Good morning,

The rally in US stocks reasserted on Friday, with breadth improving considerably despite the disappointing first round of earnings from some of the major banks. About 80% of S&P500 constituents gained on Friday, while the Russell Small/Mid-cap index lifted over 1%. Bonds were firmer, with yields edging lower. The assassination attempt will dominate the media waves this week in terms of how it will impact the election in November. The consensus view is that Trump’s election chances might have improved.

One highlight from Friday was the weakness in the US dollar. The US dollar index broke below the uptrend in place since December ’23 and the key support level at 105. The 104 level now comes into focus as US yields moved decisively lower on Friday.

Source: Thomson Reuters

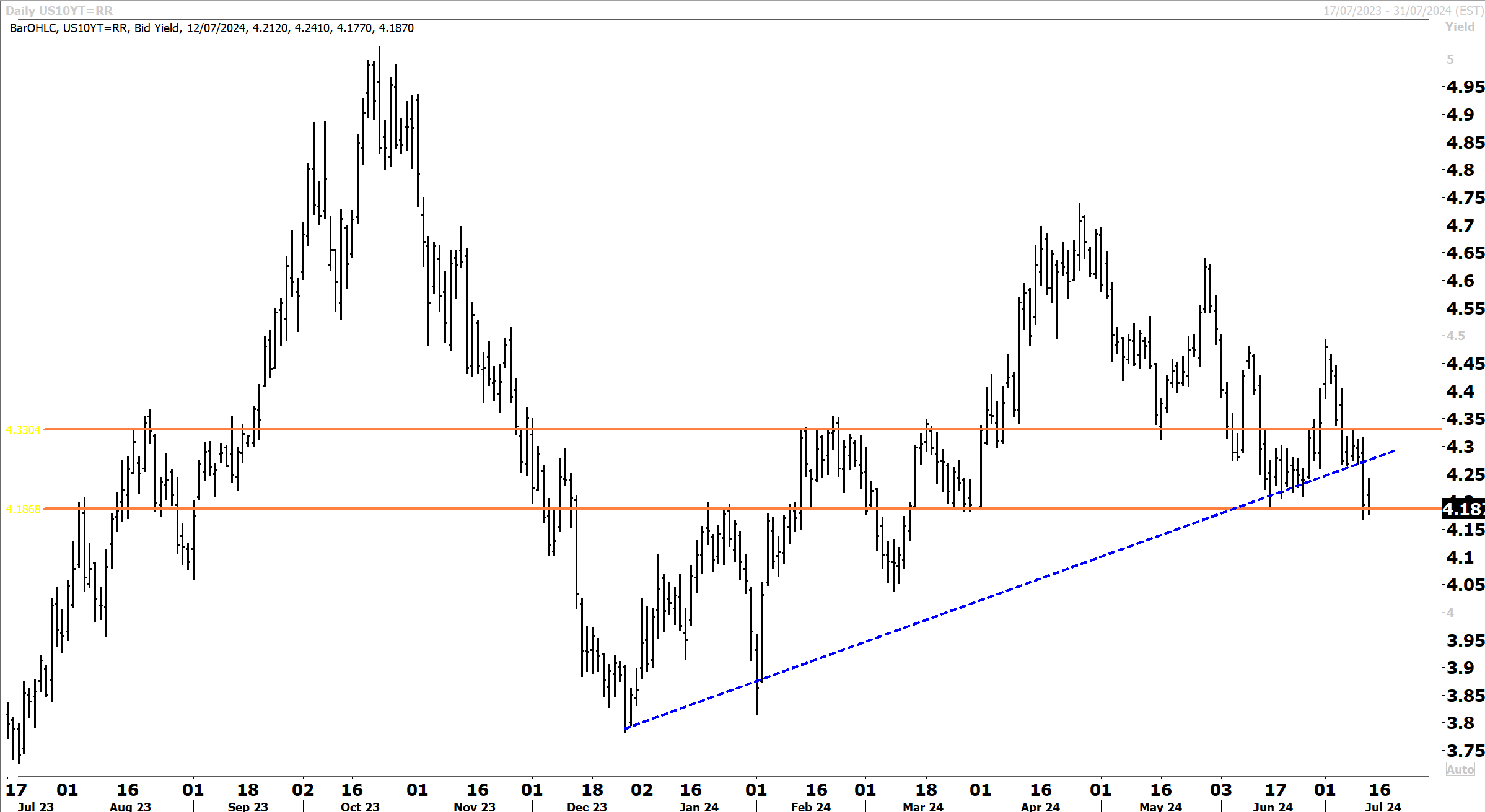

The yield on the US 10yr declined close to 3 bps Friday while the 2yr was lower by over 6 bps to 4.45% with the spread now the narrowest in over a year. US rate differentials are clearly narrowing with the rest of the world, which could weigh on the greenback in the coming months as the Fed prepares to commence easing. Similar to the US dollar index, the 10-year has broken the uptrend in place since December to now test the key level at 4.18%. The technical setup favours a downside break and a move lower into the 3.75%/4% range – which is my base case.

Source: Thomson Reuters

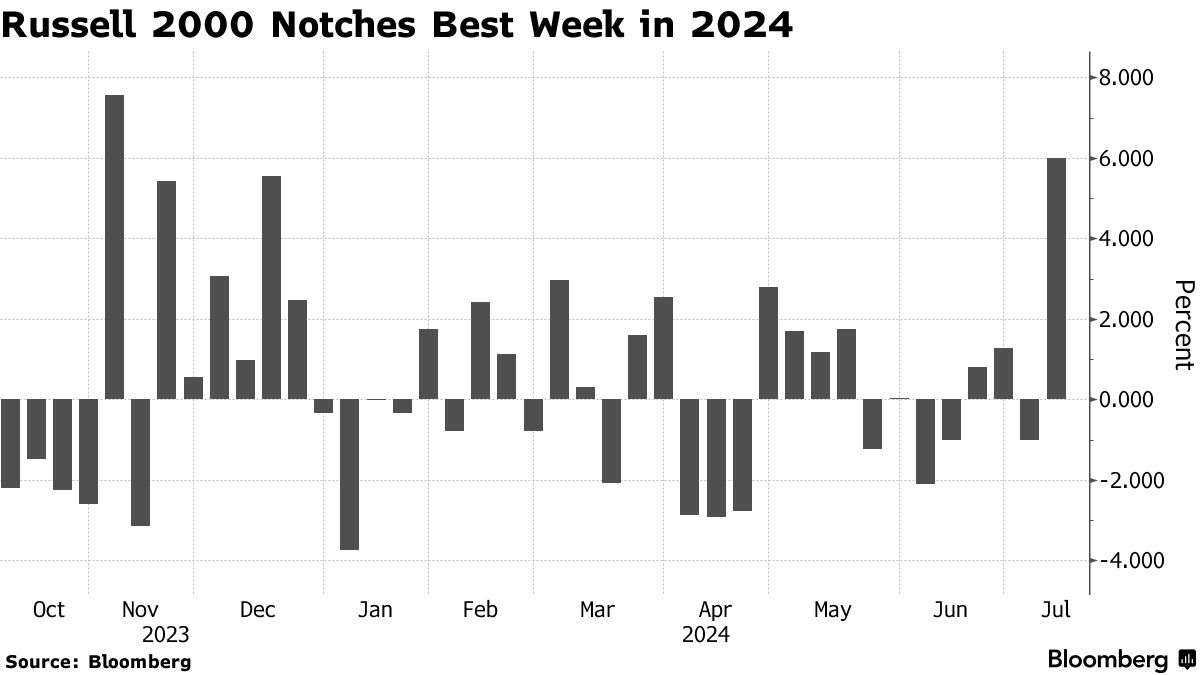

In terms of the rally in US equities, it has been encouraging to see breadth improve significantly. The Russell 2000 had its best week this year. If rates continue to move lower, we can expect further improvement in the index. The Fed is potentially entering a new phase of putting in pre-emptive rate cuts with inflation falling quickly back towards target.

The US stock market could move higher with some of the laggard benchmarks doing better as the coming rate cuts de-risk the forward growth outlook. Provided the Fed does not move too slowly to arrest underlying economic weakness, the rate cuts that are likely to be delivered favours further improvement in market breadth, cyclicals and also commodities with the dollar likely to have another leg lower.

The rotational move underway is also likely to have legs after tech stocks dominated for the past several years. The Russell 2000 is an important barometer of potential interest-rate easing, but also a gauge for economic conditions. Historically, the Russell 2000 has lagged the broader market in previous rate cutting cycles.

Friday’s breakout in the Russell 2000 has bullish connotations for the broader market. The advance on Friday above key resistance (which has capped the index for the past 2½ years) is bullish for the broader market and points to topside extension in the months ahead.

Source: Thomson Reuters

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.