Twenty years in the making

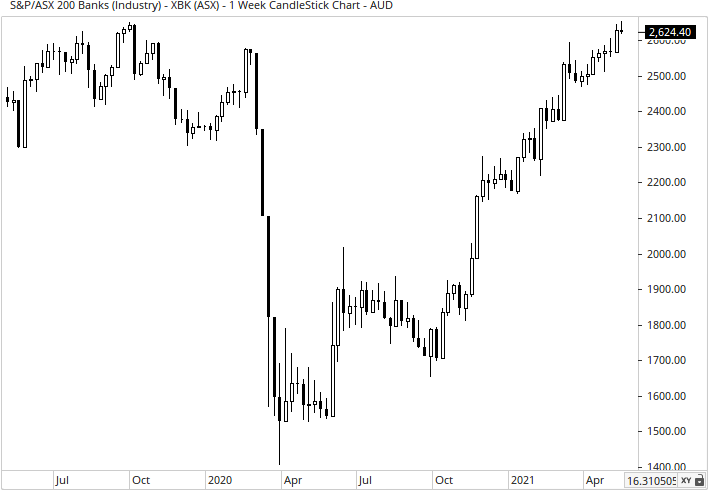

Global equities mostly advanced further in the first quarter of 2021, marking the fourth straight quarter. The gains came on the back an accelerating vaccine rollout, a strong outlook for a global economic rebound this year and continued accommodative measures from governments and central banks. Most of the pain was felt in the bond market, with yields rising on the rapid vaccine rollout in the US and UK and expectations of further US stimulus, which was forthcoming. Australian shares edged up in the first quarter and have since pushed higher to a new record high on Monday (yesterday), driven by the twin engines of banks and resources – more on that later.

US President Biden signed into a law a massive $1.9 trillion relief bill, keeping money flowing through the economy. Not to be left out, the European Parliament approved a €672.5 billion Recovery and Resilience Facility to provide grants and loans to help EU countries mitigate the impact of the coronavirus pandemic. In Australia, where the pandemic was contained much better than in most countries, stimulus is set to wind down in 2021 as the economy has rebounded strongly. Australian equities edged higher in the first quarter

Massive stimulus, significant pent-up savings and supply-chain disruptions though have combined to prompt inflationary fears around the globe. Although the most closely followed surveys in major economies have only shown inflation reaching modest levels to date purchasing manager indexes and commentary from a raft of companies implies we are on the cusp of a period of higher inflation. Whether this will be transitory as some suggest (with the Fed being a key player maintaining that view), or not remains to be seen.

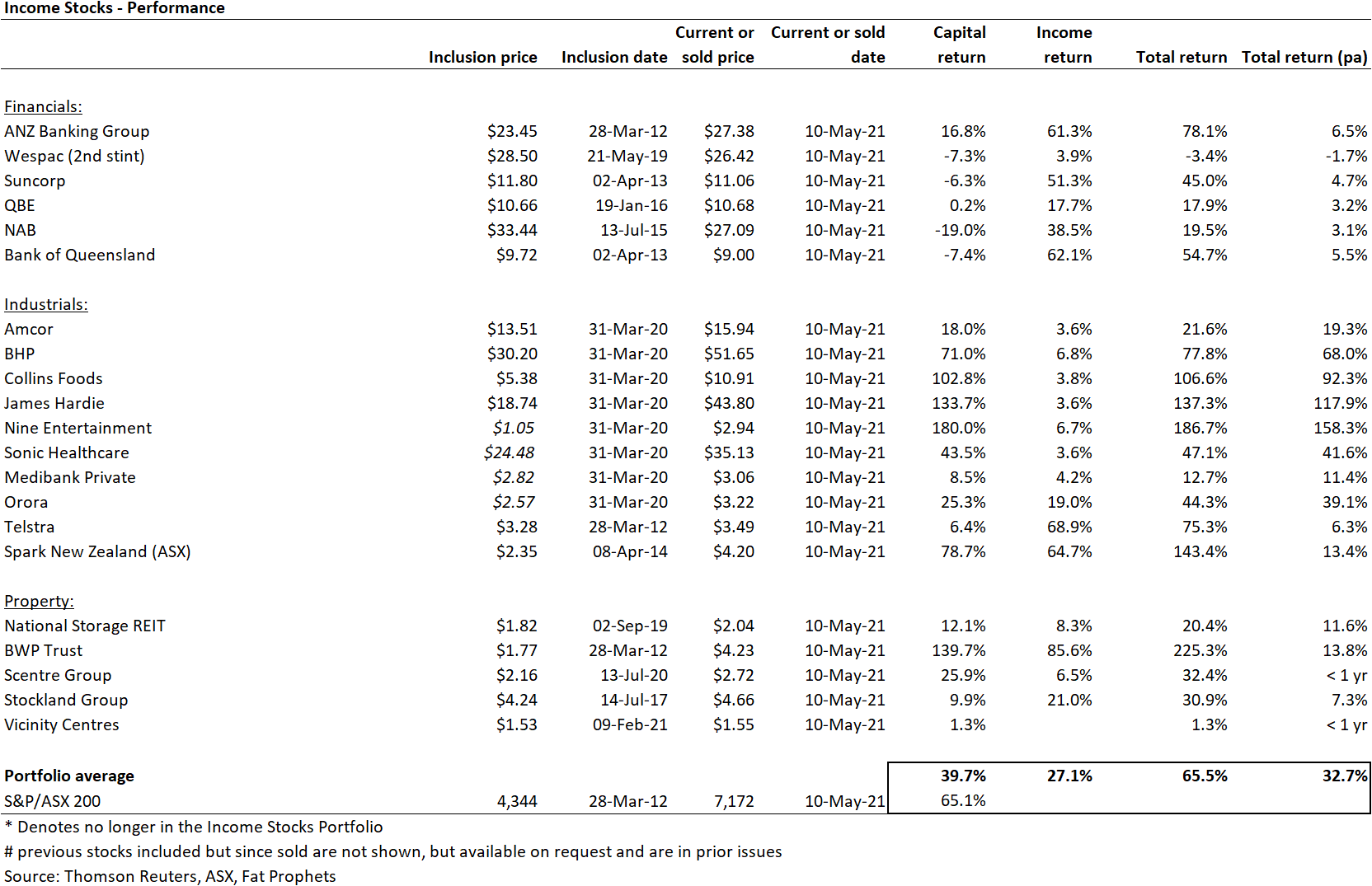

Now in May, we have seen most companies around the world post better-than-expected first quarter results. In the US reporting season, Refinitiv estimates S&P500 first quarter earnings to date are up 50% year-on-year, marking the highest growth rate since the first quarter of 2010. Companies are bouncing back stronger than anticipated, not only in the US and but in many locales, including in Australia. Country and regional GDP forecasts have been revised upwards.

At the US Fed’s meeting in April, easy monetary policy was maintained, and the central bank signalled it isn’t in a rush to change that. Last Friday’s disappointing non-farm payrolls report dampened expectations of any hikes in interest rates sooner than the market was expecting. The US economy expanded at an annualized 6.4% pace in the first quarter of 2021 according to an advance estimate and that followed on the heels of 4.3% growth in 4Q20. The 1Q21 increase was the biggest first quarter growth rate since 1984. For the year, economists polled by Reuters estimate US growth could top 7% this year, which would also be the fastest since 1984 and follows on the heels of the 3.5% contraction in 2020, the worst performance in 74 years. This is important for the global economy and hence Australia and stock markets.

Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.