Building profits

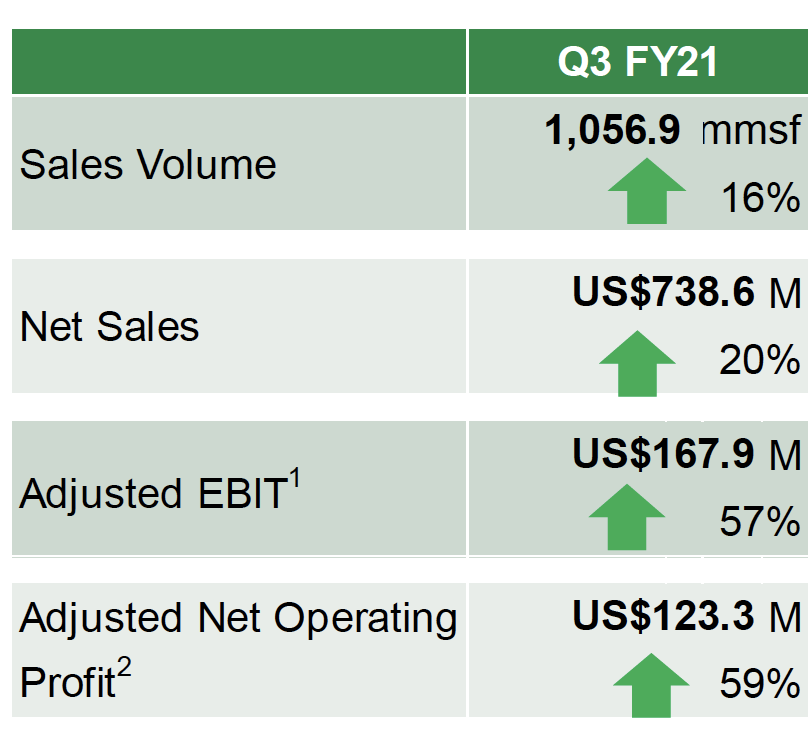

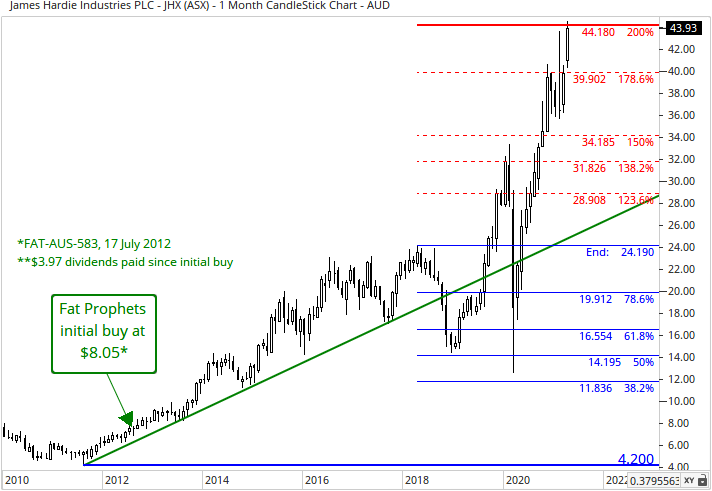

Shares of James Hardie Industries have continued to advance year-to-date, extending the strong rebound after last March’s pandemic induced sell off and hitting fresh new highs. We view the rise as justified as the core US housing market continues to look robust and James Hardie has continued to pick up market share, with more likely to come.

Under CEO Jack Truong, the operational and financial performance has continued to impress, with cost-out manufacturing initiatives combined with strong sales boosting margins. New product initiatives should boost sales further in upcoming years.

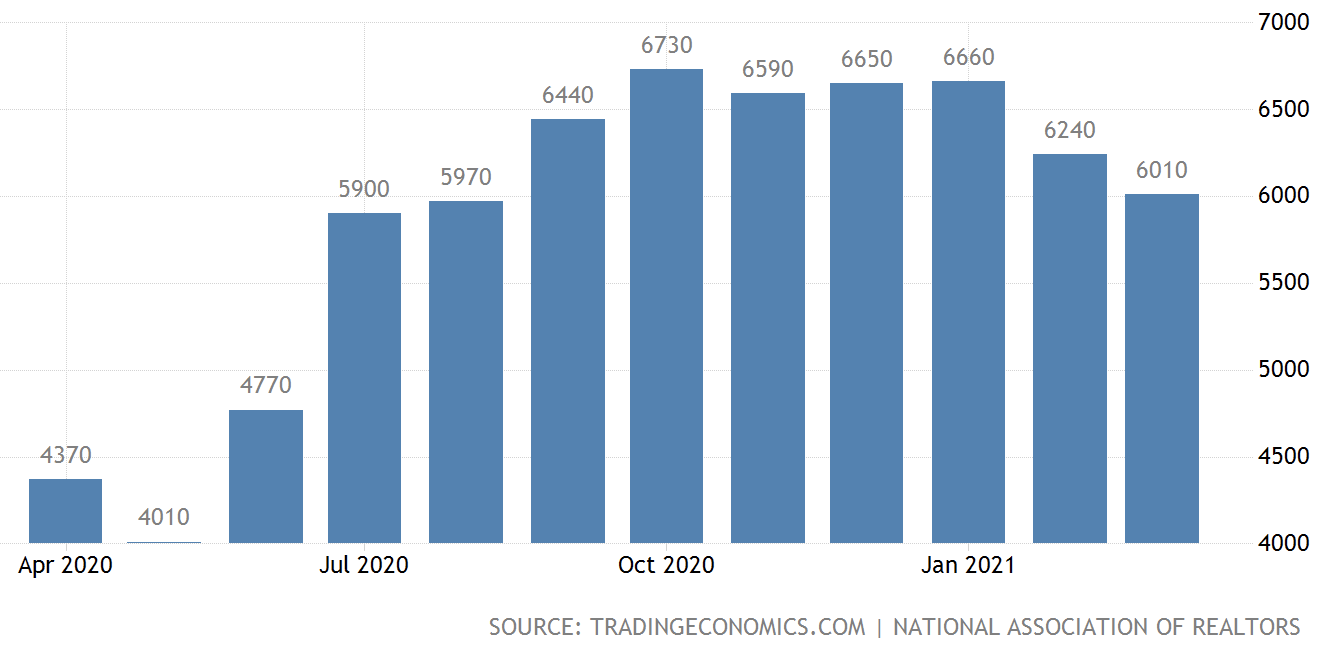

Of the major sectors of the US economy, the housing sector has been one of the brightest spots and most resilient amid the pandemic, quickly recovering from the interruption last April. Record low interest rates along with a shift in housing preferences continue to be supportive. Now we have the jobs market staging a strong recovery and huge amounts of stimulus have been pumped into the economy. The rise in housing prices is a risk for new sales but supports the upgrading of existing homes, which also benefits James Hardie sales. There is a huge inventory of aged homes in the US alone.

Positively, for the prospects for a robust housing market over the next couple of years, unlike the previous housing boom, credit scores are high across the board this cycle, reducing risk. Finally, additional government support and possibly more from the central bank for the broader economy is likely on the horizon.

We continue to believe in the quality of the business and the long-term market opportunity for fibre-cement. James Hardie’s fibre-cement product should continue to win market share, with its niche outpacing the broader building materials market. James Hardie has cited fibre-cement’s advantages as being “ more durable than wood and engineered wood, looks and performs better than vinyl, and is more cost effective and quicker to build with than brick.” Positively, with its dominance in the niche, it has strong pricing power (leading to relatively high margins within the industry) and has exhibited this through past cycles.

The Fermacell acquisition has diversified the business and provides a growth platform in Europe, where previously James Hardie has had comparatively little traction.

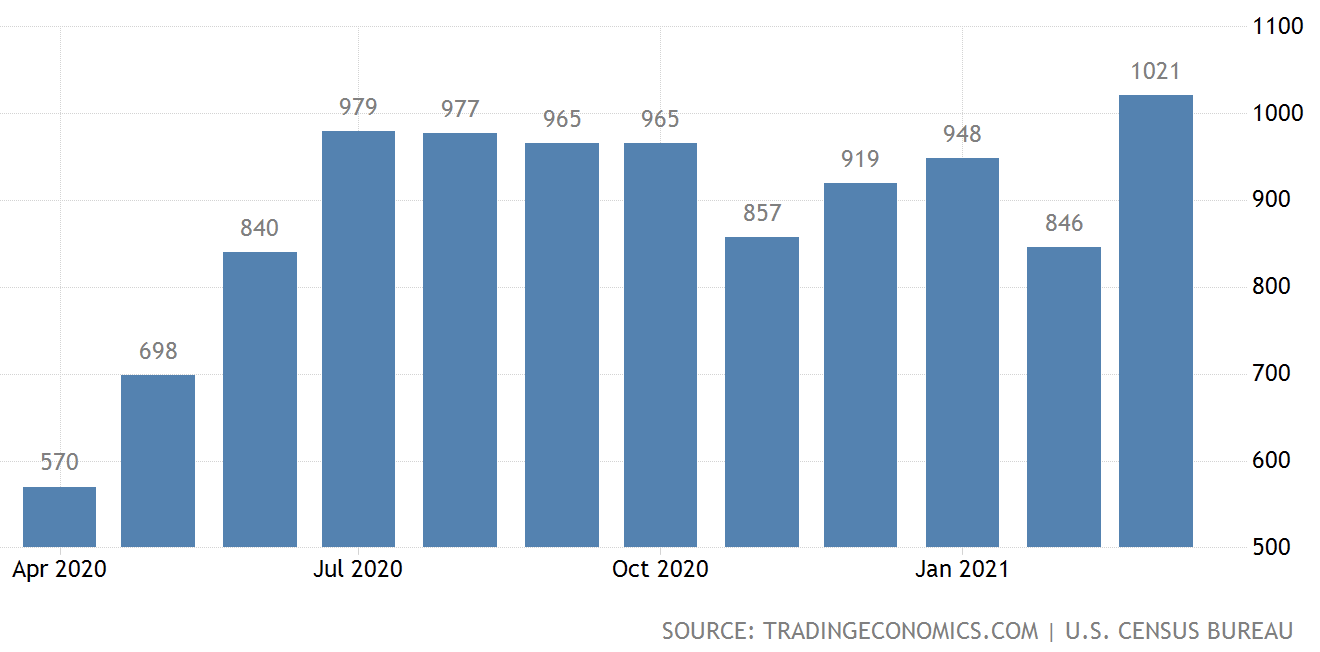

Looking at recent macro data from the US housing market and sales of new single-family homes jumped 20.7% month-on-month to a seasonally adjusted annual rate of 1.021 million in March, coming on the heels of an upwardly revised 846,000 in February and well above economists’ expectations for 886,000. It was the highest reading since August 2006 and a strong rebound after cold weather chilled buying activity in February. There is limited inventory.

Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.