Notable Stocks: ASX Movers, US Tech Updates & Global Market Highlights

Notable Stocks

- Australia Market: Stockland, Wisetech, CSL, Westpac, Domino’s Pizza, Seven Group, Qantas & ARB Corp.

- US Market: Microsoft, Alphabet, Apple, Palantir Technologies, JetBlue Airways, Arm Holdings & Cannabis stocks.

- Other Global Markets: Fresnillo – Mexico, Pernod Ricard – France, Rightmove – UK, Burberry – UK, Entain – UK & Seven & I Holdings – Japan.

1. Australia Market

Five ASX sectors advanced, led by real estate +0.87%, technology +0.4%, consumer staples +0.26% and utilities +0.17%. These groups are typically viewed as beneficiaries of lower interest rates. The materials sector just squeaked into the green by adding +0.03%. Consumer discretionary -0.82%, energy -0.78% and healthcare -0.68% led the six falling groups.

Advances were broad-based for the REITS, with Goodman Group, Scentre Group, Mirvac, and Vicinity Centres posting gains from +0.7% to +1.9%. Stockland climbed +2.1% and confirmed it is in discussions with the competition watchdog about the divestment of a residential community. The expectation is that this would pave the way for a broader deal to acquire multiple communities from Lendlease. Meanwhile, Hotel Property Investments (HPI) surged +7.5% after Charter Hall Retail REIT +0.7% and super fund Host Plus submitted an acquisition bid for HPI.

A +2% gain for Wisetech offset modest declines for other tech stocks, and the sector closed modestly higher. At the other end of the spectrum, Premier Investments dragged on the consumer discretionary sector. Premier fell -3.9% after a soft trading update and the news that Smiggle CEO John Cheston’s employment was immediately terminated upon misconduct allegations. Mr Cheston is due to shift to the CEO role at Lovisa -4.5% in June next year. Super Retail fell by 7.35%, which was another drag, although the decline was primarily due to going ex-dividend. This was significant, including a 37c ordinary and 50c special dividend.

CSL declined -1.2% as the stock traded ex-dividend, weighing on the broader healthcare sector. The energy sector struggled due to the sharp fall in oil prices over the past few weeks. Woodside slipped -1%, while Santos dropped -0.6%. The coal producers were mixed. Whitehaven -0.7% dipped, New Hope Corp added +1%, and Yancoal rallied +4.5% as the latter will join the ASX 200 upon the rebalancing on 23 September. Uranium exposures found some bidders after the recent hammering the sector has endured. Paladin Energy +0.5%, Boss Energy +0.8% and Deep Yellow +1.6% closed in the green.

Technically, CSL is poised to break above topside resistance at $310 following a multi consolidation with a broad range. The topside breakout will likely define the next upward leg in CSL, with the scope to reach a price target of $400 over the coming year. This is one stock to place on the buy list in the coming weeks when equity markets bottom during the incumbent correction.

The financial sector saw early losses but pared back most declines by the end of the session.

At the close, NAB was down -0.3%, CBA fell -0.4%, ANZ slid -0.9%, and Westpac lost -0.7%. Westpac announced an internal appointment for the CEO role with the business banking boss, Anthony Miller, who is set to succeed Peter King when he retires in December.

The looming ASX rebalancing influenced several stocks. Before the market opens on 23 September, HUB24 -0.1% and Sandfire -1.7% will join the ASX 100, while Domino’s Pizza -3.1% and Arcadium Lithium -1.7% will exit. Guzman Y Gomez +4.8%, Yancoal +4.5%, and Westgold Resources -3.5% will join the ASX 200. Domain Holdings -0.4%, Nanosonics +0.3%, and Strike Energy -2.7% will depart.

In other corporate news, insurance broker Steadfast had a tough session, plunging -6.1% before a trading halt following media reports alleging misleading behaviour. The exit from the ASX 100 for Domino’s Pizza was compounded by a filing saying that a class action against the company is proceeding, which includes an allegation that “Domino’s engaged in misleading or deceptive conduct and breached its disclosure obligations with respect to Domino’s expected performance in the Japan market.”

