The Fed started the rate-cutting cycle with “a bang” on Wednesday, reducing the Fed Funds benchmark by 50 basis points. Chair Jerome Powell cited a “greater confidence” that inflation was moving toward the central bank’s 2% target and a determination to keep the labour market healthy and achieve a soft landing. Clearly, Mr Powell and the Fed want to err on the side of caution with the outsized rate cut and reduce recessionary risks. At the pressor that followed the announcement, Mr Powell said the “central bank’s forecast for the path of interest rates did not imply the need for urgent action.”

The stock market reacted mildly in a clear case of “buy the rumour and sell the fact” with all three indexes drifting lower into the close. Bonds also came for sale while the yield curve continued to steepen. All in all, financial markets appeared not too surprised, with the key question now turning to how much more easing will occur over the remainder of the year. Trouble, meanwhile, seems to be escalating in the Middle East with a growing conflict between Hezbollah and Israel.

The S&P 500 fell 0.29% to 5,618, the Nasdaq Composite was lower by 0.31%, and the Dow Jones fell 0.25%. The Russell 2000 edged higher and closed +0.05% in positive territory. After seven straight up days, a lot of good news was priced in.

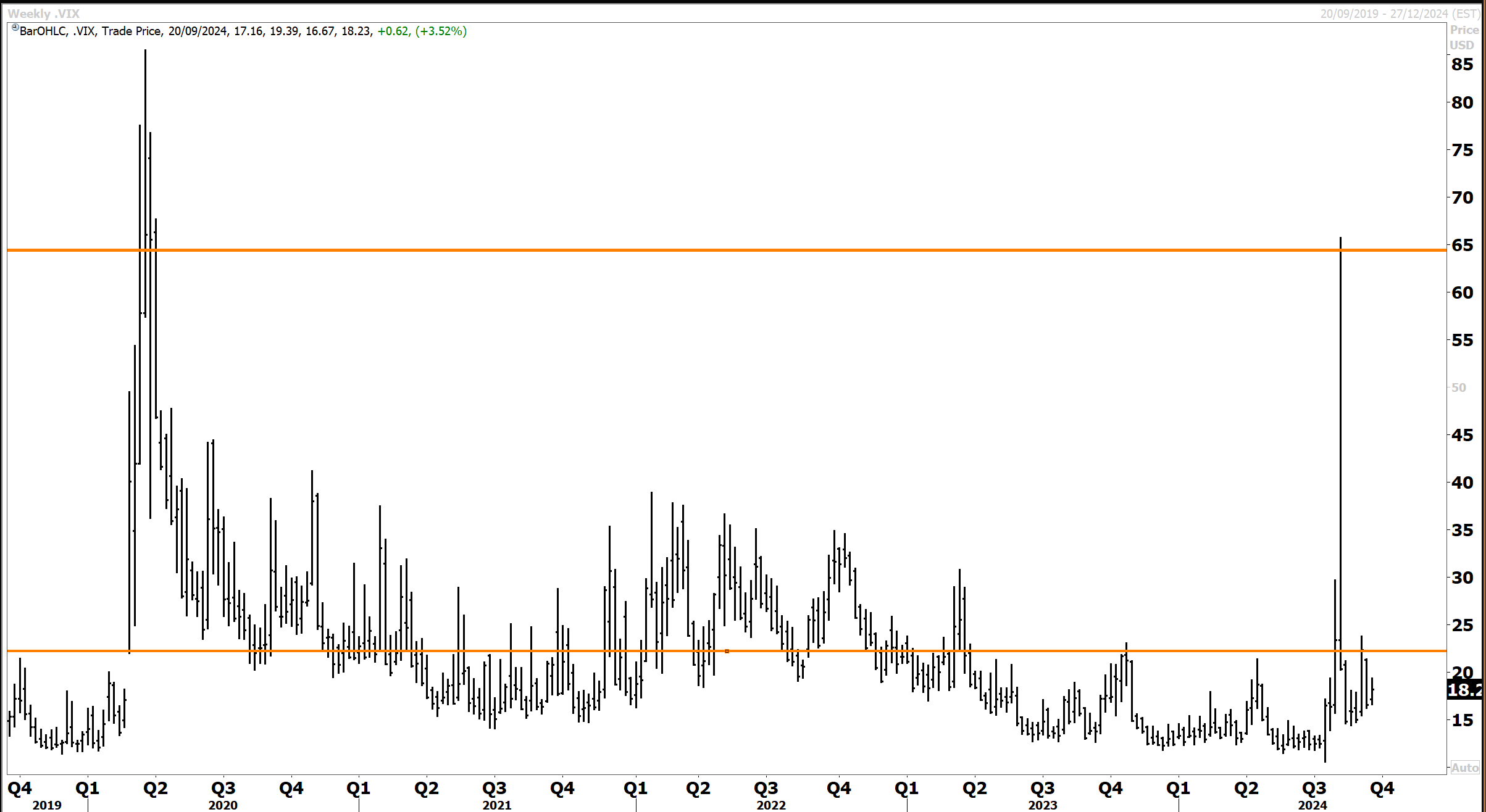

The VIX added 3.5% to 18.5 in a sign that the market is not quite out of the woods yet regarding volatility. The S&P500 rose as much as 1% after the Fed announcement before paring gains and closing lower.

Markets are now pricing in a further 50 bps of cuts by year end, with 25 to come in November and then again in December. The big question is not so much whether the disinflationary trend continues as whether the unemployment rate can remain under 4.5%. The remaining key risk is who gets elected in November.

Don’t fight the Fed.With the Fed now cutting and the economy still quite resilient, the backdrop is supportive of the stock market. Following the intraday reversal the technical setup on the S&P500 skews towards a modest pullback in coming days, but a retest of resistance at the record highs and a breakout once there is more certainty around the election.

Bond yields rose across the curve, with the US 2y and 10yr adding +6 bps to 3.62% and 3.7%. Economist Mohamed El-Erian said “this is not just a 50 basis point cut, this is a dovish 50 basis point cut. My question is what has changed since July,

when they decided not to cut rates, and now there is this very aggressive cut and aggressive signalling.”

Is the Fed worried that trouble is brewing ahead for the US economy? On this front, unemployment data will be the key focal point for the markets. A soft landing is about keeping the US economy growing and the labour market stable. At this stage, most economists don’t foresee anything other than a moderate rise in the unemployment rate.

