Key themes and stocks discussed today:

-

- Wall Street benchmarks reversed earlier gains to close sharply lower, with much of the late session selling coming in technology. Nvidia and Tesla accounted for much of the slide in the tech sector. The market weighed Nvidia’s result versus a slowing growth rate and a shadow cast over increased AI spending in the industry, where DeepSeek and peers could prove to be disruptive. Economic data also pointed to a slowing US economy. European and Asian stock markets retreated from record highs. The dollar surged which weighed on gold and commodities. Oil was a notable exception while the VIX added +5 to 20.

- The latest Trump tariff of 10% on all China imports risks hurting the US economy. The impact, according to a study from economists at the Federal Reserve Bank of New York, could be especially severe if the Trump administration ends favourable treatment of small consumer items valued at less than $800. A lot of the merchandise sold by big box retailers such as Walmart, CostCo, Target and the Dollar discount stores will be caught by this tariff. If Chinese manufacturers adopt a “price taker stance” and refuse to absorb this tariff, then prices for many cheaper goods in the US will rise – impacting inflation and lower-income consumers. This could prove to be an “Achilles heel” for the US economy and a big flaw in Trump’s trade & tariff policy.

- Data was mixed on Thursday. A second estimate confirmed the US economy notched a slower 2.3% expansion in 4Q24, powered by healthy consumer spending. However, jobless claims flashed caution as a housing demand slump. Friday’s upcoming PCE inflation reading is now in focus.

- The ASX200 recovered some recent losses on Thursday, buoyed by some well-received corporate updates and a solid performance from gold miners. Gains were relatively broad-based, albeit modest overall.

- Hong Kong’s market dipped slightly as the recent AI-fuelled surge paused following Nvidia’s update. Hopes remain pinned on forthcoming policy support from Beijing, with property developers rallying ahead of the “Two Sessions.”

- Japan’s benchmarks posted modest gains after relatively quiet trading. Rising bond yields underscored jitters over renewed tariff threats abroad and expectations the BOJ will hike further soon.

- UK benchmarks delivered a mixed performance, balanced by some upbeat corporate newstrade against trade jitters. Tariff threats saw European indices retreat from record highs. Meanwhile, minutes from the European Central Bank hinted at a more measured pace for rate cuts.

- Notable charts and stock mentions today include the S&P500, Nasdaq Composite, Russell2000, US10yr bond, Gold, Nasdaq Golden Dragon Index, Nvidia, Tesla, Warner Bros. Discovery, Snowflake, eBay, Teladoc Health, Rolls-Royce, London Stock Exchange, Coles, Qantas, Vault Minerals, Santos, Chalice Mining, Ramsay Health Care, IDP Education, Medibank Private, Country Garden, HKEX, Seven & I Holdings and Socionext.

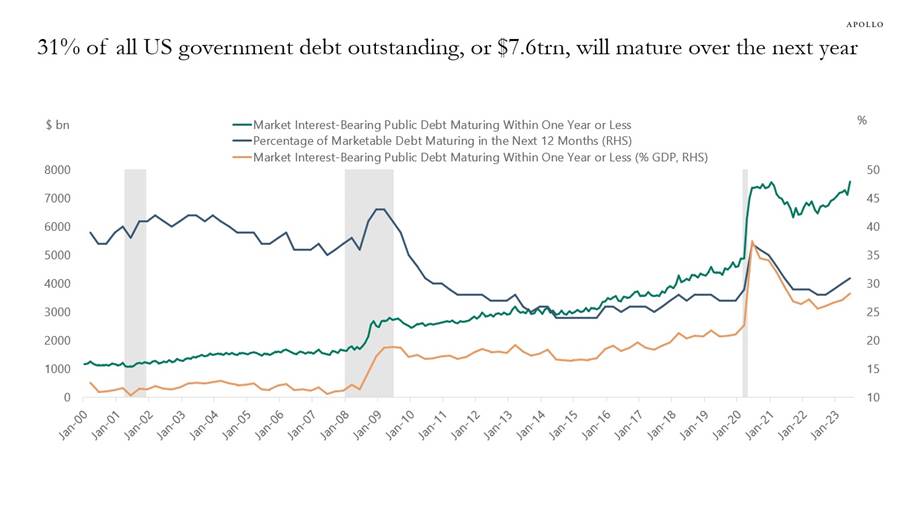

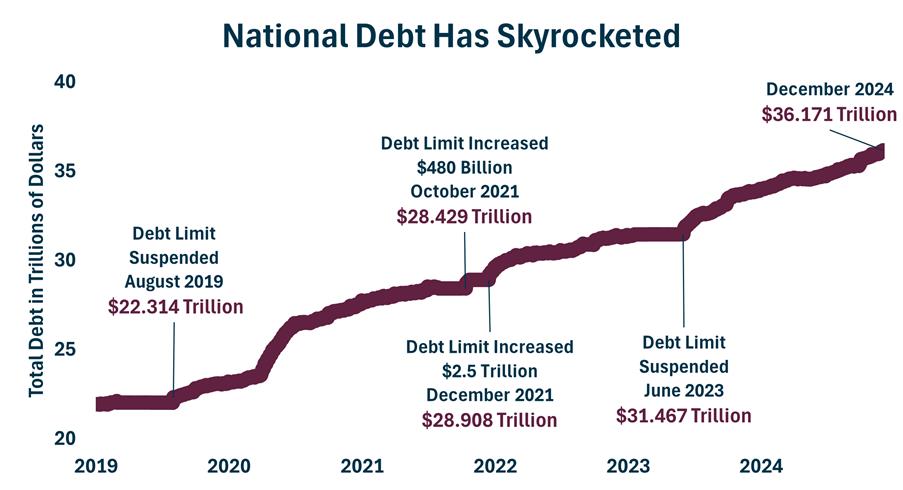

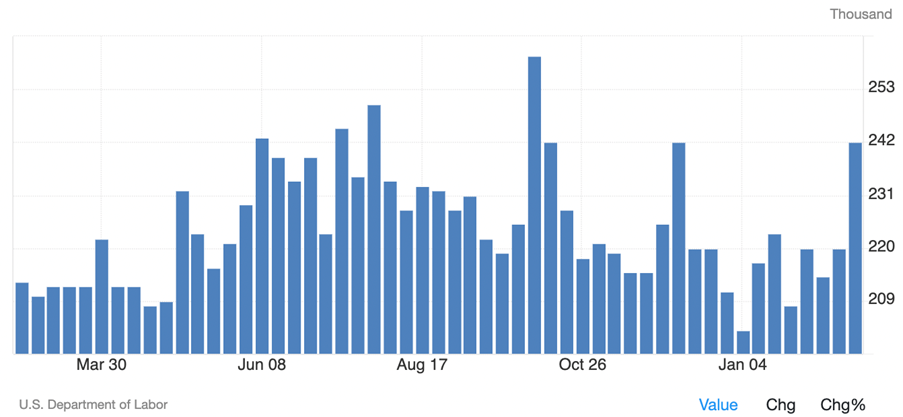

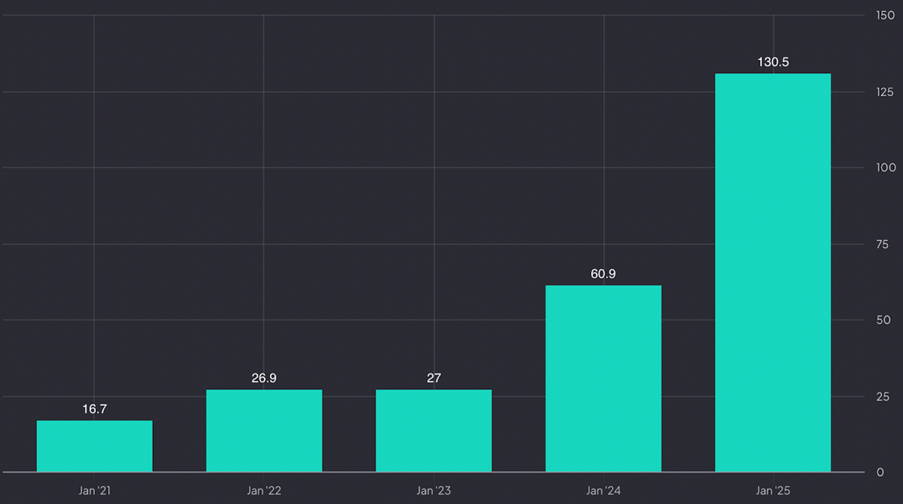

Good morning, Wall Street benchmarks reversed earlier gains to close sharply lower with much of the late session selling coming in technology. Nvidia and Tesla accounted for much of the slide in the tech sector. The market weighed Nvidia result versus a slowing growth rate and a shadow over increased AI spending in the industry, where Deepseek could prove to be disruptive. Economic data also pointed to a slowing US economy. European and Asian stock markets retreated from record highs. The dollar surged which weighed on gold and commodities. Oil was a notable exception while the VIX added +5 to 20. The Dow Jones was closed down 0.45% and outperformed other benchmarks. The