- US benchmarks finished modestly in the green as investors moved to the sidelines ahead of the highly anticipated Nvidia result due tomorrow. The key PCE inflation gauge is due on Thursday. Both results will set the market pace this week, although the PCE gauge will likely confirm the disinflationary trend. There is more uncertainty around the Nvidia result, which will set the pace for the semiconductor and tech sector, and sentiment generally.

- Bonds were steady while the US dollar continued to decline, retesting the August lows. A softer US dollar supported precious metals and commodities while oil prices retreated.

- In terms of what the Fed does next month, JP Morgan economists see the Fed cutting by 50 bps in September and November, followed by 25 bp cuts through to mid-November. This would be an aggressive pace of easing by the Fed. JPM believes the Fed will be on this path due to the slowing global economy, led by a mid-year stalling in Chinese and European growth, and that disinflation is accentuated in the US, with a sharp retreat in core inflation seen this year.

- JP Morgan strategists also noted this week that “equities no longer are a one-way upside trade, instead increasingly a two-sided debate on growth downside risks, Fed timing, crowded positioning, rich valuation, and rising election and geopolitical uncertainties. While the market focus in the first half was largely tied to the path of inflation, the second half focus is quickly turning to growth risks given elevated earnings expectations for 2H24 (+9%) and 2025 (+14%).” Staying defensive and holding some cash is prudent as we head into September and October.

- Should the Fed cut by that magnitude in the months ahead, the economy would be immediately cushioned, which adds to the soft-landing narrative that the US will avoid a recession this year. Deeper rate cuts could see more downward pressure on the US dollar index – which is retesting the lows. Meanwhile, laggard gold and silver miners could be poised for a significant catchup rally.

- The Conference Board’s consumer confidence index improved to a six-month high in August. Consumers feel more upbeat about the economy and inflation, which offset increasing concerns about the job market.

- The ASX 200 dipped as traders absorbed another wave of corporate reports, with more misses than hits. I fear that the economy is already in recession. Pressure will be mounting on the RBA to cut by year-end, in my view. Today’s inflation print will be insightful as to where the CPI is headed. BHP CEO Mike Henry gave an upbeat outlook following yesterday’s solid profit result.

- Japanese benchmarks advanced as exporters benefitted from a weaker yen, although tech stocks tracked American peers lower to curb the overall advance. The Hang Seng gained as energy and consumer stocks rose.

- The FTSE 100 edged higher as UK shop prices recorded their first deflation in almost three years. UK Prime Minister Starmer warned of a £22 billion budget gap and said the Autumn budget would be strict to tackle the shortfall.

- European regional bourses were modestly higher despite mixed economic data. The recovery from the early August sell-off has been robust.

- Notable charts and stock mentions today include the S&P500, Dollar Index, Hang Seng relative to the DXY, ARCA NYSE Gold BUGS index, Silver, Sony ADRs, Nvidia, Resmed, Insulet, Royal Caribbean, Trip.com, Bunzl, JD Sports, BHP, Woodside, Droneshield, Nanosonics, Worley, Lovisa, Zip Co, SBI Sumishin, NetEase and Coeur Mining.

Good morning,

US benchmarks finished modestly in the green as investors moved to the sidelines ahead of the highly anticipated Nvidia result due tomorrow. The key PCE inflation gauge is due on Thursday. Both results will set the pace for the markets this week, although the PCE gauge will likely confirm the disinflationary trend. There is more uncertainty around the Nvidia result, which will set the pace for the semiconductor and tech sector, and sentiment generally. Bonds were steady while the US dollar continued to decline, retesting the August lows. A softer US dollar supported precious metals and commodities while oil prices retreated.

The S&P 500 was higher by 0.16% to 5,625. The Nasdaq gained 0.16% while the Dow Jones added a marginal 0.02%. The Russell 2000 underperformed with a 0.7% decline. Nvidia’s result will be influential because there is a high bar to clear regarding earnings and guidance in the coming quarters. The profit result will spotlight the AI sector, how the rollout is travelling generally, and, importantly, whether the billions being invested within the industry are close to generating a return on investment.

Bonds were steady across the curve ahead of the key PCE gauge due Thursday. This is the Fed’s preferred inflation measure, and a benign print will seal the rate cut expected in September. The issue now for the markets is not so much when, but by how much and what the path of future cuts optically is going to look like.

Futures markets favour a 25 bp cut, but 50 bps cannot be ruled out either, depending on how the labour market is shaping up. A rising unemployment rate could spur the Fed into making a deeper cut. Meanwhile, UBS raised the odds of a US recession to 25% from 20%, citing weakness in the labour market. The Dollar was weaker against all the major currencies, while the VIX dropped 4.5% to 14.5.

Commodities received a bid with the further weakness in the US dollar. Comex gold futures made a new record high at $2560oz, while silver rose 0.5% to $30. Base metals continued to rally with copper adding 0.5% to $4.30. Soft ag was stronger across the board. The softer US dollar is making commodities cheaper in other currencies, boosting demand.

In terms of what the Fed does next month, JP Morgan economists see the Fed cutting by 50 bps in September and November, followed by 25 bp cuts through to mid-November. This would be an aggressive pace of easing by the Fed. JPM believes the Fed will be on this path due to the global economy slowing led by a mid-year stalling in Chinese and European growth – and that disinflation is accentuated in the US with a sharp retreat in core inflation seen this year. JPM highlighted that “the US remains the global growth engine for 2024 but the slowing in the labour market will continue to weigh on income gains and layoffs are likely to rise from here. That said, recent activity indicators have assuaged growth concerns, and an imminent recession looks highly unlikely.”

Should the Fed cut by that magnitude in the months ahead, the economy would be immediately cushioned, adding to the soft landing narrative and the US will avoid a recession this year. Deeper rate cuts would be a supportive outcome for stocks. However, some might see this as the Fed acting to avoid the risk of recession. Between now and the end of the year – i.e., September/October- I expect some volatility to return around uncertainty with the soft-landing narrative as investors question the significant earnings growth now priced in.

For the SPX to break through to new record highs and reassert to the topside, Nvidia needs to deliver a blowout earnings result. While this is plausible, the bar of expectation is very high. Nvidia’s profit result will also call into question the billions invested by the tech sector in AI and the timing around just when a return on investment will be achieved. Sentiment around Mag7 and AI names will therefore be tied to the result, with obvious implications for overall market direction over the next few weeks.

