Key themes and stocks discussed today:

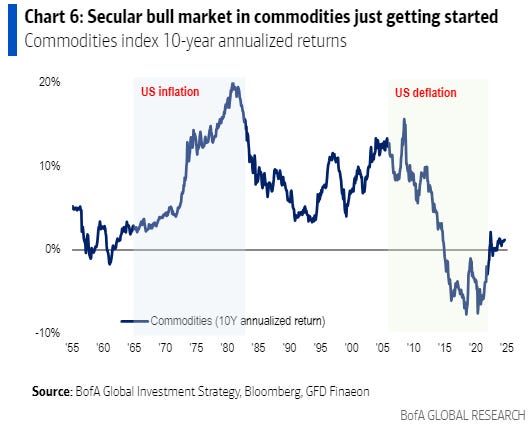

- US markets were closed for a public holiday. This week, all eyes will be on the labour market, the August Non-farm payrolls, and the unemployment rate due to the drop on Friday morning. This data point will determine whether the Fed goes with a 25—or 50-bps cut in two weeks’ time. September could be a choppy month, with earnings forecasts too high for the quarter. Having some powder set aside for these seasonally weaker months is prudent.

- JP Morgan is leaning toward being more cautious and noted this week that “at the market level, we looked for the consolidation through summer, on slowing activity, lower yields, and the risk of concentration unwind. While SPX recovered of late…JPM believes that markets are not out of the woods yet. September has seasonally been a challenging month for equities. I continue to see a second leg to the corrective selloff that began early last month.

