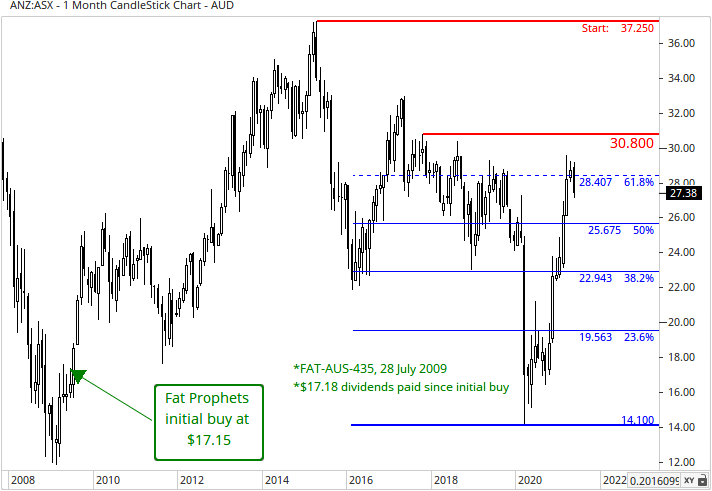

Recovery firmly underway

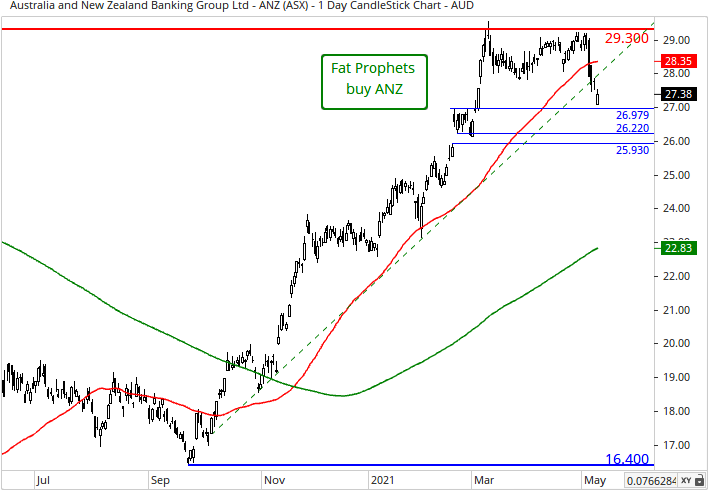

ANZ shares have staged a strong recovery since March 2020 lows and have continued to advance year-to-date. The solid rally continues to be justified in our view given the positive economic momentum of the economic recovery in Australia and the strength of the housing market. ANZ, like the other banks is benefiting from much ‘better than feared’ outcomes and made a substantial net provisions release in the first half ended March 2021. We expect there to be more to come going forward.

Although there was pressure on the ‘top line’ as the bank charged customers fewer fees, the underlying core result was solid and reflected the better outlook.

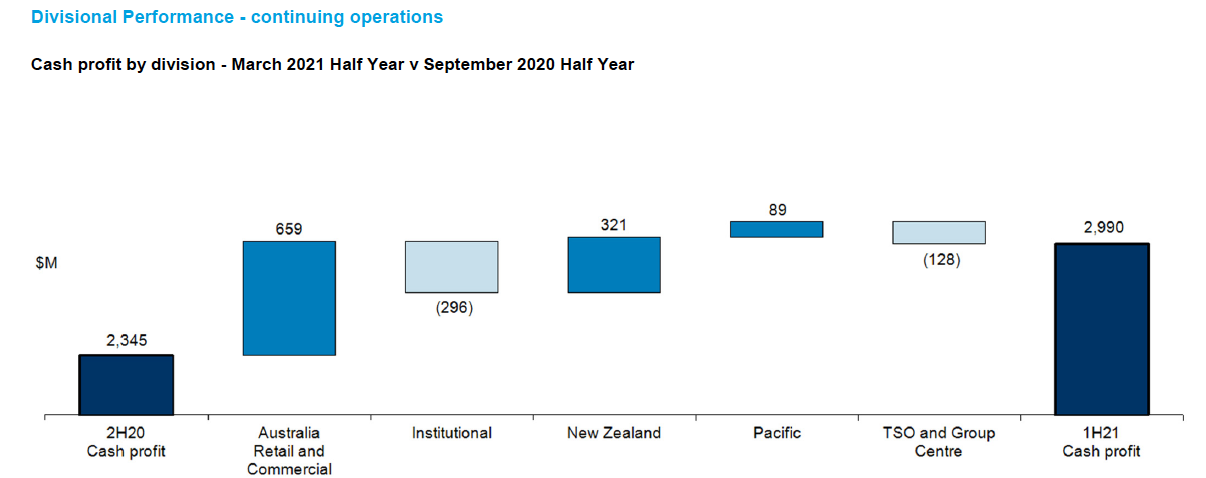

ANZ reported a 90% year-on-year increase in statutory profit to $2.94 billion, with a key driver being a net provision release of $491 million. Cash profit from continuing operations – the more closely followed metric – more than doubled to $2.99 billion and was up 28% on the 2H20 figure. The year ago period of course was marred by huge provisions to cover for potential losses against the impact from the coronavirus.