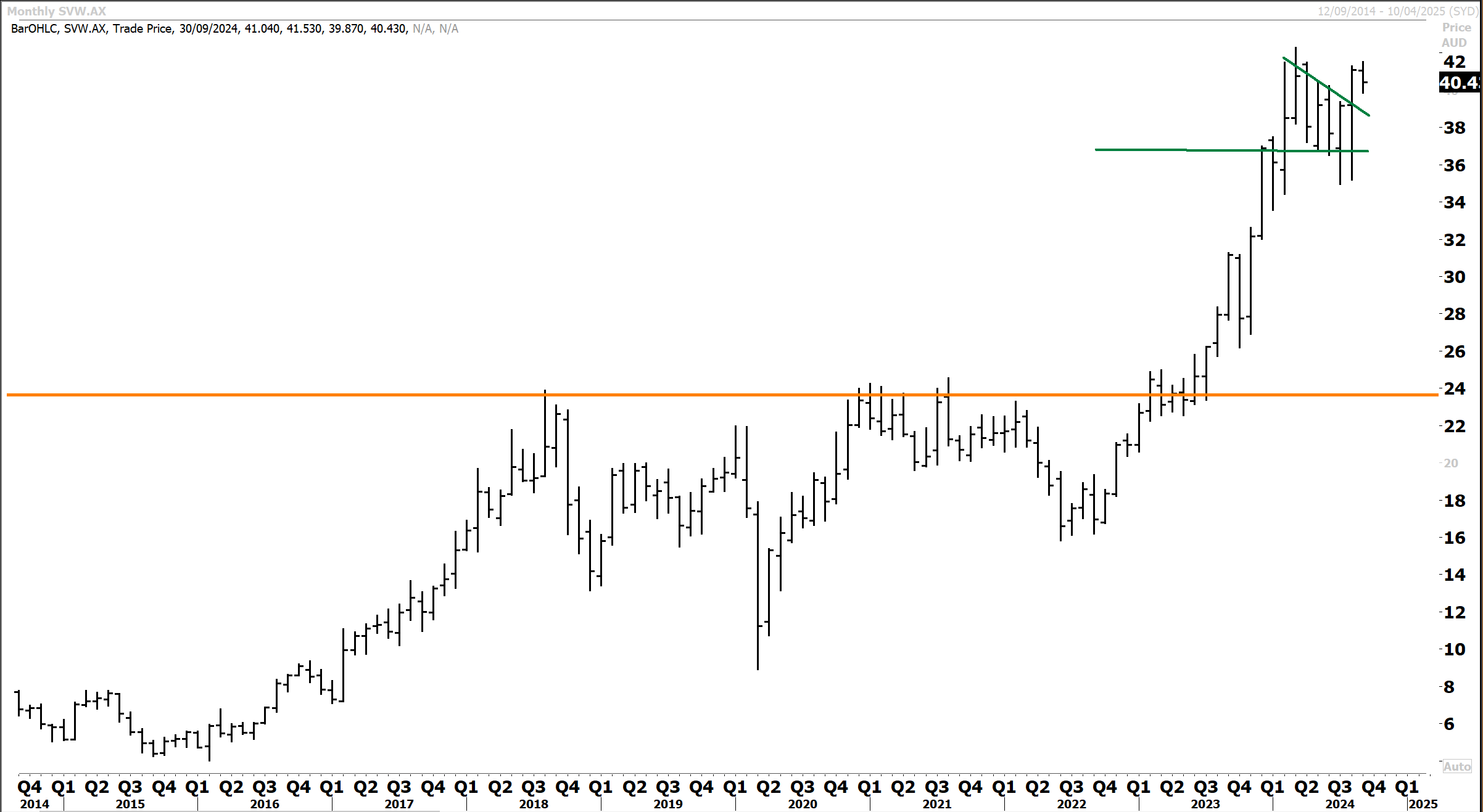

Seven Group Holdings -0.5% meandered. During the recent earnings season, the conglomerate delivered an impressive FY24 result. Revenue climbed 10% to $10.6 billion, and EBIT surged 20% to $1.4 billion, driven by booming demand at WesTrac and Boral. The group rewarded shareholders with a 30% dividend hike and forecasted robust “high single-digit” EBIT growth for FY25.