JP Morgan strategists noted this week that “equities no longer are a one-way upside trade, instead increasingly a two-sided debate on growth downside risks, Fed timing, crowded positioning, rich valuation, and rising election and geopolitical uncertainties. While the market focus in the first half was largely tied to the path of inflation, second half focus is quickly turning to growth risks given elevated earnings expectations for 2H24 (+9%) and 2025 (+14%).”

JP Morgan strategists make a fair point about being relatively defensive over the coming months. Positioning amongst investors has become extreme following this year’s rally. Many sectors of the market (tech) exhibit crowding by investors that historically leads to more volatility. The big volatility spike in the VIX earlier this month, is unlikely to be repeated – but that doesn’t mean equity benchmarks wont retest the early August lows.

JPM cited that “while the recent market flush took out some of the froth, equity positioning and valuation still remain at risk especially if growth continues to decelerate and the Fed does not show urgency. Our house view expects the Fed to cut 50bps at both the September and November meetings followed by 25bps cut at every meeting thereafter. Historically, the start of FOMC easing cycles coincided with negative performance for risky assets.” It would be hard to see how markets would not get nervous by rate cuts of those magnitude and question high valuations currently priced into US equities along with aggressive growth forecasts. While I still believe the Fed will ease at a more moderate pace – 75 bps to year end, JPM makes a fair point about overall market conditions and the potential for a market reset in coming months.

Our high conviction ‘call on dollar weakness’ this year is finally beginning to play out. If JP Morgan is correct about the Fed cutting [stu alias=”the_last_mile”]

by 100 bps this year, the US dollar could weaken much further. A weaker US dollar will have enormous ramifications for financial markets, including commodities and precious metals, but also emerging markets, including China/Hong Kong.

The Dollar Index has traded down to the lowest level this year. Whilst the technical setup favours a DXY rebound over coming weeks, I would expect the lows at 100 to be retested in September/October and for key support to be broken.

Gold has surged to a new record high as the dollar has weakened. The scope is now raised for new record highs in the months ahead, but there is also significant catchup potential for gold/silver miners, which have lagged the physical metal. The sector is widely under-owned by investors in the US, Australia, and elsewhere. Financial flows into the sector and investment reallocation could drive a powerful rally in gold and the gold miners into yearend, particularly if the dollar weakened further.

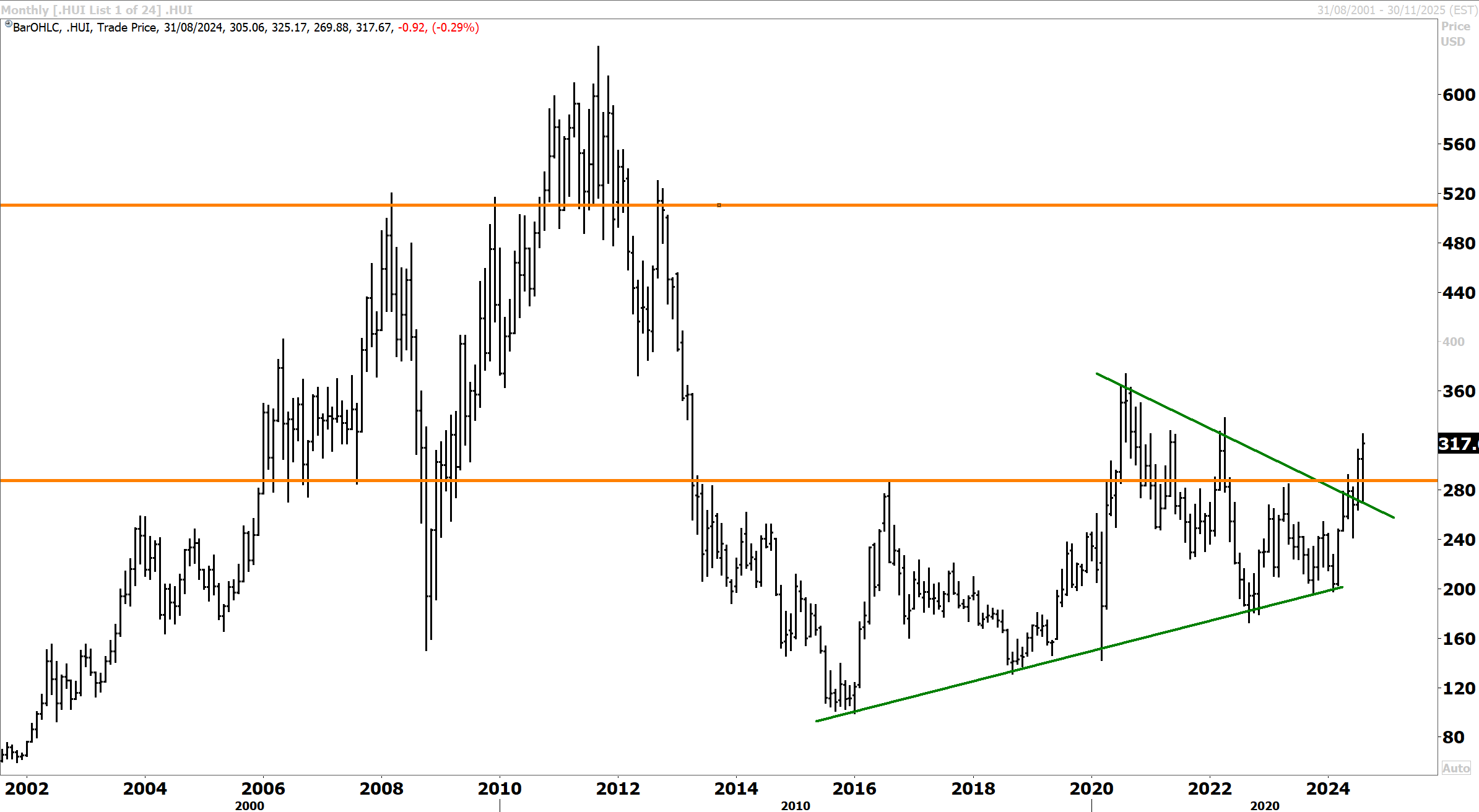

On this front, the NYSE Arca Gold BUGS Index (HUI) is a stock market index of companies involved in gold mining. “BUGS” stands for Basket of Unhedged Gold Stocks. The index is designed to track the performance of companies involved in extracting gold that do not hedge their gold production beyond 1.5 years. This lack of hedging means that these companies are more exposed to changes in the price of gold, making the HUI index particularly sensitive to gold price movements.

