1Q21; six now under one roof

Northern Star has reported its activities for the March 2021 quarter, and in doing so has brought together six operating mines, with Thunderbox, Carosue Dam and the Super Pit joining its stable of four mines. Northern Star has indicated that it remains on track to hit 2021 guidance.

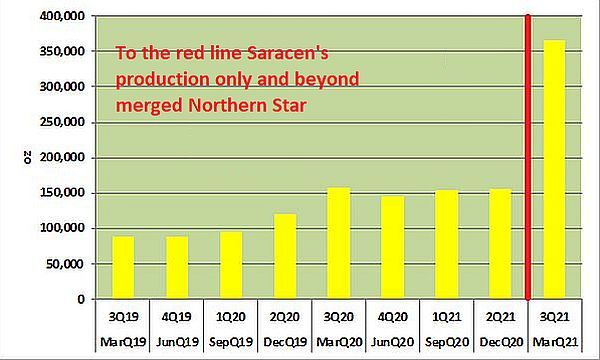

Gold production for the March 2021 quarter came in at 366,000 ounces, with the following chart showing quarterly gold production:

Source: Northern Star

Due to the merger no comparatives will be made to earlier results and when made it will be on a like-for-like comparison. As Members can see from the above chart there was a significant uplift in overall gold production for the March 2021 quarter. It is this production uplift that we considered was a key feature of the merger for Saracen Shareholders and this is especially so in a rising gold price environment.

Of the Saracen mines in the merger, Carosue Dam was the standout for the quarter, following the reporting of a 16.5% year-on-year (yoy) rise in gold production to 57,630 ounces. Driving the result were higher mill throughput and gold recoveries, with ore throughput up 47% yoy, to 858,175 tonnes, while gold recoveries jumped to 94% from 92% for a year earlier. The Jundee mine was the standout for the March 2021 quarter from Northern Stars stable following the reporting of a 16.63% yoy rise in gold production, to 63,648 ounces. Driving the result were higher mill throughput and gold recoveries, with ore throughput up 31% yoy, to 655,143 tonnes, while gold recoveries jumped to 91% from 89% for a year earlier. Management will, over the months ahead, become more familiar with the operations of the new mines and improve efficiencies and smooth the integration process.

Pro-forma guidance for 2021 is forecast to be in the range of 1.5 million to 1.7 million ounces of gold and remained unchanged. Despite integrating two operations into one, we believe the quality of Northern Stars assets and the experience of the management team are reflected in the unchanged 2021 guidance.

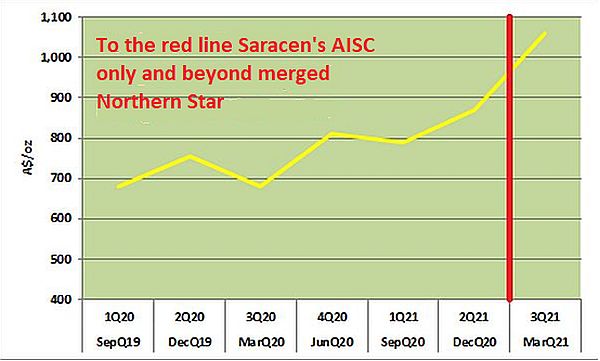

First time all-in sustaining costs (AISC) came in at A$1,598 an ounce for the March quarter, with quarterly AISC shown in the following chart:

Source: Northern Star

With the Australian gold price current trading around A$2,409 an ounce, operating margins will be substantial. We expect synergy savings will, as managements’ understanding of the merged group and the operation of each mine is more understood, lead to savings flowing. A lower AISC guidance range for 2021 does provide us with considerable comfort on this front. On synergies, post the merger, savings of A$1.5 billion to A$2.0 billion could be unlocked and we viewed this as a key benefit for Saracen shareholders.

Guidance for 2021 AISC is forecast to be in the range of A$1,390 to A$1,520 an ounce and was left unchanged.

The March quarter activities report has provided the first glimpse of the combined balance sheet. Northern Star indicated debt of A$658 million and cash (A$637 million) and bullion (A$59 million) of A$696 million, to give a net cash of A$38 million. As of 31 March 2021, Northern Star held A$16 million in equity investments. On this snapshot, we would have no concerns over the structure of the merged balance sheet.

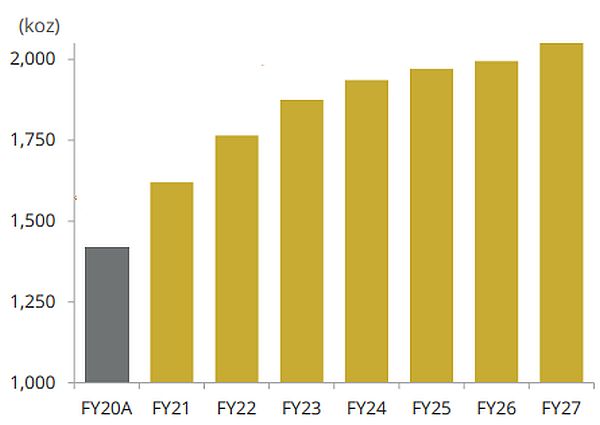

The merger has brought with it a clear pathway for Northern Star to produce 2.0 million ounces of gold per annum, with the trajectory to this target shown in the following chart:

Source: Northern Star

We are of the view Northern Star has significant brown and green field opportunities and the financial capacity to deliver on this target. With growth of +30% expected, this profile was another key feature for Saracen shareholders in the merger.

As of 31 March 2021, Northern Star carried a hedge of 844,309 ounces of gold with an average delivery price of A$2,203 an ounce. Deliveries are on the June/December months out to December 2023. We consider the position as a prudent risk management tool.

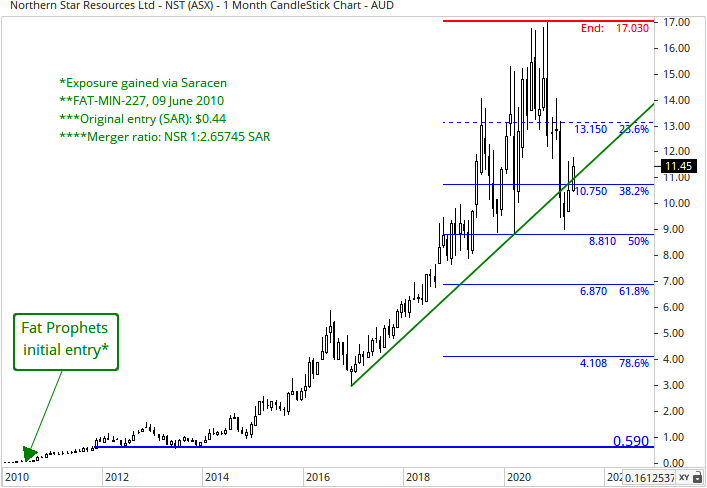

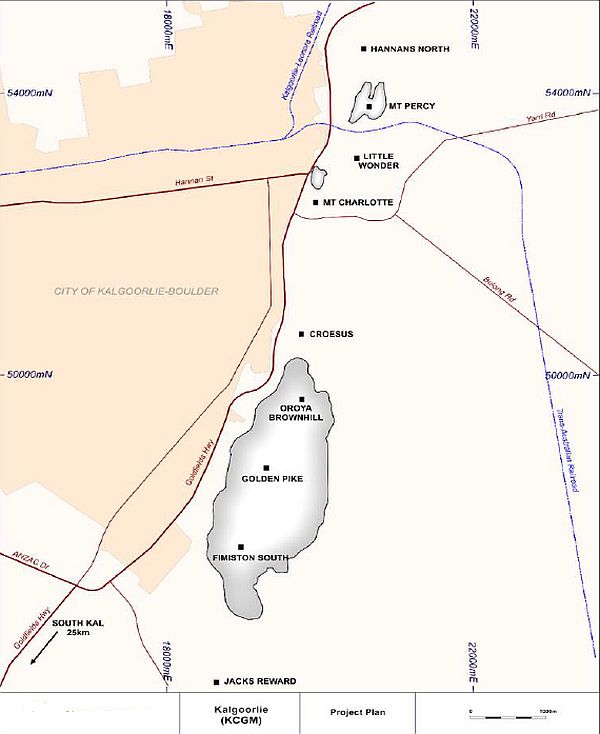

The Kalgoorlie Super Pit and the potential this piece of dirt has now that it is controlled by one savvy explorer is a key feature for Saracen shareholders, despite both Northern Star and Saracen owning half each pre the merger. The following image shows the local region of the Kalgoorlie Super Pit:

Source: Northern Star

A 1.1 million ounces of gold production target is now crystallising around the Super pit region. At Mt Percy (second name from centre top) there is a 8.1 million resource graded at 1.2 grams per tonne (g/t) gold for contained gold of 317,000 ounces and at Croesus (dead centre name) there is a resource of 10.5 million tonnes graded at 1.7g/t gold for contained gold of 588,000 ounces. While at Little Wonder (third name from centre top) there have been returned outstanding assays of 182 metres graded at 2.3g/t gold and at Jacks Reward (very bottom centre name) assays returned 72 metres graded at 1.0g/t gold and 15.9 metres graded at 3.2g/t gold. Given these sites are within trucking distance of mills they are outstanding results in their own right and more so with mills nearby.

With the financial capability to explore and develop ground and with the ground to do this and not just the Super Pit region, we find Northern Star a compelling story. Add our positive view on the gold price over the remainder of 2021 and beyond and the story is complete.

Consequently, we continue to recommend Northern Star as a high conviction buy for Members without exposure. Members already exposed to Northern Star, through the Saracen merger, and have yet to top up their exposure should take this opportunity to do so.

Disclosure: Interests associated with Fat Prophets holds shares in Northern Star.