Evolution Mining (ASX: EVN)

Evolution Mining has released its March quarter 2021 activities update, revealing a weak operational performance for the quarter. Evolution reported lower headline gold production for the quarter, but silver and copper production rose. Operating costs came in on the high side for the March quarter. A fall in the gold price delivered lower cash flow numbers, but the balance sheet remained in good shape. Production guidance for 2021 remained unchanged, while Evolution expects to see costs improve over the remainder of 2021.

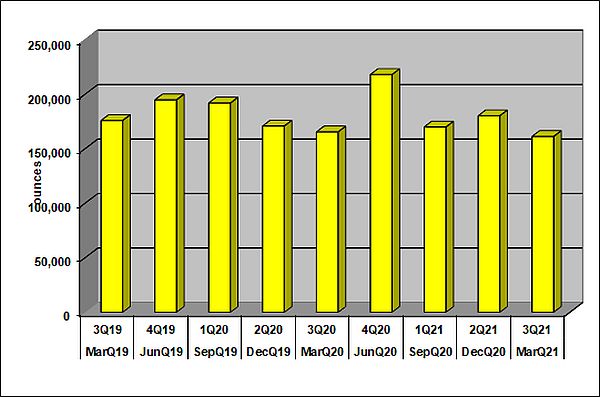

Gold production for the March quarter came in lower, with the following chart showing quarterly gold production:

Source: Evolution Mining

Production fell 2.5% year-on-year (yoy), to 161,316 ounces of gold, with four of five continuing mines in Cowal, Mt Carlton, Mungari and Mt Rawdon all contributing headwinds with lower production results. Ernst Henry ran against the trend, to report higher numbers. Overall, we consider the result was average, with 2021 guidance unchanged and the expected improvement to costs over the remainder of the year being the key positive influences.

Gold production, according to Evolution, is tracking 2021 guidance numbers with the forecast remaining unchanged in the range of 670,000 to 730,000 ounces of gold.

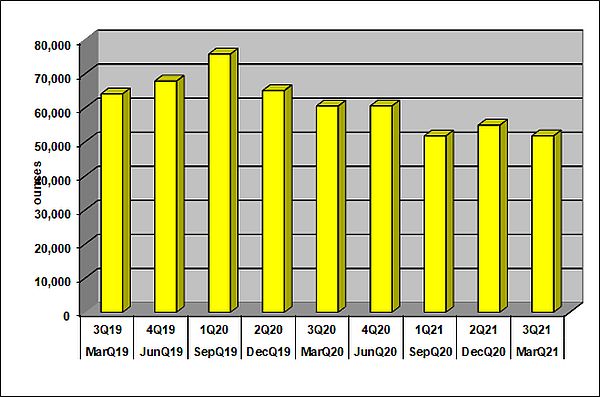

Evolution’s biggest producer in its Cowal mine, was a key contributor after reporting a fall in gold production for the quarter. The following chart shows quarterly gold production for the Cowal mine:

Source: Evolution Mining

Cowal printed a 14.4% fall yoy, to 51,823 ounces of gold. Driving the result was a fall in the milling gold grade while gold recoveries improved. Milling gold grades fell to 0.90 grams per tonne (g/t) gold from 1.15g/t from a year earlier, while gold recoveries improved to 83.5% from 81.1%. The mine operated as expected over the quarter.

Mt Carlton, Mungari and Mt Rawdon all reported yoy falls of 8.9%, 16.8% and 27.4%, to print gold production numbers of 12,117 ounces, 27,226 ounces and 11,930 ounces, respectively. These sites operated as expected for the March quarter and are expected to deliver their full year targets.

[subscribe_to_unlock_form]

The standout mine was Ernst Henry, that delivered a 10.6% yoy increase in gold production for the March quarter, to 22,408 ounces. Both gold grades and gold recoveries drove the result. Gold grades moved up to 0.62g/t gold from 0.60g/t for a year earlier and gold recoveries jumped to 73% from 70.3% for a year earlier.

For the reported quarter, Cracow was sold and did not contribute production, while Red Lake was acquired and contributed new numbers, both comparative to the March quarter 2020. Cracow contributed 22,227 ounces of gold to the March 2020 quarter, while Red Lake contributed 35,810 ounces to the March quarter 2021, for a total net gain of 13,583 ounces to the reported quarter. The acquisition of Red Lake is now paying dividends, as its fresh gold production has fully offset production lost through asset sales. We expect Red Lake’s overall contribution to the group in the near-term will accelerate, as Evolution has not sold any further assets.

Silver as a by-product printed higher numbers for the March quarter, with a 23.8% rise yoy, to 146,370 ounces. Evolution also produces a small amount of copper, with production up 3.8% yoy, to 5,013 tonnes. A pleasing aspect of the reported quarter was the delivery of higher silver and copper volumes into higher realised prices for both.

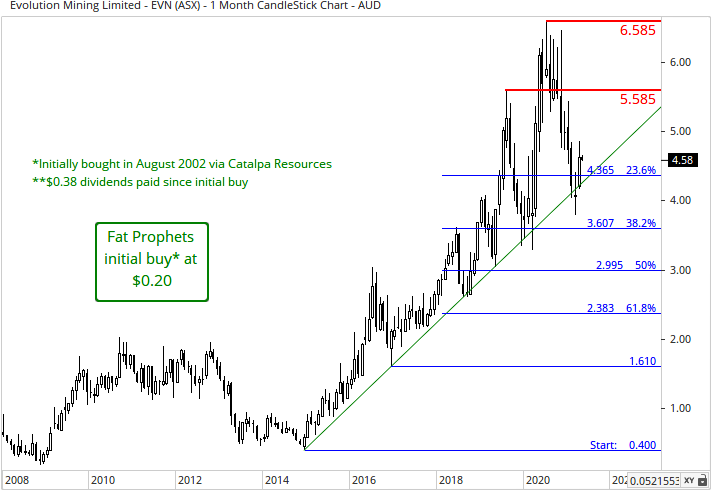

Operating costs rose on the softer production result for the quarter, with all-in sustaining costs (AISC) coming in higher. The following chart shows quarterly AISC:

Source: Evolution Mining

AISC printed a 28% rise yoy, to A$1,268 an ounce. Lower gold production was a key contributor to the result. Four of Evolution’s five sites, in Cowal, Mt Carlton, Mungari and Mt Rawdon all contributing headwinds to the AISC result. Ernst Henry ran against the trend with the reporting of an improvement in its AISC of 627% yoy, to negative A$1,027 an ounce. Higher production numbers and an improvement in by-product credits, on higher realised prices for both silver and copper, caused the result.

AISC guidance for 2021 has been upgraded and is forecast to be in the range A$1,190 to A$1,220 an ounce, from the previous forecast in the range of A$1,240 to A$1,300 an ounce. The guidance upgrade was a key standout, and we are pleased with Evolution’s cost competitiveness relative to its peers.

The average gold price received fell 5.9% yoy, to A$2,227 an ounce for the March quarter. We hold a positive view on the gold price over the remainder of 2021 and expect the price to close higher by years’ end on rising inflation and a weaker US Dollar. Realised sales prices for silver and copper on the other hand were both higher for the quarter. The realised silver price was 22.2% higher yoy and the copper price 48% higher yoy, to A$33 an ounce and A$12,137 a tonne, respectively. We hold a positive view for silver and copper prices on the same reasoning as for gold.

The weaker realised gold price and lower gold production number impacted net mine cash flow, which fell 36% yoy, to A$101.2 million for the quarter.

As of 31 March 2021, debt stood A$500 million and cash A$333.1 million, for net debt of A$166.9 million. This compares favourably with the net debt position from a year earlier of A$570 million. We have no concern with the structure of the balance sheet from the data provided.

Operationally, the March quarter numbers were a little disappointing, with a lower realised gold price amplifying the poor operational result. There were certainly gems hidden in the result such, as the higher silver and copper production numbers and 2021 production forecasts remaining unchanged. The standout feature was the upgrade to 2021 mine costs, an improvement that will maintain Evolution’s competitive position on the gold cost curve.

We believe Evolution is well positioned to leverage into our scenario of a higher gold price going forward. While a competitive downward shift in its mine costs will amplify the financial benefit. The weakness in the share price, we believe, is not reflective of our favoured gold price scenario playing out.

Consequently, we continue to recommend Evolution Mining as a buy for Members with no exposure to the stock.

Disclosure: Interests associated with Fat Prophets holds shares in Evolution Mining.

[/subscribe_to_unlock_form]