A new beast

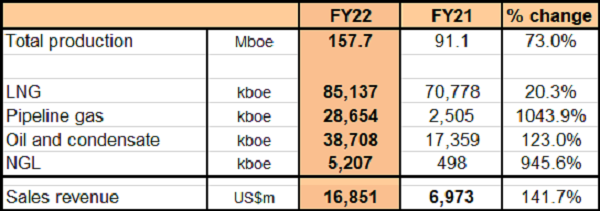

Woodside Energy (Woodside) has reported its operational numbers for 2022 and for the first time included the annual numbers for BHP Petroleum. The change is profound, with comparatives for the year reflecting this and supports our belief the acquisition is a major game changer for Woodside. Certainly, records fell in 2022 with overall production and product offerings reporting substantial changes while revenues added to the list. Pleasingly, Woodside reported a beat on an adjusted 2022 guidance. The following table shows a summary of Woodside’s key operational numbers for 2022 (LNG – liquid natural gas, NGL – natural gas liquids, boe – barrel of oil equivalent, M – million):

Source: Woodside

As Members can see from the above table, the changes on the Woodside Petroleum only 2021 numbers were profound, and we expected nothing less. We see a key takeaway in the acquisition being the production scale Woodside now boasts. We have not rated the result but are pleased 2022 guidance was pipped to the topside and was a feature amongst many. Woodside will report a bumper 2022 financial result, when it reports on 27 February 2023.

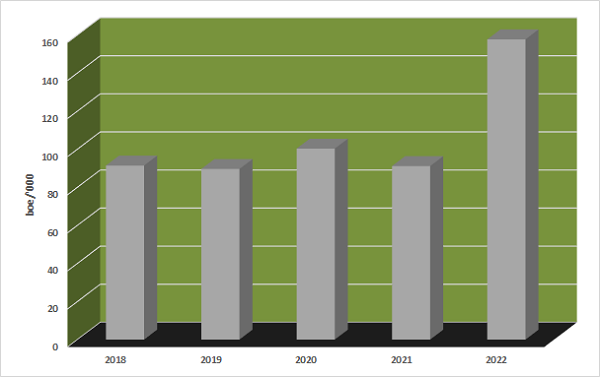

As Members can see from the above table, overall production for 2022 came in at a record 157.7 million boe, representing a rise year-on-year (yoy) of 73% on the Woodside Petroleum only 2021 outcome. The following table shows annual production on a boe basis (2021 and back are Woodside Petroleum only outcomes):

Source: Woodside

Members can see from the above chart, the scale up the additional BHP Petroleum production brings to Woodside. Pleasingly, and a feature was 2022 production coming in ahead of an adjusted guidance for the year of 153 million boe to 157 million boe. Individual product offering guidance for 2023 will be provided with the release of Woodsides’ full year financials on 27 February 2023. Woodside singled out a strong performance by its operations in the December quarter 2022 as the key driver.

Guidance for 2023 is forecast to be in the range of 180 million to 190 million boe and was unchanged. Again, the scale up is apparent with Woodside reporting an initial 2022 production guidance, as Woodside Petroleum only, in the range of 92 million boe to 98 million boe.

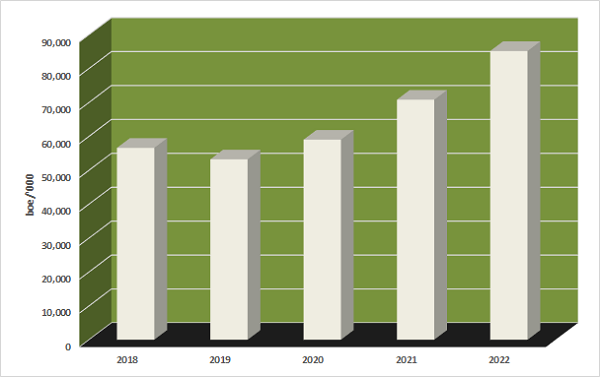

LNG production for 2022 rose 20.3% yoy, to a record 85.1 million boe. The following chart show annual LNG production:

[subscribe_to_unlock_form]

Source: Woodside

Woodside reported higher LNG production for the North West Shelf (NWS, Woodside’s interest 30.47%) and Pluto LNG (Woodside’s interest train 1 – 90%, train 2 – 100%), while Wheatstone (Woodside’s interest 11.84%) reported a fall. NWS and Pluto reported increase of 45% and 15.2% respectively, to 29.7 million boe and 46.2 million boe. Wheatstone printed a 9.8% fall to 9.2 million boe. Following the completion of the BHP Petroleum merger, Woodside lifted its interest in Pluto train 2 to 100% from the original 51% and this increase primarily drove the LNG result.