For ANZ, and the other big banks for that matter, COVID-19 has been less financially disruptive than expected and compared to the huge provisions built up on their books. ANZ’s profits were boosted by the $491 million reduction in the provision for bad loans, a stark contrast from the same period last year when this provision was increased by $1.7 billion. ANZ’s total reserve for bad loans remains at $4.3 billion in the event economic conditions deteriorate.

The improved outlook, along with capital generation on top of an already strong balance sheet, saw ANZ “able to return our dividend to a level more in line with our target and sustainable payout ratio.” ANZ raised its interim dividend to a fully franked 70 cents per share, exceeding market expectations for 63 cents.

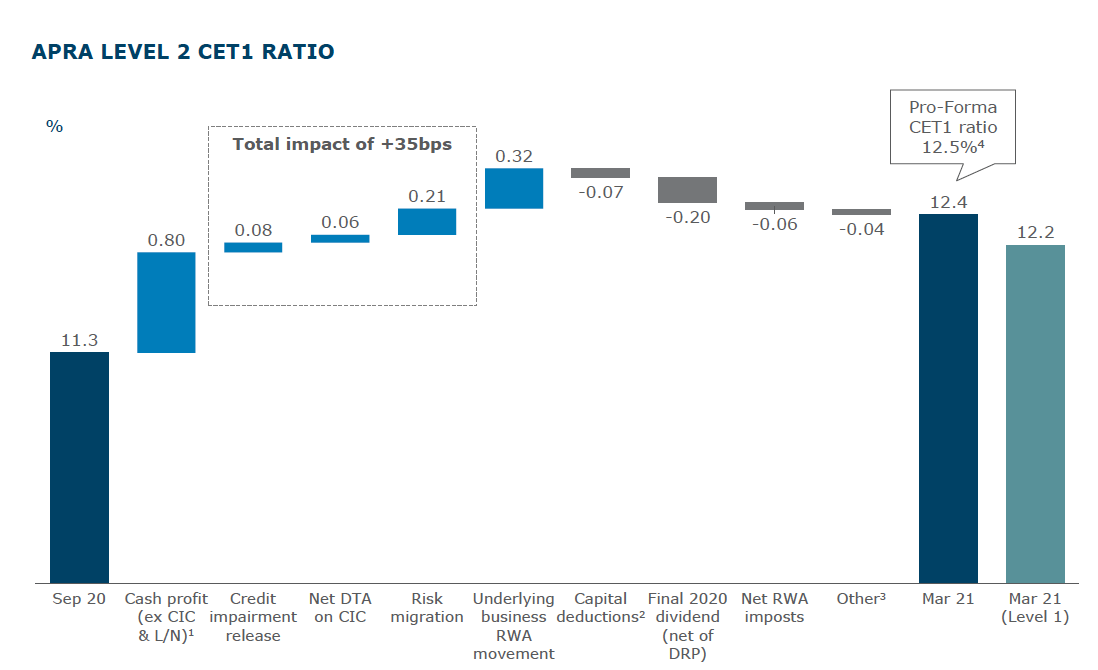

Cash return on equity improved 206 basis points over the past six months to 9.7%.ANZ’s level 2 common equity tier 1 (CET1) ratio strengthened by 110 basis points to 12.4%, well above APRA’s ‘unquestionably strong’ benchmark. The pro forma CET1 ratio was 12.5%.

Source: ANZ

There was pressure on the top line given the low interest rate environment and as ANZ charged customers fewer fees, especially compared to 2H20. ANZ CEO Shayne Elliott attributed the latter to Australia being a mature market.

ANZ is competing well and doing so in a sustainable manner in our view. The bank noted that process and system improvements have seen it move into third place in the Australian home lending market.

The bank added approximately 92,000 new home loan accounts in the Australia Retail & Commercial division over the past six months, with 42% of all retail sales, including home loans now through digital channels. ANZ will seek to continue to increase that percentage going forward as it looks to take costs out of the business in sustainable manner going forward. The division was the key contributor to the increase in group cash profits over the past six months as shown in the following graphic.

Source: ANZ

In the New Zealand business, ANZ added roughly 42,000 new home loan accounts over the past six months, representing strong high single-digit growth and maintaining its position as the leading lender in the market. It was the other strong contributor to the cash profit increase for the group by division. Notably, unlike Westpac, ANZ reaffirmed its commitment to the New Zealand market, which has been a strong historical contributor.

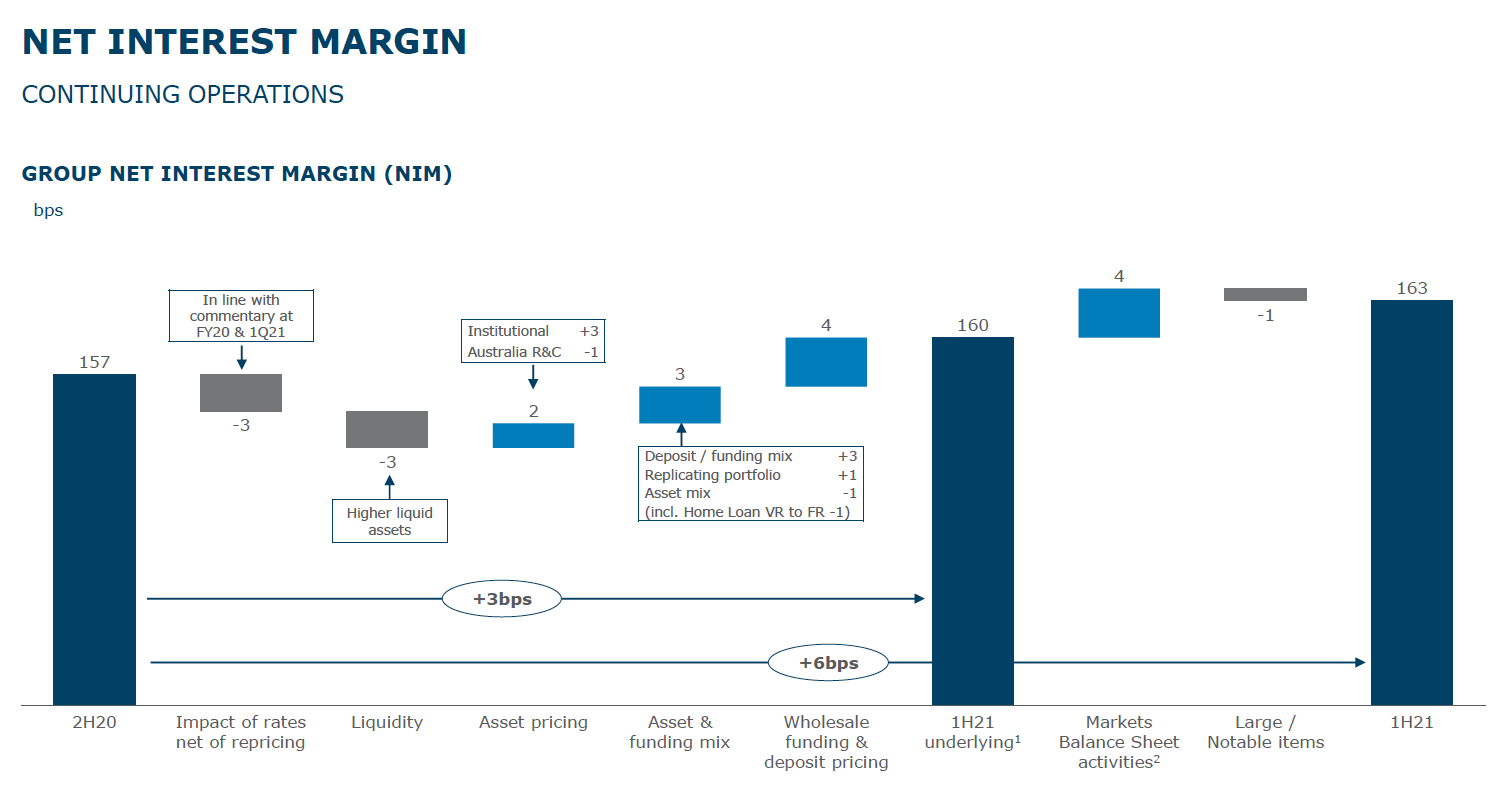

At the group level, ANZ reported a net interest margin of 1.63%, a 6 basis point improvement from 2H20 and a few basis points ahead of expectations, largely due to the benefit from the bank repricing deposits lower.

Source: ANZ

ANZ continues to progress with its strategy to simplify and streamline the bank and reported a 1% fall in expenses over the past six months and a 2% decline year-on-year. The goal is to further reduce the cost base by a further $900 million over the next couple of years, which will include continued modernization and faster transaction processing from digitalization.

Summary

ANZ reported a strong improvement in cash profit in 1H21, with a significant net provisions release. The worst appears to be well in the rear-view mirror given the strong momentum in both the Australian and New Zealand economic recoveries. Credit quality was good leading into the crisis, and the levels of soured loans are lower than earlier anticipated. Accordingly, the dividend has already bounced back faster than the market has expected and we expect further net provisions releases going forward.

ANZ entered the pandemic with a simplified business model, after withdrawing from many Asian markets and is well placed to return to finding the right balance between a leaner operation and growth on the far side of the crisis. A strong balance sheet provides support.

We recommend ANZ as a buy to Members without exposure and a medium-term or longer investment time frame.

Disclosure: Interests associated with Fat Prophets hold shares in ANZ