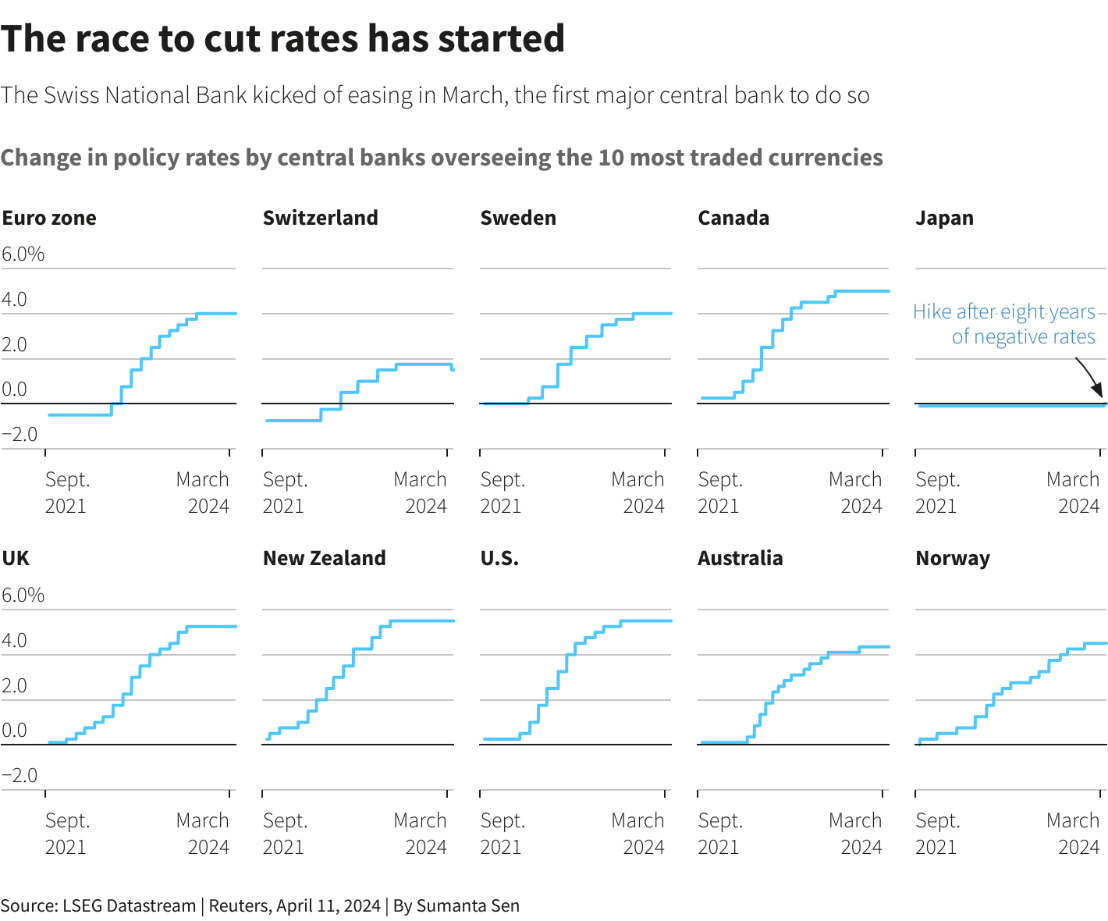

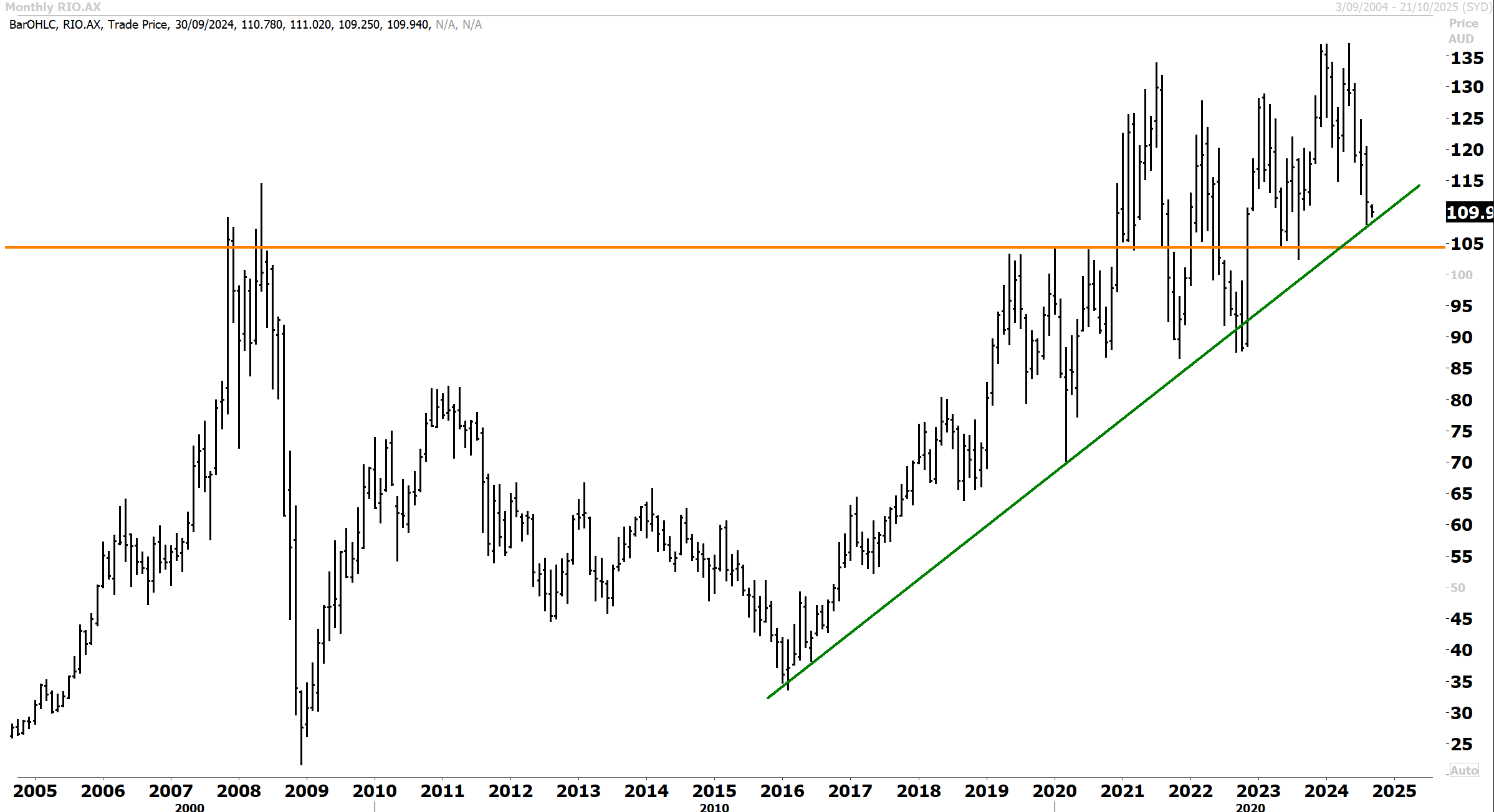

- Bank of America believes that the secular bull market in commodities is only just getting started.

