Pineapple on the Pizza

On the release of 1H23 results Domino’s Pizza’s share price has declined sharply. We digest the results and review our recommendation.

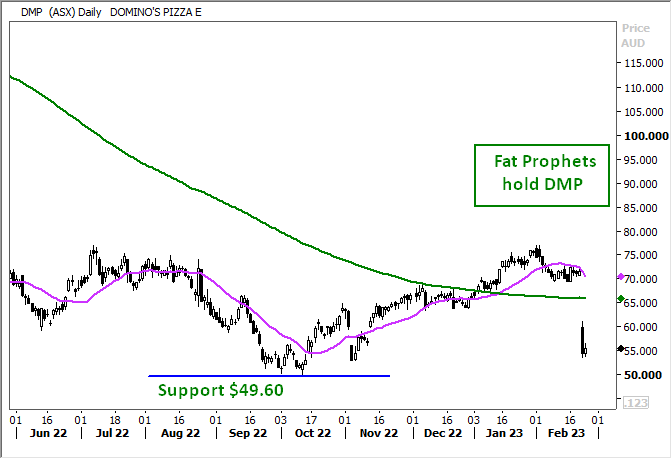

The Daily view of DMP highlights the breakaway gap towards the major support level of $49.60, current price movements remain within the multi month consolidation range between $49.60 and $75.0.

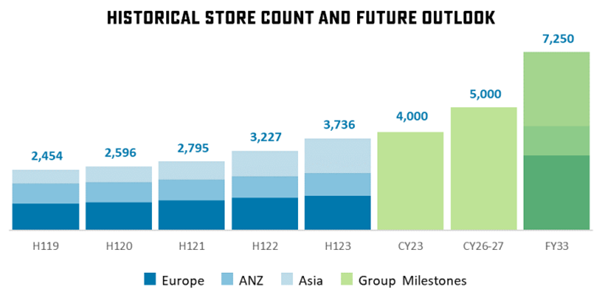

From the beginning when Domino’s pioneered the phone app for ordering pizza they have remained on a consistent expansionary mission to increase store fronts across the globe. Late 2022 Fat Prophets FAT-AUS-1100 reported Domino’s were conducting a A$150m capital raise to buy out the remainder of Domino’s Pizza Germany. The company maintains a 10 year outlook for over 7000 store fronts by 2033. Current projections include over 3000 extra stores or over two times the current market size in Europe and 3000 stores throughout Asia again over two times the current market size.

Source Domino’s

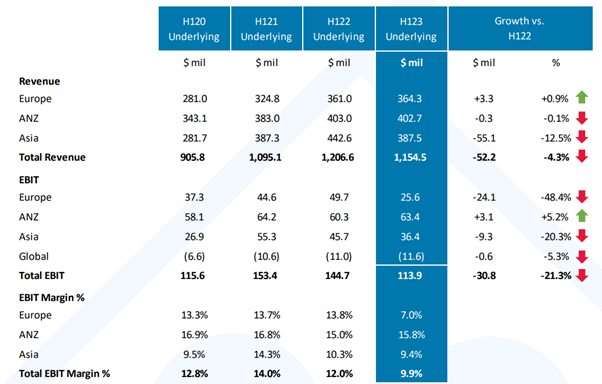

Domino’s 1H-23 revenues in the Euro region have increased 0.9% against the other Australian New Zealand segment -0.1% and the Asia segment revenues declining -12.5% , resulting in an overall 4.3% total revenue decline.

Source Domino’s

Source Domino’s

The overall performance is being impacted by the surge in inflationary pressures particularly in Germany with the latest YoY inflation reading accelerated to 8.7%, with central banks responding by lifting interest rates, the cost pressure on business and the consumer is beginning to take its toll.

Although network sales came in 1.3% higher [subscribe_to_unlock_form] the reduced customer counts has resulted in decreased food volumes leading to higher costs managing inventory.

As a result the company has passed on higher delivery and food production costs with the outcome a reduction in Domino’s customer counts, and a significant move to store pick up against using the delivery service, management have stated this has not met expectations with the decline including online sales of A$1.52b also -4.5% against 1H-22. Same store sales declined an average -0.6% primarily attributable to lower performance in the Japanese market, sales revenue from Japan also being impacted by the 12.6% weaker Yen v’s the AUD.

Net Debt increases by $95.8m vs. FY22, as a result of the Malaysia and Singapore acquisitions and dividend payment, partly offset by $163.2m net capital raising.

Current net debt is A$666.5m resulting in a Net leverage ratio of 2.1% remaining well within the company’s banking covenant. In addition, Domino’s completed a Capital raising of $163.2m net, during H123, to be used primarily to fund the acquisition of remaining shares held by Domino’s Pizza Group plc in the German joint venture this is forecast to complete 2H-23. The earlier capital raising also in part funded the Malaysia and Singapore acquisitions for A$10.1m.

Looking at the Asia segment sales increased 3%, the newly acquired markets in Malaysia and Singapore are performing at expectations, with Management intending to apply high volume marketing mentality to store operations.

Within the Australian New Zealand network sales came in marginally lower by 0.3% to A$687.3m. Going into 2H -23 the company has stated commodity and labour increases are anticipated going out to FY-24 with the focus on short-term energy prices.

The Monthly view of DMP indicates the current price decline has moved back to test the long term up trend line, current price has moved below the 12 month moving average, currently the stock remains with a primary up trend.

In the current economic cycle management remain confident the strategy of building improved performance through marketing to increase customer counts and sales is sound.

We hold the view fast food sales will remain a staple in the global diet and make the point the industry as a whole will be working through this current inflationary cycle. Currently the company is moving prices higher and expanding offerings to maintain customer numbers.

We maintain our Hold recommendation for Members with exposure. Domino’s will remain in the Fat Prophets portfolio.[/subscribe_to_unlock_form]

Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.