Wall Street sold off sharply on Friday on flaring trade tensions between the US and China. After both nations indicated a willingness to keep trade negotiations on track, the major benchmarks clawed back a chunk of Friday’s losses on Monday. The question is whether the correction continues with earnings season getting underway this week.

Expectations for a strong earnings season will be weighed against valuation, with US stocks now expensive and at the top end of the historical range. On Monday, Treasury futures edged higher (yields down), with the US bond market closed for a public holiday. The US dollar strengthened with most of the major currencies lower, while gold and silver surged to new record highs, topping $4,100, A$6,300 and £3000 an ounce for the first time.

Following the worst selloff in six months, the S&P 500 jumped +1.56% to 6,654, and the Dow Jones added +1.29%. The Nasdaq lifted +2.21% while the Russell 2000 led the benchmarks, notching up a gain of +2.8%. The benchmarks reclaimed a significant portion of Friday’s drop, but the question is whether the recent volatility is the start of a deeper market correction?

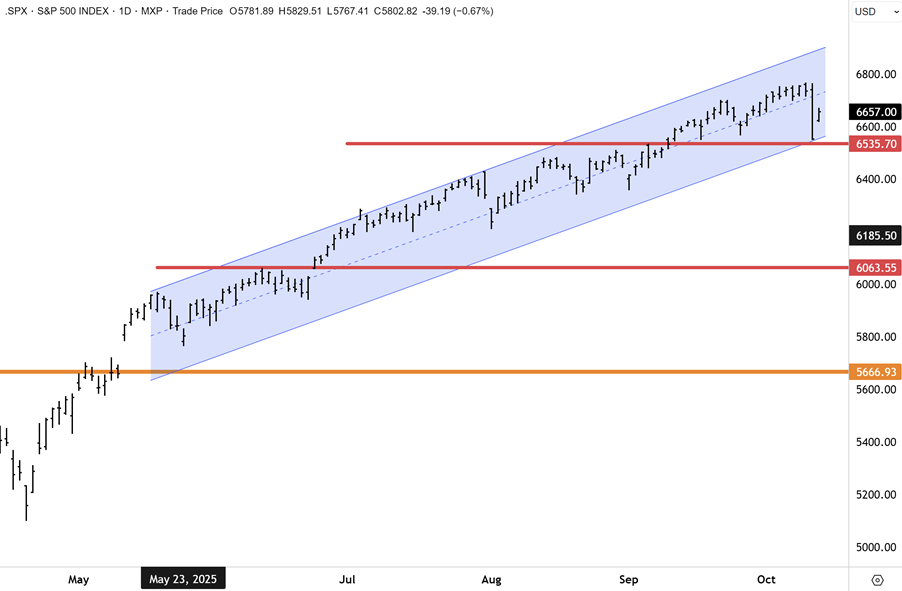

For now, the S&P500 remains mid-point within a trend channel that extends back to the April lows. Provided the SPX holds above 6,500, the technical setup still retains a bullish skew. However, a break below the bottom of the range at 6,500 would raise scope for a broader risk-off move in my view, with the next important support level residing at 6,100. The bottom line is that correction risks are still elevated with more volatility to potentially ensue over the coming weeks.

Much will come down to whether the US and China can get trade negotiations back to the table after DJT threatened to lift tariffs by +100% and Beijing said it would shut off rare earth exports. However, on Monday, the market rebound showed the “buy-the-dip” urge amongst investors as being firmly in place. The upcoming US earnings season is going to be very influential as well, given that expectations are running high.

Trade tensions dialled back after the Trump administration signalled an openness to a deal while China’s Ministry of Commerce urged further negotiations to resolve outstanding issues. Sentiment was also buoyed after Trump visited the Middle East to celebrate a deal halting the war in Gaza and securing the release of prisoners held by Hamas.

Wall Street’s biggest banks will kick earnings season off this week, with analysts generally unanimous for another strong quarter; however, there is more division around how the other S&P 500 names will fare. Having said that, earnings season will likely get off to a good start this week with the banks buoyed by a rebound in trading conditions and underpinned going forward by an easier regulatory environment.

However, Citigroup strategists highlighted recently that the number of analysts upgrading company estimates versus downgrading has turned flat for the first time since August. This has occurred as the S&P 500 has lifted to around 22X forward earnings, which is well above the average over the past decade of nearly 19X. There is not much margin for error.

I am expecting wide dispersion over the coming weeks, where some companies will miss or fail to meet guidance and investors to respond harshly. This outcome has been typical of the reporting season in the US and other markets this year. AI capex and return on investment will also be closely parsed by the market. The bottom line is that the correction could have further to run, particularly given that bases are loaded at the end of the month with the FOMC set to deliver a verdict on whether to cut rates.

On Friday, the VIX surged above 24 to then collapse by 12% on Monday to around 19. This is a sign that volatility is headed higher. While still confined to an established trading range, the underlying trend points to the VIX rising back into the low/mid 20s in the weeks ahead. The good news is that I don’t envision the VIX getting back to levels anytime soon seen during the Liberation day selloff – or last year’s yen carry unwind. This view is in line and consistent with our view that a broader correction in asset markets, if it ensues, will be limited to between 5% and 10%.

The bond market staged a big rally on Friday, with futures pointing to further gains in treasuries tomorrow when the market reopens. On Monday, the bond market was closed for a public holiday. Yield across the curve declined sharply with the US2yr, 10yr and 30yr all falling +10 bps to 3.5%, 4.03% and 4.62%. Fixed income investors continue to see the Fed cutting rates in a fortnight with at least one more cut before year-end. The dollar rallied despite the fall in yields, with major currencies including the euro and yen remaining weak. The dollar index lifted 0.3% to 99.3 – the highest level since early August.

In commodities, gold made new record highs (Read our Gold Sector Report Here), rising +3% above $4,100oz for the first time. Silver surged +4% to $52.75 while platinum added +2% to 1,630oz. Palladium led the PGMs with a gain of +5%. Copper was also strong with Comex futures, adding nearly +5% to $5.12. Copper and PGM miners were all up sharply in the US.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.