A bumper start

Agribusiness, Elders (ASX.ELD) has seen its shares continue to climb and virtually deflecting the headwinds caused by COVID-19. The fact that people still need to eat despite being holed up in their homes due to the pandemic has been a boon for Elders along with its peers but improving weather conditions and a bumper season gave the sector a solid boost. Today, we take a look at the latest round of results and update our view.

What’s new?

The last time we checked in on the agribusiness giant was back in November (FAT-AUS-996) where we saw the company report an solid performance at the end of fiscal 2020 unscathed from the COVID-19 pandemic. The pandemic has been one of the most disruptive events in recent history with many businesses across sectors suffering, with agriculture seemingly one of the exceptions. This is evidenced by Elders sending the year with an impressive 29% surge in revenues and underlying earnings per share surging 35% year-on-year.

Since then, the company has issued another round of results which we review today to see how it has measured up since. Prior to that, we want to highlight some key expectations for the sector which was based on the March 2021 release of the Australian Bureau of Agricultural and Resource Economics and Sciences noting that they expect 2020-21 season to be the “second most profitable season ever for Australian farmers.” It seems that the drought that has affected the sector in recent history has subsided with better conditions and higher than average rainfall pushing expected cash incomes up 18% – and that’s for the average farmer.

With such a bullish outlook, we now take a look at Elders to see if it’s up to compete:

1H21 Results Overview

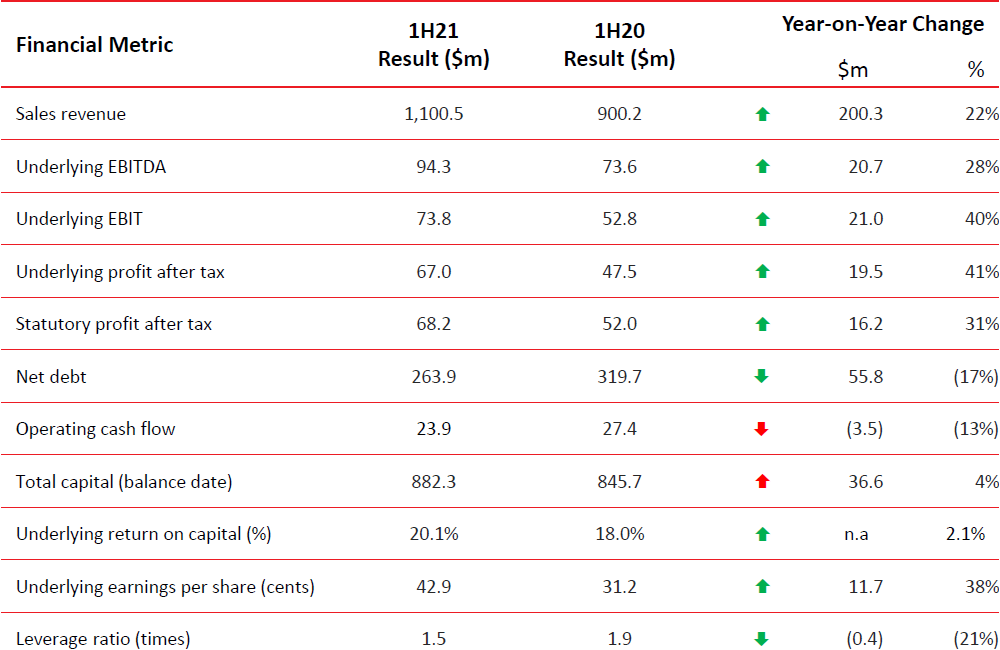

Starting from the top and revenues in 1H21 surged up 22% year-on-year to $1.1 billion, reflecting the improving conditions in Australia as well as management efforts to diversify the business model by geography, channel and product category – the diversification typically balances out the good with bad, however, this time all divisions benefited. We’re pleased to see that agriculture was one of the sectors showing to be largely resistant from the disruptive effects of COVID-19 with demand for agricultural products remaining strong (people still need to eat after all).

Group underlying EBIT surged 40% to $73.8 million and underlying profit after tax was up 41% higher at $67 million. Statutory profit surged 31% to $68.2 million. Underlying earnings per share was 38% higher at A$42.9 cents. Elders announced a fully franked interim dividend of A4 cents per share and lower from A$9 cents from last year (-55.5%). The lower dividend payout this time around likely reflects the cautionary stance in light of uncertainty from the ongoing COVID-19 pandemic. The concerning fact, however, is that management originally issued press releases noting a A20 cent dividend payout (+122% yoy) but suddenly – about an hour later – released a correction noting the actual dividend of A4 cents. This could just be an honest mistake but it is still worth monitoring as such lapses do influence price action.

Source: 17 May 2021 Elders Presentation

Source: 17 May 2021 Elders Presentation

Operating cash flow was lower year-on-year down 13% with the much higher payout for incentives with stronger performance this year but also due to much higher working capital requirements for the Rural Products division. Elders’ return on capital has improved a tad up 1.2% to 20.1% reflecting the higher earnings from all divisions. This result is pleasing above the 18.5% 3-year average and the 15% target in the Eight Point Plan – this is likely to keep at pace as the sector continues to see a bumper year. The leverage ratio of 1.5 times was well below 1.9 times a year ago.

