A good package for the times

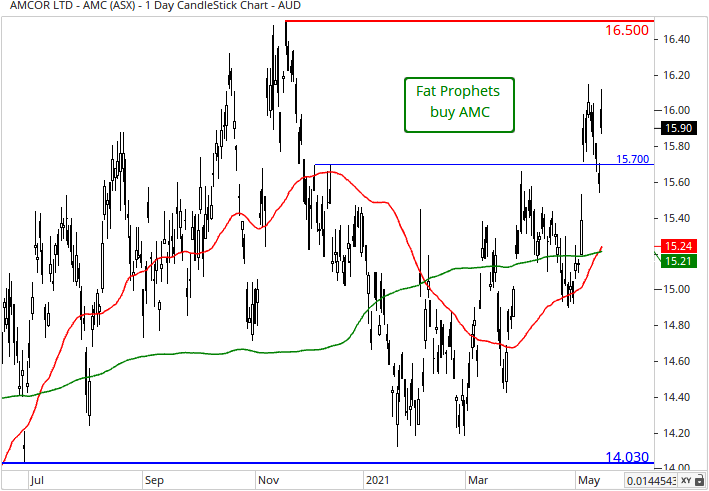

Amcor, the world’s biggest consumer packaging firm, recently reported solid numbers for its nine months update, surprising to the upside and lifting its EPS guidance range for the fiscal year. Amcor also increased its quarterly dividend a tad compared to a year ago and we like its considerable pricing power, with company generally able to pass on raw material cost increases to customers with only a modest delay. We believe this position it well for the inflationary environment we see on the horizon.

9M21 headline numbers – US$ unless otherwise noted

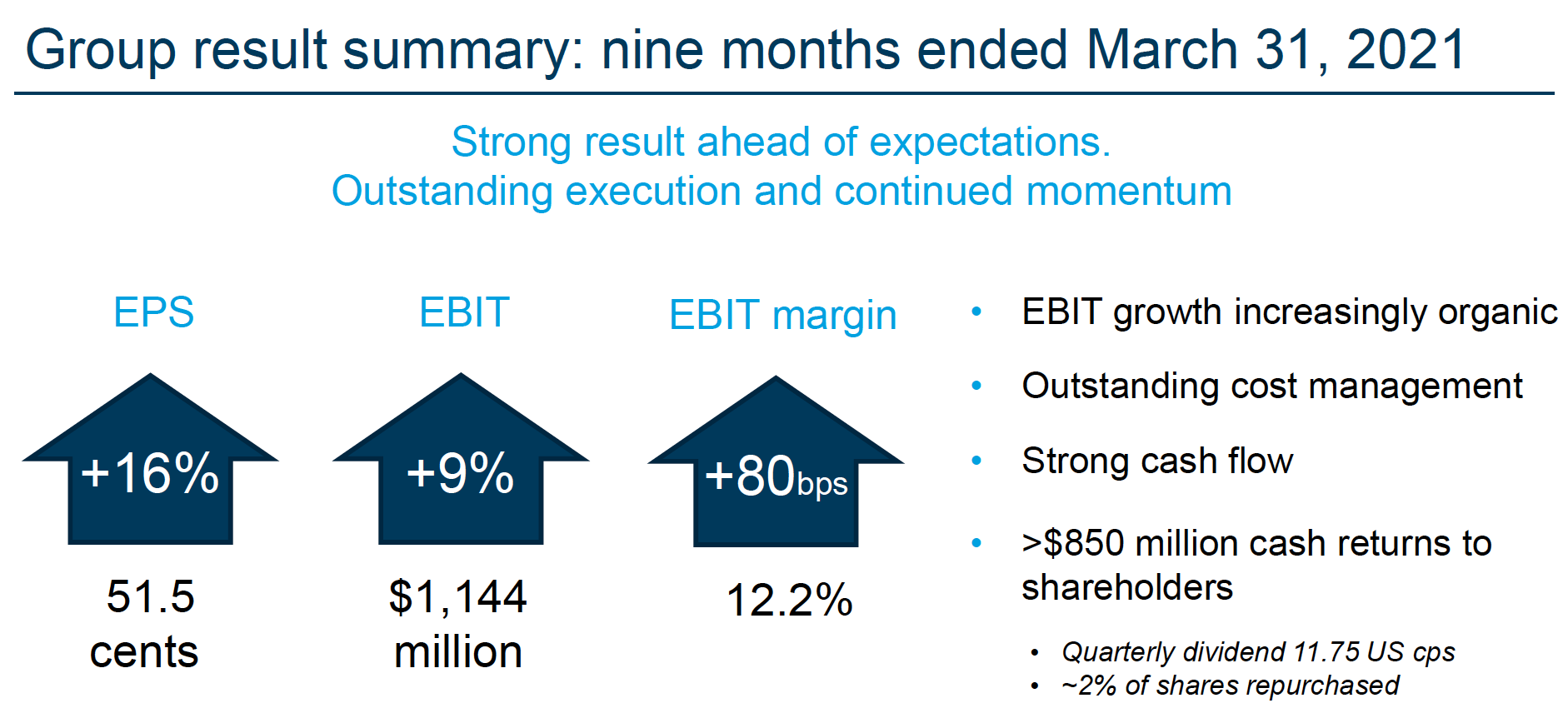

Amcor posted solid results for the nine months ended 31 March 2021. Net sales of $9,407 million were up 1% on a reported basis and by 2% on a comparable constant currency basis. The result was driven by 2% higher volumes with no material impact from price/mix.

Adjusted group EBIT increased 8% in reported terms and by 9% in constant currency terms to $1,144 million as the margin expanded 80 basis points to 12.2%. GAAP net income increased 58% to $684 million, equating to GAAP earnings per share of 43.8 cents, up 63%, with the latter given a helping hand by share repurchases. Amcor repurchased 26.7 million shares (1.7% of outstanding shares) during the nine months period for a total cost of $308 million. Amcor expects to complete its $350 million share buyback of ordinary shares and CDIs in fiscal 2021. Adjusted EPS came in at 51.5 cents, up 16% in comparable constant currency terms.

