ANZ Banking Group (ASX:ANZ)

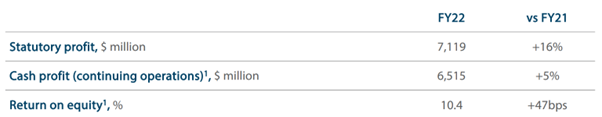

Shares in ANZ have staged a strong recovery in the past weeks, we review another strong result from the bank with profit before credit impairment and tax up 7% for FY-22 with a strong 16% in the 2H. Cash Profit from continuing operations finalized at $6,515 million, some 5% higher.

The daily chart for ANZ indicates a strong movement higher from the Q2 2022 $21.0 low with the price moving higher over the $24.40 level. The recent retest of this level has seen a strong price reaction higher above the 20 day and 200 day moving averages.

ANZ has announced an audited Statutory Profit after tax for the full year ended 30 September 2022 of $7,119 million, up 16% on the previous year and the first double-digit revenue growth for a HY since 2009.

Source ANZ

Source ANZ

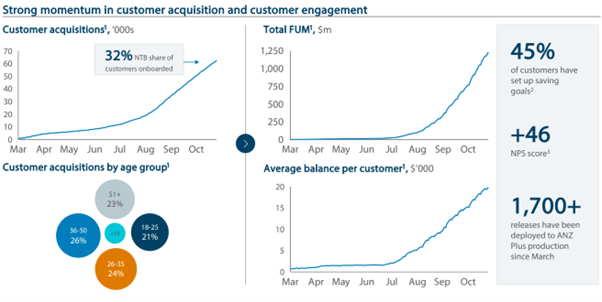

Looking at the retail division, ANZ management has spent the year focusing on organic growth for the business with a changing business model moving across to a digital platform for transactions and applications from customers. To this end, ANZ has merged Australian Retail and Digital as a single division, from this initial new model some good momentum is being created with the division showing an increasing profit to 6% 2H vs 1H. Strong customer up-take of the ANZ Plus fee free account model with deposits reaching $1.2 billion, growing at a faster pace than any peer digital bank platform in Australia. The popularity stems from the no minimum account balance and the compatibility with third-party payment application platforms of Apple pay and Google pay, this is certainly the growing trend with the older portion of Generation Z ( 10 – 25 years) and Generation Y ( 25- 40 years) customers.[subscribe_to_unlock_form]

With 2021 APRA guidelines providing some headwinds around borrower suitability, the FY 22 home loans division has closed FY22 with very positive home loan momentum with approval times back in line with major peers. This has been achieved with the introduction of the auto credit decision making process with 79% of home loan applications moving through this process, lifting the processing capacity 35%. New customer acquisitions have seen the total funds under management increase to $1.25b with the average balance increasing to $20k.

Source ANZ

The commercial division has increased profit for the year by 11% and revenue by 10% year-on-year with good volume growth and disciplined margin management. Net loans & advances increased by 6% over the year with solid lending growth in specialist segments including agribusiness and health.

Deposit growth of 2% after two years of unprecedented government support following covid also lifting deposits across the sector.

Institutional revenue increased 2% YoY and 10% HoH, driven by customer demand and disciplined margin management, despite Markets revenue being adversely impacted by external shocks including the war between Russia and Ukraine .

The business grew volumes of agency payments processed for other institutions using ANZ’s infrastructure by a whopping 85% year-on-year, with digital payments volumes also up by a solid 52% and aided by an increase in customer foreign exchange transactions. Within the Institutional division growth in corporate finance fee income in the 2H was driven by increased corporate M&A activity and increased trade flows as trade flows from overseas opened up again post the Covid period with supply chains beginning to be restored. The division’s fee growth came from participation in 127 sustainable finance deals, we note this is quite an achievement since the board decided not to fund fossil fuel projects, this increased from 81 deals in the FY21 period.

The monthly chart indicates price has set a “higher low” with price again moving higher to retest the down trendline. Currently price is trading at 2013 levels and has moved above the 12-month moving average.

The New Zealand arm of the bank also enjoyed a strong financial performance with profit up 7% for the year and 5% when compared to the previous half. The division maintained a market share lead in key products including retail housing and funds management. The process also reached the final stages of the BS11 which is one of the largest compliance programs in New Zealand banking history.

Source ANZ

Compliance in CET (Common Equity Tier 1 Ratio) was strong at 12.3% and Cash Return on Equity was 10.4%. The agreement to acquire Suncorp, required the bank to conduct a $3.5b capital raise to partially fund the acquisition, the outcome will lower CET to 11.1% and remains well within APRA guidelines. ANZ has proposed the final dividend of 74 cents per share, fully franked and showing a slight improvement over 2021.

In summary

ANZ produced a standout year-on-year result, with the ability to pass on higher funding costs and at the same time increase the customer base increasing funds under management and further developing products to customer requirements. In this area some headwinds will persist as competition increases for deposits. On the lending side NIM (Net interest margin) remains at 1.8% with the potential to increase in 1H-23. Credit impairment charges remain low at 0.2% of loan book value or $60m in cash terms.

We maintain our Buy recommendation for members without exposure and a medium term outlook.

Disclosure: Interest associated with Fat Prophets holds shares in ANZ bank.[/subscribe_to_unlock_form]