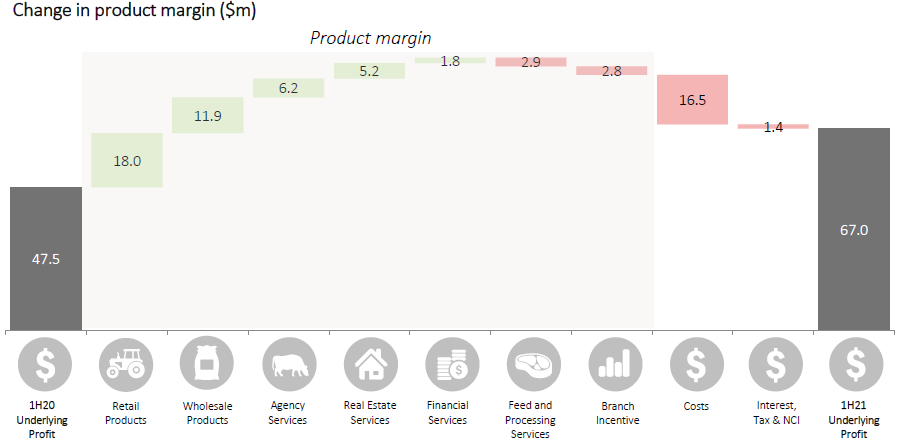

Looking at the performance by product margin, and Retail Products was the greatest beneficiary having seen a bump of $18 million with a bumper crop supported by strong demand. There were also improving margins as a result of ‘pricing techniques.’ Wholesale Products also reported a strong performance with AIRR contributing an additional $11.9 million in gross margins – a performance above management expectations.

Agency Services was another solid contributor up $6.2 million as a result of strong livestock prices for cattle and sheep – a result of limited domestic supply. Wool prices have also recovered and the boost in demand also resulted in a much strong comparison on a year-on-year basis given that last fiscal year saw subdued global demand, particularly in China as factories were shut down.

Source: 17 May 2021 Elders Presentation

Source: 17 May 2021 Elders Presentation

Real Estate services margin increased $5.2 million reflecting much stronger turnover across residential and broadacre volumes – likely the result of positive expectations for the sector. The Financial services margin was up $1.8 million with stronger performance in the insurance business as well as interest income from a new offering: livestock funding.

Costs this year were up substantially by $16.5 million due to the effects of acquisition, higher insurance costs and investment in IT modernisation. Despite the bump, these are all worthwhile. Overall we’re pleased with the strong result.

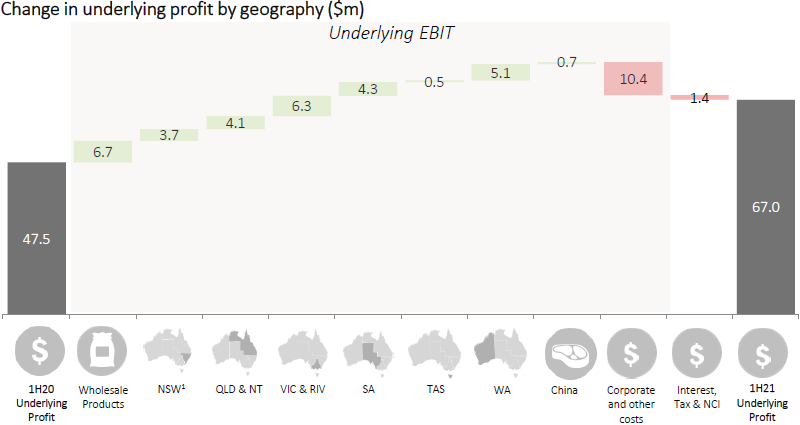

Briefly on the geography side, there were broad-based improvements at home, while international showed some slight improvements – likely reflecting the logistical difficulties during the pandemic. Corporate overhead, however, has increased reflecting the continued investment in the Eight Point Plan.

Source: 17 May 2021 Elders Presentation

Source: 17 May 2021 Elders Presentation

On that note, we look at the company’s progress of its third Eight Point Plan. According to management, Elders continues to develop greenfield sites as well as acquisitions and also improved its frontline sales teams and IT solutions. The company looks to be well on track to achieve its key financial goals where they are targeting 5% to 10% growth in EBIT and EPS through the agricultural cycles at a return on capital of 15%.

Finally, outlook for the remainder of 2021 remains positive with positive expectations for the winter crop and cattle prices are expected to remain strong. Other segments are also expected to maintain momentum. The only downside is cost expectations which are pegged to hit higher but are meant to support the Eight Point Plan.

We maintain a buy on Elders for Members without exposure and who have a longer-term investment horizon.

Disclosure: Interests associated with Fat Prophets hold shares in Elders.

Remove term: FAT-AUS-1020

Remove term: FAT-AUS-1020