Building profits

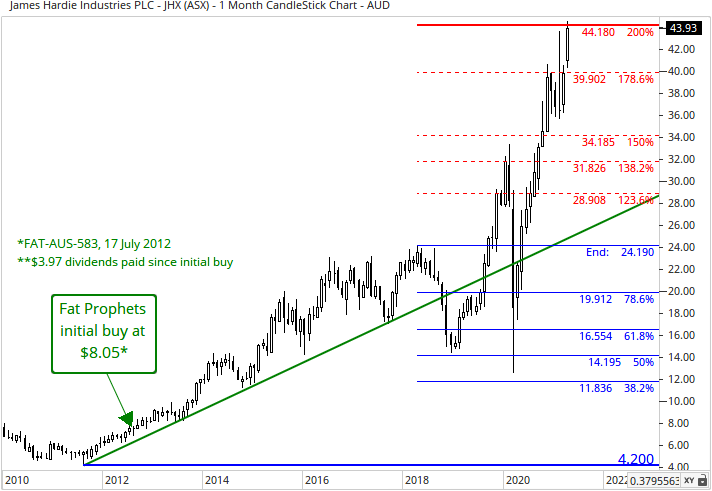

Shares of James Hardie Industries have continued to advance year-to-date, extending the strong rebound after last March’s pandemic induced sell off and hitting fresh new highs. We view the rise as justified as the core US housing market continues to look robust and James Hardie has continued to pick up market share, with more likely to come.

Under CEO Jack Truong, the operational and financial performance has continued to impress, with cost-out manufacturing initiatives combined with strong sales boosting margins. New product initiatives should boost sales further in upcoming years.

Of the major sectors of the US economy, the housing sector has been one of the brightest spots and most resilient amid the pandemic, quickly recovering from the interruption last April. Record low interest rates along with a shift in housing preferences continue to be supportive. Now we have the jobs market staging a strong recovery and huge amounts of stimulus have been pumped into the economy. The rise in housing prices is a risk for new sales but supports the upgrading of existing homes, which also benefits James Hardie sales. There is a huge inventory of aged homes in the US alone.

Positively, for the prospects for a robust housing market over the next couple of years, unlike the previous housing boom, credit scores are high across the board this cycle, reducing risk. Finally, additional government support and possibly more from the central bank for the broader economy is likely on the horizon.

We continue to believe in the quality of the business and the long-term market opportunity for fibre-cement. James Hardie’s fibre-cement product should continue to win market share, with its niche outpacing the broader building materials market. James Hardie has cited fibre-cement’s advantages as being “ more durable than wood and engineered wood, looks and performs better than vinyl, and is more cost effective and quicker to build with than brick.” Positively, with its dominance in the niche, it has strong pricing power (leading to relatively high margins within the industry) and has exhibited this through past cycles.

The Fermacell acquisition has diversified the business and provides a growth platform in Europe, where previously James Hardie has had comparatively little traction.