The HUI also has other unique characteristics, including gold mining companies that are traded on major exchanges, particularly the New York Stock Exchange and other major North American exchanges. The HUI is one of the most closely watched indices for gold-related stocks, often used as a benchmark for the performance of the gold mining sector.

The HUI is often compared with the Philadelphia Gold and Silver Index (XAU) (see my note from earlier this week for tech comments), which includes both gold and silver mining companies, some of which might hedge their production. Because of its unhedged nature, the HUI index tends to be more volatile than other indices that track gold mining stocks.

In the last big gold bull market between 2000 and 2011, the HUI rose nearly 15-fold from 40 to 600. A similar pattern has been traced since the HUI bottomed in 2016 (along with the broader commodity complex). The HUI has recently broken above resistance at the 280 level decisively and followed through on the topside with sustained price action. The technical setup now raises the scope for a significant recovery and a broad-based rally to a record high above 600 over the coming year.

Silver also looks to have significant upside potential. Often considered high beta gold, silver has managed to hold in and recover back to the $30 level following the risk-off correction in early August. Silver has also managed to consolidate above the breakout level at $27, which is encouraging. The technical setup now favours highs above $40 over the coming year.

US-listed silver miner Coeur Mining (US: CDE), which we hold in all our portfolios, is one way to play silver. CDE has consolidated nicely since retesting the breakout level, forging back to the four-year highs. While September/October could produce a decent buying opportunity, CDE is well-positioned to benefit from higher spot silver prices. A breakout above the primary downtrend at $7 would confirm an important inflection and topside reversal and raise scope for a significant recovery in the year ahead. Ultimately, I would expect ten-year highs above $16 to be challenged.

US-listed silver miner Coeur Mining (US: CDE), which we hold in all our portfolios, is one way to play silver. CDE has consolidated nicely since retesting the breakout level, forging back to the four-year highs. While September/October could produce a decent buying opportunity, CDE is well-positioned to benefit from higher spot silver prices. A breakout above the primary downtrend at $7 would confirm an important inflection and topside reversal and raise scope for a significant recovery in the year ahead. Ultimately, I would expect ten-year highs above $16 to be challenged.

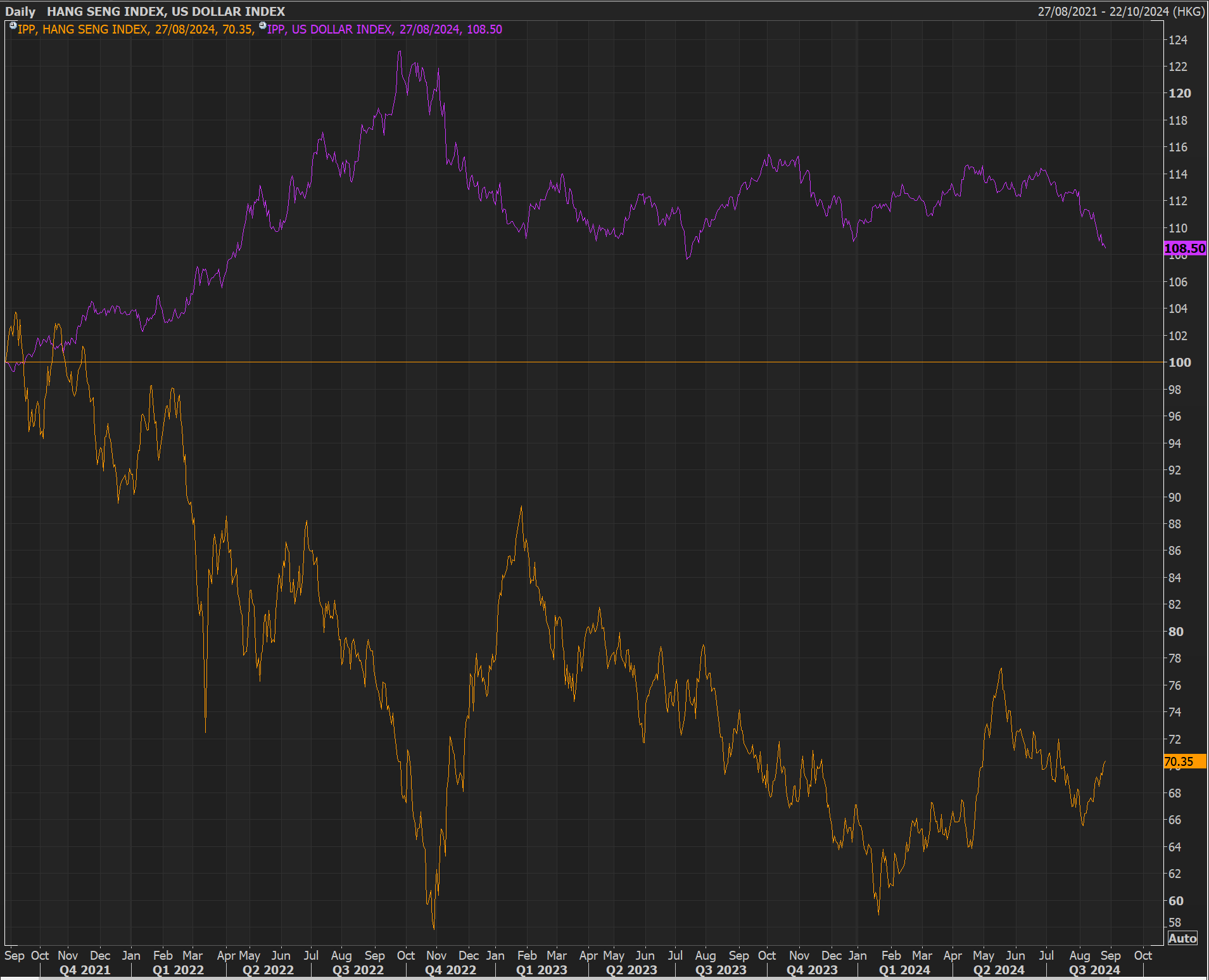

Finally, the Hong Kong dollar is pegged to the greenback, so any decline in US rates will support the Hang Seng. Despite the consistent negative headlines about China’s economy, the Hang Seng has continued to grind higher in recent weeks, which is a further sign that the bear market is over. Bear markets typically conclude when markets no longer go down on bad news, and this is proving to be the case for both the Hang Seng and CSI300.

The Hang Seng has historically been inversely correlated to the dollar index. The recent selloff in the dollar index has renewed impetus and upward momentum in the Hang Seng. This is relationship is worth watching closely, given that China mainland companies listed in Hong Kong are priced on the lowest PE multiple in decades. I expect the Hang Seng to stage a powerful rally into the end of the year, with a weakening dollar providing a formidable headwind.

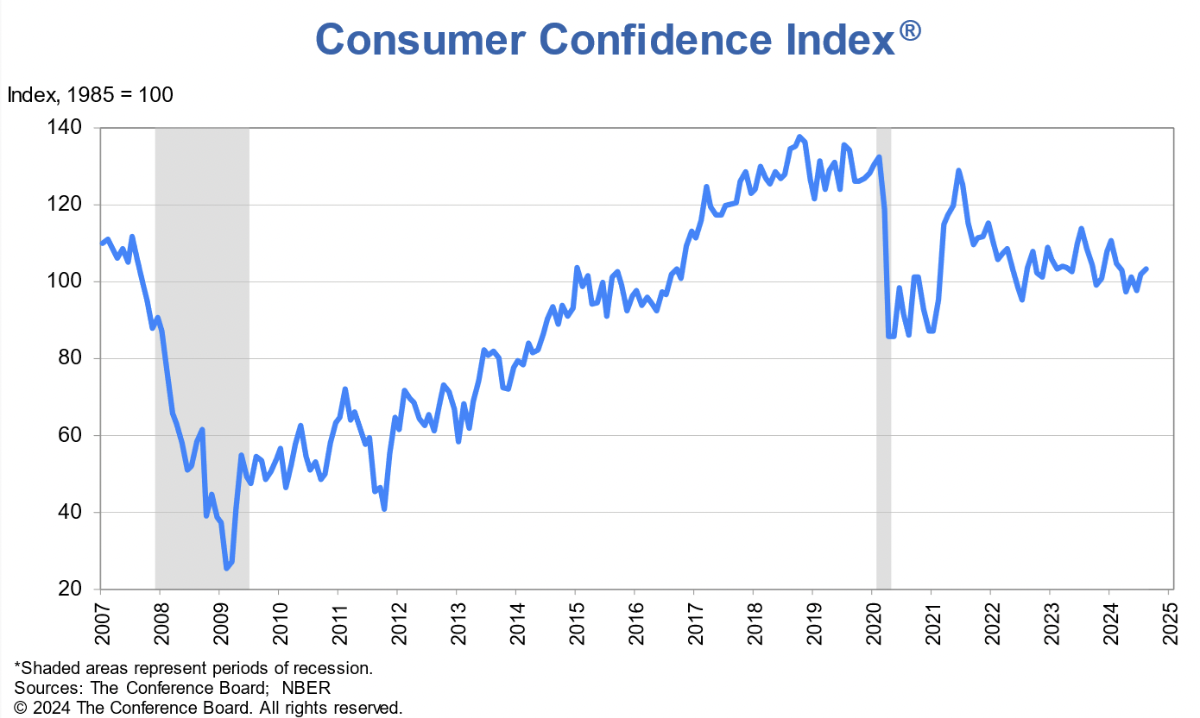

Turning to data, the Conference Board’s consumer confidence index improved to a six-month high in August. Consumers feel more upbeat about the economy and inflation, which offset increasing concerns about the job market. The headline reading rose from an upwardly revised 101.9 in July to 103.3 in August. That was above market expectations of 100.7.

The Conference Board noted that “US Consumers were likely rattled by the financial market turmoil in early August, as they were less upbeat about the stock market…However, consumers did not change their views about a possible recession. The proportion of consumers predicting a recession was stable and well below the 2023 peak.”

Separately, the aged S&P CoreLogic Case-Shiller data showed that the 20-city home price index rose by 6.5% annually in June, well above market expectations of a 6% increase but slowing from the upwardly revised 6.9% increase in May.

Despite the Mag 7 names’ mixed individual performance, Mega-caps were supportive overall on Tuesday. Nvidia +1.5% was the firmest riser, while Apple and Microsoft inched higher. Tesla -1.9% and Amazon -1.4% were the weakest, while Alphabet and Meta edged lower. Nvidia’s results on Wednesday will be crunch time and are highly anticipated. Options data shows a high likelihood of a more than 10% swing for Nvidia stock, following the numbers, which will likely flow through the broader AI-related group.

FDA-related news helped Resmed +7.3% (the Australian shares are set to follow today) and Insulet +6.6% top the S&P 500 table. Meanwhile, Eli Lilly inched +0.4% higher after launching a lower-priced version of its weight loss drug Zepbound, offering single-dose vials priced roughly 50% lower, aimed at patients without insurance coverage for weight loss treatments.

Royal Caribbean was +4.3% higher after ordering another cruise ship, indicating firm confidence in demand. Its peer Carnival +2.6%, and airlines were up on the read-across.

Hain Celestial Group shares soared +18% following stronger-than-expected fiscal fourth-quarter earnings. The food company is known for healthier snack options like Terra chips and Garden Veggie Straws. Conversely, Hershey’s stock dropped -2.7% after Citi downgraded the stock from neutral to sell, citing potential risks from declining sales volume and rising cocoa prices.

After Edgar Bronfman Jr. withdrew his attempt to acquire Paramount Global, the media giant saw its stock slide -7.2% to near the bottom of the S&P 500 table. This paved the way for Skydance to finalise its approximately $8 billion purchase agreement, initially reached in July.

Hanesbrands gained +5.7% after UBS identified it as a “stock to watch” in 2025, though the firm maintained its neutral rating. Energizer Holdings shares rallied +6.6% following a broker upgrade.

ADRs of China-based travel platform Trip.com surged +8.6% after its second-quarter revenue exceeded expectations. Sony ADRs rose 3% after the company announced a 19% price increase for its PlayStation 5 gaming console in Japan. The nearly four-year-old console is anticipated to receive a mid-cycle refresh within the next six months.

Sony US-listed ADRs have consistently respected the primary uptrend on the 10-year monthly chart below. The recent correction quickly found support at $75, which is the primary uptrend. An upward dynamic has since followed, with the ADRs breaking out above near-term resistance. The correction now looks complete, and Sony is well positioned technically for a retest of the record highs over the coming year.

After opening slightly higher, the ASX 200 drifted lower through the session as traders absorbed another wave of corporate reports, this time with more misses than hits. Nevertheless, the decline was a modest -0.17% to close at 8071, remaining within striking distance of its all-time high of 8148. Advances for BHP and Woodside lifted the mining and energy sectors. Lovisa dragged on the consumer discretionary sector, while tech stocks followed American peers lower. SPI futures are pointing to a 0.36% decline on the open.