Source: Amcor

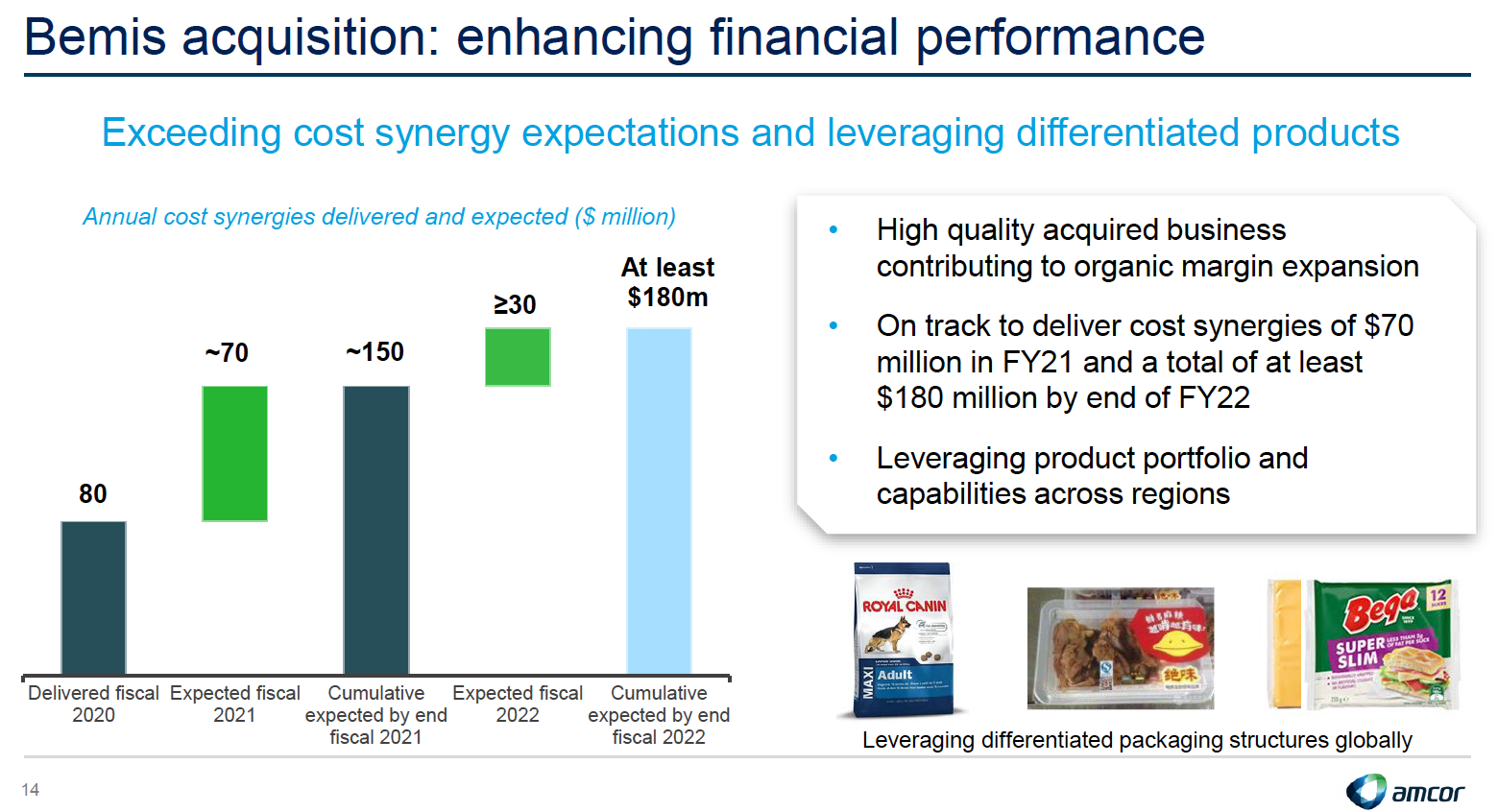

Of that EPS growth 7% was organic, while 6% came from incremental Bemis acquisition synergies, which have hit $55 million to date this fiscal year. Management noted progress continues to run ahead of initial expectations and remains on track to deliver $180 million of synergies by the end of FY22. The remaining 3% of EPS growth was from the share buyback.

Synergies on track

Source: Amcor

The quarterly dividend of 11.75 cents was declared, up a tad from 11.50 cents a year ago. The ex-dividend date is 25 May 2021, with a payment date on 15 June 2021. Holders of CDIs on the Australian Stock Exchange will receive 15.12 Australian cents per share.

Turning to the segments briefly and net sales year to date for the Flexibles segment of $7,350 million were 1% higher than the prior period in reported and comparable constant currency terms, driven by 1% higher volumes. Demand remained relatively broad-based with growth in North America, Latin America and the Asia Pacific regions, while Europe was flat with a year earlier. Notably there was double-digit growth in China and India. There has been growth in a range of end markets, including protein, coffee, cheese and petfood, partially offset by lower healthcare volumes beginning from the June 2020 quarter, with this due to fewer elective surgeries and prescriptions.

Adjusted EBIT for the segment increased 9% in comparable constant currency to $1,005 million, which was helped by 4% organic growth (higher volumes and improved cost management). The other 5% came from synergy benefits linked to the Bemis acquisition. The adjusted EBIT margin improved 1.1 percentage points to 13.7%. Management noted that input cost rises had been manageable.

Year to date net sales in the Rigid Packaging segment of $2,059 million were a smidgen higher on a reported basis compared to $2,047 million a year ago but up roughly 7% on a comparable constant currency basis. Volumes increased 4% with growth in North America and Latin America, while price/mix had a 3% benefit, which included pricing to recoup input cost inflation in Latin America. Beverage volumes in North America were a notable 7% higher and hot fill container volumes were up 13%. Specialty container volumes grew in certain categories such as spirits, personal care and home planning.

Segment adjusted EBIT increased 9%, driven by higher volumes and positive price/mix. The adjusted EBIT margin expanded 50 basis points to 10.1%.

Outlook

Regarding the outlook and the strong results to date have given the company the confidence to lift its EPS growth guidance to a range of 14% to 15%, up from the previous range of 10% to 14%. This followed on from earlier hikes in guidance during the fiscal year.

Summary

Packaging giant Amcor has continued to deliver, as shown by the impressive cost control and earnings performance in the latest quarterly update. Amcor continues to be well placed to cater to trends that were already in place. E-commerce has been accelerated by the pandemic and Amcor will also benefit from the shift to smaller individual portions and premiumisation. Additional synergies and other benefits from the Bemis merger, which is on track, bolster the investment case, as does pricing power and an appealing dividend yield in this low interest rate environment.

We rate Amcor as a buy for Members without exposure.

Disclosure: Interests associated with Fat Prophets hold shares in Amcor