Budding value emerging amid uncertainty

Shares of Elders have fallen significantly since hitting multi-year highs in the first half of 2022. The correction has been a function of uncertainty about margin pressures on the horizon after strong prior financial performance and then in November, the shares tumbled more than 20% when Elders announced that the well-respected CEO Mark Allison’s planned retirement. We believe the share price correction has been overdone and remain content to hold the stock.

Several areas of uncertainty, including soft commodity price volatility, the quantification of the east coast floods, elevated costs for farmers, and the ongoing search for a successor CEO prevent us from becoming more bullish at this juncture but there are also enough supportive factors to warrant staying on board.

While we have enormous respect for Mr Allison and how he has steered the business during his tenure, delivering impressive value for shareholders, we believe the more than 20% dive in the stock last November when his retirement was announced was excessive and Elders stock has drifted a smidgen lower since. Mr Allison will retire on or before November 14, 2023, and Elders has plenty of time to find the right successor, with the company currently undertaking a national and international search. Both internal and external candidates will be considered.

The next person to fill the role will inherit a business in a strong position. Under Mr Allison the balance sheet has been repaired, operations refocused (prior to the GFC the company had become a sprawling conglomerate in disparate areas), and the business expanded and firmly diversified. A culture of strong financial discipline and focus on return on investment (ROI) are embedded in the company. The business should be able to continue thriving given the quality and depth of management in place and a capable replacement found to take the helm.

In December Elders acquired a 11.95% stake in New Zealand Agricultural firm PGG Wrightson, in line with its diversification strategy, this time largely on a geographic basis. The shareholding was acquired by private sale from a Chinese firm for a total investment of approximately NZ$37.1 million (A$35.2 million), funded by existing debt facilities. Elders said at the time it did “not currently intend to initiate a proposal to acquire control” of PGG Wrightson, although we suspect this would be on the agenda under the right circumstances.

Elders has significantly diversified the business over the past five years through acquisition, which has paid off for shareholders. A notable transaction was the 2019 deal to buy Australian Independent Rural Retailers, among others. In FY22, Elders made 13 bolt-on purchases over the reporting period for a total investment of $28.6m, with the real estate arm expanding into residential property sales.

The strategy has created a somewhat smoother earnings profile, although being in the agricultural space there will always be significant volatility. Nevertheless, after the stock price correction Elders is trading at an undemanding valuation below the industry average, despite what we view as one of the best businesses in the industry. The business has a solid reputation with customers, maintaining its position as rural Australia’s most trusted agribusiness by farmers according to Roy Morgan brand trust research and Elders has been gaining market share.

The outlook for the broader agribusiness sector is somewhat cloudy in 2023 but Australian producers will mostly have had a very strong 2022, bolstering their balance sheets. Many soft commodity prices have already corrected sharply from earlier highs and the picture is mixed across the spectrum (i.e., cattle markets have seen a sharp decline, while this season’s wheat harvest should be at record levels according to ABARES, despite the floods across parts of eastern Australia) but overall prices remain well above pre-pandemic levels and should remain so through 2023, although headwinds are gathering in several sectors. Strong production is forecast in the first half, although the heavy rainfall and floods in eastern Australia will hit cropping, wool, and horticultural sectors.

Elders enters calendar 2023 after delivering strong results for FY22 and lifting the final dividend by 27%, taking the total dividend to 56 cents (30% franked), up from 42 cents (20% franked) in FY21. Financial performance strengthened across the board geographically and in product areas, with a bumper result from Rural Products. To recap, sales surged 35% to a record $3.44 billion and underlying EBIT increased 39% to $232.1 million.

Source: Elders

AgChem, Agency Services and Wholesale Products were responsible for 25.6%, 22.5% and 11.2% of group gross margin respectively. Still, as can be seen in the graphic below Elders has evolved into a well-diversified business and all areas delivered improvement last year, with the company continuing to make strides under its 8-point plan, although favourable conditions of course played a key role.[subscribe_to_unlock_form]

Source: Elders

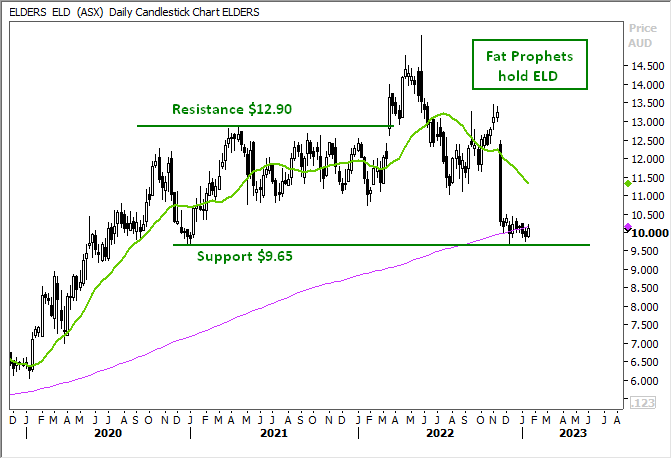

Moving onto the technical picture and the Daily chart of Elders indicates price is trading around the 200-day moving average and above the Daily $9.65 support level. Overall, the price remains within a large consolidation area with $9.80 as support and $14.50 as resistance.

The Monthly view of ELD shows the stock remains with a broad primary UP trend, with the current retest towards the historical resistance level proving to be support. The long-term up-trend line remains in place as the price moves below the 12-month moving average.

Summary

Margin pressures will likely rise throughout 2023 but we believe the share price correction has already priced in these pressures and significant uncertainty. Elders has evolved into a stronger, more diversified business, with a repaired balance sheet and good operational execution. Elders is trading at an undemanding valuation below the industry average, despite what we view as one of the best businesses in the industry. The business has a solid reputation with customers and has been gaining market share.

Elders will remain held in the Fat Prophets portfolio.

Disclosure: Interests associated with Fat Prophets hold shares in Elders

[/subscribe_to_unlock_form]Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.