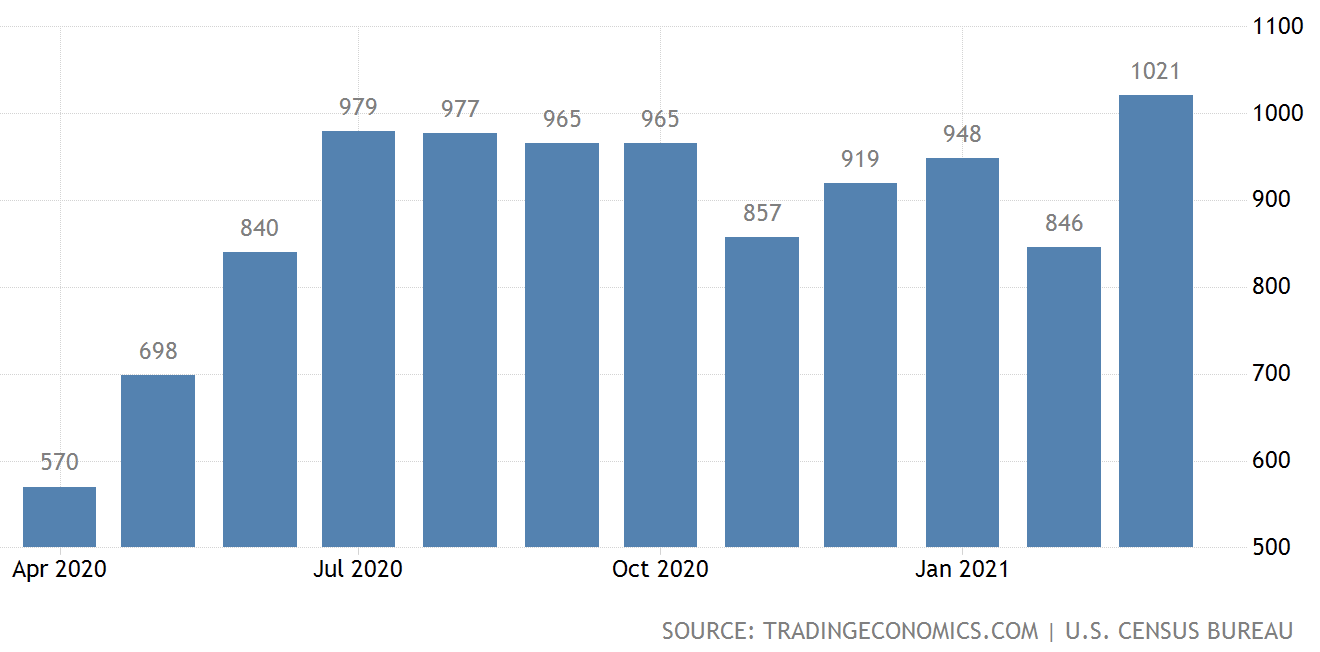

Looking at recent macro data from the US housing market and sales of new single-family homes jumped 20.7% month-on-month to a seasonally adjusted annual rate of 1.021 million in March, coming on the heels of an upwardly revised 846,000 in February and well above economists’ expectations for 886,000. It was the highest reading since August 2006 and a strong rebound after cold weather chilled buying activity in February. There is limited inventory.

New home sales

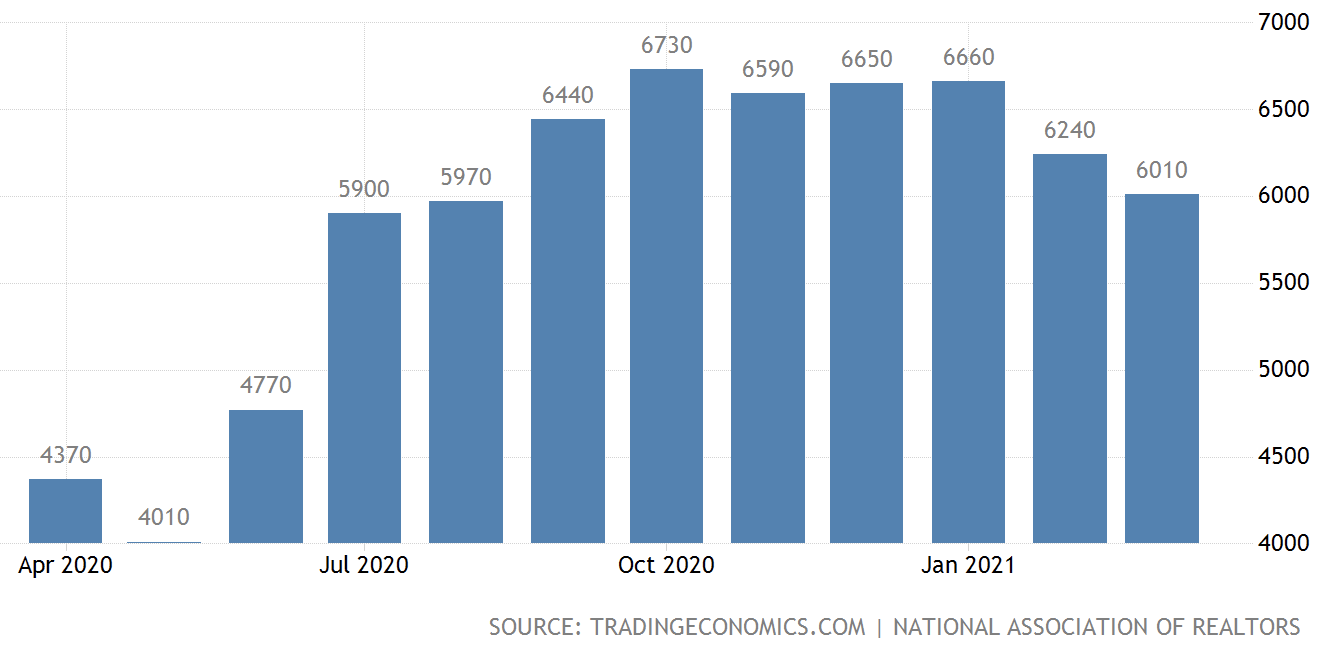

Sales of previously owned houses declined 3.7% month-on-month to 6.010 million units in March, marking the lowest level in 7 months and missing market expectations to edge up 0.8%. It was the second straight decline as home prices hit record highs and inventory has fallen to low levels. Nonetheless, properties are selling at a record pace of just 18 days on average. National Association of Realtors chief economist, Lawrence Yun, said, “Consumers are facing much higher home prices, rising mortgage rates, and falling affordability, however, buyers are still actively in the market. The sales for March would have been measurably higher, had there been more inventory.”

US existing home sales

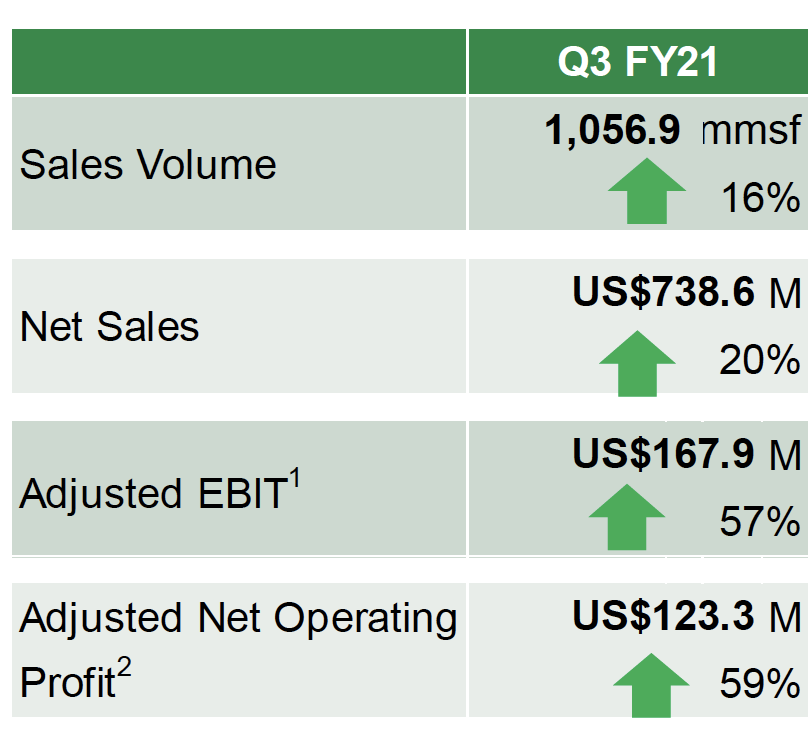

To recap recent financial performance and James Hardie has delivered a string of strong results recently and in the fiscal third quarter (3 months ended 31 December 2020), James Hardie’s group net sales surged 20% to US$738.6 million, as sales volumes increased 16%. The result was propelled by higher net sales across all main geographic regions. Gross profit came in at US$272.0 million for the quarter representing an increase of 23%. Group EBIT jumped 49% to US$131.8 million with EBIT increasing strongly in all regions, as costs were well contained. Net operating profit expanded 50% to US$68.6 million, with a corresponding increase in earnings per diluted share to 15 US cents.

Looking at adjusted figures, which are the more closely followed metrics and adjusted group EBIT surged 57% to US$167.9 million. The result was driven by a strong increase in the key North American business, supported by a jump in Europe and solid increase in APAC. Costs were kept under control with the adjusted EBIT margin expanding 530 basis points to 22.7%.

Adjusted net operating profit (NOPAT) jumped 59% to US$123.3 million. Operating cash flow swelled 72% to US$285.0 million and cash flow generation in the fiscal year has benefited from continued improvement in the company’s LEAN manufacturing initiatives, the strong organic sales growth and integration of its supply chain.

Group summary

Source: JHX

James Hardie noted it had achieved global LEAN savings of US$83.4 million in the first nine months of the fiscal year. As a result, operating cash flow for 9M21 were up 72% to a record US$678.4 million. Management has done a good job in reducing working capital and inventory overhang.

Summary

Shares of James Hardie have continued to be solid performers year-to-date. The North America market remains critical to the group performance and housing industry metrics remain encouraging, due to ultra-low interest rates and a shift in housing preferences, prompted by the pandemic and now we have a recovering jobs market. The company continues to increase market share and is pushing into the remodel and repair market, which has a long runway of growth considering the aged housing inventory in the United States alone. The company has delivered a string of strong quarterly results, and we see strong trading conditions continuing.

We recommend James Hardie as a buy to Members without exposure.

Disclosure: Interests associated with Fat Prophets hold shares in James Hardie Industries.