S&P500 lost 1.6% to 5,861 and the Nasdaq Composite led on the downside falling a sharp 2.8%. The Russell 2000 declined 1.6%. Nvidia was down 8.5% which contrasted with earlier gains following upbeat quarterly revenue guidance, but investors focused on a slowing growth rate. The launch of low-cost AI models from China’s Deepseek and Tencent releasing a faster yesterday, has cooled a two-year bull run in US tech. It is looking more certain that China will be able bring forward capable artificial intelligence at a much lower cost which casts a shadow on the big budget spending of big US mega cap tech stocks. The rotation beneath the surface continued Thursday with investors switching into other sectors of the market, and notably energy which bucked the trend adding +1%. Financials and banks also outperformed. With a huge valuation and positioning crowded, Nvidia came under more pressure post the result. The unwind in the stock is likely to continue with the uptrend broken, and the next key support level at $110. The Russell 2000 Small/Midcap index also corrected back to key support at 2150, which is an important support level. The RUT is still holding above the uptrend, which looks to hold. Lower interest rates and bond yields are supportive for Small/Midcaps, but the index is sensitive to the economy and needs growth to remain resilient. Technically, the correction from the record highs at 2400 now looks almost complete. The bond market remained steady with yields creeping only marginally higher at the long end of the curve. Data showed the labour market slowing with jobless claims jumping more than expected over the previous week, while another report reiterated that economic growth slowed in the fourth quarter. Focus will now shift to the monthly PCE gauge, the Federal Reserve’s preferred inflation gauge, due on alter today. Traders expect the Fed to lower borrowing costs by at least 50 bps by December, so the print will be influential on this outlook. On the trade front, President Trump floated a 25% “reciprocal” tariff on European cars and other goods, along with proposed tariffs on Mexico and Canada going into effect on March 4th. He is also threatening another 10% levy on Chinese imports which could damage the US economy and lift inflation – more on this below. US listed China ADRs reacted mutedly and were little changed with the Nasdaq Golden Dragon index down 0.93%. The US dollar index surged +0.75% to 106.8 on the tariff announcements with. Precious metals came under pressure with gold lower by 1.4% to $2888oz while silver and platinum fell 2% and 1.5%. Copper bucked the trend +0.3% to $4.60. The soft ag complex was lower across the board. WTI and Brent crude bucked the trend adding +2% to $70.19 and $74. Bitcoin fell another 4% to $82.6k. The latest Trump tariff of 10% on all China imports risks hurting the US economy. The impact, according to a study from economists at the Federal Reserve Bank of New York, could be especially severe if the Trump administration ends favourable treatment of small consumer items valued at less than $800. A lot of the merchandise sold by big box retailers such as Walmart, CostCo, Target and the Dollar discount stores will be caught by this tariff. If Chinese manufacturers refuse to absorb this tariff, then prices for many cheaper goods in the US will rise – impacting inflation and the lower income consumers. Onshoring manufacturing of these goods into the US is unlikely to happen anytime soon – and costs would likely be much higher anyway given the discrepancy in China/US labour costs. China will likely shrug this off (and refuse to cut prices and absorb the tariffs) given that the US now only accounts for 13% of total exports which is down from 18% in 2018. US retailers wont be able to source goods cheaper elsewhere and will have to pass the