The US dollar fell on Wednesday despite rising bond yields. Gold and the other PGMs eased, as did commodities, with WTI crude lower by 1%. Copper was steady while the soft ag complex rallied. The DXY touched the 100 level briefly before rebounding later in the day. The rebound rally might have been greater if the Fed had gone with a 25 bp cut.

Whilst technically, the dollar risks a rebound, my base case is for a defining downside break below 100 – with this to occur before year-end. This outcome will likely also coincide with defining breakouts in precious metals, gold and silver miners and upward momentum reasserting in a number of commodities – including copper.

Former JP Morgan head equity strategist Tom Lee said this week the “Fed put” is back, and stock investors may not be fully pricing in the good news. Mr Lee was prominent in calling the big rally last year and argues the Fed could move to further ease monetary policy at any sign of weakness in the stock market.

During an interview, Mr Lee said that “foremost, the Fed ‘put’ is back. That means the Fed’s mandate is now primarily supporting a strong labour market. The Fed wants a healthy economy. A healthy economy, though, hinges on consumer and business confidence, which is largely tied to the stock market. Even if stocks were to see a 10% correction, businesses could become more cautious, and might lay off more workers.”

The labour market will be a key focal point going forward in terms of how the market calculates and assesses recessionary prospects for the US economy. A stable labour market with an unemployment rate below 4.5% will underpin the soft landing narrative. However, one key potential risk is if job losses unexpectedly accelerate. While this is not the base case for most economists, equity markets will remain sensitive to data points on this front.

Don’t fight the Fed. Just as markets were wrong footed in 2022 when the Fed commenced an aggressive tightening cycle after underestimating inflation, equities and risk assets will benefit from rate cuts.

Mr Lee said that a 30% stock decline would “almost guarantee” a recession due to the impact on the job market and household wealth. “We think the Fed does not want the S&P 500 to falter. The Fed in 2022 probably found the 27% decline of stocks as supporting their attempt to control inflation and manage inflation expectations. This is not the case any longer. A supportive central bank is majorly bullish for stocks, but investors probably haven’t priced that in yet. More upside is on the way for equities.”

As we approach October, another month of seasonal volatility, we have likely seen the worst of the selloff that occurred earlier this month and in August. Financial markets still has to navigate the November election, but a lot of the risks around the timing on rate cuts has dissipated. Meanwhile, economic data points to a resilient economy which is a supportive backdrop for equities.