Seven Group Chart (which replaced Boral in the model research portfolio due to the takeover) has had a stellar run since breaking out above resistance at $24 last year. The Kerry Stokes-backed conglomerate has had a history of making astute acquisitions. Whilst resistance at $42 has been the catalyst for consolidation, the upward trend appears intact and quite consistent. The recent breakout above near-term resistance at $38 now raises scope for a retest of the record highs in coming months.

Qantas was flat. The airline announced a share buyback in August alongside reporting numbers that saw declines for some key metrics, but topped muted expectations. In our last technical update in mid-June we highlighted that “Qantas remains rangebound at $5.90 and below resistance at the primary downtrend, now situated at $6.40. A breakout above this resistance level would mark the resumption of upward momentum, but that outcome remains for the shares to prove. Near term resistance at $6 also looks heavy.”

Qantas did, in fact, manage to breakout and clear resistance at the primary downtrend at $6.40. This is encouraging. While historic resistance at $6.80 could prove stubborn, the technical setup now favours a breakout and retest of the record highs at $7.20 over the coming year.

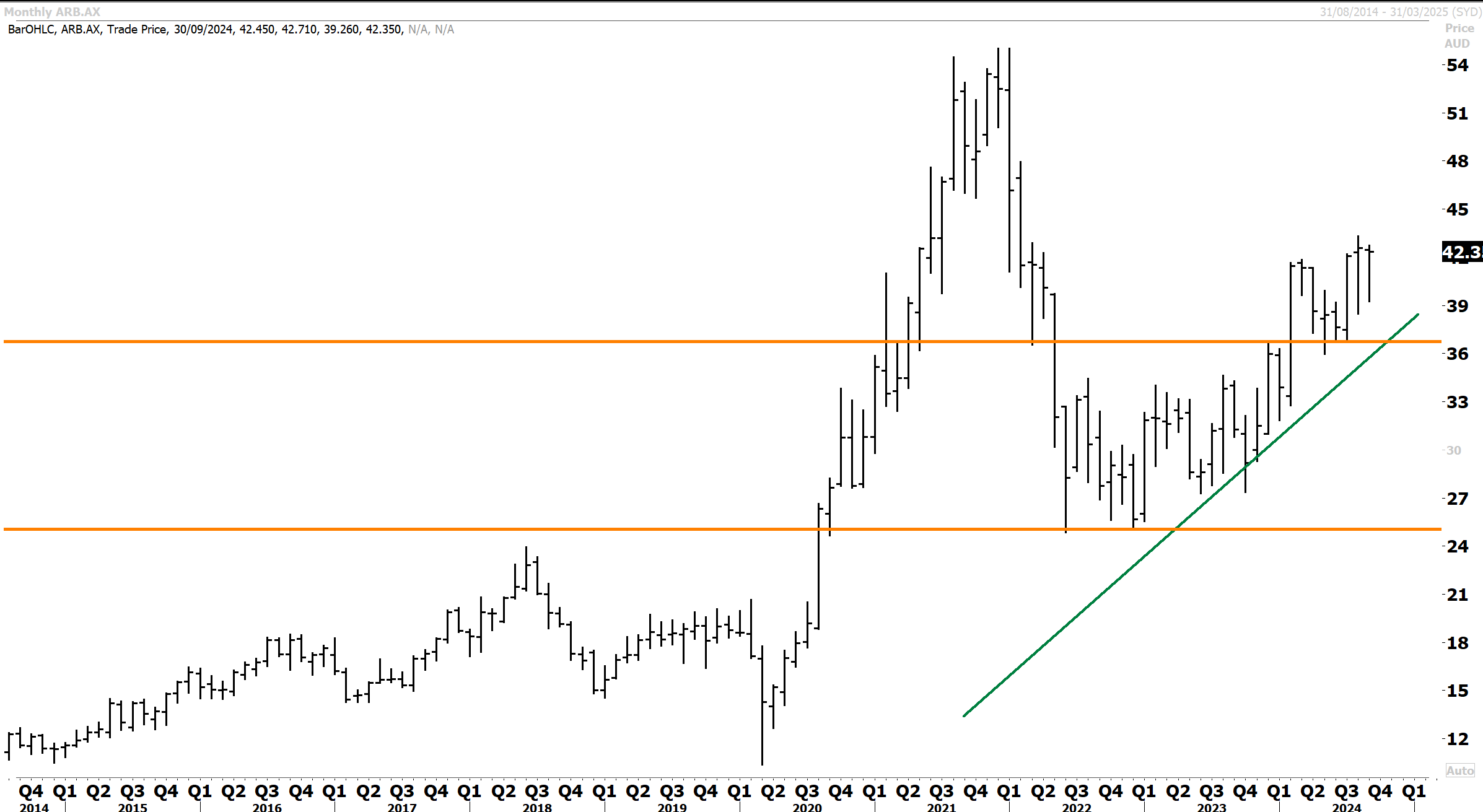

ARB Corp +6.3% surged on acquisition news. ARB is buying US-based firm 4WP in a US$30 million deal. Following the recent corrective selloff and correction from record highs above $54, ARB Corp has reasserted to the topside. The recent breakout above $36 from the lower trading range confirmed an important inflection. The scope is now raised for a resumption of upward momentum.

2. US Market

US Tech bellwether Microsoft is precariously perched on key support. Other Mag 7 tech stocks share a similar technical setup. A break below key support would define another leg down. But support is very robust at levels around 10% lower, which will be vigorously defended. MSFT is one stock on our shopping list in the coming weeks.

For other stocks like Alphabet (Google), the correction is likely over. Alphabet has fallen around 25% from the peak and now should enjoy very strong support at the primary uptrend and the ’23 breakout level.

Mega-caps provided upward support, with Nvidia +3.5% leading a rebound, followed by Tesla +2.6% and Amazon +2.4%. Alphabet dipped -1.7% as a second antitrust trial got underway. Oracle -1.3% beat expectations on the top and bottom lines and rose in after-hours trading. Chip stocks rebounded on buy-the-dip activity, with stocks broadly higher, including Taiwan Semi +4%.