The monthly July inflation reading is due later today, with a consensus expected at 3.4%, which shows a fall from 3.9%. Underlining inflation is expected to remain at 4%. Any improvement on these figures will be supportive of the market. I am expecting the RBA to be cutting by year-end. A close friend of mine is involved in retail and finding store locations for major retail brands looking to roll out a store chain in Australia.

He said last night that luxury retail was down about 10% to 15%, while the middle segment of retailers was all doing very tough. Sales turnover was down between 20% and 25%. I believe that, but for immigration, statistics would confirm Australia as being in the first recession since the early 1990s.

Small businesses are having a tough time, and this is compounded by the inflexible labour market laws for businesses with headcounts above 15. With imminent rate cuts from the Fed, the RBA will have to decide whether the last mile on inflation is worth deepening what is now a probable recession for Australia’s economy.

Only four broad ASX sectors advanced, with energy +2.34% and materials +0.8% posting solid gains, while utilities +0.24% and consumer staples +0.05% edged higher. Real estate was flat. Tech -1.33%, financials -0.86% and industrials -0.7% led the six declining sectors.

The weekend’s clashes between Israel and Hezbollah, along with the supply concerns from Libya, pushed oil prices higher, offering support to the energy sector. Santos rose +1.9%, while coal miners were little changed. Paladin Energy -1.1%, Boss Energy -0.3% and Deep Yellow (flat) held onto most of Monday’s gains prompted by reduced production guidance from the top global uranium producer.

However, Woodside stood out with a gain of +3.9% thanks to a better-than-feared 1H result and dividend. The energy giant stuck with an 80% payout ratio and declared a US69¢ interim dividend. Though underlying profit fell 14% to US$1.63 billion, the company maintained robust production and launched key projects like Senegal’s Sangomar oil field. CEO Meg O’Neill emphasised Woodside’s strategic expansions, including a US-based LNG acquisition.

In our last technical update earlier this month we highlighted that “Woodside has failed to reassert on the topside, and with this week’s break below the recent key support at $27 and the primary uptrend, the scope is now raised for additional downside extension. Woodside does, however, screen cheap on a fundamental basis relative to international peers. JP Morgan maintains an overweight on WDS with a substantially higher price target.”

Following the downside break below support at $27, Woodside extended lower to make a new three-year low near $24. Woodside has since managed to stage a decent upward dynamic and push back up above the $27 support level. This is encouraging, with scope now raised for a recovery. Only a break below the recent lows near $24 refutes the technical outlook.

The materials sector also posted gains, supported by resurgent iron ore prices and a solid result from BHP +1.25%, highlighting the mining conglomerate’s top-tier assets and ability to generate rivers of cash despite headwinds. CEO Mike Henry provided an outlook that reflected “cautious optimism” amid ongoing global economic challenges. Mr Henry acknowledged the uneven economic recovery in China, particularly its struggling property sector, which directly impacts the demand for BHP’s iron ore and expressed some concern about the near-term volatility in global commodity markets but maintained confidence in the long-term fundamentals of key commodities like copper, which BHP sees as critical to the energy transition.

I thought this was a very positive outlook, with Mike Henry seeing huge potential in copper to provide growth for BHP. Whilst iron ore prices might be subdued – BHP is a cost leader, and other producers are likely to face shutdowns if lower prices are sustained. Demand in China will also return when the property market recovers. At some point, they will need to build more residential housing.

In light of these challenges, it is encouraging that BHP is doubling down on its copper growth strategy. The company plans to expand its copper operations in Chile, South Australia, and Argentina, aiming to exceed 2 million tons of annual production in the early 2030s. This focus on copper is part of a broader strategy to mitigate the tougher outlook for iron ore, BHP’s largest revenue generator, as China’s economic growth slows.

Excluding one-off items like the US$2.7 billion write-down of the Western Australian nickel operations, underlying FY profit increased 2% to US$13.66 billion, and EBITDA of US$29 billion was up 4%. Despite the recent decline in iron ore prices, underlying EBITDA from the iron ore segment chipped in US$18.9 billion for the group, rising 13%. BHP is the lowest-cost iron ore producer, so it can still print impressive profits at prices that will drive the marginal producers out of business. BHP signalled an intention to grow its market share.

Meanwhile, growth in the copper segment is encouraging. Copper and potash are ‘forward-facing’ commodity areas where BHP intends to grow strongly in the coming years. The final dividend of US74¢ per share brought the total dividend to US$1.46, down from US$1.70 a year earlier. However, this still represents a total payment of US$7.9 billion, BHP’s fourth-largest dividend payment. The lower 53% payout ratio (down from 59%) provides BHP with the firepower to invest in its growth projects.

