Australian shares endured their sharpest drop since the risk-off move in early August, with the ASX200 falling 1.88% to 7950. Declines were broad-based across sectors and stocks as global growth fears resurfaced. This followed weaker-than-expected US manufacturing data and sharply lower oil prices. Local miners and energy stocks came under pressure. Local GDP data confirmed that many Aussies are doing it tough, with a rare decline in household consumption.

The ASX200 will likely retest the big support level at 7600 in the weeks ahead, with growth scares and concerns around a global slowdown likely to be the catalyst.

GDP growth per capita went backwards for the 6th consecutive quarter, which has not happened since the early 1990s recession. The only factors preventing an outright recession are government spending, hiring and immigration. The private sector pretty much stopped hiring some time ago.

ABS data showed that Australia’s economy grew by just 0.2% in the June quarter and 1% over the past year, marking the slowest annual growth outside the pandemic period since 1991-92. This matched muted expectations.

Household spending, which makes up half of GDP, fell by 0.2%, diving after two quarters of growth. Many are having to tighten their belts and choose lower-cost alternatives, like eating more at home.

Fixed investment declined for the third consecutive quarter, while exports rose 0.5% and imports dipped slightly by 0.2%. Meanwhile, government spending continued to prop up growth, increasing 1.4%.

Immigration is buoying overall growth. The streak of lower GDP per capita extended to six quarters and fell by 1.5% over the past year. While the RBA continues to talk a tough game, I have high conviction that the first rate cut will be confirmed by Christmas.

Commodity prices were generally lower, which weighed on the materials and energy sectors. This included a more than 3% fall in the iron ore price, which traded below US$94 per tonne in Singapore. BHP fell -2.5%, Rio Tinto slid -2.3%, and Fortescue Metals tumbled -8.5%, though Fortescue’s larger drop was mainly attributable to trading ex-dividend. Copper exposures also struggled, with Sandfire Resources down -6%, 29Metals off -5.6%, and the Global X Copper Miners ETF shedding -6.2%.

There was no hiding in gold either, with the gold sub-index the worst performer of the day, sliding -3.95%. Northern Star lost -2.2%, Evolution Mining slumped -5.5%, and Newmont declined -1.9%. There were deeper cuts in the small/mid-cap gold mining space, with St Barbara -8%, Gold Road -7.7%, Genesis Minerals -5.5% and others heavily sold.

The sell-off in Australian gold miners occurred despite the A$ gold price holding in above $3700oz with the technical setup favouring new record highs over coming months. The margin squeeze that hit the sector a few years ago could reverse quickly with inflation and input costs (such as diesel) set to reverse.

Energy stocks were slammed as Brent crude fell nearly 5%, dipping below US$74 a barrel. Woodside dropped -2.5% and Santos slipped -2.6%. Santos has sealed a deal to supply 19 LNG cargoes, totalling around 500,000 tonnes per year, to Glencore in Singapore over three and a quarter years, starting late 2025. This oil-indexed contract, drawing from Santos’ global LNG portfolio, reflects the strong Asian demand for high-heating LNG, particularly from projects like Barossa and PNG LNG. The agreement supports Santos’ momentum on this front, following a 10-year deal with Japan’s Hokkaido Gas and further solidifying its strategic presence in the Asian LNG market.

In our last technical update in August, we highlighted that “Santos has not been able to break out from the converging triangle pattern – however, the technical setup still skews to the bullish side. Although the apex is fast approaching, STO remains within the triangle range between support and resistance. A downside break below support would raise scope for a deeper correction, while a topside breakout above $8 would likely see resistance challenged above $8.60. In terms of near-term direction, much will come down to energy prices and which oil/LNG heads in the coming months.

Weaker energy prices have indeed impacted Santos. The downside break below the lower end of the triangle range has seen Santos correct lower to $7, which defines near-term support. A break below this level risks a further decline to support at $6.50. A rebound and breakout above $8 would confirm an inflection; however, our base-case technical view is for further consolidation to occur between $6.50 and $7 until the direction of oil prices becomes more decisive.

Coal miners were similarly under pressure, with Whitehaven Coal falling -4% (albeit including going ex-dividend), while New Hope Corporation lost -1.4%. Uranium exposures fell sharply, with Paladin Energy -7.1%, Deep Yellow -8.8% and Boss Energy -5.6% dripping red ink. There was similar damage in the beleaguered lithium group.

Financials were another significant drag on the market, with the big four banks retreating on some profit-taking. CBA dropped -2.4%, NAB fell -2.5%, ANZ slipped -1.6%, and Westpac declined -2.1%. Insurers QBE +1.2% and IAG +0.65% bucked the downward trend.

