US benchmarks were mixed on Monday with the small-cap Russell 2000 continuing to lead the market. Bitcoin broke above $87,000 as the post-Trump rally in crypto continued. The US dollar also continued to rally which weighed on gold, commodities. The US bond market was closed for a public holiday. Asian stock markets came under some pressure as China’s stimulus package disappointed some, but Beijing is likely to keep its powder dry for when Trump assumes office in January and imposes higher tariffs.

The Russell 2000 index of small caps rose +1.5% to the highest level since 2021. The Dow Jones rose +0.69% while the S&P500 +0.1% and Nasdaq +0.06% were marginally higher. Economically sensitive shares outperformed with the banks continuing in a blistering rally. With the election and another rate cut in the rear-view mirror, the question is whether the bull market rally can continue. The great rotation with cyclical and small caps could continue as the bull market broadens to some of the laggard sectors in the market. This week’s inflation data will provide the next important catalyst for the market.

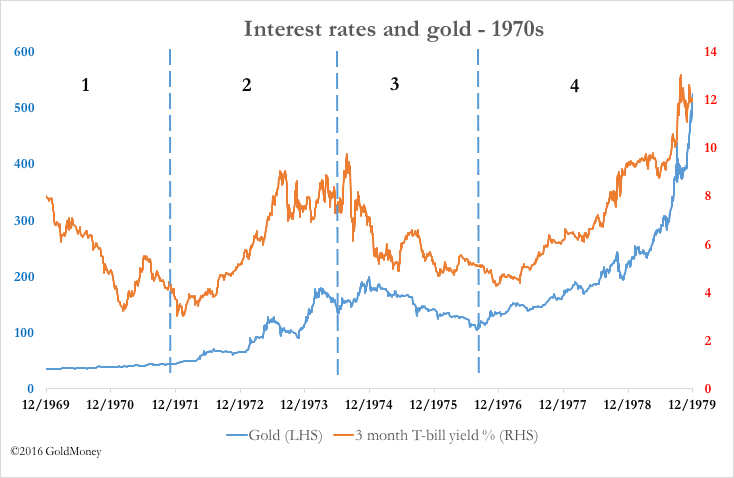

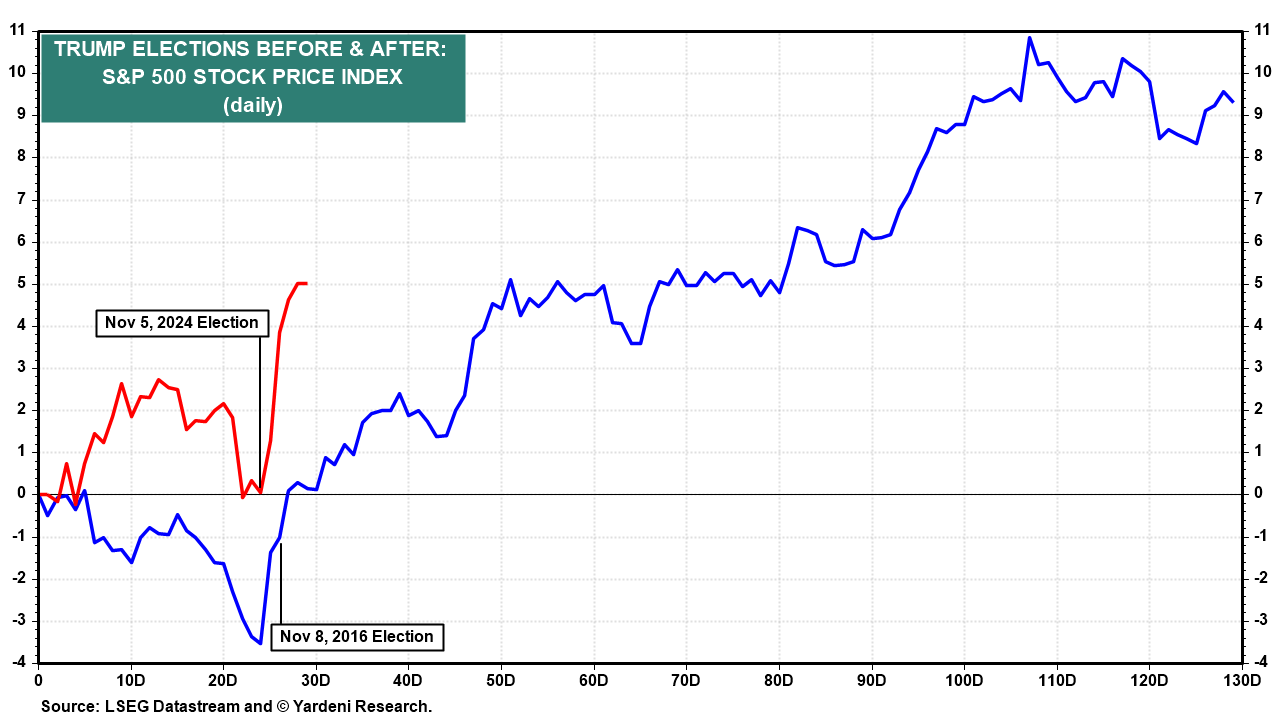

The September reporting season is winding down and in the final stage. Most S&P 500 companies’ results have delivered well, with on average profits increasing by around 8.4% – which was double the expected increase. Valuations are high now for US stocks, but while the economy remains resilient, and with the incoming Trump administration set to spur further growth next year, my base case is for key US benchmarks to move higher into year-end, fuelling a rally in equities around the world. Meanwhile, expectations around the December quarter have recalibrated higher. Consensus forecasts have jumped by 13%, which is the biggest increase since the post-pandemic economic rebound in 2021. One risk factor is the US bond market where yields have jumped across the curve, with many expecting a Trump administration to usher in a new phase of inflation. Please note this morning, technical issues have prevented charts, but I will have this sorted out tomorrow. The bond market and rising yields are one potential risk to the US stock market. Morgan Stanley CIO Lisa Shalett said on Monday in a note to clients that the “decisive win by Trump has set up a potential confrontation between stock and bond investors. Equity investors have added a high degree of confidence in tax-cut extensions and deregulation to their bullish narrative… It’s been less joyous for bond investors, with yields backing up sharply midweek over concerns around unfunded tax cuts and the inflationary impact of proposed tariff and immigration policies. As these dynamics have introduced uncertainties around Fed easing, rising yields have coincided with US dollar strength, leaving victims among multinationals and emerging markets…Opportunities exist, especially in large-cap value, midcap growth and emerging markets, as currency volatility has surged.” Lisa is right to highlight the pain in the bond market, which has had a very poor performance since the Fed cut by 50 bps in September. The next few months are going to be important for the bond market and could confirm a trajectory on the 10yr to 5%. This would have consequences for the financial markets. The US10yr finished trading on Friday at 4.3% and remains just below the big resistance level at 4.35%. A sustained advance above this level, would be negative for the bond market and raise scope for a bigger selloff. The US bond market was closed for a public holiday but bears monitoring closely. Bonds will take their lead from the core consumer price index which is due on Wednesday. Consensus expectations by economists are that the index rose at the same benign pace as last month, which will keep the rate cut narrative intact for now. With the US dollar index lifting 0.5% to 105.5, commodities came under pressure across the board. WTI and Brent crude declined 3% to $68.13 and $71.89. Gold was lower by 2.5% to $2,625 silver and platinum declined marginally less by 2% and 1%. Copper was lower by 1.5%. The soft ag complex was also lower across the board. I listened to a fascinating interview yesterday with hedge fund and investing legend Stanley Druckenmiller who declared that he wasn’t “ready to put inflation aside yet” and says the Federal Reserve shouldn’t either. “I’m a little worried that the Fed has declared victory too early on inflation. With credit spreads tight, gold at new highs, equities roaring, no sign of material weakness in the economy — of course, there’s some spots — that just makes me nervous that inflation could turn up again and the Fed has jumped the gun and eased too early.” Mr Druckenmiller said that history should caution against presuming that inflation was finished, and he cited the 1970s, “which was a tumultuous period in which inflation fell and then rebounded. It went back up again, and the number of months would correlate to the bottom being right now. The Fed’s decision to pursue deeper interest rate cuts at a time of economic strength is a mistake caused by the bank’s obsession with data-points.” The Fed infamously cut rates too early during the 1970s under the leadership of Arthur Burns. Inflation took off which ignited not only higher interest rates but a secular bull market in commodities and gold. During the interview Mr Druckenmiller emphasised the Fed is taking the wrong approach. “To me, the Fed’s job is to avoid the big, big mistakes like the ’70s, like the great financial crisis, like the big inflation we just had, but all this fine tuning and worrying about a soft landing that that is not the job of the Fed. In my opinion, it’s to maximize employment for the long term, not for the next three months or the next four months.” Mr Druckenmiller said that Trump’s tariff plans are inflationary, meanwhile immigration has been a non-inflationary source of growth for the US, which is now at risk. Whilst gold and commodities have come under some pressure since the election and Republican sweep last week, I believe any weakness will prove transitory, with the bull market to reassert once the incumbent correction plays out. Veteran strategist Ed Yardeni who presciently called the bull market since early 2023, noted this week that “Animal spirits are back now that Trump won a second term on November 5 and in a clean sweep if the Republicans win the House, which seems likely”. However, he asl cited some concerns over the bond market. The stock market jumped for joy that the election results were definitive, thus averting a contested election. Stock investors are also thrilled by the regime change to a more pro-business administration promoting tax cuts and deregulation. Concerns about tariffs and bigger federal deficits haven’t weighed on the stock market so far, though they seem to be weighing on the bond market. The S&P 500 rose 4.5% from Election Day through Friday last week, exceeding a similar comparison in 2016 (chart). Mr Yardeni said that analysts are likely to up their earnings estimates and stressed we are too. “For the S&P 500, we are raising our 2025 and 2026 operating earnings per share from $275 to $290 and from $300 to $320. These estimates assume that Trump will quickly lower the corporate tax rate from 21% to 15%…We expect that the S&P 500 profit margin will rise to new record highs of 13.9% and 14.9% over the next two years thanks to Trump’s corporate tax cut, deregulation, and faster productivity growth.” This outcome seems probable now that growth is set to be unleashed within the US economy, but as discussed above (and reinforced by Stanley Druckenmiller) we could also of inflation – in a second phase. However, Ed Yardeni confirmed we are “raising our S&P 500 year-end targets as follows: 6100 (2024), 7000 (2025), and 8000 (2026). We are now targeting 10,000 by the end of the decade. That’s a 66.6% increase from 6000 currently over the next five years.” Further, he mentioned that “we believe