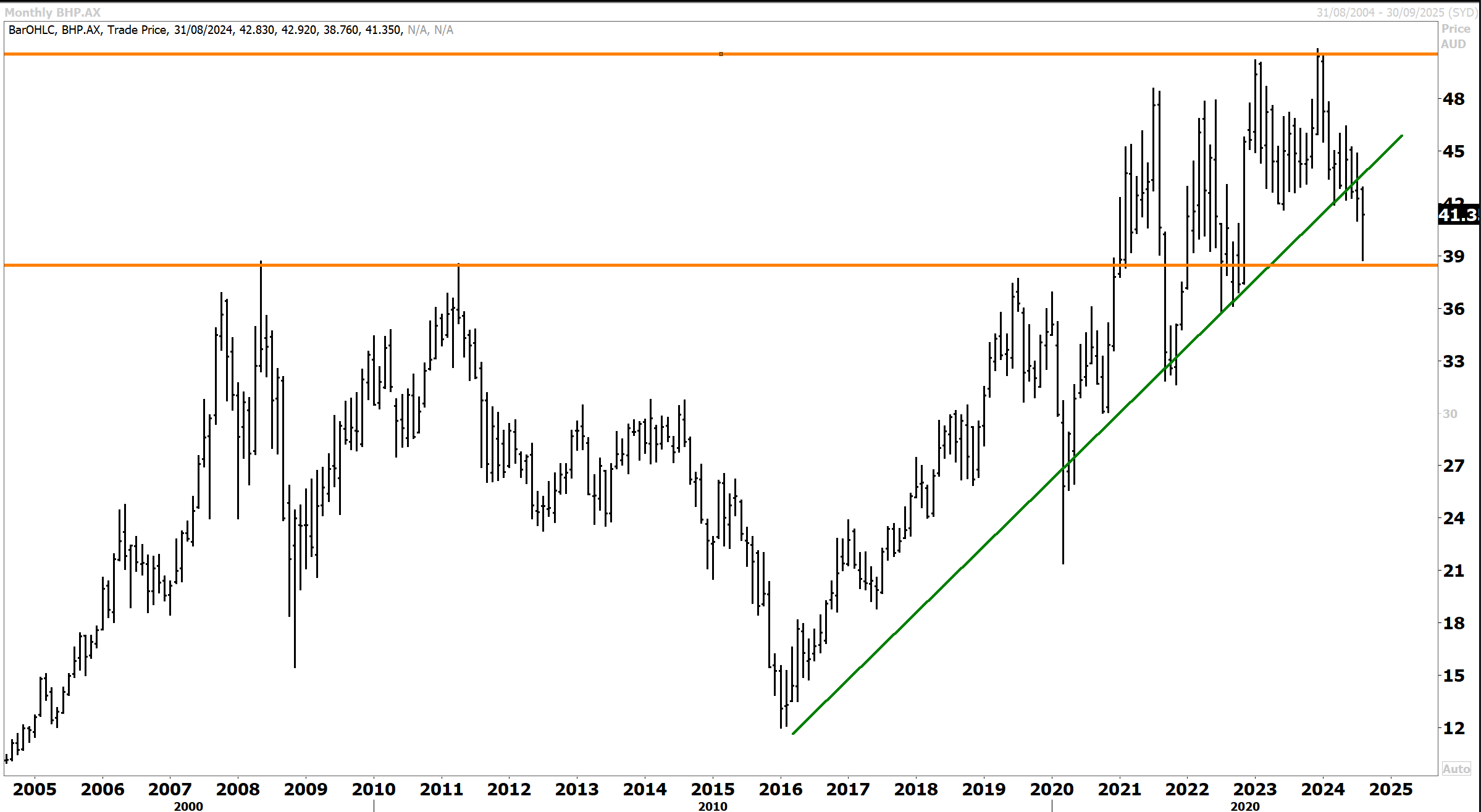

In our last technical update in late July, we highlighted that “BHP is testing the primary uptrend after breaking below near-term support at $42. Our base case remains for a rebound off primary support (with copper and iron ore likely bottoming out after a recent correction). However, a break below the primary uptrend would raise the scope for a deeper pullback, with the next significant support level at $36. This is not our base case, but an upward dynamic in the coming weeks/months is needed to have confidence in the primary upward trend being sustained.

On the 20-year monthly chart below, BHP has corrected sharply after encountering resistance at record highs. Encouragingly, however, BHP looks to be finding support at the big breakout level that has proven formidable over the past five years. While the primary uptrend was broken a few months ago, the big support level looks set to dominate the technical setup. We expect BHP to make a decent recovery over the coming year from current levels as iron ore prices stabilise and copper reasserts to the topside.

Fortescue followed suit, rising 1.8% ahead of its own results today, while Rio Tinto advanced 0.8% on the recovering iron ore price. The gold sub-index inched +0.1% higher. Northern Star added a modest +0.5%, Newmont increased +0.2%, and Evolution Mining slipped by -0.5%. Copper exposures were similarly subdued. Sandfire Resources dipped -0.2%, 29Metals advanced +1.3%, and the Global X Copper Miners ETF (WIRE) edged +0.9% higher.

Fortescue followed suit, rising 1.8% ahead of its own results today, while Rio Tinto advanced 0.8% on the recovering iron ore price. The gold sub-index inched +0.1% higher. Northern Star added a modest +0.5%, Newmont increased +0.2%, and Evolution Mining slipped by -0.5%. Copper exposures were similarly subdued. Sandfire Resources dipped -0.2%, 29Metals advanced +1.3%, and the Global X Copper Miners ETF (WIRE) edged +0.9% higher.

Financials weighed on the index. The big four banks declined between -0.2% and -1%. Bendigo Bank shed -4.2% after a harsh broker response to Monday’s FY results. Insurers were broadly lower. Zip Co tumbled -7.9% as traders took profits after a stunning rally YTD. Despite a sharp lift in transaction volumes, traders seemed underwhelmed with the FY25 guidance.

Technology stocks were the hardest hit as the broader sell-off in US tech names fed through to the local market. Xero slid- 2.2%, while Life360 and Technology One also pulled back, falling -1.8% and -1.4%, respectively. Wisetech dipped -0.4%.

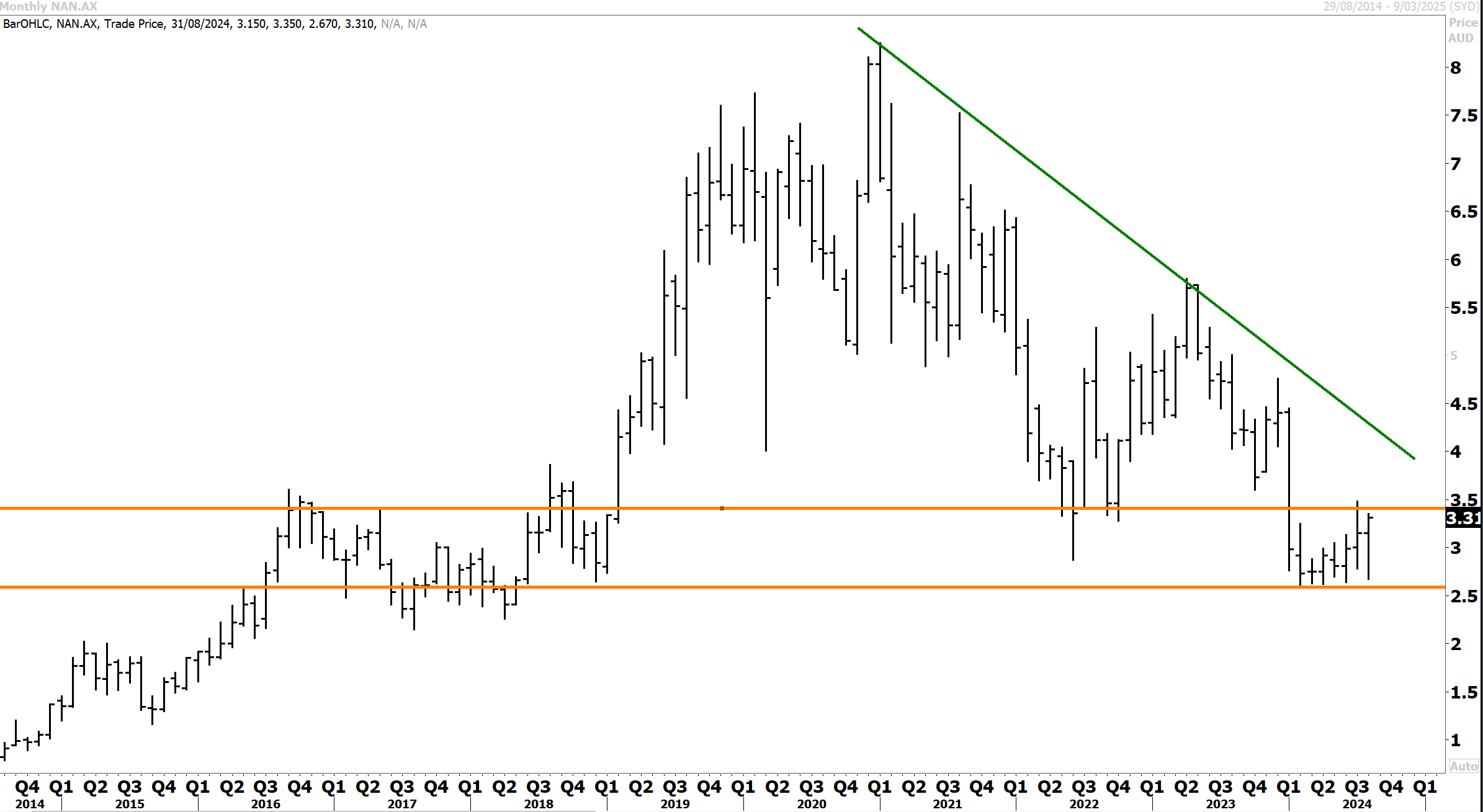

In other corporate news, Nanosonics soared +22.6%, the best performance among mid-caps, following an earnings beat and improved FY25 guidance. The stock had fallen sharply heading into the results, so expectations were low.

Nanosonics looks to be finding support following the big decline from highs above $8 established in 2020. However, only a breakout above the primary uptrend at $3.50/$4 would confirm an inflection and mark the resumption of upward momentum.

Guzman y Gomez closed +3.2% higher after reporting a narrower than forecast FY24 net loss. Worley advanced +2.8% after a jump in profits and robust cash flows. More sustainability-related work bodes well for margins in FY25. Coles added +1.7% after reporting better-than-expected FY net profits.

Jewellery retailer Lovisa plunged -13%, its worst decline since 2020, as a disappointing trading update overshadowed solid FY24 profit figures. Johns Lyng Group was hammered, sinking -27.1%, after downgrading its FY25 revenue guidance. Austin Engineering slumped -10.7% as a solid FY24 result was overshadowed by softer-than-hoped guidance.

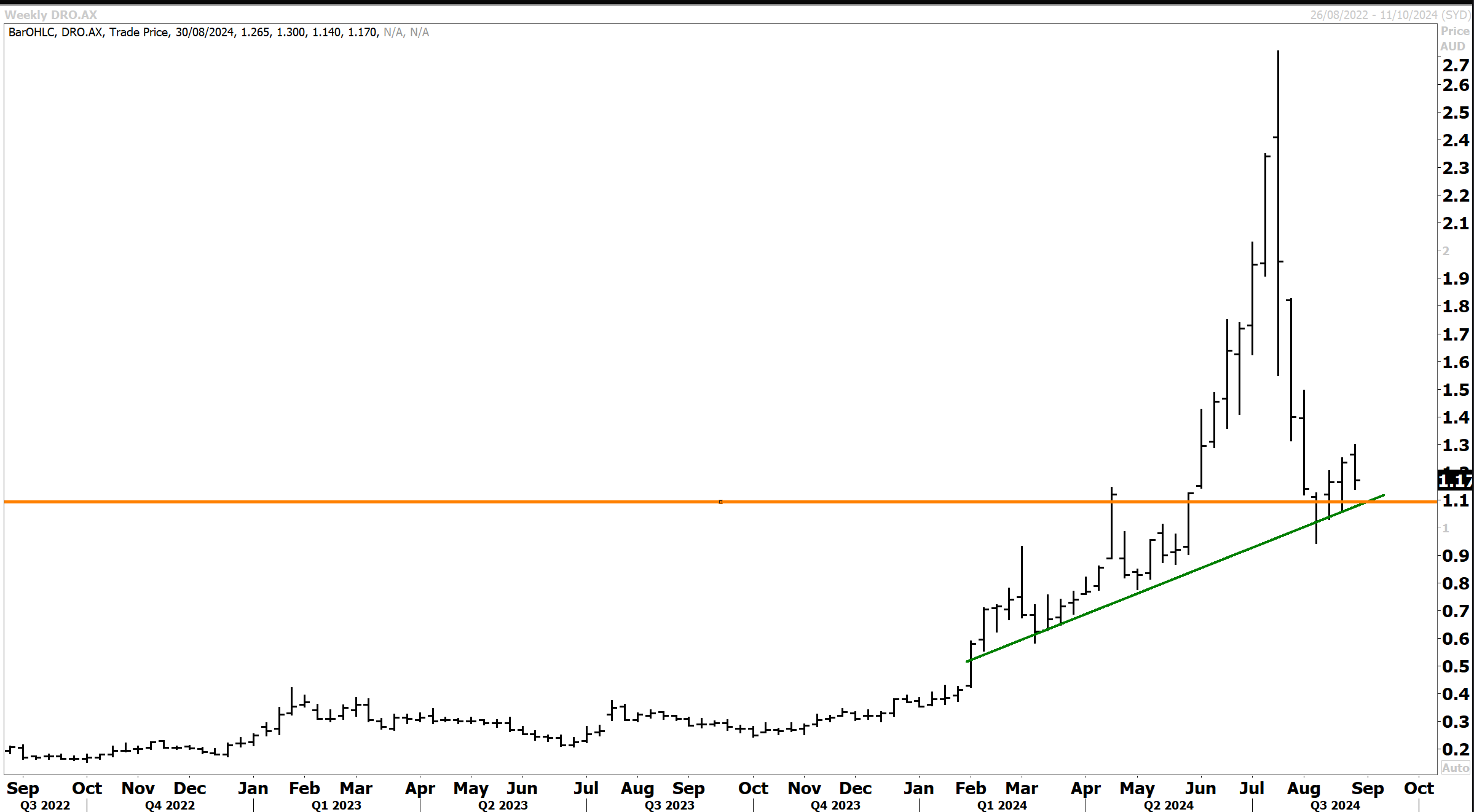

Droneshield fell -8.2% despite a record-breaking 110% revenue surge to $24.1 million in 1H24. However, the company reported a deeper net loss of $4.8 million. The counter-drone tech firm ended the period with $230 million in cash and a $32 million order backlog. The $1.1 billion sales pipeline signals strong potential for future growth, driven by global demand for counter-drone solutions amid heightened geopolitical tension and conflicts.