tariffs on directly to consumers. The bottom line, is this could set in train a resurgence of inflation. To date, the bond market has behaved but this has been amidst uncertainty over White House policies on trade and tariffs and what the final objective is. The Fed report also found that tariffs on imports from China could hit the American economy more than official US trade data indicates. “US imports from China have decreased by much less than has been reported in official US statistics. As a result, the recent tariff increase on China could have a larger impact on the US economy than is suggested by official US data on the China import share.” The NY Fed also found that the hit to the US economy will be amplified if Trump does away with an exemption threshold for direct-to-consumer imports. That threshold was increased to $800 from $200 in 2016. Since returning to the White House in January, Trump has imposed a new 10% tariff on Chinese goods. He also announced (and then delayed), a plan to end tariff exemptions for smaller merchandise from China/Hong Kong valued below $800. This could well prove to be one Achilles heel for Trump’s strategy to impose higher tariffs. The correction in gold could also extend lower, although support at $2800oz is well defined and prominent. Precious metals are a natural hedge against inflation, uncertainty around the US trade policies, and also the US dollar. Gold miners are likely to be well supported given cheap valuations. In Australia the spot A$ gold price pushed above A$4600 after the Aussie dollar declined 1% to 62.3c. The narrative is similar for most gold miners outside the US. The NY Fed said that “US consumers could face larger consequences than meet the eye from the recent 10% tariff increase if smaller merchandise exception is ended for China, and Chinese sellers do not slash their profit margins by reducing their export prices.” This outcome seems highly likely because on this front, China is a price maker to many items that have become essential for consumers not just in the US – but around the world. My argument is that Trump’s trade and tariff policy could badly misfire if inflation is reignited – that then precipitates a rise in interest rates and bond yields that will end up costing the US treasury much more in debt rollovers. The US treasury is facing much of its long term debt profile maturing this year and in 2026 that will need to be funded at higher rates.’ This could then in turn blowout the US deficit and wipe out any cost saving on Federal spending achieved by DOGE and Elon Musk. The bottom line is that what the US Government gains in tariffs could be dwarfed by much higher debt servicing costs, which in turn would undermine sovereign creditworthiness and inevitably the US dollar. Mike Wilson, the chief investment and US strategist at Morgan Stanley, said in a note this week that “DOGE is off to an aggressive start and this is likely a headwind to growth initially, as Federal spending and headcount is reduced.” Another regarded economist Torsten Sløk at Apollo believes that DOGE could eliminate as many as 300,000 federal positions, translating to nearly 1 million job losses. This would case significant labour-force disruption that would ripple through economic data and eventually asset prices. “Any increase in layoffs will push jobless claims higher over the coming weeks, and such a rise in the unemployment rate is likely to have consequences for rates, equities, and credit.” So far, the bond market has taken DOGE and Elon Musk’s efforts constructively in reducing Federal spending. Elon Musk has cited the US 10-year yield as a key scorecard (which contrasts with Donald Trump who focuses on the stock market). Lower bond yields are positive for US debt rollover and funding, but the tariffs could reverse the recent positive progress. In terms of investment considerations, the yield on the US 10yr bond is by no means bullish – but bearish and could well prove to be the “Achilles heel” for the US economy. With the technical setup pointing to a sustained uptrend and retest of the highs above 5% some time this year. An inflationary impulse from tariffs could well prove to be the catalyst. Meanwhile the correction in US stocks that began a few weeks ago when resistance at the record highs proved a significant hurdle – likely has further to go. The S&P500 and the Nasdaq Composite likely have further to go on the downside during the incumbent correction. The next key support level is at 5,600 which could be tested in coming months. I expect the rotation into international stocks and specifically European/UK and China/Hong Kong stocks to continue. The market doesn’t care about whether things are “good or bad”, but whether they are getting “better or worse”. There is a case to be made things look like they are getting better for Europe and China, and there is now concerns that things could get worse for the US. Valuations are cheaper and more defensive in international stock markets, but the same is not true for the US. International stocks could be set to sustain recent outperformance against the US. Extremely low positioning by international investors in Chinese equities creates the set up for the big rotation to continue especially if Beijing finally delivers fiscal stimulus that is impactful (which is our base case). Economic data was mixed on Thursday, though overshadowed by tariff threats and a slide from Nvidia. According to a second estimate, the US economy grew at an unrevised annualised rate of 2.3% in the fourth quarter of 2024, its slowest pace in three quarters. Consumer spending remained the primary driver, rising 4.2%, the fastest pace since early 2023, with gains in both goods and services. The job market showed signs of softening, with initial jobless claims jumping by 22,000 to 242,000 last week—the highest in over two months and well above expectations of 221,000. However, continuing claims edged lower to 1.862 million, slightly below forecasts. Finally, the housing market remained under pressure as pending home sales slid 4.6% in January, far worse than expected. PCE prices due on Friday will be the key data point of the week. Jobless claims jumped last week. Credit: Trading Economics Mega-caps were sharply lower on Thursday, as selling pressure mounted in the last trading hour. Nvidia led the group lower, while Tesla also extended its recent fall. Amazon, Alphabet, Meta and Microsoft were roughly -2% lower in late trade, though Apple was holding up better. Nvidia crushed expectations again but disappointed in terms of the slowing growth rate. Priced to perfection, the stock lost 8.5% post the result. Despite reporting Q4 revenue of $39.33 billion (vs. the $38.05B est.), representing 78% YoY growth, investors headed for the exits. Net income nearly doubled to $22.09 billion, but gross margins slipped to 73%. EPS of 89 cents easily beat the 84 cents consensus estimate. That took annual FY25 revenue to $130.5 billion revenue, up 114%. The graphic below highlights the explosive growth in revenue Nvidia has seen since the public release of ChatGPT (November 2022) launched an explosion of interest and investment in generative AI. Nvidia’s revenues ($bn) have rocketed over the past two years. The growth has been almost entirely driven by high-performance and AI-related demand. For example, in Q4, data centre sales soared 93% to $35.6 billion, making up 91% of total revenue. Demand for its next-gen AI chip, Blackwell, is surging, with $11 billion in sales already booked. CEO Jensen Huang called it the fastest ramp in company history. Nvidia believes AI inference (basically more computing time for ‘thinking through steps’) will drive even greater demand. Nvidia forecast about $43 billion (+/- 2%) in revenue for the current quarter, well above the $41.8 billion average that analysts were modelling. Still, the stock slid sharply on Thursday as the company noted some gross margin pressure, and the forecast fell below the upper end of analyst estimates. Ultimately, it has become extremely difficult for Nvidia to ‘wow’ investors and lingering worries about inflated AI spending persist, especially as so-called foundation models begin to look like they will quickly become commoditised. In addition, many other companies are developing their own AI chips, which may be ‘good enough’ for much of their computing needs without paying massive premiums Nvidia currently enjoys. Warner Bros. Discovery jumped to the top of the S&P500 table as strong earnings outweighed a revenue miss. The company also added 6.4 million subscribers in the quarter and expects to reach 150 million global subscribers by the end of 2026. Snowflake heated up after the data cloud firm beat on the top and bottom lines. Nutanix, another cloud-related business, also jumped after better-than-expected earnings. On the flipside, eBay fell sharply after its first-quarter revenue forecast came in below expectations, overshadowing a revenue and EPS beat. Teladoc Health tumbled following a wider-than-expected fourth-quarter loss and a weak revenue outlook. C3.ai dropped despite better-than-expected results as investors were underwhelmed with its outlook. Elsewhere, PGM prices fell, weighing on Harmony Gold, Coeur Mining and other related exposures. Likewise, lower Bitcoin prices dragged on Coinbase and MicroStrategy. Uranium exposures dropped alongside Nvidia, including the Global X Uranium ETF and Sprott Physical Uranium Trust. Newmont fell despite smashing expectations in 4Q24, with adjusted earnings of $1.40 per share beating forecasts as soaring gold prices and higher production fuelled a strong quarter. Gold output increased 9.2% to 1.9 million ounces, while prices surged 31.9% to $2,643 per ounce, boosting cash flow to a record $1.6 billion in the quarter. Newmont is well-positioned for FY25, forecasting 5.9 million ounces in gold production and steady shareholder returns. In our last tech update on Nov 20th we noted that “Newmont has found support at $40, but with gold not being able to break above $2800 and encountering resistance, the envisioned recovery looks delayed. Having said that, Newmont has the potential to rebound strongly once disappointment around the recent earnings quarter is fully digested (and forgotten). Our base case technical view remains for a broad-based rebound to test resistance above $55.” Newmont rebounded to $48 and then subsequently corrected after encountering resistance. The global gold bellwether has underperformed the broader gold sector, but we continue to see scope for a significant recover. Near term, support should prove to be significant at $40. Our base case is for a retest of the primary downtrend that has been in place since the 2021 highs some time this year. Our base case technical outlook this year is for Newmont to breakout above $50 (which would confirm an inflection) and raise scope for a recovery towards the record highs. The ASX200 regathered its footing on Thursday, breaking a two-day losing streak, fuelled by some upbeat earnings reports and a rebound from gold miners, to advance +0.33% to 8268. Although the benchmark move was modest, eight of the 11 sectors finished in the green. Market breadth was solid, with the ASX 300 showing a decisive tilt with advancers outnumbering decliners by more than two to one. SPI futures are however pointing to a 0.84% decline today. The Aussie dollar declined sharply falling 1.1% to 62.3c against the greenback. A$ spot gold pushed back above A$4600oz. Consumer staples led the charge, rising +1.55%, followed by materials +0.98% and industrials +0.92%. On the flip side, three sectors closed below water: healthcare -1.07%, tech -1.01% and real estate -0.37%. Coles did the heavy lifting in the consumer staples group, rallying +3.5% after lifting its interim dividend to 37 cents per share. The supermarket giant benefited from the December strike at Woolworths +0.3%, which shifted sales to Coles stores, bolstering earnings. Treasury Wine Estates +1.7% and Endeavour Group +1.6% provided support. Within Industrials, Qantas rose +5.6% higher after reporting a better-than-expected $1.39 billion interim profit and resuming dividend payments with a bonus special dividend (9.9c), alongside an interim dividend (16.5c) rather than expanding its buyback program. The materials sector bounced back as iron ore stocks found support. BHP climbed +0.8%, Rio Tinto added +1.5%, and Fortescue jumped +1.7%. Copper exposures were mixed after the recent copper probe news. Sandfire Resources was up +1.8%, the Global X Copper Miners ETF gained +0.8%, while 29Metals slid -2.9%. Elsewhere in the broader minerals space, Chalice Mining +12.9% surged on an upgrade to buy from Morgans. Gold stocks had a strong session, with the gold sub-index rising +1.7% after bullion prices ticked higher overnight. Northern Star gained +1.6%, Evolution Mining rose +1.5%, and Newmont added +1.9%. Vault Minerals advanced +2.6% after reporting better-than-expected revenue and EPS, buoyed by elevated gold prices. Group EBITDA hit $267 million, while cash and bullion levels hit $576 million for this debt-free gold miner. An $80 million expansion of the King of the Hills processing facility has already been approved, and hedges are running off. Vault looks undervalued around current levels. In our last tech update on ??, we noted that “Vault Minerals has recovered significantly from the post-merger-induced corrective selloff. The primary uptrend in place since early 2023 has continuously been respected, with a series of higher reactionary lows now in place. The rally this week that cleared topside resistance at 39c is technically encouraging and points to upward momentum continuing over the coming months. Our base case technical outlook is for a retest and breakout above the record highs at 48c this year.” Vault Minerals (formerly Red5) has in the past month retested historic resistance at 40c, recovering all of the correction that ensued post-merger. The technical setup is constructive in our opinion and our base case is for a breakout above 40c and for new record highs to follow this year. Vault has risen consistently in recent months to establish a series of higher lows. The financial sector edged up +0.22%, with the big four banks mostly treading water. CBA +0.02% was effectively flat, while NAB dipped -0.2%. Westpac gained +0.4%, and ANZ rose +0.5%. Medibank Private was the standout in financials, surging +10% after announcing an 8.3% increase in its interim dividend, as strong customer retention and premium hikes helped lift profits. Perpetual sank -9.2% after reporting a 65% fall in interim profit, weighed down by a $25 million impairment on fund assets. The energy sector advanced +0.67%, with Woodside rising +0.4% and Santos climbing +1.2%. Coal miners were mixed, as Whitehaven fell -1.4% while New Hope edged up +0.3%. Uranium names tilted higher, with Paladin Energy up +0.4%, Boss Energy gaining +0.8%, and Deep Yellow adding +1.4%. Santos +1.2% is staging a recovery after reporting a steeper-than-expected annual profit drop, with underlying earnings of $1.22 billion falling short of forecasts and revenue down 8.5% to $5.5 billion. Lower oil and gas prices, supply chain disruptions, and weaker Chinese demand weighed on results, while production declined to 87.1 million barrels. The company cited a looming “inflection point” as its Barossa and Pikka projects are near completion. CEO Kevin Gallagher expects production to jump 30% in two years, with strong cash generation set to fuel higher shareholder returns. In our last tech update on Jan 23rd we highlighted that “Santos has managed to hold in above key support at $6.50/$7 but remains confined within a triangle trading range and below key historical resistance at $9. We expect Santos to retest the historical resistance level at $9 this year, but upward momentum needs to be restored – and oil and LNG gas prices need to improve further. A breakout above the near-term downtrend at $8 would increase the conviction that Santos had inflected.” Santos continues to coil up within a converging triangle range and our base remains bullish and for a breakout above the primary downtrend (intersection now at $7) to ensue this year. If Santos can confirm the breakout at $7, scope would be raised for a retest of historic resistance at $9. An advance above this level would confirm an important inflection. Healthcare was the weakest group as CSL -1.7% and Pro Medicus -3.7% dragged, offsetting a +6.8% rally from Ramsay Health Care after a well-received 1H update. The hospital operator has hired Goldman Sachs to explore a sale of its 52.8% stake in European hospital operator Santé. Tech was not far behind, as WiseTech slipped -2.6%, Xero dipped -0.3%, and Technology One dropped -1.7%. Appen’s collapse continued, sliding -14.3% after recently revealing poor numbers and the loss of a major $82 million contract with Google. REITS were broadly lower, but the moves were mostly muted. Scentre Group -2% and Charter Hall -1.5% were among the steeper large-cap fallers. Elsewhere, Eagers Automotive surged +19.9%. Profits skidded 25% but the market was braced for worse. IDP Education slumped -7.6% as a sharp contraction in the international student market saw earnings dive. Turning to Asia, China’s CSI300 ticked up +0.21%, while the Hang Seng dipped -0.29% to 23,718 as the recent AI-driven tech rally, fuelled by startup DeepSeek, took a breather following Nvidia’s earnings. Hong Kong’s tech index fell -1.3%. There were no major local economic releases. Within tech, Xiaomi -5.7%, Kuaishou -3.3%, NetEase -2%, Baidu -1.2%, Tencent -1.2%, Alibaba -0.9%, and Meituan -0.8% closed in the red, though some profit-taking is to be expected. There remains significant value on offer across the group versus US peers. Meanwhile, bourse operator Hong Kong Exchanges & Clearing rose +1.1% after posting record annual profits that slightly beat expectations. Traders bid Chinese property developers higher on optimism Beijing will step up stimulus efforts. The upcoming “Two Sessions” in Beijing will be closely watched next month. Country Garden +17.7%, Longfor Group +4.5% and China Vanke +2.4% led. Brewer Budweiser APAC +2.9% extended recent gains, while KFC operator Yum China added +1.6%. Japanese benchmarks staged moderate gains on Thursday amid muted trading. The Nikkei advanced +0.3%, while the Topix gained +0.73%. Gains were led by nonferrous metals, insurance, and transportation stocks. The yen remained in the lower 149 range against the greenback following former President Donald Trump’s renewed tariff threats on European imports. Meanwhile, the 10-year Japanese government bond yield rose 2.5bps to 1.39%. Financials were mostly higher, although SBI Sumishin -1% dipped. Mebuki Financial +2.3%, Resona Holdings +2.3% and Mizuho Financial +2.1% led the advancers. In the tech space, traders had been hoping Nvidia’s earnings would lift the market but sentiment remained muted given Nvidia’s uncertain trade after hours. Tokyo Electron added +0.9%, providing the biggest boost to the index, but Advantest dropped -1.9%, making it the biggest drag. Socionext soared +12.7% after announcing a partnership with Google Quantum AI. Seven & I Holdings tumbled -11.7% after the founding Ito family failed to secure financing for a $58 billion management buyout, leaving the company to consider a rival bid from Canada’s Alimentation Couche-Tard. Meanwhile, Itochu gained +4.3% after dropping plans to back the Ito family’s buyout attempt. Nissan accelerated +3.7% higher following reports that it may replace CEO Makoto Uchida after failed merger talks with Honda +0.5%. Elsewhere, Nissha Co +2.7%, Nintendo +2.7%, Inpex +1.9%, and Mitsubishi Heavy +1.5% advanced. Tokyo Electric Power -4.7%, Chugai Pharma -2.7% and Ajinomoto -1.3% were laggards. London benchmarks closed on a mixed note, with the FTSE 100 managing to recover from early losses, while the FTSE 250 declined amid broader economic concerns. The blue-chip index FTSE100 edged up +0.28% to 8,756, buoyed by some solid corporate earnings, whereas the more domestically focused FTSE 250 dropped -0.88%. Investors were closely watching trade developments as the UK outperformed its European peers, as the UK Prime Minister Keir Starmer met Trump in Washington, hoping for a tariff exemption. Meanwhile, data from CGA by NielsenIQ and RSM showed UK hospitality (restaurant, pubs and bars) sales falling -1.3% in January, marking the sector’s steepest decline in nine months. Pubs saw a slight –0.1 dip, while restaurants declined -1.1% and bars suffered a sharp -10.2% drop. The slowdown was attributed to reduced post-holiday consumer spending and adverse weather conditions. Rolls-Royce surged +15.9% to the top of the FTSE100 table after the engine and turbine maker raised mid-term guidance, reinstated dividends for the first time since the pandemic, and unveiled a £1bn share buyback. London Stock Exchange Group climbed +6.1%, while Aviva gained +4.2%, both benefiting from stronger-than-expected earnings results. Insurer Hiscox advanced +4.5% after reporting record full-year profits and announcing a $175m share buyback, further lifting investor sentiment. However, not all companies fared as well. Ocado plunged -18%, despite reporting narrower full-year losses and forecasting positive cash flow by 2026, as investors remained sceptical of its long-term strategy. WPP slumped -16.2% to the bottom of the FTSE100 table after the ad titan posted a decline in annual revenue and warning of flat or lower growth in 2025. Aston Martin continued its downward trajectory, skidding -12% as disappointing full-year earnings dampened confidence in its turnaround efforts. Barclays, Diageo, and Ashmore traded lower after going ex-dividend. British Airways owner IAG +3.5%, BAE Systems +3.5%, and BT Group +1.8% outperformed. Across Europe, markets buckled under the weight of fresh US tariff threats, particularly in the automotive sector. Trump’s confirmation he intends to impose 25% tariffs on EU imports and the European Commission’s promise of immediate retaliation rattled investors with the likelihood of a trade war. Meanwhile, the ECB is considering a more cautious approach to rate cuts as inflation risks rise. While cuts are still expected at the next two meetings, the pace may slow over 2025. Back in October, the ECB moved aggressively due to economic weakness, but the latest minutes show a shift. Policymakers now see a potential consumer-driven recovery, though risks remain, including Trump’s proposed EU tariffs. Services inflation, now 75% of the headline figure, is a key concern. With rates at 2.75%, the ECB aims to stay flexible, balancing inflation risks with growth uncertainties. At the close, the pan-European Stoxx 50 was down -1%, Germany’s DAX declined -1.07%, while France’s CAC-40 slipped -0.51%. Italy’s FTSE MIB retreated -1.53%, while Spain’s IBEX 35 shed -0.46%. Have a great weekend. Carpe Diem! Angus