2023 reflections

Global stock markets have performed better than feared in 2023 as a widely expected recession for the US economy was avoided without the negative knock-on impacts that would typically have entailed. The Australian economy has also proved resilient in an aggressive rate-hiking cycle. Most other major countries have been on the same page to varying degrees, although individual stock market performances have varied. As of mid-December, the S&P500 is an impressive 23% higher, in large part thanks to a stellar performance from the Magnificent 7 (the Nasdaq 100 has zoomed more than 51% higher) but enjoying broadening support from other pockets of the market over the past few weeks.

On home shores, the benchmark S&P/ASX200 is up a tad over 6%, supported by a solid advance over the past six weeks, recovering from a challenging September and October trading period.

The ride for investors hasn’t always been smooth, though, with bouts of volatility during the year. Touching on a few, there was a banking crisis scare early in the year prompted by US regional banks. Losses on cryptocurrency investments, sharp downturns in the value of bond portfolios and commercial real estate investments, and runs on bank deposits triggered the collapse of the likes of Silvergate Bank, Silicon Valley Bank, Signature Bank and First Republic Bank.

The resulting waves played a key role in the failure of Credit Suisse, one of Europe’s largest banks, forced into a shotgun marriage with UBS. Fears of contagion from the banking crisis hit financial stocks hard and rippled across other sectors. A broader and deeper banking crisis was likely averted as the Federal Reserve stepped in. A group of larger banks, led by JPMorgan Chase, stepped in to provide further support. Ultimately, the broader market impact was relatively short-lived. While not immune, Australian banks were relatively insulated from the turmoil due to diverse customer bases combined with substantial capital and liquidity standards in place. The financial sector in Australia, dominated by the banks, has advanced approximately 3.9% year-to-date.

We moved our recommendations on the big banks (NAB, WBC, ANZ) back to hold in early 2023 as we anticipated pressure on the sector from rising expectations of potential soured debts from very low cyclical levels as more Australians rolled over from low-cost mortgages. In addition, as the economy slows, system loan growth has plumbed lower levels, and the banks have been intensely competitive in the mortgage market while the tailwind from interest rate rises began to taper. The big banks delivered solid results, dividend increases and share buybacks but have traded in a range. Our buy recommendation on QBE fared well in 2023 thanks to the firming premium cycle and improving investment returns. The latter tailwind is still flowing through, but we are beginning to see fading investor interest as markets look forward. We will be revisiting our recommendation on the stock in early 2024.

Hopes that the Ukraine war would be resolved never really looked even close to unfolding. Sadly, the world was in for more geopolitical turmoil after the shock Hamas attack on Israel and the subsequent ongoing war. Energy markets endured another spike, albeit a brief one. Crude oil prices have quickly corrected to the downside on signs of discord within OPEC+ and as US oil producers have ramped up production. The energy sector in Australia is one of three sectors in the red YTD, down 4.3% at the time of writing. We have recommended Woodside and Santos as buys, although our timing regarding crude oil prices has been disappointing. We see considerable value in the sector for patient investors, given very undemanding valuations and as fossil fuels appear positioned to remain an essential part of the energy mix for a long time. News that Santos and Woodside are in merger discussions reignited some interest in the names over the past few weeks.

Uranium prices have continued to ascend in 2023, and the structural set-up looks favourable for years to come. Supply has effectively lagged demand for years, as prices plummeted following the Fukushima disaster in 2011. Until now, demand has been filled by existing inventory, but with energy security and the green transition growing in importance, there has been a renaissance in plans for new reactors to come online over the next decade.

We recommended Paladin Energy (PDN) as a new buy in August, followed by a buy recommendation for the Global X Uranium ETF (ATOM) for those seeking exposure to the same theme without the specific company risk. Both recommendations are away to a strong start.

Recently, the chronic underinvestment in new uranium supply over the past several years has been undergoing a positive momentum swing, but there continues to be a shortfall. This scenario caters to an energy-hungry world seeking carbonless, reliable base electricity capacity, with uranium a potential key to meeting what the world is seeking. We continue to view this area favourably for investment opportunities heading into 2024.

Inflation and interest rates have again dominated investor attention in 2023. Here, the developments have been about as positive as investors could have hoped after beginning the year with inflation at very elevated levels.

Inflation has headed notably lower globally (although it is still running well above many central banks’ target pace), and central banks have been able to take their foot off the pedal with interest rate hikes. Elevated inflation heading into 2023 saw consumers enduring a cost-of-living crisis while companies passed higher costs onto customers. Harsh medicine via interest rate hikes lifted borrowing costs for corporates and consumers.

The big worry was this would tilt economies into recession. The US economy has shown remarkable resilience, avoiding recession and faring reasonably well overall, albeit with pockets of weakness. In Australia, a similar theme has played out. We have seen an economic slowdown but avoided recession, and the job market has held up better than feared.

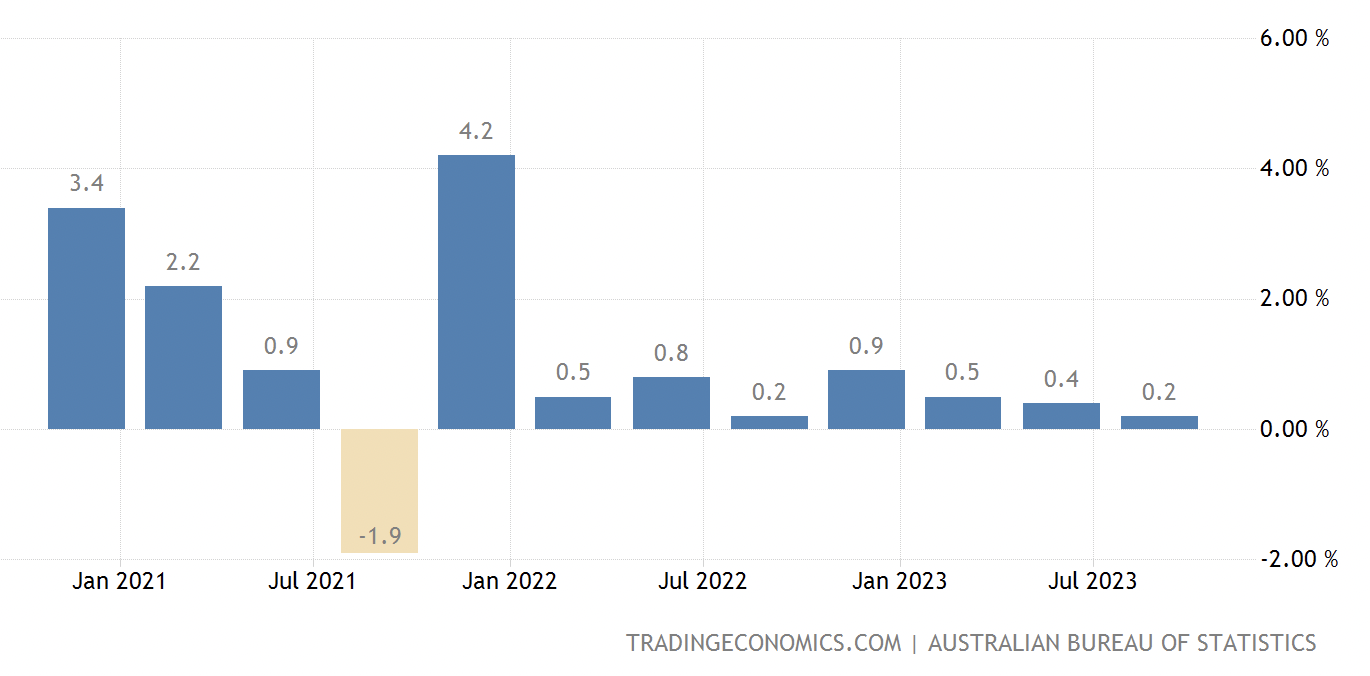

Australian GDP expanded 0.2% QoQ in the September quarter, well below expectations for 0.4% growth and slowing from 2Q23. That marked the slowest expansion in a year as household consumption stalled. Fixed investment grew slower, and net trade was a drag as exports fell for the first time since the March 2022 quarter. We note that migration supported GDP, as on a per capita basis, GDP shrank by 0.5%. Meanwhile, annual GDP growth was 2.1%, ticking up from 2.0% in 2Q23 and above forecasts of 1.8%.

Australia’s GDP change (QoQ)

The slowdown in quarterly GDP growth buoyed stocks as investors believed the RBA would be done with rate hikes and began betting on cuts in late 2024. Local bond yields fell across the curve.