- In Australia, GDP will come in tomorrow and is expected to show the slowest growth since 2021. Meanwhile, the economy is doing it tough. I see the first rate cut from the RBA being no later than Xmas.

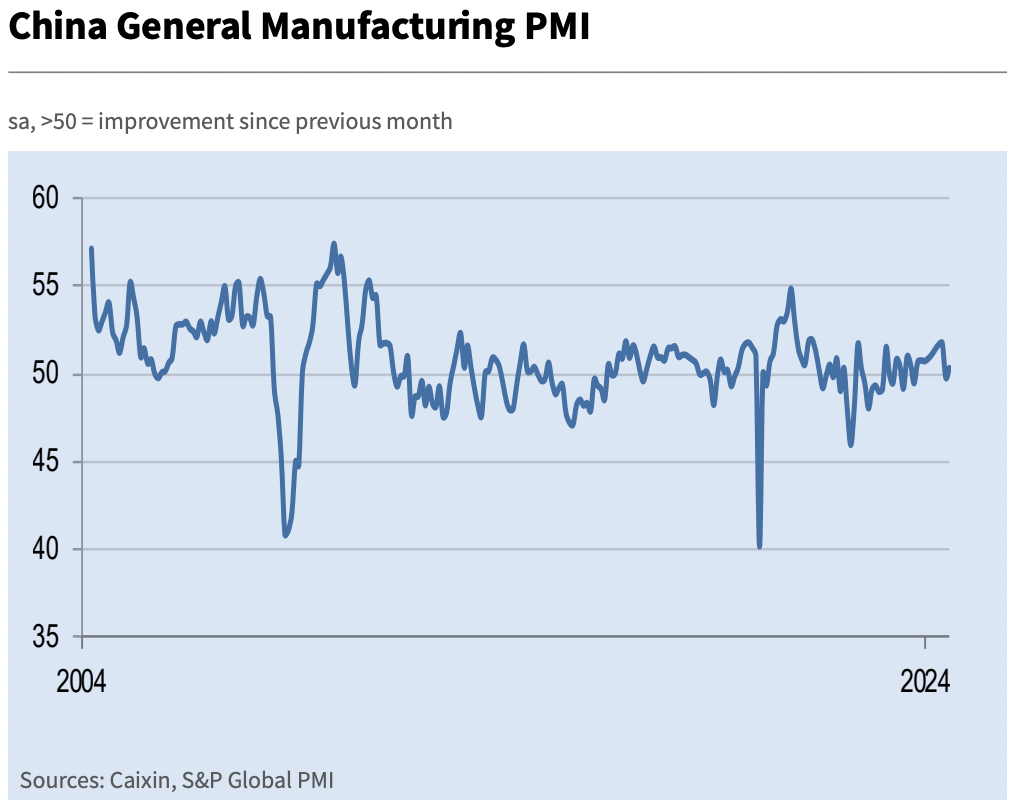

- Conflicting manufacturing data weighed on Greater China stocks, with the Hang Seng beginning September trading on the back foot, interrupting a nearly +4% rally in August.

- Japanese benchmarks crept higher, supported by advances from financials and transportation stocks.