these forecasts are consistent with our Roaring 2020s scenario, which is receiving a boost from the “animal spirits” that should result from Trump 2.0’s economic policies. We also expect that the animal spirits will intensify as the wars between Russia and Ukraine and in the Middle East are resolved sooner rather than later.” There were no major economic releases on Monday, with Wednesday’s inflation data and Friday’s retail sales print set to be influential this week. Megacaps were mixed. Most declined around -1% or so, although Alphabet was moderately higher and Tesla’s euphoric rally extended. Tesla shares have gained more than +40% post-election, with the EV maker joining the trillion-dollar market cap club. It’s hard to see any realistic scenario where a Trump win will benefit Tesla anywhere near the extent that the stock has rallied, but volumes remained well above average on Monday and reportedly accounted for about a quarter of all trading in S&P 500 shares. However, Nvidia shares dipped despite being promoted to top large-cap pick by Piper Sandler. The investment bank cited the upcoming launch of the Blackwell chips and its dominant position in AI accelerators. The company’s chips lead in accelerating AI-related workloads in areas like machine learning and deep learning, thanks to high parallel processing capabilities. On the same page, Bitcoin’s spike continued, cresting the $87,000 level, which sparked double-digit gains in exposures like Coinbase, MicroStrategy and Riot Platforms. Major banks continued rising Monday as investors anticipated lighter regulation and increased deal activity under the new administration. Wells Fargo, Morgan Stanley, Citigroup, and Goldman Sachs enjoyed solid gains. The SPDR S&P Bank ETF (KBE) gained +3%. Halliburton and Schlumberger shares rose even as crude oil prices fell. They are seen as beneficiaries of Trump’s “drill baby drill” directive. Another Trump trade surging was the private prison stocks, like CoreCivic, as President-elect Donald Trump named immigration hardliner Tom Homan as his “border enforcer.” Small/mid-cap stocks were on the ascent, seen as winners from fewer regulations, which boosted the Russell 2000. Cigna surged after announcing it wouldn’t pursue a merger with Humana, which fell 8% on the news. Cigna also reaffirmed its FY24 and FY25 guidance. AbbVie shares tanked 12% after its experimental schizophrenia drug failed to show significant improvement in Phase 2 trials. AbbVie’s loss boosted shares of competitor Bristol-Myers Squibb. Cboe Global Markets advanced after Deutsche Bank upgraded the exchange to buy from hold, expecting benefits from increased demand amid post-election market volatility. The ASX200 retreated on Monday, ending a three-day rally as mining stocks slumped following a thumbs down from the market regarding Beijing’s stimulus plan. The ASX200 ended -0.35% lower at 8266, roughly in the middle of the intraday range. The modest move for the benchmark masked a broader divergence at the sector and stock level. SPI futures are pointing to a 0.1% gain on the open. While there were no major local economic releases, local investors were underwhelmed by Beijing’s stimulus (of which I expect more to follow), and this led to ‘China trade’ laggards versus ‘Trump trade’ winners on Monday. Information Technology +1.39%, and Real Estate +1.24% both benefitted from slightly lower yields in the US on Friday. In contrast, the Materials sector suffered a steep -2.8% drop, and the Energy sector lost -0.67%, weighed down by declining iron ore and oil prices on the Beijing news. Consumer staples fell -1.84% due to some company-specific news and slides from China-related exposures in the group (Treasury Wine -4.1%). WiseTech +2.2% and Xero +1.7% led the tech group higher. Gains in real estate were broad-based, with Goodman Group +2.5%, Scentre Group +1.2%, Stockland +2.2% and GPT Group +1.6% doing the heavy lifting. Stockland raised its FY25 funds from operations (FFO) per share guidance to 33–34 