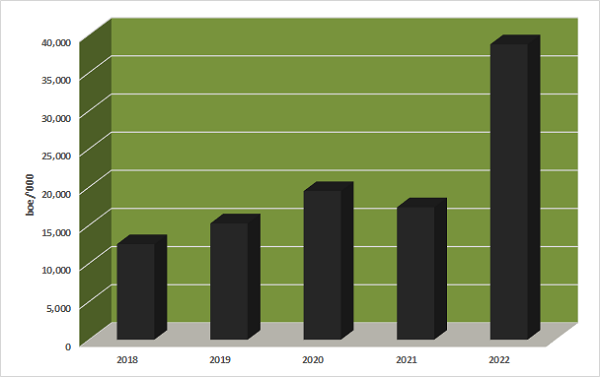

Oil and condensate production for 2022 was the real beneficiary of the merger with BHP Petroleum. The following chart shows annual oil and condensate production:

Source: Woodside

Oil and condensate production leapt by 123% yoy, to 38.7 million barrels. Woodside picked up exposure to the Gulf of Mexico through the merger with BHP Petroleum. This new exposure equated to 14.7 million barrels of oil and condensate being added to the 2022 result from this source. New exposure to Bass Strait added a further 2.6 million boe.

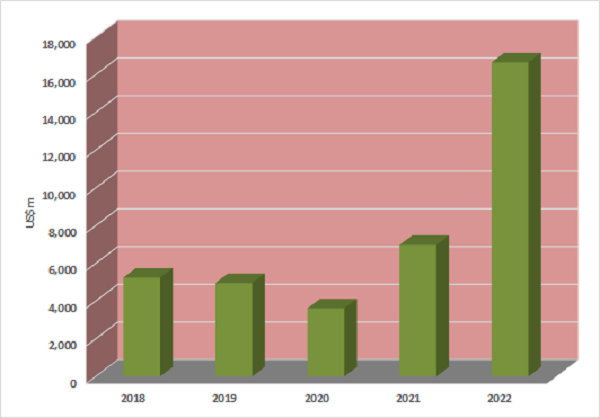

Revenue was the end beneficiary and was a standout feature from the 2022 operational results but was not all of Woodsides’ own doing. The following chart shows annual revenue:

Source: Woodside

Revenue hit a record US$16.6 billion, following the reporting of a yoy surge of 139%. Operations were an obvious contributor on the BHP Petroleum acquisition, while a higher realised energy price was the “icing on the cake.” On top on the BHP Petroleum leverage, Woodside reported a higher average portfolio price of US$98 per boe, representing an 8.9% yoy increase. On the operational data, Woodside will report a bumper full year 2022 financial result that will show positive volume and price variances. Going forward, we have a positive view on energy prices for 2023, on growing demand and muted supply responses.

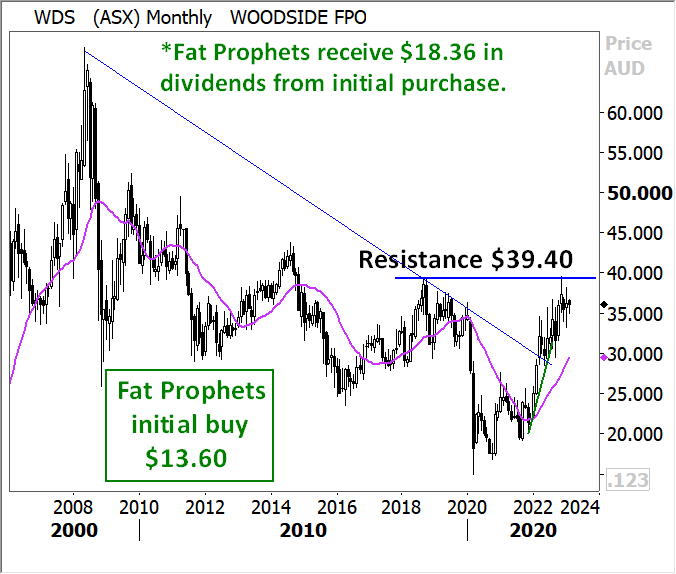

The daily chart of WDS indicates the price has remained above the 20 day simple moving average, as the daily resistance level set during August 2022 is broken to the upside. In this short term view the daily trend is up

Woodside carries a hedge book of 21.8 million boe covering 2023 production with an average price of US$74.50 per barrel. Given the Brent price is currently trading around US$85.67 a barrel, at the average price the position is not profitable. Woodside also maintains a special hedge over part of its Corpus Christi LNG volumes to 82% for 2023 and 29% for 2024. We consider both positions to be prudent risk management hedges.

Woodside opened the purse in 2022, reporting rising capital and exploration spending over the year. Exploration and evaluation spending surged 44% yoy, to US$465 million, with capital expenditure jumping 52% yoy, to US$4.0 billion with the focus on oil and gas properties acquisitions, which jumped 79% yoy, to US$3.9 billion.

The monthly chart shows price movements of WDS indicate a breakout from the longer term down trendline. Current price movements remain above the 12 month moving average with the price retesting the $39.60 resistance level set during 2018. The underlying primary trend for WDS is up

Armed with our positive outlook for energy over 2023 and especially natural gas and its derivative LNG. Woodside has the swelled asset base, we believe, to deliver LNG into what we see as an expanding energy market over an extended period of time. Importantly, Woodside has retained the financial capacity and holds prospective assets to leverage into our scenario over this period. The full year operational results were a bumper and have reinforced our view of Woodside.

Consequently, we continue to recommend Woodside Energy as a buy for Members who have no current exposure to the stock.

Disclosure: Interest associated with Fat Prophets holds shares in Woodside Energy.

[/subscribe_to_unlock_form]Fat Prophets has made every effort to ensure the reliability of the views and recommendations expressed in the reports published on its websites. Fat Prophets research is based upon information known to us or which was obtained from sources which we believed to be reliable and accurate at time of publication. However, like the markets, we are not perfect. This report is prepared for general information only, and as such, the specific needs, investment objectives or financial situation of any particular user have not been taken into consideration. Individuals should therefore discuss, with their financial planner or advisor, the merits of each recommendation for their own specific circumstances and realise that not all investments will be appropriate for all subscribers. To the extent permitted by law, Fat Prophets and its employees, agents and authorised representatives exclude all liability for any loss or damage (including indirect, special, or consequential loss or damage) arising from the use of, or reliance on, any information within the report whether or not caused by any negligent act or omission. If the law prohibits the exclusion of such liability, Fat Prophets hereby limits its liability, to the extent permitted by law, to the resupply of the said information or the cost of the said resupply.

Funds Management – In addition to the listed funds FPC, FPP and FATP, Fat Prophets Pty Ltd manages the separately managed accounts, namely Concentrated Australian Shares, Australian Shares Income, Small Midcap, Global Opportunities, Mining & resources, Asian Share, European Share and North American Share. These SMAs are managed under their own mandates by the fund managers, and this is independent to the research reports.

Staff trading – Fat Prophets Pty Ltd, its directors, employees and associates of Fat Prophets may hold interests in many ASX-listed Australian companies which may or may not be mentioned or recommended in the Fat Prophets newsletter. These positions may change at any time, without notice. To manage the conflict between personal dealing and newsletter recommendations the directors, employees, and associates of Fat Prophets Pty Ltd cannot knowingly trade in a stock 48 hours either side of a buy or sell recommendation being made in the Fat Prophets newsletter. Staff trades are pre-approved by an appointed staff trading compliance officer to ensure compliance with the staff trading policy.

For positions that directors and/or associates of the Fat Prophets group of companies currently hold in, please click here.