Opinion on Wall Street is almost unanimous that investors “buy the dip” in the event of any selloff ensuing over the coming weeks. I always get a bit nervous when markets become one-sided, but a lot of liquidity seems to be sidelined and ready for a correction should it emerge. JP Morgan’s trading desk said in a note to clients that the Fed’s next move threatens to curb investor enthusiasm and could be a “sell the news event.”

Trading head Andrew Tyler noted that the “current bull market feels unstoppable with new support forming as former tent poles weaken. If the Fed follows through on a widely expected interest-rate cut next week, that could turn into a ‘sell the news’ event as investors pullback.” JP Morgan’s trading desk maintained their lower conviction tactical bullish call while pointing to several risk factors, including inflation, employment and the trade war, in a note on Monday. JPM also flagged that retail investors typically scale back participation in September, while “less corporates have been buying back their own shares”.

Andrew Tyler makes a fair point in having concerns around the upcoming FOMC meeting and said that “the consumer-price index reading on Thursday is unlikely to stop the Fed from cutting rates, commentary from public and private companies on inflation indicate there is more tariff-induced cost passthrough on the horizon, the speed and magnitude of which are unknown. Additionally, rate cuts could spur labor demand and in turn trigger wage inflation, which is typically “sticky.”

However, so far this month, the usual seasonal weakness in equity markets has been notably absent. JPM believes that given the heightened risks, “we like long volatility and investors should consider boosting gold exposure as rate cut expectations weaken the US dollar.” This has been my view for some time, and I see the US dollar as being at a key crossroads and a more important event for financial markets this month than a correction in equities if it plays out.

The US dollar index is at an important crossroads, with historical support being tested. A downward break below 97 could usher in a new phase of weakness in the DXY.

Given that investors have become almost unanimous in their outlook for future rate cuts, any short-term pushback from the Fed or elevated inflation print could precipitate an upward gyration in bond yields. The stock market would likely react negatively. Given the bases are fully loaded in terms of expectations around Fed rate cuts, we could well find that the stock market sells off following Jerome Powell’s press conference next Wednesday.

Head strategist at UBS Global Wealth Management, Mark Haefele, said there’s little to prevent the Fed from cutting rates this month and “that would likely kick-start a run of 100 basis points in reductions over the next four meetings, from September to January. Any market pullbacks would likely present buying opportunities, in our view. Against this backdrop, we continue to recommend high-quality fixed income, where investors can lock in yields above those available on cash and benefit from potential capital gains if policy becomes more accommodative.”

Goldman Sachs macro head trader Paolo Schiavone said that “tactically, I am a buyer of the September equity dip. I expect SPX 6700–6900, when the market embraces the narrative that rate cuts fuel re-acceleration.” Mr Schiavone raised some concerns “about a new regime of fiscal dominance with central banks losing independence, pushing the rates front end and raising stagflation risks.”

Finally, Morgan Stanley’s Chief Investment Officer Mike Wilson wrote yesterday, “the weak jobs report supports our view that we’re transitioning to early cycle – from rolling recession to rolling recovery. Near-term risk is tied to whether the monetary policy response is significant enough. Potential choppiness in the short-term should set up a strong finish into both YE & 2026.”

Mike Wilson also believes that a rapid rise in the unemployment rate and or significantly negative payroll numbers is coming unless there is another shock to the economy. “We think the V-shaped rebound in earnings revisions breadth supports our view as it shows that corporate confidence has improved materially since Liberation Day…we’ve only seen these types of inflections higher in earnings revisions breadth when we’ve been in early cycle transitions (i.e., after recessions, not before)”.

This is a great point, and with US earnings amongst the majority of S&P500 (barring Mag 7) recovering from a downturn, the foundations are set for a solid rally and a broadening of the bull market over the next twelve months. The US homebuilders, including James Hardie, are setting up for a strong cyclical recovery in earnings next year.

But Morgan Stanley also holds some concerns around next week’s FOMC, noting that “with the Fed still focused on the potential for inflation and the labour data weak but not ‘bad enough,” there are questions in terms of just how much the Fed can cut in the near term. These dynamics could lead to choppy price action during a weak seasonal window in September/October…However, we think any associated consolidation in equities would set up a strong finish to the year and 2026 given our conviction for a durable and broad earnings recovery.”

The bottom line is there is no room for disappointment next week. The Fed will deliver a cut in my view, but there could be some uncertainty around the future path of easing, which could push out further into next year. An elevated inflation print on Wednesday could prove to be disruptive to the current easing narrative now priced in by the market. We therefore could well see a “sell the news” outcome following next week’s Fed press conference. However, any corrective selloff will likely prove shallow and short given the amount of liquidity and cash on the sidelines that is positioned to “buy the dip”.

Circling Bears

Yesterday I discussed the US dollar index and the fact that a primary trendline in place since the end of the last bear market in 2011, now looks vulnerable. The direction of the dollar is important for financial markets and exerts a strong influence on commodities, gold and emerging markets in particular. As the dollar has weakened in recent months, gold has made new record highs, while emerging markets have performed strongly. China’s CSI300 is up circa +30% since the April lows, while commodities including iron ore and LME copper have also risen.

The bears are circling the greenback. The US dollar index continues to look vulnerable, with the primary uptrend since 2008 now being put to the test.

We have held a high conviction view that the dollar will weaken this year and possibly, a lot further into next year. But what will be the catalysts? An erosion of Fed independence and isolationist trade and foreign policies from the White House stand out. A deterioration in the US fiscal situation has also undermined the dollar. Technically, the dollar index also looks vulnerable as overbought conditions that occurred around the highs above 110 unwind.

We might also see other major currencies fare a lot better. On this front, the yen looks set to rally following the resignation of the Prime Minister and as the Bank of Japan prepares to hike rates that would narrow rate differentials even further with the US. The yen has been weak versus the dollar as the BOJ have delayed rate hikes, but this looks increasingly probable in the months ahead.

Technically, the dollar/yen is testing support at the uptrend, after tracing out a series of lower highs. The technical setup on the chart below points to dollar/yen vulnerability, and a potential retest of the big support level at 140 by December.

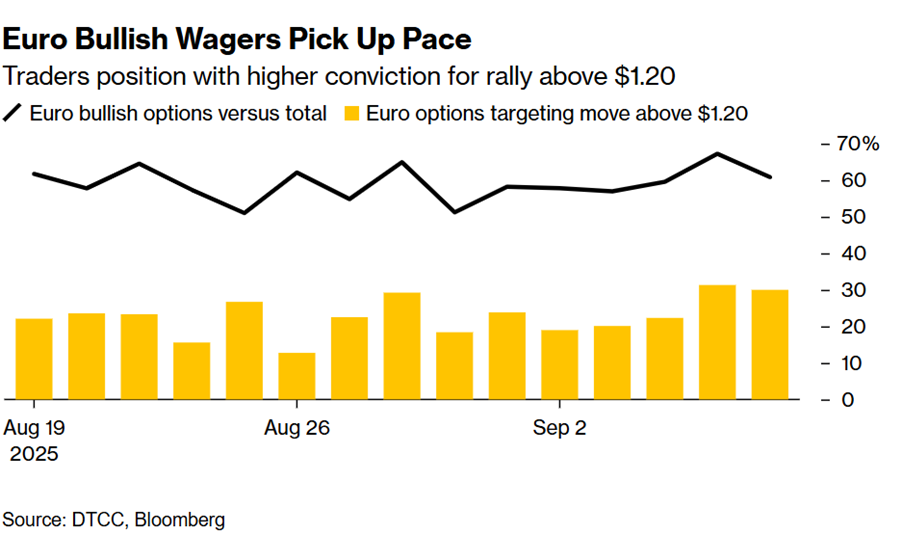

The euro also looks to be on the cusp of surging higher following a shakeout in French politics. I think the next move for the euro is for upside extension towards the $1.20 level as markets factor in a pause by the European Central Bank in cutting rates and as the Fed commences an aggressive easing cycle. Rate differentials are about to narrow between Europe and the US.

The next key resistance level for the euro is $1.18, where, according to currency strategists at Societe Generale, many stop-loss triggers are clustered that could precipitate further gains.

The weaker US non-farm payrolls data last week and downward revision of the number of jobs being added also could help the euro’s advance. The ECB has paused on cutting rates, with markets now pricing only a 30% probability of further easing in December. Meanwhile, with the US unemployment rate at the highest level since 2021, the chances for significant rate cuts in the US have grown in recent weeks.

One currency strategist I rate is George Saravelos, global head of FX research at Deutsche Bank, who has called the rolling dollar bear market well this year. Mr Saravelos believes “that underlying cyclical support for the dollar has deteriorated, reflected in a material narrowing in the EUR–US rate differential, which is now consistent with a financial fair value in EUR/USD in the 1.18-1.20 range. It is stating the obvious that additional Fed cuts from here would increase incentives to hedge dollar assets by foreign investors.”

I believe this move is well underway and that it is only a matter of time before the euro breaks out and extends higher against the dollar. The euro exited a seventeen-year bear market on the charts in April this year when the White House announced tariffs on Liberation Day. The breakout above the primary downtrend looks conclusive in my view, with the euro now having significant scope for a recovery.

What has been encouraging in terms of this week’s price action is that the euro has managed to shrug off French political risks and the resignation of Prime Minister François Bayrou, who lost a confidence vote in parliament. France might yet have to confront credit ratings downgrades after Bayrou’s fall, due to his political move to address fiscal indebtedness being thrown out by parliament. However, a full-blown crisis still looks unlikely at this stage, given that France has close to a near-balanced current account.

On a YTD chart, the euro has managed to hold above the breakout at the near-term trendline. The technical setup favours a retest of overhead resistance at $1.18. If this level can be hurdled, the euro could quickly rally to $1.20 on stop loss covering with scope open over the medium term for upside extension to the next significant resistance cluster near $1.30.

I am not the only one who has singled out the risks posed to the US dollar from incumbent policy settings in Washington. Billionaire hedge fund manager Kenneth Griffin said this week that DJT’s attacks on economic institutions risk prolonging higher inflation and weakening investor confidence in the country’s assets. Mr Griffin is the founder and CEO of the $US66 billion hedge fund Citadel, which has a formidable track record.

Mr Griffin has sounded the alarm over the Trump Administration’s undermining of the Federal Reserve board over rate cuts, attempting to fire Fed official Lisa Cook, and sacking the BLS statistics boss. In an opinion article in the Wall Street Journal, Mr Griffin wrote that “together, these developments highlight risks that recall experiences in emerging markets where political influence eroded institutional credibility. While the US benefits from a large stock of credibility accumulated over decades, it isn’t limitless. If eroded, markets will demand far higher interest rates for longer-term debt.”

Fair point, and one that I have repeatedly warned about, along with the vulnerable medium to longer-term technical setup for the US bond market. I have held a high conviction view that US and global bonds are now within a secular bear market where long-dated yields could rise significantly in the years ahead.

Mr Ken Griffin

Ken Griffin is a long-time Republican donor and was a staunch supporter of President Trump before last year’s election. Following Trump’s win last year, Mr Griffin stated that the US was “open for business again”. His opinion in the WSJ, therefore, represents a reprimand of the Trump administration.

Mr Griffin went on to highlight that “elevated long-term interest rates reflect growing market doubts about the stability of inflation and the sustainability of public finances. Without resolution, the government will pay more to finance deficits, young families will struggle to afford homes, and companies will invest less.” The hedge fund manager clearly sees harder times ahead for the US government with an increasing cost of servicing the now massive +$37 trillion plus in federal debt.

The meddling we have seen in US politics with independence at the Fed has not been seen on this scale since the 1970s. I have mentioned that President Nixon exerted pressure on the Fed and Chair Arthur Burns in the early 1970s to lower rates, which he did. What followed was a resurgent and prolonged spike of inflation. Some economists believe that the current interference going on at the Fed dwarfs the pressure from Nixon’s White House in the 1970s.

Mr Griffin reinforced this in the WSJ and said that “protecting the Fed’s independence must come alongside other efforts to strengthen the economic foundation of the US, namely reducing government spending, bringing in more highly skilled migrants and modernising permitting for projects. Congress must summon the will to halt the surge in the ratio of debt to gross domestic product while structural reforms – targeted deregulation and investment in human capital – reinforce the effort.” DJT doesn’t have the best track record for listening.

But either way, I see the stage as now being set for pending dollar weakness. A break below the primary trendline could usher in another downward phase. Looking out over the next several years, I also see the dollar remaining within a secular bear market, which could rival the 2000 to 2012 bear market, where the DXY lost 40%.

Morgan Stanley currency strategists updated clients this week and said that “we are not convinced that the dollar’s downtrend has run its course – on the contrary, we think its decline is barely halfway through. We believe that investors should be cautious about dismissing the risks that a shift in Federal Reserve policy poses to the USD. Our US economics team believes the Fed is now more willing to live with the threat of higher inflation. If market rates are guided further lower, while inflation remains stubbornly above target due to a gradual but persistent pass-through of tariffs to consumer prices, real yields would erode, a historical headwind for the dollar.” I mentioned today the risks posed to the dollar of a narrowing in rate differentials. Higher inflation relative to the rest of the world will also impact real rates and returns that will further push investors away from US assets – and dollars.

Morgan Stanley’s baseline view is that “US GDP growth will slow to around 1% by 4Q25 and remain only marginally higher in 2026. These growth rates hardly suggest that US growth will outperform the rest of the world. Friday’s weak labour market report suggests hiring has stalled, highlighting the downside risks to growth. Against this backdrop, the risks of the market pricing more Fed easing are substantial.

Lower rates will undoubtedly motivate further hedging and divestment of USD assets held by foreign investors, which has been ongoing for much of this year. There has been a definitive shift in market behaviour and perceptions that is unlikely to change anytime soon. MS noted that “while the Fed has lowered the bar for cutting, the European Central Bank has raised it and the Bank of England has recently struck a more hawkish tone – a combination that supports USD weakness.”

The bottom line is that in a world of a weakening US dollar, other assets, including gold, precious metals, commodities, and emerging & international equities, are likely to continue doing well. Secular trends rarely come and go in a matter of months and typically endure for many years, and in some cases, decades. While some investors have cautioned on gold and the record highs being sustainable, it is likely the bull market in precious metals has much further to go.

The big Anglo American-Teck mega-merger (discussed further below in the UK section) highlights the forward-facing copper sector, while taking a couple of targets off the board (Anglo and Teck).

Why the big interest in copper?

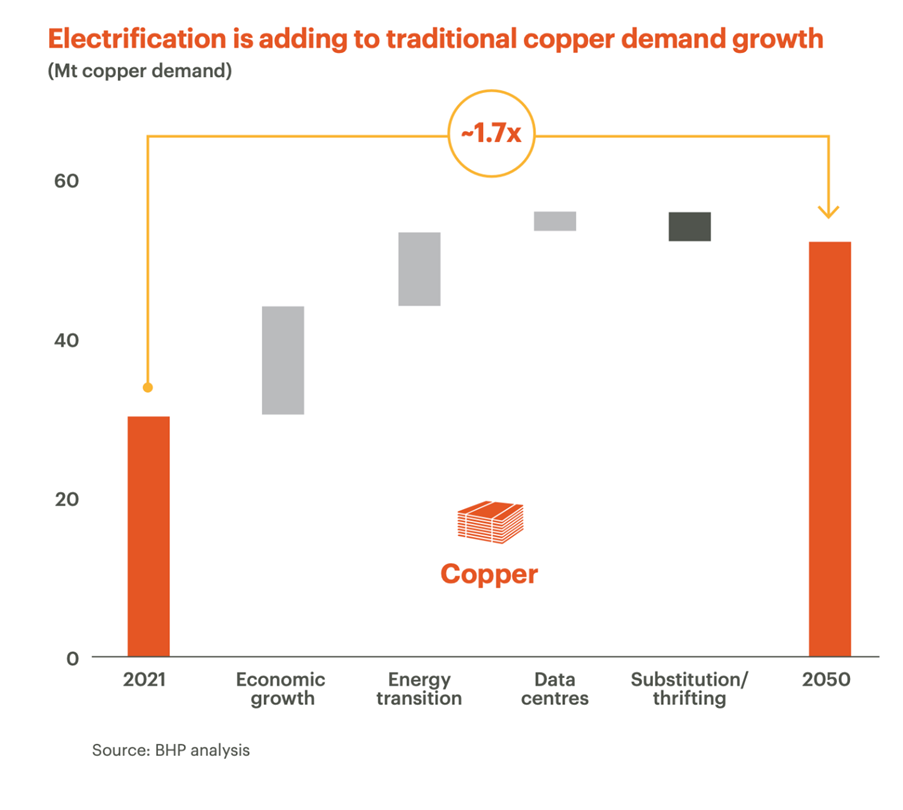

This is all about the looming mismatch between supply and demand for the red metal. A powerful undercurrent is building that points towards a significant structural shift. On the demand side, the engine is not just one megatrend, but a combination of three. The global energy transition, with an appetite for copper in electric vehicles and renewable energy infrastructure, is a primary driver. This is amplified by the explosive growth of the digital economy, where the build-out of data centres requires vast amounts of copper wiring.

Finally, the foundational growth in emerging economies, led by an ascendant India whose per-capita copper consumption is currently just one-eighth of China’s, promises decades of sustained demand for housing, appliances, and infrastructure. Combined, these forces are projected to swell global copper demand from 32 million tonnes today to more than 50 million by 2050.

Source: BHP Economic and Commodity Outlook 2025

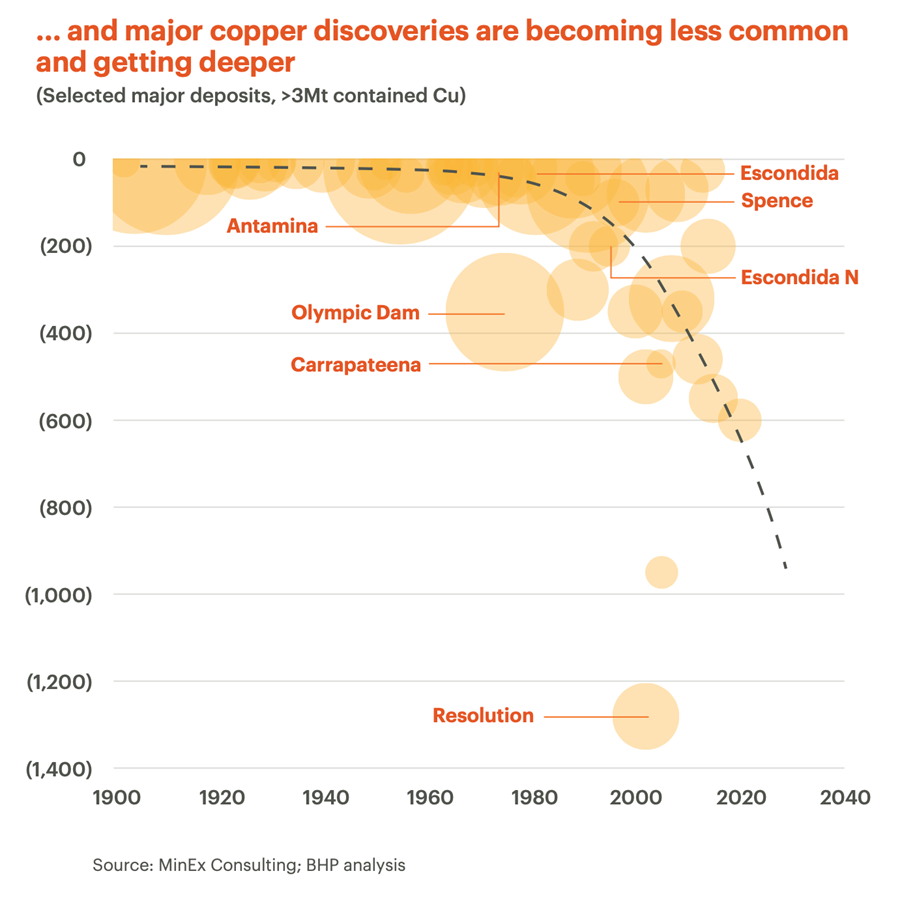

The critical question, however, is where the supply will come from. The stark reality is that the industry is facing a supply-side reckoning. The low-hanging fruit has been picked. New deposits are deeper, of lower grade, and geologically more complex, driving up the cost of extraction. With capital intensity for some key projects soaring by 65% since 2010, the economic hurdle for new investment is high.

With supply from existing and committed mines set to peak in the late 2020s, the market is facing a potential 10-million-tonne supply gap over the next decade alone.

Source: BHP Economic and Commodity Outlook 2025

To prevent a severe deficit, prices will need to rise to levels that can justify the immense investment required to bring new, more challenging projects to life. For investors, this sets the stage for a period of durable outperformance in one of the world’s most essential commodities.

We advocate several miners, including diversified majors like BHP and Rio, along with specialists such as Sandfire, Capstone and 29 Metals. For those looking for a more diversified exposure to the copper theme without specific miner risk, the Global X Copper Miners ETF (ASX: WIRE, US: COPX) is worthy of consideration.

In mid-June, we noted that “WIRE has broken out above near-term resistance at $13, with the corrective selloff from highs above $15 now looking complete. A buying opportunity is opening with copper prices surging back to the highs of earlier this year. If WIRE can sustain the recent breakout (which is our base case), we will have conviction that the ETF can retest and surpass the record highs above $15.50 this year.”

Since breaking out above the resistance flagged back in our June update, WIRE has surged to retest the highs at $16. We anticipate new highs to follow after some consolidation at the resistance level and before a breakout ensues.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.