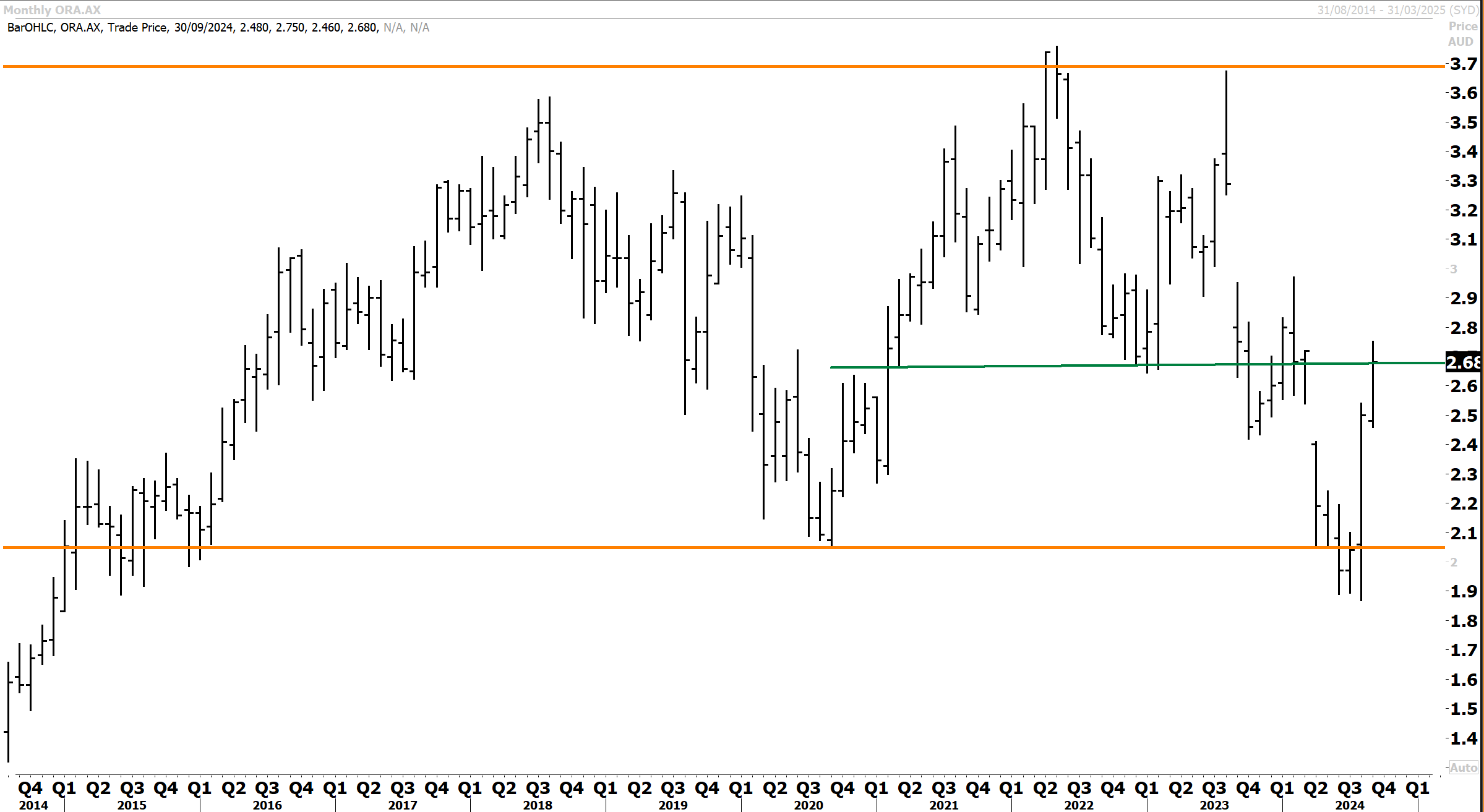

Despite the carnage, there were a few individual winners. Orora surged +7.2% after announcing the sale of its North American packaging solutions business to Veritiv for $1.77 billion. Investors cheered the deal, seeing it as a positive move towards focusing on core operations and delivering the balance sheet. The FY24 results reported over the August earnings season were better than feared, and the company has been in the crosshairs of private equity giant Lone Star.

Back in April, we noted that “Orora is precariously perched on key historical support at $2.1/$2.20. Whilst this support might drive a rebound, the technical setup for Orora looks bearish. A break below the key historical support level would raise the scope for further significant downside.”

In mid-August we concluded that “Orora subsequently fell to $1.90 after breaking below the $2.10/$2.20 support level. The recent upward dynamic is more positive, but resistance at the high $2.40 level could provide a significant barrier to additional upside.” Resistance now looks to be overcome at $2.40, but the $2.60 barrier could prove more formidable. An advance above the $2.80 level would potentially confirm an inflection.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Stock Chart Source: Thomson Reuters