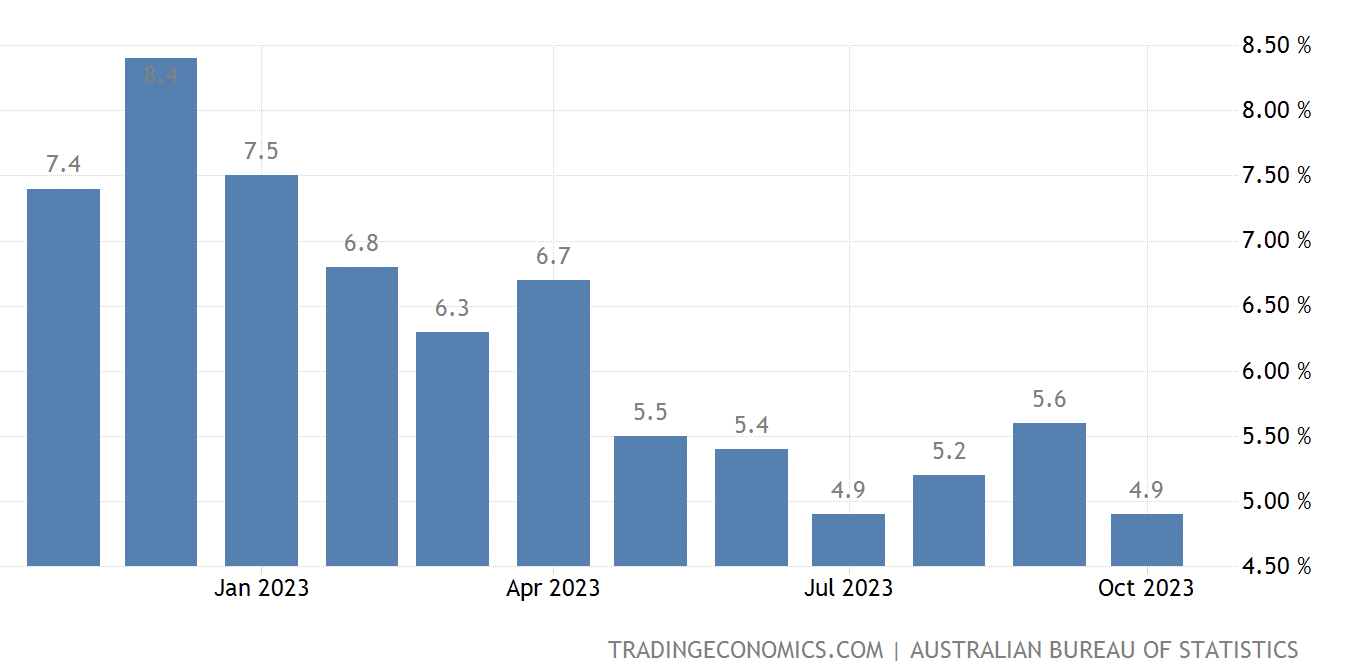

Inflation in Australia has proven stubborn, seeing the RBA respond by lifting the cash rate to its highest level in 12 years, at 4.35%. The last 25bps hike came at the November meeting, following four months of being on pause. As widely expected, the RBA left rates unchanged at the year’s final meeting in early December.

In good news for mortgage holders, the monthly CPI data released by the ABS in late November showed annual inflation eased to 4.9% in October, down nicely from the 5.6% pace in September and well below the 5.2% the market was expecting. This marked a welcome reversal after the annual CPI reaccelerated in August. The cooling was helped by softer increases in transport prices and housing, along with several other categories.

Australian CPI (YoY)

Combined with the slide in retail sales reported earlier that week and the other soft data points we have since seen, the RBA should feel comfortable staying on the side-lines at upcoming meetings. Indeed, traders have increasingly begun laying bets on when the first cuts will come in 2024. We caution against expecting a rapid pivot. We anticipate the RBA to remain data-dependent and that officials will continue to do some tough talking. Inflation remains too high, although the impact from the last rate hike has yet to flow through in the numbers. In addition, a slowdown of immigration should ease demand pressures on the economy, although it may lead to a bout of weakness in the housing market. We suspect inflation levels will likely remain elevated at levels such that the RBA will stay on pause in the first half, likely with rate cuts to be on the table in late 2024.

The recalibration of interest rate path expectations has seen the real estate sector rally over the past two months, given the heavy dependence of the business model on debt and what we viewed as undemanding valuations in many instances. We conclude the year with buy recommendations on Mirvac and National Storage REIT, both of which participated in the rally. The real estate sector has recouped losses from earlier in the year to be 9.4% higher YTD at the time of writing. The sector looks well placed to perform well in 2024. We also have hold recommendations on Scentre Group and Vicinity Centres. These are quality exposures, and Australian consumer spending has held up better than feared. Both companies are improving the asset mix within their portfolios.

Another sector that rallied on the shift in interest rate expectations is technology, the best YTD performer, up more than 28%. Another element that has supported the sector in 2023 is the explosion of AI on investor radars. While AI is nothing new, the emergence of generative AI, spearheaded by ChatGPT, has been a game-changer for interest in the possible commercial potential in the years ahead. This interest drove much of the stellar performance of the Magnificent 7 on Wall Street and has had a ripple effect on Australian-listed stocks, albeit with many having a more adjacent exposure. Still, combined with the change in interest rate expectations, many in the sector have surged. We expect AI to continue to be a popular theme in 2024, although we anticipate investors to be more focused on seeing tangible results rather than hype.

The heavyweight materials sector has benefitted from elevated iron ore prices in 2023. Indeed, these have surprised on the upside significantly despite China’s embattled property sector. Supporting iron ore prices has been a steady stream of supportive rhetoric from Chinese authorities throughout the year, and some firm stimulus has been announced, even if the benefits for the Chinese economy have been muted to date. This price action has supported BHP, Rio Tinto and Fortescue, all of which are recommendations within the research portfolio. The materials sector has gained 9.1% year-to-date.

Gold prices hit a record high of US$2,150 per ounce in early December, although had retreated to around US$2,035 per ounce at the time of writing. The All Ords Gold sub-index has returned approximately 23.4% for the YTD as heavyweight exposures such as Northern Star and Evolution Mining have rallied. We still see significant value in the sector at current levels and retain buy ratings on those two stocks.

The picture elsewhere in the commodities space has been rather bleak overall. Underlying lithium prices have tanked for much of the year as investors fretted the uptake of EVs will slow amid sluggish global economic growth as these are big ticket items. Despite a spate of M&A news flow in the sector, many Australian lithium players, such as Allkem and IGO, have retreated. Nickel has had a brutal year, and copper has fallen, albeit been rangebound in 2H23. Exposures in these areas and some other metals have endured a challenging patch.

Elsewhere, consumer staples -3.9% and utilities -3.9% were two of the three sectors below water, while healthcare +0.3% is barely in the green. Industrials are up around 8.9%, while telcos have added 10.3%. We note this has been without the help of Telstra, though, which has fallen a tad over the past year. For much of the year, the rise in interest rate expectations was a headwind, but Telstra has failed to join the rally over the past couple of months as traders rotated into more cyclical names. The improving backdrop for Telstra’s mobile business continues to underpin our expectation of robust cash flows and dividend prospects.

We provided much traffic light coverage over 2023 and made seven new buy recommendations over the year. When discussing our positive view on uranium, we previously touched on two above – Paladin Energy (PDN) and the Global X Uranium ETF (ATOM). We added business payment solution provider Tyro Payments (TYR) as the company reported a maiden profit, marking an inflection and turning point. Tyro is now generating robust cash flow from its POS electronic payments business. The technical picture is supportive.

Coal miner New Hope Corporation was another new buy recommendation, noting that despite coal prices having corrected sharply from the spike amid the pandemic, they remained elevated. We highlighted the appeal of the Bengalla and New Acland sites producing high-calorific-value (HCV) coal, sought after by utilities, giving better burn results than lower-HCV coal. Meanwhile, the Maxwell mine produces metallurgical (met) coal and commenced operations in the June quarter of 2023.

Graincorp was a recent addition, and we are drawn by the company’s strong market positioning, appealing valuation and our expectation of a favourable price outlook for wheat. Mirvac was our other recommendation. We like fading headwinds on the macro side from interest rate expectations and several company-specific attributes. Mirvac has a stellar track record of consistency and growing dividends, a crucial attractiveness of Mirvac through the cycle. An element we are excited about in the coming years is the opportunity to ramp up residential and benefit from a boom in residential development across the country. This is sorely needed to address the chronic housing shortage.

Signing off for 2023, we would like to thank all Members for their continued support and wish all a safe and happy Christmas and a prosperous New Year.

Best regards,

Fat Prophets

Disclosure: Interests associated with Fat Prophets hold shares in NAB, WBC, ANZ, TLS, GNC, TYR, WHC, PDN, ATOM, NHC, BHP, RIO, WDS, STO, NST, EVN, MGR.