Equities have in the past reacted well to easing cycles. Since 1971, the first Fed cut led to positive returns for investors 100% of the time in the next six months, with an average gain of 13%. According to Mr Lee, three out of five Americans believe the US is already in a downturn. “But there is room for a positive surprise in stocks given that some investors believe the economy is already in a recession. Keep in mind the Fed is dovish and there is a focus on keeping labour markets strong. We could be seeing turbulence for the next 8 weeks, but this is also in the context of a very strong stock market in 2024.”

I think we have seen the worst of the volatility, and while markets could be choppy in the weeks ahead of November, the VIX is unlikely to rise to levels seen last month.

While the Fed’s front-loaded 50 bps cut and associated commentary dominated investor attention on Thursday, there was a side dish of economic data. In August, housing starts jumped 9.6% from July, reaching an annualised rate of 1.35m units. That easily beat market expectations of 1.3m and marked the sharpest increase in nine months, rebounding from a nearly 7% drop in July. Single-family home starts surged 15.8% to 992,000 units, more than offsetting a 6.7% decline in multi-family homes, which fell to 333,000 units. This bodes well for the homebuilders, including the building materials group, James Hardie.

Housing starts rebound

Meanwhile, the average interest rate for 30-year fixed-rate mortgages dropped by 14 basis points to 6.15% last week, hitting its lowest point since September 2022, according to the Mortgage Bankers Association. This marks the seventh consecutive week of declines, totalling a 67-basis point drop. In addition, the average 30-year rate has fallen meaningfully from the 7.9% peak in October 2023. There is still a chronic shortage of housing inventory, and falling rates will see some move from the sidelines. Zillow advanced +3.8%, while D.R. Horton -0.5% and James Hardie -0.2% dipped.

Meanwhile, the average interest rate for 30-year fixed-rate mortgages dropped by 14 basis points to 6.15% last week, hitting its lowest point since September 2022, according to the Mortgage Bankers Association. This marks the seventh consecutive week of declines, totalling a 67-basis point drop. In addition, the average 30-year rate has fallen meaningfully from the 7.9% peak in October 2023. There is still a chronic shortage of housing inventory, and falling rates will see some move from the sidelines. Zillow advanced +3.8%, while D.R. Horton -0.5% and James Hardie -0.2% dipped.

After the Fed’s cut, the ‘sell the news’ attitude saw mega-caps drag on the indices. Declines from Nvidia -1.9%, Microsoft -1%, Amazon -0.2% and Tesla -0.3% outweighed advances from Apple +1.8%, Alphabet +0.3% and Meta +0.3%. Morgan Stanley reiterated their buy rating on Apple while acknowledging that news reports of sluggish iPhone orders could provide a more attractive buying opportunity. MS noted that a multiyear upgrade cycle for iPhones is “when, not an if.” Given the many aged (i.e. three or more years) iPhones in the wild, I concur with this. AI-related features should prompt the earlier adopters.

Corporate news flow was thin on Wednesday, overshadowed by the Fed cut and commentary. US Steel rose +1.5% on reports that a US security panel allowed Nippon Steel to refile its plans to acquire the company for $14.1 billion, likely postponing a decision until after the November presidential election.

Intuitive Machines soared +38% after securing a $5 billion contract with NASA to build “lunar relay systems.” Some competition for Space X, perhaps? Boeing -1% has begun furloughing thousands of workers amid a strike.

Medical Properties Trust dropped -5% after announcing a $430 million impairment in its fiscal third quarter following a settlement with its tenant, Steward, which had filed for Chapter 11. Also in the property space, McGrath RentCorp fell -3% to a new 52-week low after terminating its merger with WillScot Holdings.

US-listed ResMed shares declined more than -5% after Wolfe Research downgraded the stock to underperform, citing slowing revenue growth due to GLP-1 medications. These include a growing number of weight-loss and diabetes drugs like Ozempic. Australian shares are likely to follow suit today. Barclays upgraded a couple of retailers under its coverage, including Victoria’s Secret +3.5% and VF Corporation +4%. The latter is home to brands like Timberland and North Shore.

Gold prices pulled back, dragging on Hecla Mining -3.4%, Coeur Mining -3.2% and other precious metals exposures.