cents, following regulatory approval for a $1.1 billion acquisition of 12 Lendlease residential communities with its Thai partner, Supalai. The major acquisition is set to close by mid-FY25 and is expected to elevate Stockland’s gearing within its target range, fuelling an increase in settlement volumes and distribution. CSL +0.7%, Resmed +1.9% and Cochlear +2.7% lifted the healthcare group +0.7% into third place on the table on Monday. The heavyweight financial sector posted a slight +0.22% advance. Commonwealth Bank inched up +0.3%, setting an intraday record above $150 before settling just below that milestone. National Australia Bank climbed +0.9%, while ANZ was nearly flat. Westpac lagged slightly, easing -0.4%. QBE added +1.3%, while peers Suncorp -0.1% and IAG -0.4% dipped. The Materials sector bore the brunt of the downturn, largely due to slipping iron ore prices and tempered expectations for a Chinese boost. BHP fell -4.1%, while Rio Tinto declined -3.1%, and Fortescue was hit hardest with a steep -7.3% drop. The weakness extended to copper plays, where Sandfire Resources dropped -2.5%, 29Metals fell -4.9% and the Global X Copper Miners ETF (WIRE) slid -3.2%. BHP remains the low-cost iron ore producer and has a growing copper business. Weakness could provide a buying opportunity. Gold stocks held up better than their base metals peers, with the gold sub-index falling just -0.5%. Northern Star edged up +1.3%, while Evolution Mining slipped -0.2%, and Newmont was effectively flat. Genesis Minerals stood out with a +4% pop following well-received drilling results. The hope is these will provide an upside to the company’s five-year plan. In the Energy sector, Woodside saw a slight -0.2% decline, while Santos was down -0.9%. Coal stocks were similarly soft, with Whitehaven Coal dipping -0.6% and New Hope Corporation slipping -0.4%. Uranium-related stocks lost ground as well, with Paladin Energy down -0.4%, Boss Energy falling -2.8%, and Deep Yellow dropping -1.9%. In corporate news, Endeavour Group was one of the day’s biggest laggards, slipping -4.9% after issuing a profit warning for the latter half of the year, citing stagnant store sales. HMC Capital gained +4.1% on plans to launch a $4 billion data centre investment trust, while battery tech firm Novonix jumped nearly +12% after securing a supply deal with automaker Stellantis. Elsewhere, SRG Global +3.5% and James Hardie +3.2% were outperformers, while Praemium -5.3%, St Barbara -4.6% and Droneshield -4.1% were laggards. Turning to Asia, China’s CSI300 advanced +0.66% but the Hang Seng fell -1.45% but rebounded well off the intraday lows as investors were underwhelmed by Beijing’s stimulus package on Friday. China unveiled a 10 trillion yuan ($1.4 trillion) debt package which was flagged by Reuters a few weeks ago, and is designed to ease local government financing worries. Investors were disappointed by the lack of direct stimulus, hoping for some targeted directly at boosting consumer and corporate spending – but Beijing might be saving this up for January when Trump assumes office and imposes tariffs. Meanwhile, over the weekend, inflation data for October highlighted persistent deflationary pressures. Annual consumer inflation eased to 0.3% from 0.4% in September, marking the lowest level since June and the ninth consecutive month of subdued inflation. The monthly consumer price index fell by 0.3%, more than the expected 0.1% decline, after a flat September reading. Producer prices dropped by 2.9% year-on-year, extending the deflationary streak to 25 months and exceeding forecasts of a 2.5% decline. This contraction, the sharpest since November 2023, reflects ongoing weak demand across sectors. Monthly producer prices dipped 0.1% after a 0.6% drop in September, so at least there was some sequential improvement. In Hong Kong trading, property developers saw steep declines. Among property stocks, China Vanke -6.1% and Longfor Group -5.1% tumbled. In tech, Meituan -3.2% and JD.com -2.3% led the group lower, while Sunny Optical +4.5% and Xiaomi +3.5% posted solid gains. Most stocks tilted to the downside, including local bourse operator HKEX -4%, MGM China -3.2% and Wynn Macau -2.3%. In Japan, the Nikkei inched +0.08% higher to 39,533, while the broader Topix dipped -0.09%. Investors stayed on the sidelines ahead of Japan’s first runoff leadership vote in decades, which later confirmed Shigeru Ishiba as the PM. Although Ishiba’s victory was anticipated, the runoff—which concluded after markets closed—added to an already cautious mood, especially after his coalition lost its majority in the lower house last month. The Japanese yen weakened slightly against the greenback, settling in the mid-153 range in late afternoon trading. The 10-year government bond yield edged down by 0.5bps to 0.995%, tracking a dip in long-term US Treasury yields. Separately, loan growth of 2.7% year-on-year in October matched market expectations. This was unchanged from September but down from 3% in August. Megabanks banks saw a 2.5% increase, while regional banks posted a stronger 3.3% increase. Banking stocks were mixed, with SBI Sumishin +1.4% and Fukuoka Financial +0.8% leading the advancers, and Sumitomo Mitsui -0.7% and Mitsubishi UFJ -0.3% in the red. Video game stocks diverged. Sony rallied +6% after reporting a 73% surge in operating profit for the July-September quarter, driven largely by robust sales in its game and network division, which helped counter weaker performance in TV production. For the fiscal year ending in March, Sony kept its profit forecast steady at ¥1.31 trillion. On the other hand, Square Enix slumped -10.9% after disappointing results. Net revenue fell 8% to ¥157.6 billion and ordinary profit slid 31% to ¥18.1 billion following soft video game segment numbers. New releases failed to live up to the performance of titles a year ago. The FTSE 100 gained +0.65% to close at 8,125, while the FTSE 250 gained +1% amid an overall positive mood, despite a lack of local economic news ahead of employment data on Tuesday and monthly GDP figures due Friday. Economists are expecting a marginal rise in the unemployment rate to 4.1%. The job market has held up well and the recent pivot from the BoE is supporting consumer and corporate confidence. Banking stocks were up as the UK government further sold down its stake in NatWest, which rose +3.7%. The government now holds an 11.4% stake, marking progress toward full privatisation after bolstering the bank amid the GFC fallout. Barclays was up +3.6% on the read-across. Speciality chemicals firm Croda International topped the FTSE 100 table, advancing +5.2% after a positive third-quarter trading update. While Croda reaffirmed its profit guidance, it cautioned that a stronger pound might weigh on its bottom line. Software group Kainos surged +6.2%, supported by a £30 million share buyback program and better-than-expected interim profits. Luxury fashion brand Burberry Group was up in early trade amid fresh takeover speculation, with reports suggesting Italy’s Moncler could be a potential acquirer, but fell sharply in late trade to close -3.3% lower. Heavyweight miners were in the red as the mood towards China exposures soured after investors were disappointed with last Friday’s policy announcement. Rio Tinto -1.9%, Antofagasta -1.9% and Anglo American -1.9% led the group lower. Precious metals miners Endeavour -5.9% and Fresnillo -3.4% tracked gold and silver prices lower. Regional bourses on the continent extended gains, basking in the afterglow of the US election and hopes of a new economic growth leg, although the risks of being embroiled in a trade war add some caution. There were no major pan-European economic releases, with GDP data the looming highlight on Thursday. At the close, the pan-European Stoxx 50 was up +1.07%, Germany’s DAX added +1.21%, while France’s CAC 40 gained +1.2%. Italy’s FTSE MIB advanced +1.56%, while Spain’s IBEX 35 added +0.4%.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters