AI has been a theme that has driven markets in 2025, and notably in the US and China, where tech dominates both stock markets. One concern amongst investors has been the huge amounts of CAPEX invested in recent years on a massive infrastructure buildout. The question that many are quite rightly asking is whether all this investment will pay off.

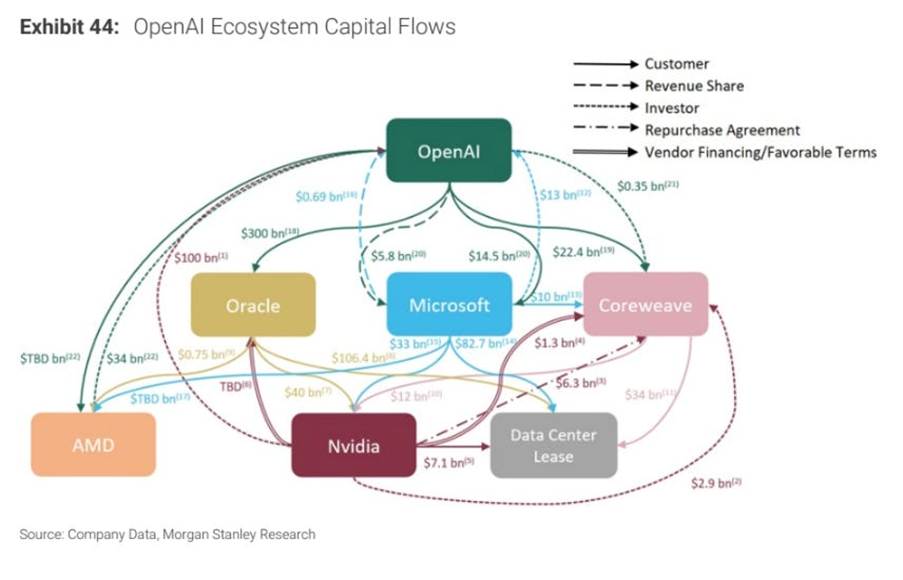

There is still a healthy amount of scepticism amongst many investors, not to mention in the media and business press, which has become preoccupied with the dotcom bubble of 25 years ago and whether there are distinct parallels. OpenAI alone has announced a huge web of deals this year with the largest players in tech, announcing big partnerships with Oracle, Nvidia and AMD. The AI startup OpenAI is doubling down on investments in chips and data centres to support its fast-growing infrastructure. The circular relationship of many of these deals is similar to what occurred in the late 1990s, which is worrying to some.

Morgan Stanley this week put out some insightful research and believes that strong productivity and efficiency gains will become ubiquitously manifested in the economy by 2028. This contrasts with the Dotcom era, which took a decade or more before really impacting the economy. In an October 13 note to investors, Morgan Stanley global director of research Katy Huberty shared a chart on AI tech spending diffusion. The graph below shows a group of highly connected tech companies with a lot of capital flowing either through or from OpenAI.

Source: Morgan Stanley

Morgan Stanley’s tech team believes the AI spending cycle is still in its early stages, but the huge price tag shouldn’t necessarily worry investors. “Our team believes the sustainability of the current investment cycle ultimately depends on whether AI generates durable cash flows to support returns on the significant capital being committed.” Morgan Stanley’s bottom-up analysis suggests the AI boom will deliver, and forecast US$1.1 trillion in AI software revenue in 2028 at typical software margins.

Morgan Stanley’s forecast implies the current wave of AI spending is part of a longer-term profit cycle and not a speculative bubble that many are worried is beginning to manifest. MS believes that if their revenue targets prove correct, the AI boom will continue to drive growth for companies that are heavily investing in the space today. What is interesting is that during the dotcom era, few understood how the economy was going to change and how long it would actually take.

As history turned out, the dotcom boom took much longer to deliver – and along the way, many startups collapsed and did not make it to the finish line. Meanwhile, as the internet developed along with e-commerce, many “old brick” industries and notably newspapers, failed to see the disruption that would come. These businesses, in many instances, were decimated by the arrival and development of e-commerce and saw revenues plummet sharply.

For example, many companies like Cisco (one of the dotcom leaders) fell by the wayside and underperformed for decades. It has taken 25 years for Cisco to fully recover from the dotcom crash – and the shares are still below the 1999 highs.

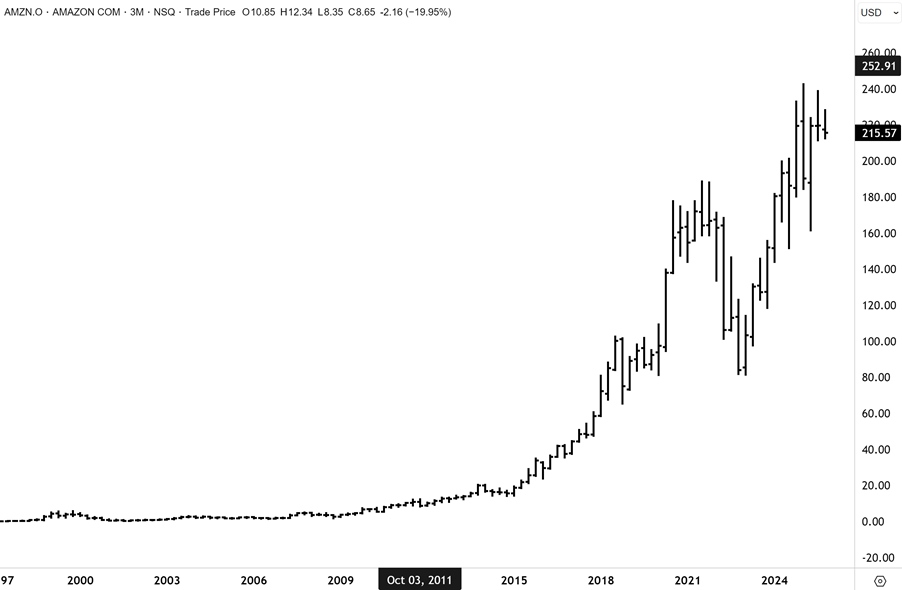

On the other hand, no one saw Amazon coming (at the time, primarily an online bookseller), which emerged to dominate e-commerce retail, and later on in cloud computing. Amazon went on to become one of the most highly valued companies in the world, returning huge returns to shareholders. I do not doubt that the current boom in AI will produce a similar disarray and set of outcomes in the decade ahead.

I don’t believe some of the negative forecasts from firms such as Morningstar that the huge AI capex amongst tech companies such as Amazon, Microsoft, and Alphabet could negatively impact their stock prices over time. All these companies have established businesses and are funding capex out of cash flow and not debt or new equity issuance.

In addition, these companies likely have better clarity over how this capex will benefit revenues, earnings and overall productivity and efficiency. Finally, the AI era is likely to deliver these gains much faster, as per Morgan Stanley’s research highlights. Whilst I would not rule out volatility and steep corrections on the way, many industries and sectors are going to be greatly disrupted in the years to come.

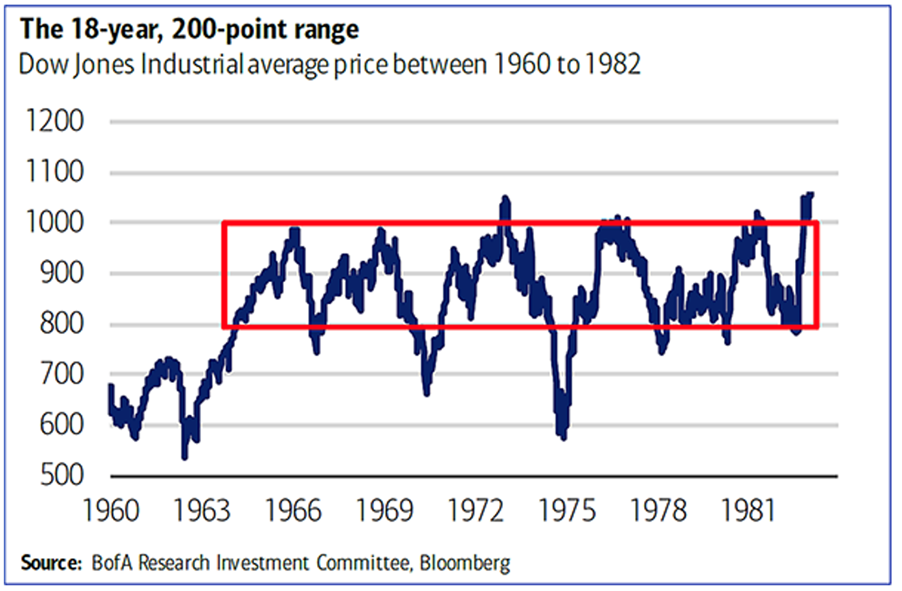

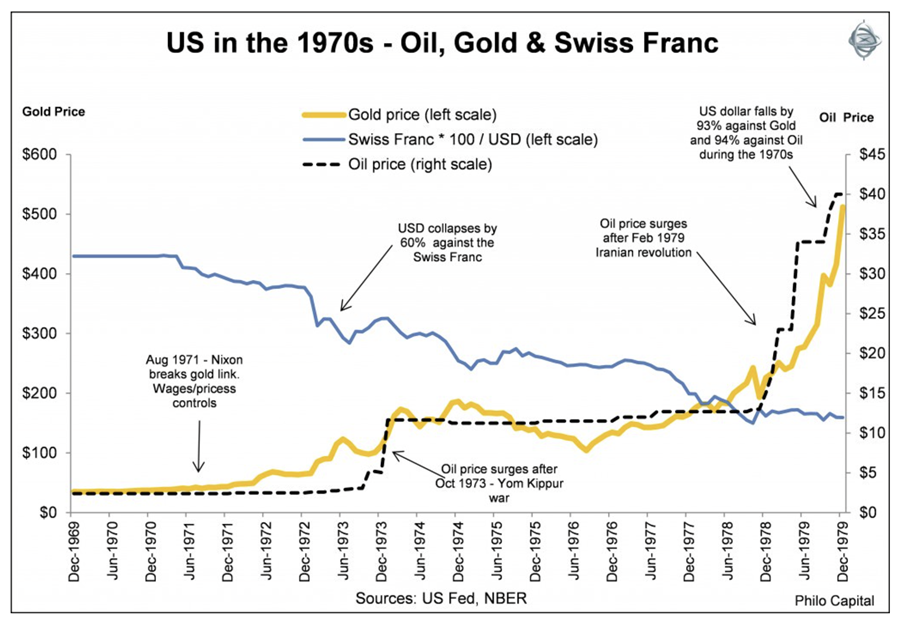

Turning to gold, the record-breaking run this year has left many “deeply perplexed” as to exactly why. Citadel’s Ken Griffin described the big run in gold as being troubling, while Dr Marc Faber said it was a ‘harbinger of bad times to come’. I have discussed the immediate and obvious drivers many times in recent years, and yesterday, highlighted a wholesale consternation of deep capital pockets, including nations and central bank reserves towards fiat currencies (not just the US dollar) and other financial assets, notably bonds. We saw a similar cycle play out in the 1970s, which I believe is repeating.

Morgan Stanley’s CIO Lisa Shallet this week discussed gold’s run and noted that “gold’s continued material outperformance, alongside the broadening of the US equity bull market, has investors scratching their heads. The two assets, both of which hit an all-time high last week, are typically reasonably negatively correlated—with gold strength associated with economic fear, investors’ desire for a “safe haven” and hedging against inflation, geopolitical adversity and US dollar weakness. While these are all plausible, we are not sure they fully explain current dynamics.”

I would also add that during the 1970s, at times, gold and equities were highly correlated, with both asset classes outperforming at the same time periodically during that decade. The 1970s were characterised by high inflation – and a deep distrust of government bonds (given high deficits and rising national indebtedness). Equities were also seen as a decent hedge against inflation, given the pricing power that came along side. Many companies were able to put their prices up faster than inflation and therefore benefited from positive operating leverage. Of course, two deep recessions during that decade also weighed on the stock market, but by the end of the 1970s, most benchmarks, including the Dow Jones, finished near the record highs.

The greatest financial market casualty in the 1970s was indeed the bond market. Governments could not reign in spending, and debt climbed. Bond issuance went through the roof, and all fiat currencies weakened relatively against one another, and prominently against real asset prices and, of course, gold. Those investors holding long-duration government bonds at the beginning of the 1970s were crushed by the decade that would follow and the high rates of inflation. Equities, on the other hand, fared much better and would go on to deliver very strong returns when, in the 1980s, inflation eventually came back under control.

The “word is not necessarily the government’s bond”. Bonds harshly underperformed all other asset classes during the 1970s. I hold high conviction that US bonds – and other sovereign government debt – are in a long-term secular bear market, akin to what occurred during the 1970s.

I believe a similar cycle is playing out in the bond market today. Despite the fact that bond yields are relatively well-behaved and contained today, the second leg of a secular bear market might soon get underway next year. I believe that precious metals reflect this cycle, and that other commodities and real assets will also benefit over the coming years in a similar way.

Lisa Shallett said this week that “the US economy is still exhibiting resilience, investors do not appear to be positioning for risks, and gold has decoupled from inflation breakevens. And as the dollar has declined 13% since late 2022, the

precious metal is up nearly 2.5 times. So, what’s going on? While gold may reflect risk premiums not visible elsewhere, it may also signify a secular growth story of its own. Beyond the “debasement trade,” we believe its behaviour may be part of a broader global rebalancing, reflecting not only reserve de-dollarization but a coming currency market transformation driven by stablecoins and cryptocurrencies. As a result, the equity and gold bull markets can continue simultaneously, but with cross-asset allocations so high, diversification and security selection grow more important.”

This was a pertinent analysis in my view. Lisa Shallet is one of the few fund managers who seems to grasp that this cycle is very different – and could coincide with higher real asset prices, which can perform alongside equities.

The CIO said that investors need to “consider squaring portfolios to strategic asset

allocations, with a focus on asset class diversification. Real assets, municipal bonds, intermediate US Treasuries, real estate and select private infrastructure are opportunities to add.” She has for some time been an advocate of gold. I think this is the right approach as it relates to real assets and property (which did well in the 1970s due to surging replacement costs), but would be avoiding medium to longer dated bonds – at the government and municipal level – like the plague!

Giddy up

Whilst equity markets are likely to face a correction in the coming weeks, it is worth looking at where the opportunities are going to emerge. I have been a bull on Japanese equities for some time and still see a very favourable risk/reward skew, despite near-term uncertainty on the political landscape. There is a lot to be bullish about in Japan.

The fundamental framework in the economy has gone through a big transition over the past decade, culminating in significant and ongoing corporate reforms. This has become a major contributor to sustained growth in the Japanese equity market, which stands out in my view, from other, more expensive markets. I believe that corporate reforms in Japan have entered a self-sustaining phase and see further potential for the return on equity of Japanese companies to rise further towards 12% in the coming years. This could underpin a further rise in the Nikkei, and possibly justify 60,000 at the index level within the next two years.

Japan began to reform the corporate sector across the economy just two years ago, back in 2023. There has been a big shift in not just the mindset of company managements but also their active approach to capital management, where shareholders are being treated completely differently than at any other time in corporate history.

This movement paradigm shift really commenced and gained momentum when Warren Buffett’s Berkshire Hathaway made significant investments in five of the major trading companies back in 2020. These reforms are likely to continue – and this will lift returns to shareholders. Given any corrective weakness in the coming weeks (or months), I would single out Japan (and China/Hong Kong) as fertile hunting grounds for investment opportunities.

We have focused on the banks, but also other companies, including Mitsubishi Heavy Industries, Sony, Nintendo and of course the banks and financials. The banks have taken a lead in the stock market due to the BOJ normalising monetary policy, but they also have benefited from corporate reforms. Many of the banks have reduced or eliminated cross-shareholdings and are now boosting capital returns to shareholders through increasing dividends and buybacks. This trend will only continue.

One major bank we own that suffered a ‘near death’ experience in the 1990s is Mizuho Financial Group. Today, the bank is one of the strongest and, for the first time last year, commenced an aggressive buyback program, which will continue. I met with senior Mizuho execs earlier this year at our offices in Sydney.

Mizuho Financial Group reported a solid increase in profit for the first quarter of fiscal year 2025, with profit rising to about $1.93 billion, a 1.2% increase over the previous year. The company raised its full-year profit outlook by 15% to a record JPY1.02 trillion ($6.77 billion), citing solid Q1 results and expectations for future business upside. Mizuho guided higher earnings based on confidence in continued earnings growth amid a stable domestic lending environment and reduced uncertainty in global conditions.

Mizuho has aggressively ramped up its share buyback initiatives in recent years as part of a dual strategy to optimise capital efficiency but also enhance shareholder value. The group’s most substantial buyback occurred in May 2025, where 40 million shares were authorised to be bought back, which is approximately 1.6% of outstanding shares, for around $1 billion. These buybacks are likely to continue. Amongst other Japanese banks we hold, Mizuho is one I would consider in the event of a market pullback – along with other majors, including Sumitomo Mitsui Financial Group and Mitsubishi UFJ, along with some of the regionals.

Mizuho has increased around threefold since first buying several years ago, but the shares are still well down from the 2006/7 highs of around Y11,000. The resistance cluster above ¥5000 is presently being tested, but I have conviction this will be cleared in the coming months and that Mizuho will then have ample scope for a sustained recovery towards the 2007 highs over the coming years.

Another market I like is China/Hong Kong. If any weakness ensues in the coming weeks, I would be looking to this market also for opportunities. One sector that stands out is the Macau gaming and casino operators. Macau gaming companies were knocked for a six during the pandemic, but revenues have since recovered and are almost back at peak levels. I see this trend continuing, particularly given that China’s economic recovery is continuing and consumers are spending again. But for the typhoon, the Macau casino sector would have almost reported record revenues during the recent Golden Week holiday.

JP Morgan noted recently in an update on the sector that “Macau just can’t catch a break, and when it rains, it pours. After typhoon disruptions in September, October Golden Week numbers are coming in soft, and the upcoming earnings season until November looks to be uninspiring. We’re not throwing in the towel, however: we see these as speedbumps, not roadblocks, and still see significant value even as we trim estimates.” I concur with these comments and conclusions, and we positioned earlier this year in a number of the Macau gaming companies, including Sands China, MGM China and Wynn Macau.

Patience needs to be exercised here – and I believe investors need to have at least a one-year view. However, a broad-based recovery potentially awaits the sector. The big stock market rally in China has given consumers confidence once again, and they are returning to Macau with gusto. There is significant operating leverage within the sector towards an improving Chinese economy. This trend is likely to continue. Meanwhile, the sector is very cheap by historical measures, and operators such as Wynn Macau pay a dividend of around 5%. JPM analysts believe that Wynn could surprise to the upside with EBITDA of around US$285-290m, implying mid-teens growth quarter over quarter.

Wynn Macau was dragged down in the China/Hong Kong bear market, which endured for five years, and was very severe. The shares have now bottomed out in my view and are close to confirming an important inflection. Looking past any weakness over the coming weeks and months, the recovery potential for Wynn Macau is significant in my view. Macau is not just about gambling; it is China’s preeminent entertainment precinct, and it attracts tourists from the mainland and abroad.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.