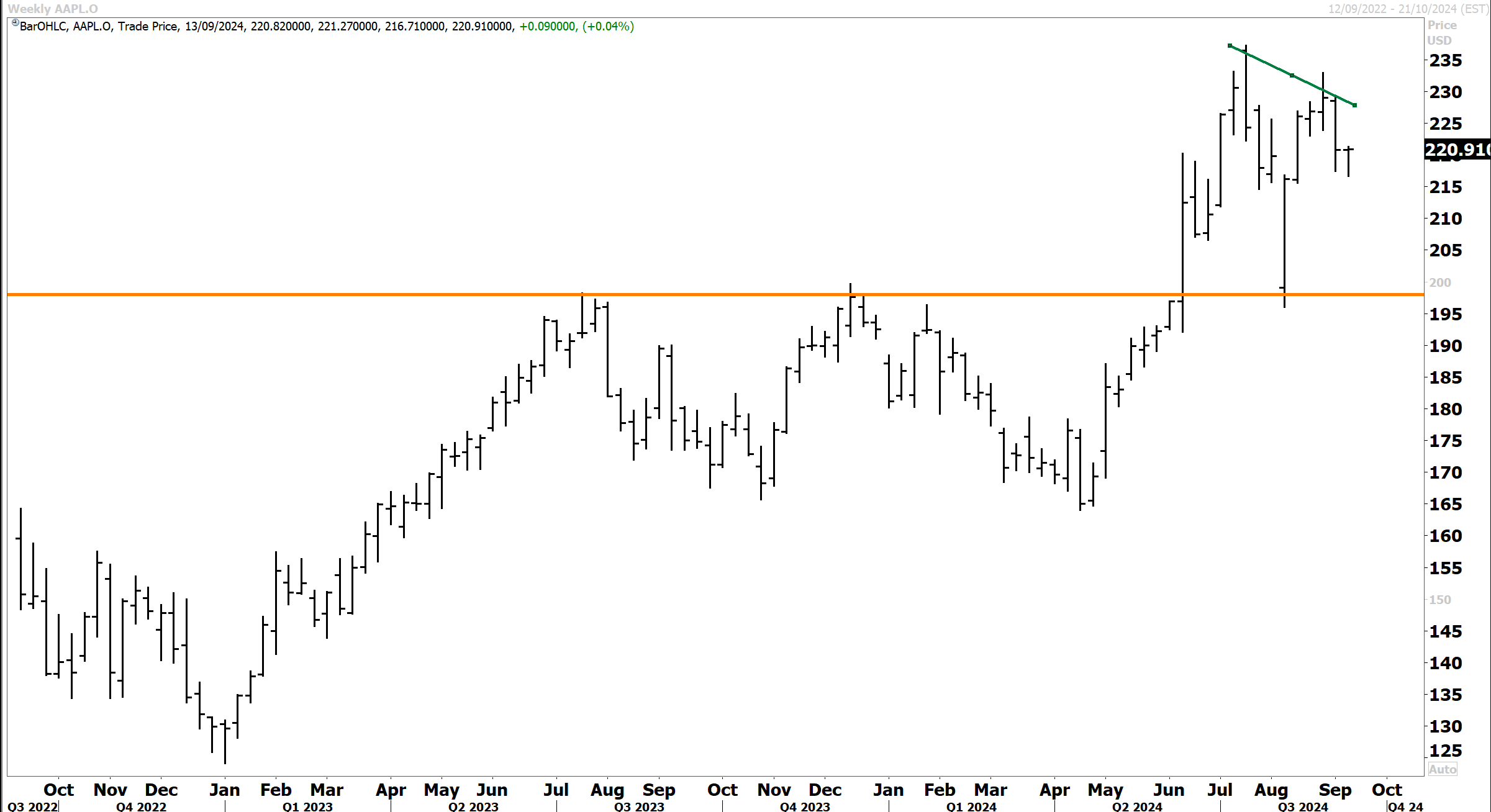

Apple was flat after its iPhone 16 reveal, which wasn’t particularly exciting. New Apple Watch and AirPods iterations were also announced. Apple’s latest flagship, the iPhone 16, features a range of subtle design tweaks and hardware upgrades. One of the most noticeable changes is the return of the vertical dual-camera setup. The iPhone 16 also comes in brighter, more vivid colours.

Under the hood, the iPhone 16 is powered by Apple’s new A18 chip, built on a 3mm processor. This upgrade brings a 30% boost in CPU speed and a 40% improvement in GPU performance while using significantly less power. This translates to better battery life and improved gaming capabilities. There is the usual Phone 16, iPhone Plus, iPhone Pro and iPhone Pro Max model iterations. Most notably, at the top of the range, the iPhone Pro Max gets a screen size bump to 6.9 inches from 6.7 inches. AI-related updates start in Beta next month and are hoped to kick off an upgrade cycle. The iPhones go on sale later this month.

In our last technical update on Apple on June 12th we highlighted that “Apple remains in a well-defined primary upward trend on the 10-year monthly chart below. Since hitting a record high just below $200, Apple consolidated within a range above key support at the primary uptrend. Apple broke out above key overhead historical resistance on Tuesday to make a new record high at $207, confirming the breakout.”

Apple went on to make a new record high above $235 in July. Since then, the stock has corrected sharply to retest the breakout level at $195 during the risk-off move in early August. Apple has since rebounded 10% and is within $15 of the all-time high. Whilst Apple will likely further consolidate within a range, a resumption of upward momentum and retest of the record highs should ensue later this year.

Palantir Technologies surged +14%, and Dell Technologies climbed nearly +4% after news that both companies will join the S&P 500 on September 23. Palantir will replace American Airlines +4%, while Dell will take Etsy’s -1.6% spot.

