). Wednesday is shaping up as a pivotal one for the markets.

The S&P500 corrected into the first few weeks of September, but quickly found support at 5400. The recent run back to the record highs has occurred quickly as markets have recalibrated a larger rate cut probability for Wednesday. The technical setup now favours a topside breakout in coming weeks and months. The worst of the August/September volatility could now be potentially over.

Depending on how Wednesday goes, we might have already seen the lows in the risk off move that got underway a few weeks ago.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters