TWE Snapshot

A good vintage

The premiumization trend has been underway for quite a while now and even as a cost-of-living squeeze unfolds for many in Australia and around the world, the results from premium and luxury brands we have seen around the world in recent weeks/months, along with experience in past cycles provide us with some confidence that management expectations at Treasury Wine Estates for resilient demand at the higher-end are justified. The shares have performed robustly year-to-date even amid broader market turmoil and momentum is on the company’s side.

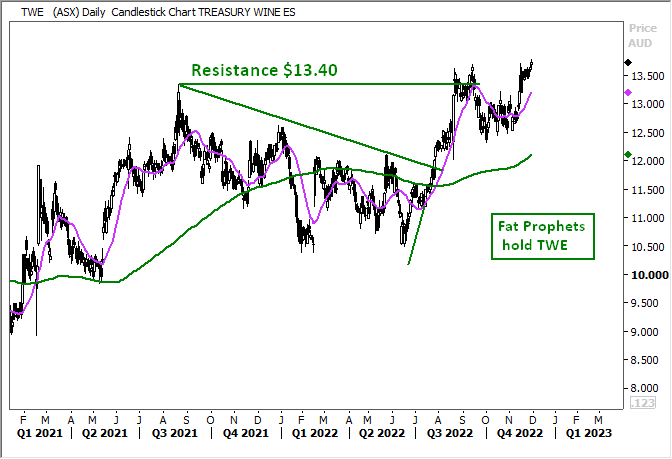

The Daily view to TWE shows the recent price decline below the $13.40 resistance level back into the 20 period moving average. The current price movements remain above the 20 period moving average and above the 200 day moving average.

Another trend unfolding in the wine and broader alcohol industry is for many consumers seeking lower-alcohol, and no-alcohol options. Treasury Wine is growing its product offerings here, including the likes of Matua Lighter, a lower-alcohol version of the Squealing Pig brand and a no-alcohol offering from Wolf Blass, named Wolf Blass Zero. The younger age group is leading the charge in demand for products along these lines and Treasury Wine has invested significantly here and its scale will help with innovation and distribution.

The recent (albeit brief) first-quarter trading update provided by the company was relatively upbeat, with trading conditions and EBIT across the group in line with company expectations and the market reaction was positive. The address from CEO Tim Ford noted, “Demand for Premium and Luxury wine has remained consistent across all of our key markets throughout the first quarter, reflecting ongoing category premiumisation trends. We will continue to closely monitor the consumer and trading environment, confident that the strengths of our brand portfolios, the historic resilience of the category through past economic downturns and the flexibility of our business model leaves us well placed to react to any changes that may arise.”

Management went on to note that the inflation and cost outlook was unchanged from the view outlined along with FY22 results provided in August. Positively, northern hemisphere vintages, including in key regions California and France, were progressing in line with company expectations.

Accordingly, Treasury reiterated being on track to deliver “strong growth and EBITS margin expansion” towards the long-term Group target of 25%. FY23 priorities are summarized in the slide from the company’s AGM below:

Source: TWE

We viewed the $434 million acquisition of Frank Family Vineyards in Napa Velley, California as attractive from both a financial and strategic perspective. The acquisition brings with it one of the biggest luxury chardonnay brands in America, slotting nicely into the company’s portfolio of brands.

We have been satisfied with [subscribe_to_unlock_form] the progress under CEO Tim Ford and improving performance in the American market, long an Achilles heel for Treasury, is part of our investment thesis for the stock. The above acquisition will help with the transition to improving margins by tilting the portfolio towards premium offerings – the Americas business has exited lower-end commercial wines. There remains work to do on improving logistics and distribution channels and time will tell whether management changes are the right team for the job. We are encouraged by the progress we have seen. One of the company’s newer brands, 19 Crimes, was reportedly recognized as the number 1 US market wine innovation for Martha’s Chard in the 2022 calendar year. The brand has a high-profile celebrity relationship with Snoop Dogg.

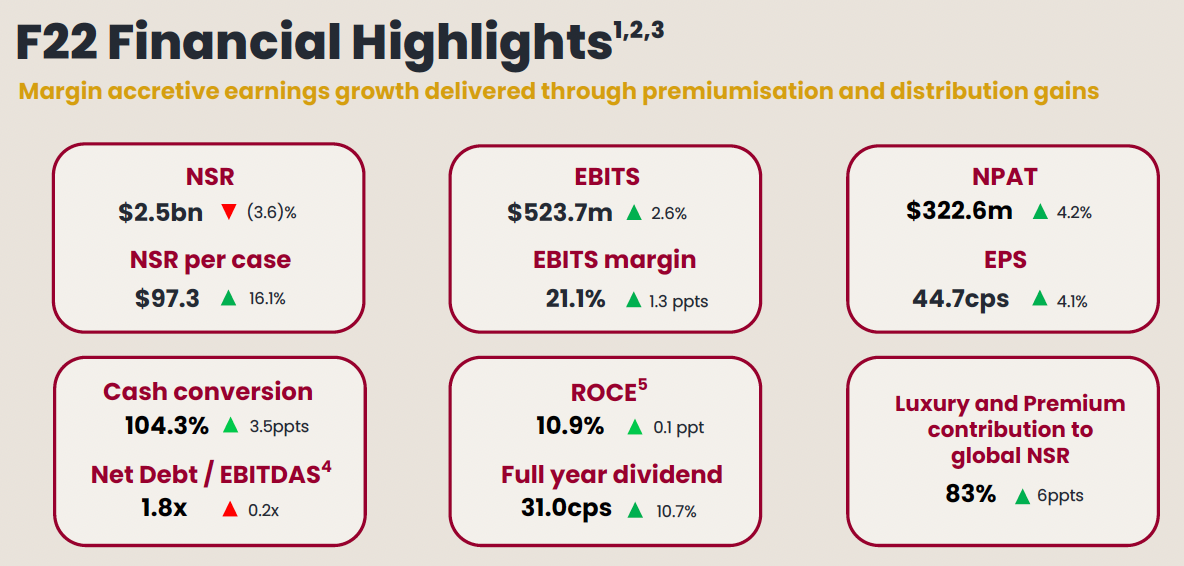

The Treasury Americas segment increased net sales revenue (NSR) 2.5% to $963.4 million in FY22, with EBITS surging 20.5% to $185.6 million, as the EBITS margin expanded 2.9 percentage points to 19.3%. Bolstering this further will assist the company with its 25% group EBIT target. To recap, group EBITS edged 2.6% higher to $523.7 million, even as net sales revenue decreased, driven by a 1.3 percentage point improvement in the EBITS margin to 21.1%. EPS was 4.1% higher at 44.7 cents and the full-year dividend was 10.7% higher at 31.0 cents per share.

Source: TWE

Another plank of our investment thesis is the scope for the China market to eventually return to becoming a solid contributor after the business was devasted by the sky-high margins (+175%) imposed by Beijing. Treasury Wine has been working to fill that gap by steadily diverting sales to other regions, including the likes of Singapore, Thailand and Malaysia. The company has been successful in this regard, reducing reliance on China and improving the overall quality of the business but should some of that business return in the future that would be a positive.

We see some scope for a thawing of relations between Canberra and Beijing going forward, with the meeting between the leaders of the two countries in Bali encouraging. We view this as a call option, but certainly not part of our core thesis for the short-term. Instead, TWE is looking to sell the new Chinese-made Penfolds, retailing at about $50 a bottle.

The monthly view of the TWE price chart indicates a new breakout above the $13.40 resistance level. Currently, price movement remains above the 12-month moving average as the Primary up trend resumes.

Summary

The strategic pivot at Treasury Wine Estates is progressing solidly and the premium and luxury sector is well-placed to be resilient during the economic downturn beginning. The company’s brand portfolio is well placed here, ranging from ‘affordable luxury’ treats like a $20 plus bottle of wine all the way up to the $1,000 Penfolds at the high end. The premiumization at the company continues, with the Napa Valley acquisition slotting in nicely. Momentum is on the company’s side and the shares have been robust performers amid broader market volatility.

We recommend Treasury Wine Estates as a buy to Members without exposure.

[/subscribe_to_unlock_form]Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.