JetBlue Airways ascended +7% following an upgrade from Bank of America, which moved the stock to neutral from underperform. The analyst noted that JetBlue’s revenue improvement initiatives are showing early results and doubled the stock’s price target to $6. Boeing shares rose +3% after the company reached a deal with a workers’ union, averting a potentially costly strike.

Arm Holdings advanced +7% after reports that Apple would use Arm’s next-generation chip design in the iPhone 16. United States Steel rose +5% after JPMorgan upgraded the stock to overweight, viewing the recent pullback as a buying opportunity.

Cannabis stocks rallied after Donald Trump expressed support for legalising adult marijuana use in Florida. Tilray Brands gained +5%. Bitcoin is another theme Trump is trying to appeal to voters through, and miner Riot Platforms +7% tracked a rebound in Bitcoin prices. Elsewhere, Genius Sports gained +6.4%, Carnival added +2.3%, and Zillow rose +1.8%.

3. Other Global Markets

Convenience store operator Seven & I Holdings gained +2.4% upon saying it remains open to takeover talks with Canada’s Alimentation Couche-Tard.

Entain surged 5.3% after announcing better-than-expected growth in online gaming revenue in the second half of the year. Its UK and Ireland divisions saw an earlier-than-expected recovery in sports and gaming, with stronger volumes and margins boosting performance. This bodes well for upcoming guidance.

Barratt Developments posted a modest gain of +0.6% after announcing a joint venture with Homes England and Lloyds Bank to develop large housing sites.

Rightmove gained +1.3% after Jefferies upgraded the stock from “underperform” to “hold.” Remember, Australia’s REA Group is eyeing a cash and share offer for the property portal. Burberry tumbled -4.9% after Barclays downgraded the luxury retailer to “underweight,” reportedly citing structural concerns about brand weakness and Chinese demand.

While Mexico-based silver miner Fresnillo -0.8% delivered a mixed operational performance at the half-year mark, the financials tell a better story. Silver production was flat at 28.2 million ounces, while gold output dropped 16.8%. Despite rising production costs and a stronger Mexican peso, Fresnillo leveraged higher silver, zinc, and lead prices to boost gross profit by 39% to $393 million, while cash profits jumped 55% to $544 million.

In our last technical update on Fresnillo back in late July we highlighted that “ Fresnillo has consolidated constructively below the 650p resistance level. A breakout above this level and sustained follow-through above the primary downtrend would confirm an important inflection. The technical setup favours the bull side (our base case), with an important breakout and upside reversal likely coming.”

Fresnillo remains within a range after failing to break above resistance at 650p which also is the primary downtrend. The recent pullback to 500p seems to have lost momentum with support now being found. The base case technical outlook favours a breakout above 650p and strong recovery over the coming year.

Pernod Ricard +0.9% is reportedly planning to sell its second-best-selling Indian whisky brand, Imperial Blue, potentially fetching INR5,000 crore (~USD593.8mln), signalling a shift in strategy. Despite robust sales of 22.8 million nine-litre cases in 2023, volumes have declined since 2019. The move aligns with Pernod’s focus on its premium portfolio, including Glenlivet and Jameson, and mirrors Diageo’s 2022 sale of low-margin Indian brands. Despite a 1% FY24 sales drop, Pernod forecasts a return to growth in 2025, navigating challenges in both the US and China.

In our last technical update back in May, we highlighted that “Since hitting a high above 210, Pernod Ricard has broken key support at 170 and the primary uptrend (in place since 2009). Further follow-through on the downside is probable over the coming year. The next major support is at 110. Only an upside reversal above 170 would negate the near-term bearish technical outlook.

Pernod Ricard continues to skew with downside risk, although support is being found near term at 110. A breakout above 140 would potentially confirm an inflection, while a downside break below 110 risks a deeper pull back to 100. Our technical base case outlook is for further consolidation and the shares to retest at the 110 level, where a double bottom might then be established.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters.