A bumper start

Agribusiness, Elders (ASX.ELD) has seen its shares continue to climb and virtually deflecting the headwinds caused by COVID-19. The fact that people still need to eat despite being holed up in their homes due to the pandemic has been a boon for Elders along with its peers but improving weather conditions and a bumper season gave the sector a solid boost. Today, we take a look at the latest round of results and update our view.

What’s new?

The last time we checked in on the agribusiness giant was back in November (FAT-AUS-996) where we saw the company report an solid performance at the end of fiscal 2020 unscathed from the COVID-19 pandemic. The pandemic has been one of the most disruptive events in recent history with many businesses across sectors suffering, with agriculture seemingly one of the exceptions. This is evidenced by Elders sending the year with an impressive 29% surge in revenues and underlying earnings per share surging 35% year-on-year.

Since then, the company has issued another round of results which we review today to see how it has measured up since. Prior to that, we want to highlight some key expectations for the sector which was based on the March 2021 release of the Australian Bureau of Agricultural and Resource Economics and Sciences noting that they expect 2020-21 season to be the “second most profitable season ever for Australian farmers.” It seems that the drought that has affected the sector in recent history has subsided with better conditions and higher than average rainfall pushing expected cash incomes up 18% – and that’s for the average farmer.

With such a bullish outlook, we now take a look at Elders to see if it’s up to compete:

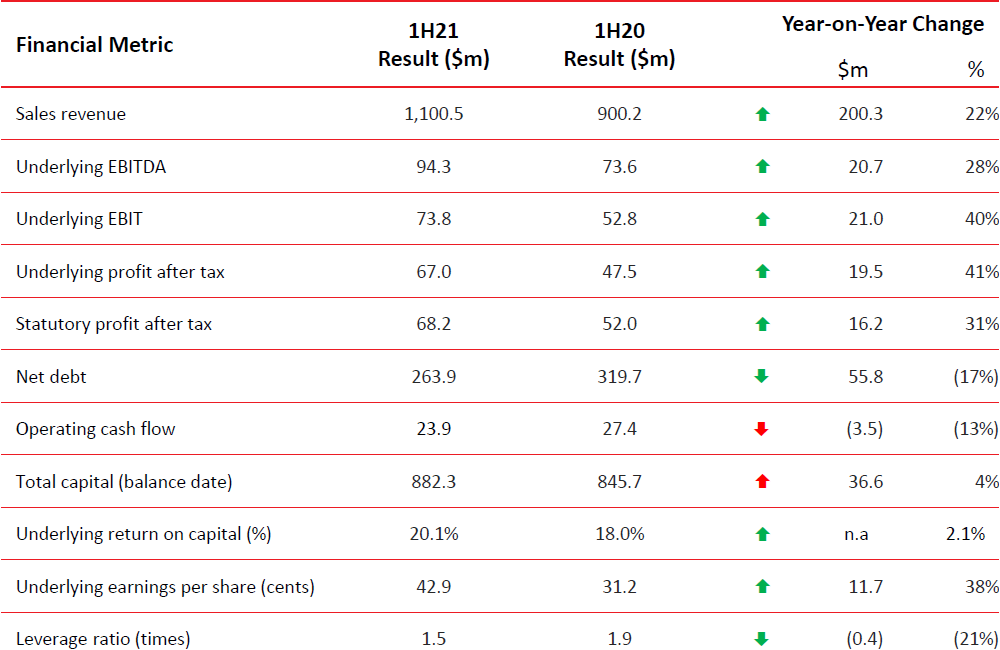

1H21 Results Overview

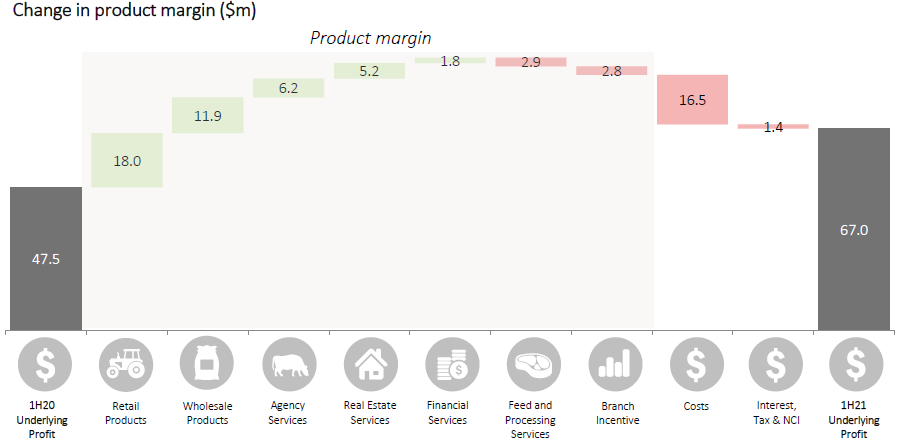

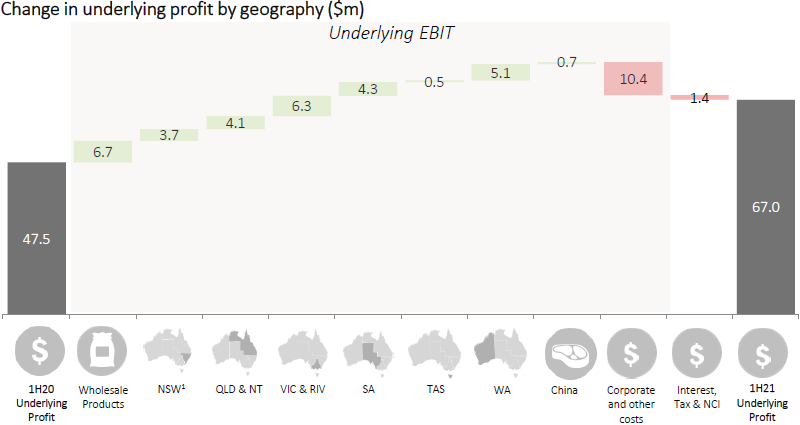

Starting from the top and revenues in 1H21 surged up 22% year-on-year to $1.1 billion, reflecting the improving conditions in Australia as well as management efforts to diversify the business model by geography, channel and product category – the diversification typically balances out the good with bad, however, this time all divisions benefited. We’re pleased to see that agriculture was one of the sectors showing to be largely resistant from the disruptive effects of COVID-19 with demand for agricultural products remaining strong (people still need to eat after all).

Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.

Remove term: FAT-AUS-1020

Remove term: FAT-AUS-1020