In our late July technical update on Droneshield we highlighted that “The big downside reversal that has occurred after DRO hit record highs above $2.70 likely now defines a period of consolidation. The key support level at $1.70 will likely be tested in coming weeks, and perhaps additional downside extension following the big run since the breakout above 40 cents earlier this year. DRO remains in a primary uptrend and only a downside break below the support level at $1.10 changes the bull narrative. However, Investors must be prepared for a lengthy consolidation following the circa seven-fold advance in the past six months.

Since the big downside reversal and correction from the record highs, DroneShield has encouragingly consolidated above the important $1.10 support level. The uptrend from the ‘24 breakout level also appears to be consistent. With the dust settling after the big selloff, and provided there is no further downside break below $1.10, the scope is raised for upside extension over the coming year.

Elsewhere, outperformers included Paradigm Biopharmaceuticals +8.5%, Chrysos +7.1%, Regis Healthcare +6.8% and SRG Global +3.1%. Laggards included Helloworld Travel -9.6%, Tyro Payments -5.9% and Smartgroup -7.9%.

Elsewhere, outperformers included Paradigm Biopharmaceuticals +8.5%, Chrysos +7.1%, Regis Healthcare +6.8% and SRG Global +3.1%. Laggards included Helloworld Travel -9.6%, Tyro Payments -5.9% and Smartgroup -7.9%.

Shifting to Asia, Japan’s Nikkei +0.47% and Topix +0.73% indices closed higher on Tuesday, driven by gains in export-related companies as the yen weakened against the US dollar. However, declines from tech stocks (tracking American peers) curbed the overall advance.

The yen weakened to around 145 against the greenback. The 10-year JGB yield was marginally lower at 0.875%. Financials posted solid gains, with online lender SBI Sumishin rallying +5.3%, followed by insurer Dai-Ichi Life.

Some other notable advancers included Yokogawa Electric +4.4%, Seven & I Holdings +4.1% and Mitsubishi Heavy +3.95%. Exporters like Sony +2.8% and Nissha Co +2.7% gained. In contrast, technology heavyweights like Tokyo Electron -0.9% and Advantest -1.6% dragged.

China’s CSI 300 slipped -0.57%, while the Hang Seng diverged to rise +0.43%. In Hong Kong trading, advances for energy and consumer stocks outweighed slides for e-commerce stocks following a plunge from Temu parent PDD Holdings in New York trading overnight.

PDD warned that past levels were unsustainable, leading to a 28% plunge on the New York bourse. This dragged on Alibaba -4%, JD.com -3.7%, and Meituan -2.6% in Hong Kong trading. NetEase bucked the downward trend, advancing +2.8%. Regulators have relaxed game approval rules this year. Meanwhile, Baidu also outperformed, posting a +1.3% gain. Higher oil prices lifted China Petroleum +5.2%, PetroChina +4.1%, CNOOC +3.4% and China Oilfield Services +1.6%. Gold miner Zhaojin Mining fell -3.8% on some profit-taking.

The UK benchmarks closed mixed on Tuesday. The FTSE 100 advanced by +0.21% to 8,345, supported by solid performances from retail and airlines. On the other hand, the mid-cap-oriented FTSE 250 dipped by -0.13%.

In local economic news, UK shop prices recorded their first deflation in almost three years. The British Retail Consortium reported that overall shop prices fell by 0.3% in August, marking a stark reversal from the inflationary pressures seen amid the pandemic and in its immediate aftermath. Non-food prices, in particular, dropped sharply by 1.5% as retailers heavily discounted summer stock. Food inflation also eased, driven by a notable drop in fresh food prices to their lowest level since October 2021.

On the political side, UK Prime Minister Starmer warned of a £22 billion budget gap and said the Autumn budget would be strict to tackle the shortfall.

On the stocks side, the standout performer on the FTSE 100 was Bunzl, which surged +8% after upgrading its full-year profit outlook and announcing a £250m share buyback. The company’s consistent cash generation, bolstered by recent acquisitions and a double-digit dividend increase, bolstered investor sentiment. Bunzl is a specialist distribution business that supplies essential products to various sectors. Their key offerings include items businesses need for day-to-day operations. This can include disposable packaging, cleaning and hygiene products, safety equipment, and facility supplies.

Mining stocks lent support as copper prices hovered around 5-week highs. In addition, BHP delivered better-than-expected underlying earnings. Anglo American and Rio Tinto were up by +1.3% and 1.1%, respectively. Airlines ascended following encouraging comments from Ryanair’s CEO, Michael O’Leary, who indicated that airfares had stabilised, suggesting that the worst price-cutting could be over. Investors welcomed the outlook for more stable pricing. EasyJet soured +6.9% and IAG rose +2%.

On the downside, housebuilders suffered losses, even as Jefferies maintained a positive outlook on the sector in coverage. The stocks seemed to succumb to profit-taking after a robust rally YTD. Barratt Developments led the decline, plunging -6.6%, followed by Berkeley Group and Persimmon, each down by -4.3%.

JD Sports Fashion lost -4.1%, giving back some of the gains from last week, despite news that its part-owned subsidiary, Applied Nutrition, was planning a £500m IPO.

European markets edged higher on Tuesday, though gains were moderate. The pan-European Stoxx 600 index rose by 0.16%, continuing its positive momentum from the early August sell-off. Despite a broadly optimistic sentiment, concerns around the German economy capped gains. The September consumer confidence index showed further deterioration, with forward-looking sentiment dropping to -22 amid rising unemployment and corporate insolvencies. Nonetheless, the final reading for Germany’s 2Q24 GDP was revised slightly upwards, providing some support. The change was from an estimated -0.1% contraction in 2Q24 to being flat on a year-on-year basis. The QoQ change remained at -0.1%.

At the close, the pan-European Stoxx 50 was up+ 0.04%, Germany’s DAX added +0.35%, while France’s CAC-40 declined -0.32%. Italy’s FTSE MIB advanced +0.52%, while Spain’s IBEX 35 added +0.55%.

[/stu]

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.