Since breaking out of a primary downtrend, silver producer Coeur Mining has forged ahead to break the next key resistance level at $6.50. The second step above what is now key support at $6.50 is now being established. Further consolidation might ensue in the coming weeks before what we expect to be a defining breakout above the primary downtrend that has dominated since the 2016 highs. A breakout and sustained advance above $7.40 would confirm an important inflection and mark the resumption of upward momentum. The next key price target for Coeur would then be confirmed at the resistance level around the early ‘21 highs of around $11.

Turning to Australia, today we get the key unemployment data, which might confirm a further deterioration in the labour market that will pressure the RBA to put the first cut in by year-end. Consensus expectations are for 20,000 jobs to be added and the unemployment rate to tick up to 4.3%. Anything worse than this will bring the prospects of a rate cut forward. The last RBA meeting is in December, and the first in 2025 is not until February. While RBA governor Michele Bullock is adamant that we won’t see a rate cut this year, I believe this narrative could change quickly. The RBA won’t be able to wait that long, which risks pushing the economy into recession.

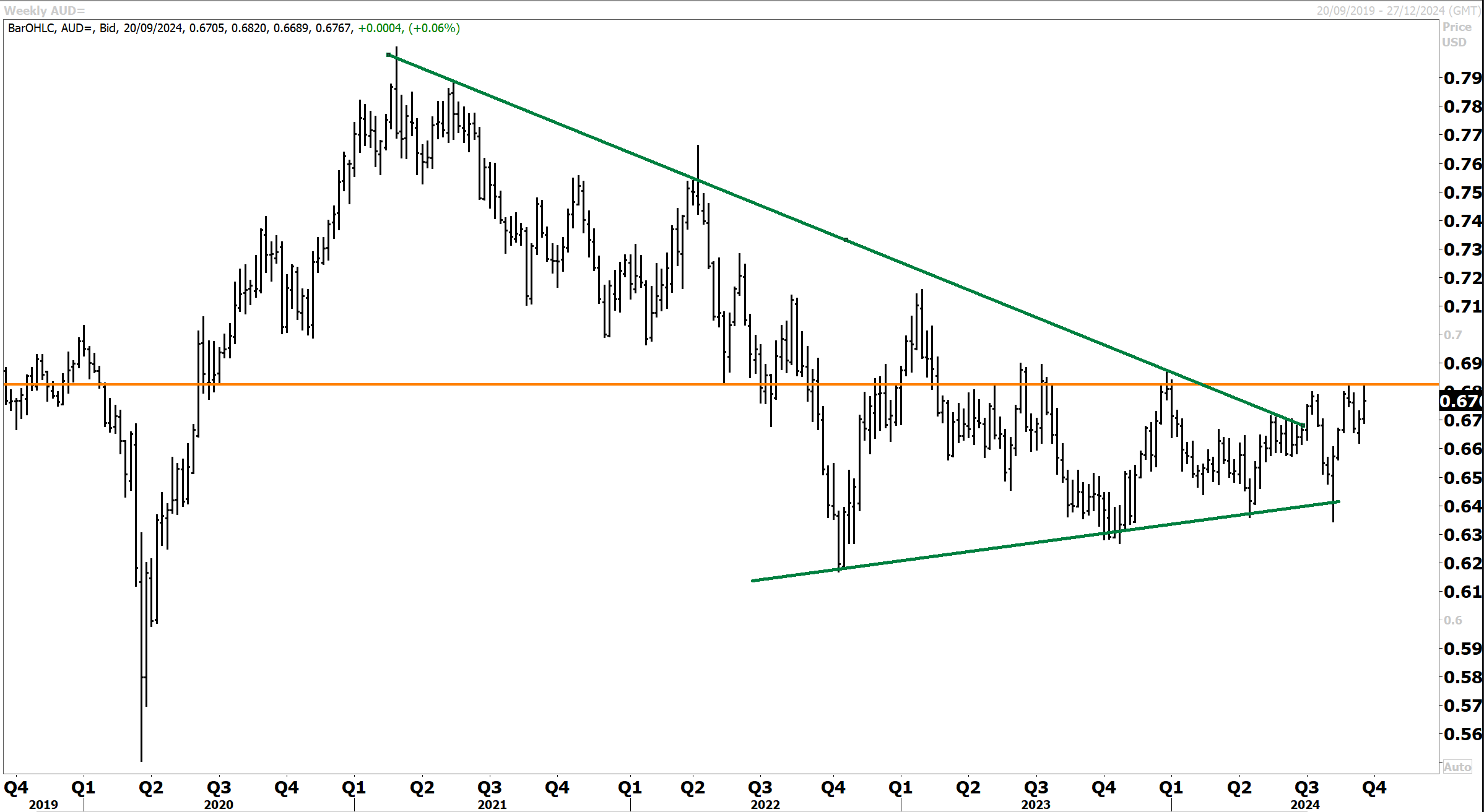

The Australian dollar looks technically poised for a bullish breakout above key resistance at 68c. Since bottoming out in ’22 after hitting highs above 79c, the Australian dollar has consolidated sideways within a range to establish a series of higher reactionary lows. Resistance has been compelling above 68c, but this now looks vulnerable to a topside breakout. If confirmed, the Aussie could recover quickly into the mid70s by next year.

The ASX 200 quickly rebounded from earlier losses yesterday to briefly reach a new record intraday high before settling into a narrow trading range and closing at 8,142. All eyes today are on the key labour market data. SPI futures are pointing to a 0.46% decline on the open.

Energy benefited from higher oil prices due to heightened Middle East tensions. Sector heavyweights Woodside +0.8% and Santos +0.4% posted modest gains. Woodside was supported by inking a new 10-year LNG supply contract with Japan’s JERA. Coal miners had a robust session, with New Hope Corporation gaining +4.6% and Whitehaven Coal climbing +1.4%. New Hope benefited from a broker upgrade after decent results earlier in the week. Deep Yellow logged a solid +2.2% gain in the uranium space, while Paladin Energy +0.1% was quiet.

In the financial sector, NAB led the pack with +1.4% advance, followed by WBC +0.4% and CBA +0.2%, while ANZ dipped -0.2%. Macquarie Group added +0.6%, supported by reports about a potential stake sale in the UK-based tech services firm WaveNet.

Materials came for sale as iron ore prices fell to around the US$90/t level in Singapore trading. BHP and Rio Tinto declined moderately down just -0.9%, while Fortescue edged down -0.3%. I continue to see opportunity with the big, diversified miners bottoming out following a correction from record highs – see notes from earlier this week. Copper-related stocks were under pressure, with Sandfire Resources declining -0.7% and 29Metals lower by -3.8%.

Iron ore looks to be bottoming out near key support at the primary uptrend. The near-term risks an overshoot, but downside momentum should soon dissipate as higher cost producers pare output.

The gold sub-index posted a modest +0.35% advance. Northern Star inched +0.1% higher, Newmont climbed +0.8%, and Evolution Mining rose +0.9%. Northern Star continued to execute well operationally in FY24, setting up for a bumper FY25 due to elevated gold prices.

Since exiting a primary downtrend in early 2023, Evolution Mining has finally broken out above key resistance at $4.20. This followed numerous tests and setbacks, albeit with a series of higher lows traced out over the past 18 months. Given the lengthy consolidation, upward momentum could now return quickly. The scope is now raised for retests of the next big resistance levels at $4.80 and $5.40.

In corporate news, Harvey Norman remained flat after investors shrugged off a class-action lawsuit over the sale of alleged “worthless” extended warranties. ASX-listed shares of Fonterra gained +3% after the New Zealand dairy giant announced its third significant investment in the past few weeks, planning to spend NZ$150 million on a new cool store in Taranaki (New Zealand).

Chalice Mining rallied another +14.6% on the news I reported on Wednesday. The WA government awarded its Gonneville Project in Western Australia strategic project status. The project has a vast asset base of nickel, copper, cobalt, palladium, and platinum. Although Chalice has struggled to convince the market about the viability of its project roadmap, investors have welcomed the WA government’s support.

Austal lifted +4.8% after the earlier announcement about securing a US$450 million contract from General Dynamics that fund an expansion in the US, creating up to 1,000 jobs and help deliver one Columbia-class and two Virginia-class submarines annually.

In our last technical update on March 21st, we highlighted that “Austal remains below the primary downtrend on the 7-year weekly chart below but looks to have traced out a base in recent years with support defined at $1.60. A breakout above resistance at the primary downtrend and follow-through price action above $2.40 would raise scope for a further recovery. A break below key support would be bearish. Technically, Austal continues to be at a crossroads.”

This week’s big upward dynamic marks a potential inflection and turning point for Austal following a multiyear consolidation with a large range. The breakout that occurred this week is potentially redefining, provided Austal can sustain momentum above key resistance at $2.80. Any selloff back into the range would be disappointing and potentially mark another phase of consolidation and ranging. If Austal can hold above $2.80 and establish this as a key support level, an inflection would be confirmed with good prospects of a broader recovery towards the next big resistance level at $3.80.