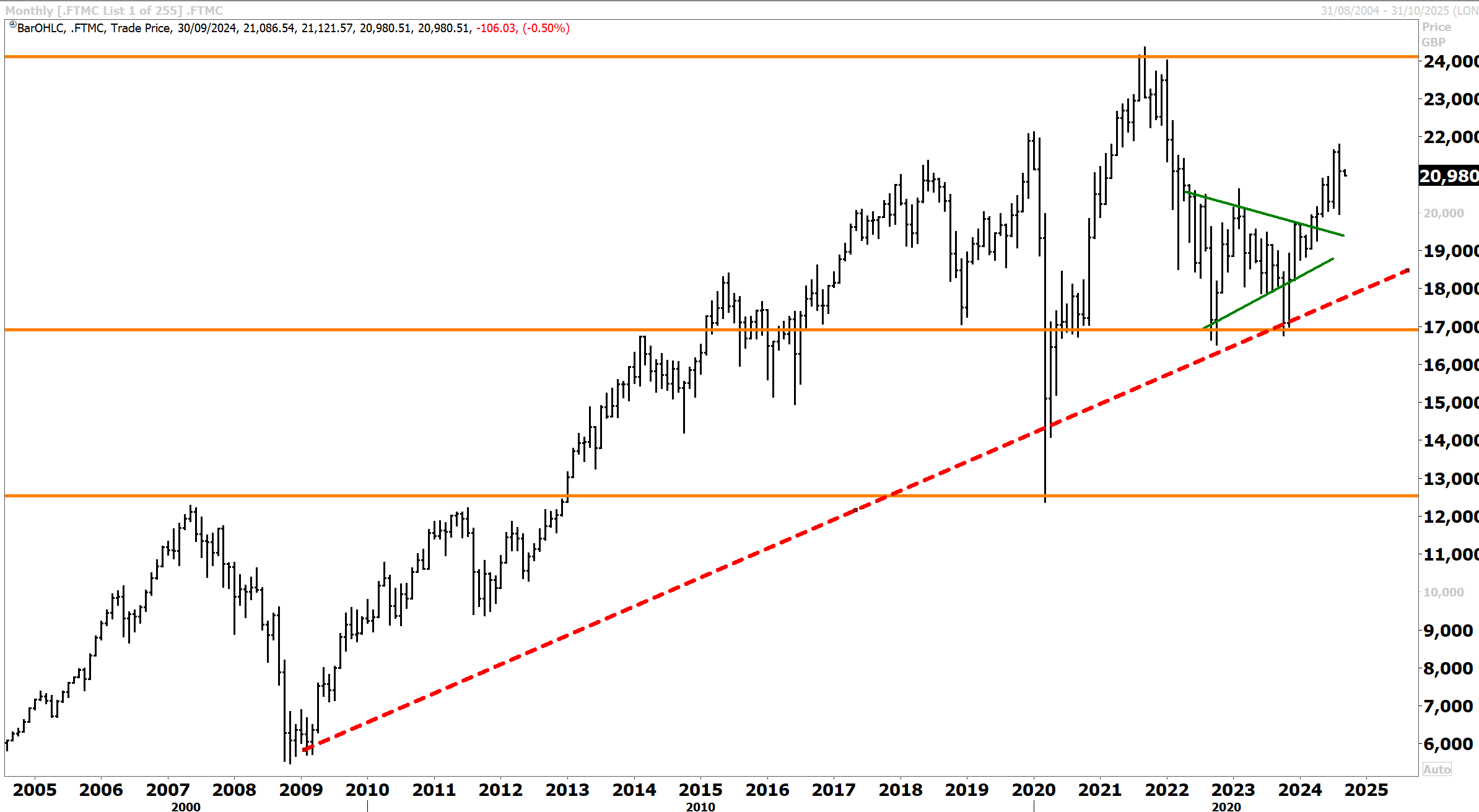

- UK benchmarks dipped on Monday amid quiet trading due to the US holiday. This was despite a “Buy British” note from Goldman Sachs and some notable M&A news. European benchmarks were mixed as the manufacturing sector continued to struggle. Political news from Germany also ruffled a few feathers.

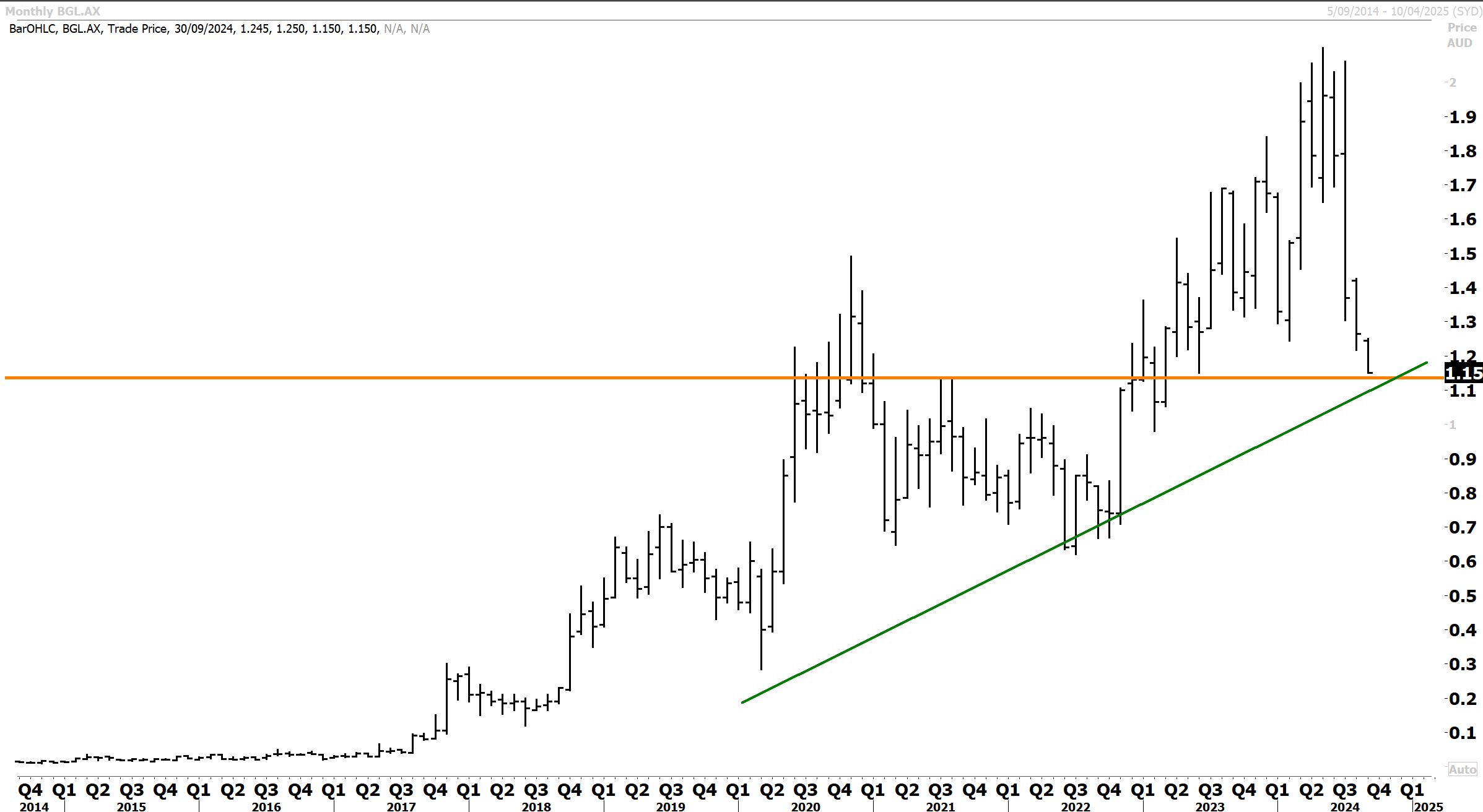

- Notable charts and stock mentions today include the S&P500, FTSE250, Antofagasta, REA Group, Barratt Developments, Kainos, Rio Tinto, 29Metals, REA Group, CBA, Viva Energy, Red 5, Bellevue Gold, China Vanke, Japanese banks, and Yaskawa Electric.

US markets were closed for Labor Day on Monday, but futures markets point to a slight gain when trading resumes tomorrow. This week, the big focal point for the markets will be the August non-farm payrolls print, which is due to drop on Friday morning. The key labour market data will be influential, given last month’s growth scare narrative and ahead of the September FOMC meeting, when the Fed is expected to deliver the first-rate cut.

Will it be 25 bps or 50 bps? The state of the labour market will play a key role here. A weaker or hotter-than-expected print will likely determine whether the Fed runs with 25 or 50 bps.

We could also see some volatility as we head into September as volumes pick up with the Northern Hemisphere summer over. September and October have historically been seasonally weak, so pruning portfolios and carrying some extra cash is prudent. October could also be choppy given the uncertainty around the US election and a closely run race.

Resistance at the SPX’s record highs is likely to prove a barrier as we enter the seasonally weaker months of September and October. A retest of the early August lows between 5100 and 5200 would not surprise. However, once the election is out of the way, the SPX could lead global stock markets higher into new record territory for a strong finish to the year.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters