Another Record Set!

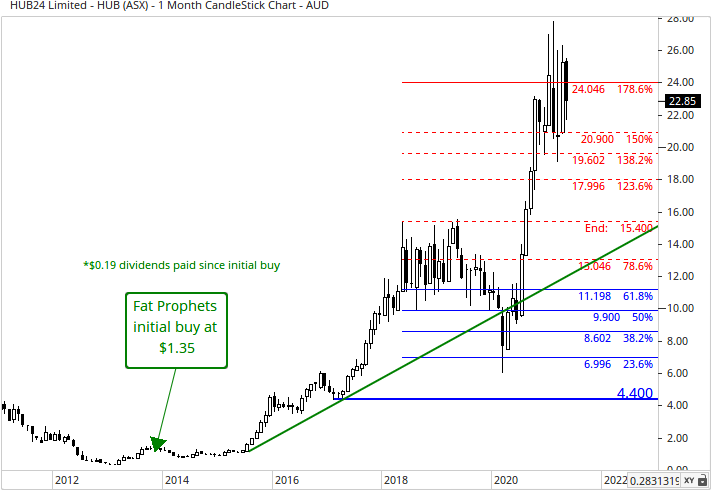

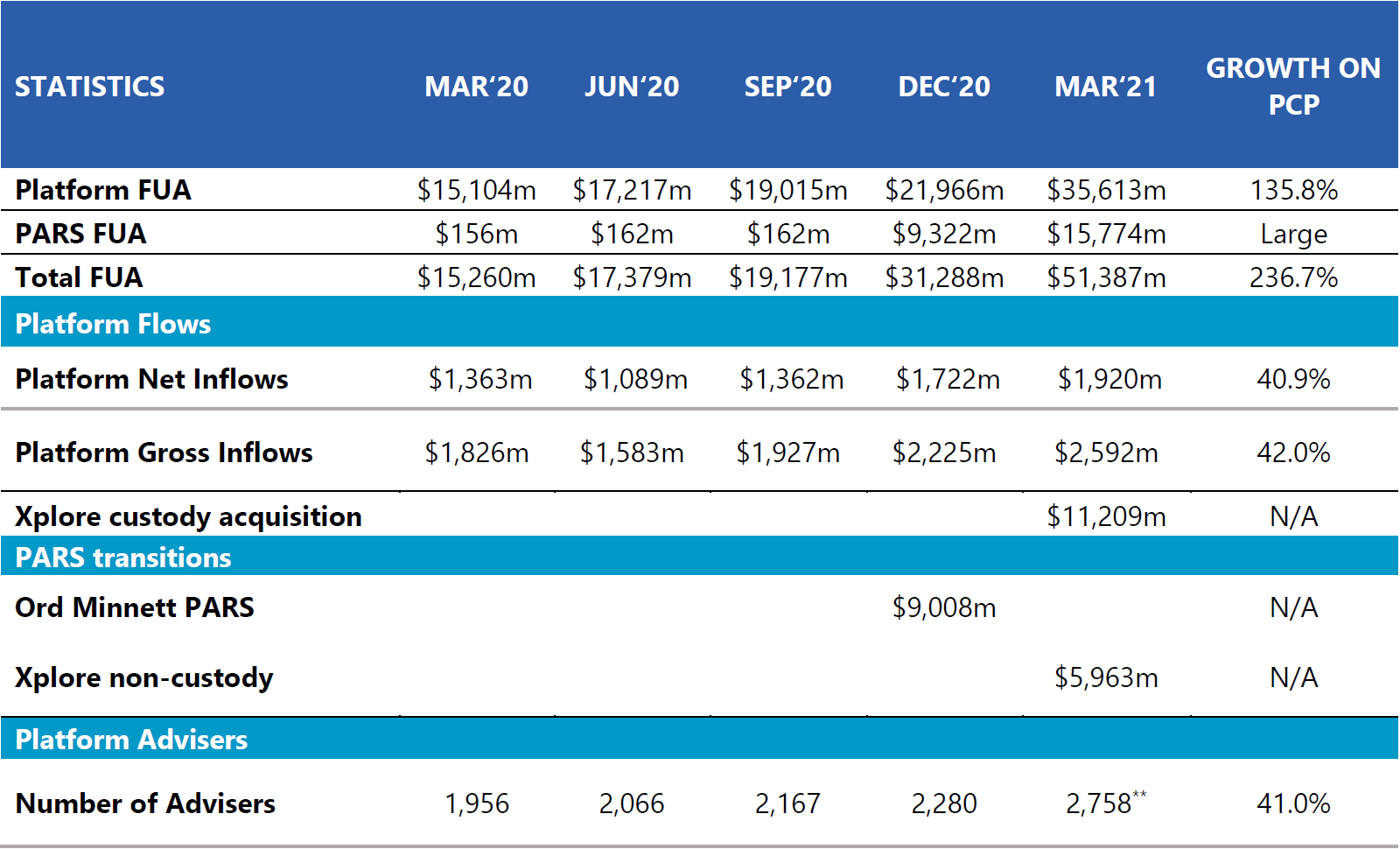

Financial services platform, HUB24 (ASX.HUB) has done it again having broke another record with the latest quarter report highlighting an impressive run with Funds Under Administration making a massive year-on-year surge. Today, we take a look at how it has tracked since the last quarterly update as well as some key business deals.

What’s new?

At the end of March (FAT-AUS-1014), we covered some concerning developments for HUB24 as one of its rivals, Netwealth (and biggest listed player in the sector), are in negotiations with ANZ regarding its deposit arrangements which are set to be terminated in 12 months. There are expectations that the terms would shift from the 95 basis points above the T overnight cash rate to potentially lower (~40bps) levels – terms not as favourable for the sector and could pressure margins.

With that development, there could be the possibility that a similar development or worse for HUB24. At this point, however, there hasn’t been much in the way of news and we will continue to monitor developments as this does have a tremendous impact on the company’s topline.

Since then, there have been two key updates for HUB, the (i) first is the company issuing its third quarter (3Q21) report which we review below. The next one (ii) the deal with ClearView Wealth. The latter update has HUB24 completed the wrap platform development and bulk transition. This transition entails the transfer of $1.4 billion in Funds Under Administration (FUA) to HUB24’s private label solutions.

Last year, Clearview’s WealthSolutions2 white label for investor directed portfolio service and Super was launched onto HUB24’s network and has since reached 14 managed portfolios available to financial advisors. This is a key win for HUB24 and shows the strengths of its strategy from building up organic and acquisition-based approaches to grow FUA.

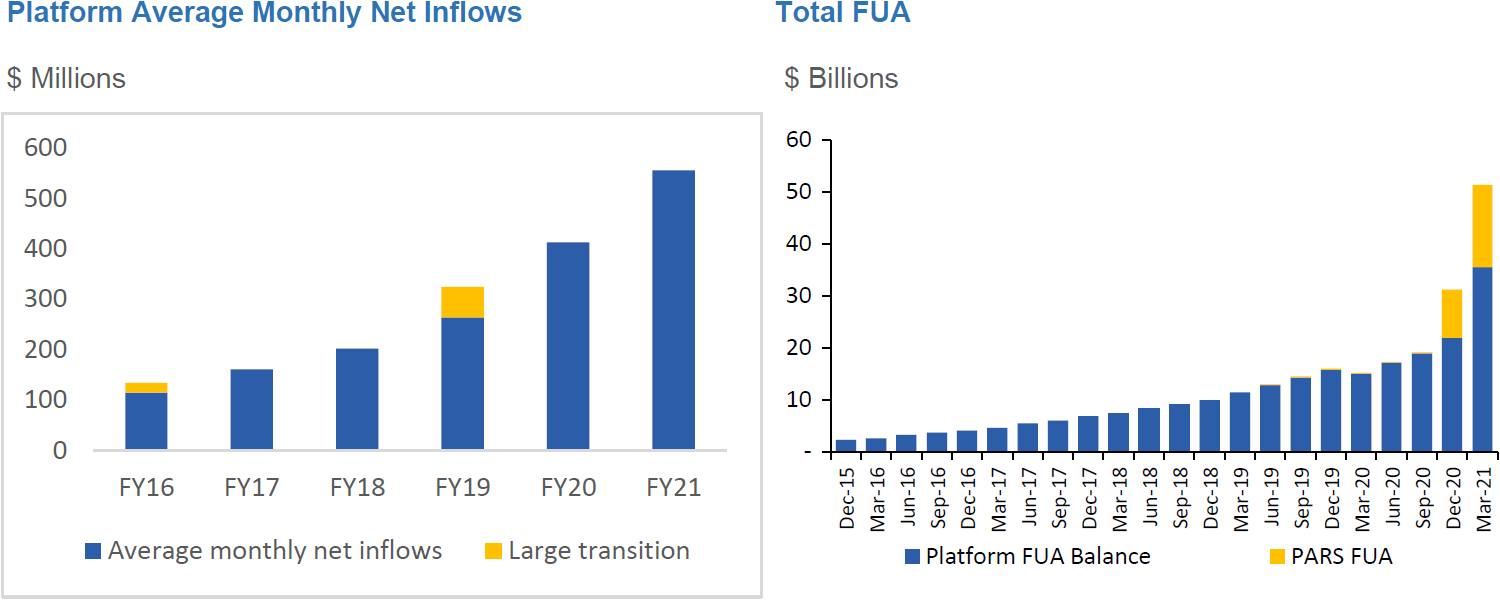

On that note, let’s see how management has expanded the group’s scale in the latest report:

Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.