In Japan, the Nikkei advanced +0.49% to 36,380, while the broader Topix added +0.38%. Gains from exporters supported the benchmarks as the yen weakened. Semiconductor stocks staged a modest rebound to offer additional support, although there was still caution in the air ahead of the Fed decision and commentary.

Government data showed that Japan welcomed a record 2.93 million foreign visitors in August, a 36% year-on-year increase. This surge was primarily driven by the yen’s depreciation, which boosted overseas travellers’ purchasing power. The figure also marks a 16.4% rise compared to August 2019, before the pandemic. August is typically a peak holiday season for Japan, contributing to the substantial numbers.

In late afternoon trading, the yen weakened to the high 141 range against the greenback. The yield on the benchmark 10-year Japanese government bond settled at 0.82%, a marginal decline from Tuesday’s close, as cautious trading persisted ahead of the Fed’s rate decision. Still, most financials advanced alongside the broader market, with Resona Holdings +3.1% and Fukuoka Financial +1.7% among the leaders in the group.

The dollar/Yen has rebounded off key support at Y140, but this now looks vulnerable. The yen soared against the dollar after breaking below the primary uptrend in place for several years. Whilst, in the near term, the dollar/yen could rebound, any rally is likely to be muted and short-lived ahead of what is a probable downside break below the key Y140 support level. This would raise the scope for a deeper pullback towards the next supports at Y136 and Y132 in the year ahead.

Automotive-related stocks accelerated higher, including Hino Motors +3.9%, Mazda +3.6% and Toyota +3.3%. Other exporters, such as THK Co +1.4% and Alps Alpine +1%, participated in the recovery. Chip stocks saw some buy-the-dip activity after earlier losses, with Advantest +1.8% and Sumco +4.4% providing upward support.

London’s equity benchmarks ended underwater on Wednesday as investors absorbed the latest UK inflation data while keeping a wary eye on the Federal Reserve’s upcoming policy announcement. The FTSE 100 closed down by -0.68% at 8,253 points, while the more domestically focused FTSE 250 shed -0.52%. The mood was cautious, as much was riding on the Fed move and commentary.

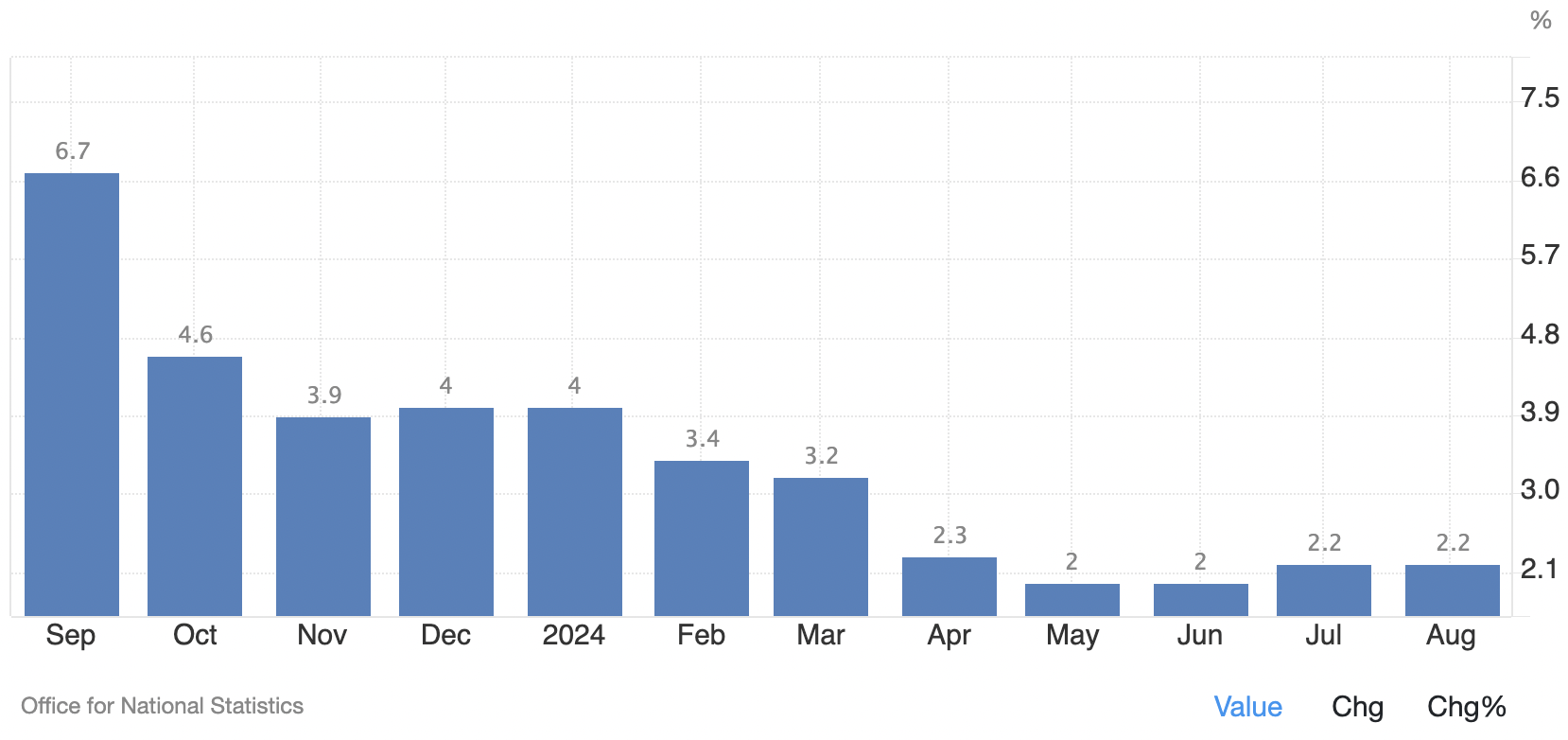

UK inflation remained steady at an annual rate of 2.2% in August, matching market expectations. Airfares, especially to European destinations, saw a significant monthly rise, while falling fuel prices and reduced costs at restaurants and hotels provided some counterbalance. The headline annual rate is narrowly above the Bank of England’s 2% target. Services inflation increased from 5.2% in July to 5.6%. The core annual inflation rate edged up to 3.6%, slightly higher than the expected 3.5%,

Headline annual inflation (YoY) – slightly above the BoE target

Despite the Fed opting to cut with a 50-bps cut, Wednesday’s UK inflation data will likely see the BoE stand pat on interest rates at Thursday’s meeting.

Meanwhile, according to HM Land Registry data, in July, average house prices increased by +0.6% from June and +2.2% year-on-year to an average of £289,000.

On a separate note, industry research firm NIQ reported grocery sales growth had slowed, with total sales at the till up by +4% in the four weeks to September 7, compared to a +5.5% rise in the prior month. Online sales outperformed physical stores, growing by +6.1% versus the +1.8% rise in in-store sales. Fresh food, particularly produce, remained strong, increasing by +8.1%. Within the sector, Ocado led with a +15.4% year-on-year increase in sales, followed by Marks & Spencer at +12.4%. Tesco retained its market leader status, holding a 26.4% market share, while Aldi and Lidl accounted for 10.3% and 7.3%, respectively.

In stock-specific movements, Legal & General fell -2.9% following the announcement of its sale of housebuilder Cala Group for £1.35 billion. The insurer will receive £1.16 billion in cash, with £500 million paid upfront and the remainder spread over five years. PZ Cussons tumbled -15% after reporting a full-year pre-tax loss, primarily due to the devaluation of the Nigerian naira. On the upside, Reckitt Benckiser climbed +1.2% amid reports that it is considering selling its homecare assets, a move that could potentially be valued at over £6 billion. Wizz Air continued its rally, ascending another +2.4% on the earlier news that it expects 15% to 20% passenger growth next year, partly thanks to new low-cost routes to the Middle East.

Across Europe, markets retreated as investors adopted a cautious stance before the Federal Reserve’s policy decision.

Final estimates confirmed Eurozone inflation easing to 2.2% in August, down from 2.6% in July, providing some relief to concerns over price pressures. As this was unchanged from earlier estimates, the data was not market-moving. Meanwhile, construction production in the EU remained stable, showing a modest +0.2% monthly increase in July.

At the close, the pan-European Stoxx 50 was down -0.52%. Germany’s DAX dipped -0.08%, while France’s CAC-40 declined -0.57%. Italy’s FTSE MIB retreated -0.37%, while Spain’s IBEX 35 slipped -0.16%.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters