Listening to CNBC and Bloomberg, there continues to be a lot of debate around whether the boom in all things AI and technology stocks is a bubble, which continues to dominate the airwaves. I have listened to countless interviews with fund managers and economists who have waded into the debate, many of whom are cautious, likening what is going on now to what happened in the 1990s during the dotcom bubble.

Market cycles that lead to bubbles tend to run parallel in history, given the confluence of greed and fear amongst investors, which leads to the same mistakes being made time after time. History doesn’t always repeat in the markets, but it often rhymes due to this interplay of human emotions. I do not doubt that some of the events around the dotcom bubble, which ended in spectacular fashion 25 years ago, will repeat. But the timing is not going to be certain, and just as Fed Chair Powell expressed concerns around valuations, like his predecessor Alan Greenspan, he might be early by four to five years.

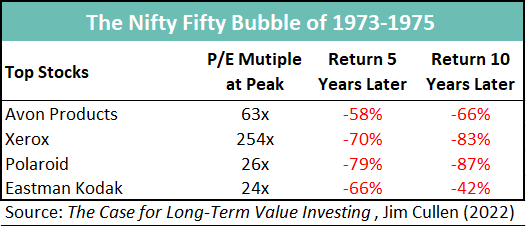

There are many similar characteristics with what occurred back in the 1990s, but there are also prominent differences. I would also add that for many market participants who were on the front line and observed the dotcom bubble directly, memories remain acute. As the dotcom bubble inflated back in the 1990s, many of us had seen nothing like it in our lifetimes (the 1970s nifty fifty had parallels). But towards the end of the bubble, things got really stupid. Companies with no earnings and no hope of ever really making any durable profits in the future sold for huge valuations and sheer speculation, excess, and greed.

The nifty fifty bubble in the 1970s occurred with a small leadership leading the benchmarks higher, but commanding nose-bleed valuations at the peak.

I recall ringing clients in late 1999 and advising them to avoid tech stocks and get out of that sector of the market. My recommendation was to switch into gold and gold stocks, and of course, many shunned this advice and turned to other brokers. I eventually got fed up with stockbroking and quit the industry after deciding to set up Fat Prophets around March 2000. What followed, of course, was the bubble imploding and fortunes in dotcom stocks were wiped out in what turned into an ugly bear market. Gold, incidentally, rallied from that point onwards in what turned out to be a bull cycle that ran for 12 years, which took prices from $250oz up towards $2000oz.

The point of telling this story is that markets will always repeat cycles due to greed and fear factors. The boom around AI will also likely play out with similar consequences, but the runway might have much further to run. The key lessons and pitfalls to be avoided were running with some of the hottest names at the time (Nvidia today rings true on this front). Companies with no earnings running on hype and excessive investor expectation were amongst the biggest casualties.

I also observe that in the aftermath of the bubble bursting, out of the ashes emerged some of the survivors that would go on to transform the US economy (Amazon was a notable winner). The same will likely happen again. But the AI boom could run for years before it finally gets into trouble. And unlike the dotcom bubble, where it took the economy a decade or so before tangible economic benefits began to filter through, the AI boom could deliver the stock market productivity and efficiency gains much faster.

There are also some other important differences. Companies that have strong businesses that are investing in AI could enhance their earning power and build on already entrenched positions. Others might succumb to AI in the same way as decades-old industries were knocked down by the advent of the internet 25 years ago. I am talking about sectors such as newspapers, where the internet reached a tipping point that saw classified print ads decimated almost overnight.

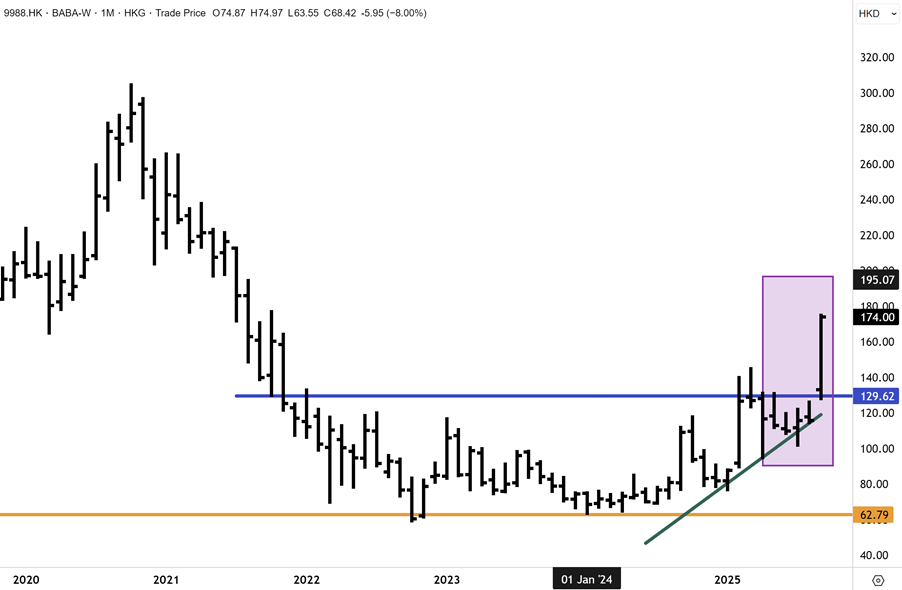

It’s important to maintain perspective and strong filters to avoid situations where value is not anchored to reality, but expectations about where AI will take the economy in future years. On this front, I have been bullish on major China tech companies this year, which many perceived to be well behind the US in the AI race at the beginning of the year.

Many of these major Chinese tech monoliths were selling for very low valuations that had been compressed by a severe five-year bear market. This fundamental backdrop has changed, but even with the recent re-rating, valuations still skew cheap and are well below similar counterparts in the US. I also like the starting point, given AI will complement already entrenched businesses that have solid, consistent revenues and earning power. For this reason, the recent advances in Chinese tech might have much further to run, with a comparative risk/reward skew advantage.

There is no sign of a bubble emerging yet in the Hang Seng Tech index. The index has recently broken through overhead resistance at 5,800, but remains around 50% below the previous peak near 11,000. The scope is open for further significant upside and recovery potential in the year ahead, in my view.

Bellwether Alibaba (which we hold across all our portfolios and is a top ten position in the Fat Prophets Global Contrarian Fund – as disclosed to the ASX) has

surged to the highest level in nearly four years after revealing plans to ramp up AI spending past an original $50 billion-plus target in a global race for technological breakthroughs.

CEO Eddie Wu said this week that he anticipates overall investment in AI accelerating to some $4 trillion worldwide over the next five years, and Alibaba needs to keep up. He is totally correct on this front. Alibaba will soon add to a plan laid out in February to spend more $53 billion developing AI models and infrastructure over three years. Alibaba’s cloud division already has a head start with operations from the US to Australia, and with plans to launch the first data centre in Brazil, France and the Netherlands in the coming year.

Holding Alibaba might seem contradictory with what was discussed above, but we bought Alibaba and established a position on a PE multiple of around 10X existing earnings. This contrasts with some of the major US players, which sell for +30 to +40 times.

Alibaba rose as much as +10% yesterday as plans were outlined to roll out Qwen models and “full-stack” AI technology. The bullish reaction does point to global exuberance for all things AI, but the recovery potential for Alibaba and other leading Chinese tech stocks that were smashed during the bear market is considerable in my view. And the stocks themselves are lifting off what were very depressed valuations that didn’t reflect and were disconnected from the long-run growth potential of the Chinese economy. Growing corporate confidence amongst leaders in the Chinese technology space is therefore to be applauded.

This week’s breakout in Alibaba points to significant recovery potential and upside extension in the year ahead, now that an inflection has been fully confirmed. Support is well defined at HK$130 and below.

Mr Wu said yesterday that “the industry’s development speed far exceeded what we expected, and the industry’s demand for AI infrastructure also far exceeded our anticipation. We are actively proceeding with the 380 billion investment in AI infrastructure, and plan to add more.”

Total capital expenditure on AI infrastructure and services by Alibaba, Tencent, Baidu (all names we hold) and JD.com could top $32 billion in 2025 alone, according to Bloomberg Intelligence, which is a big increase on the $13 billion or so committed back in 2023. All of China’s internet majors are developing AI models and services at a rapid clip, including Tencent’s Hunyuan and Baidu’s Ernie. On Wednesday, Alibaba unveiled its new Qwen3-Max large language model and a series of other improvements to its suite of AI offerings.

The repositioning of Alibaba has already started to deliver, and in the most recent quarter, the company reported triple-digit growth in AI-related products. Its cloud division also posted a better-than-expected 26% jump in sales, making it the group’s fastest-growing unit. Alibaba has more than doubled this year, and is one of our best performers, but scope for further upside remains significant in my view. We hold Alibaba, Tencent, Baidu and other key China/Asia tech names in our Global and Asian managed account portfolios – reach out to patrick.ganley@fatprophets.com.au for more information.

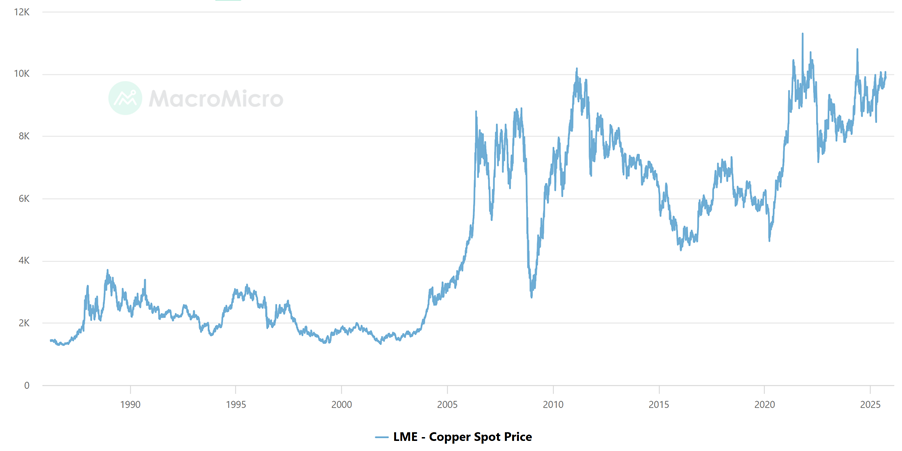

Turning to the copper market, prices surged after Freeport McMoRan said force majeure was declared on contracted supplies from its giant Grasberg mine in Indonesia, the sixth largest source of copper in the world. Freeport cut both copper and gold production guidance for the quarter as it continues to search for five missing workers following an accident at the site two weeks ago. Two employees are confirmed to have died following a flow of about 800,000 metric tons of mud into Grasberg’s underground levels.

The disruption to supply comes at a time when inventories are tightening and demand is surging amidst a surge in AI, energy, and power infrastructure investment around the world – all of which will require vast amounts of copper. The interruption also highlights the relative tightness of supply embedded in the copper market.

Following the unwind of the arbitrage-fuelled buildup in the US ahead of anticipated tariffs that never eventuated, copper prices are now reasserting to the topside. The recent breakout above resistance at $4.60 potentially confirms an inflection and marks the resumption of upward momentum. I anticipate US Comex copper prices to reassert as the inventory overhang clears. LME copper prices, meanwhile, are hovering within 5% of the record highs.

Copper for delivery in three months rose 3.6% to settle at $10,336.50 a ton on the London Metal Exchange on Wednesday, the highest in more than a year. While Freeport shares fell as much as 15% in New York trading, rival producers, including Antofagasta and Capstone, surged around +10%. The accident at Freeport highlights the copper market’s vulnerability to global supply shocks and is just the latest disruption to the industry. I am sure other supply shocks, and what happened on Wednesday, point to how little it takes to tighten up the market.

The technical setup for LME copper prices (traded in London) is also bullish. A topside breakout to new record highs could potentially ensue over the next six months, in my view.

Aladdin’s Cave

First up, billionaire hedge fund manager Ken Griffin, and founder of Citadel, which runs around $60 billion, told CNBC early this morning he expects the Fed to cut the benchmark rate only once more this year. “I think the Fed is nervous about the labour market because we did see this decline in the number of jobs being created, and in terms of balance of risks they chose to focus on the unemployment side rather than on the inflation side”. But he added that he expects the Fed to cut interest rates one more time this year, or maybe “two on the outside.”

During the interview, Mr Griffin said he expects inflation to be in the mid-2% to 3% range next year, above the long-run “historical target of 2%. “It’s really hard to know precisely where we are at this minute when it comes to the labour market. What we do know is that US population growth is much lower without the influx of immigrants, and that’s going to bring our ability to create new jobs down.”

Earlier this month, Mr Griffin, in an opinion article in the Wall Street Journal, argued that it was in President Donald Trump’s best interest to protect the central bank’s independent structure. “He wants lower interest rates, and I got to tell you, if I were the president, I would let the Fed do their job. I would let the Fed have as much perceived and real independence as possible, because the Fed often has to make choices that are pretty painful to make.”

Mr Griffin has a long track record within financial markets, and his hedge fund, being one of the largest, has considerable clout. He made some good points, and as discussed above, I believe there is now risk to financial markets around the aggressive easing path now priced into equities. Correction risks in October are therefore elevated, and a selloff would not surprise. However, any correction, if it ensues, is likely to prove relatively shallow and in the vicinity of a 5% to 7% drawdown with a bottom likely to be quickly priced by mid to late October.

Mr Ken Griffin

A correction is already underway in the Russell 2000 and international markets such as Australia. However, with global central banks easing and the Fed also likely to bring rates down quickly next year, monetary conditions are set to remain supportive for equities. Any disruption to the bull market will therefore likely prove temporary, with stocks quickly recovering from any short-term setback. Liquidity remains abundant not just in the US (with around $7.5 trillion parked in money market funds). Many investors are positioned to “buy any dip”. This is an approach advocated by leading investment bank strategists, including JPMorgan and Morgan Stanley.

The AI boom likely has years to run and will underpin growth and the global bull market in equities in the US and around the world for some time to come. Central bank easing, as always, provides a powerful tailwind. The bottom line is that any pause by the Fed next month, around the expected rate cut priced in, could induce near-term volatility in October, a seasonally weak month anyway. However, the Fed will only be delayed, and the case for more aggressive easing next year still remains in place. The upcoming reporting season that gets underway later next month could also underpin valuations.

Another market where investors will likely “buy the dip” on any setback is in China. Savings and money market deposits dwarf the US with liquidity levels at a historic high of c$18 trillion. On this front, the upcoming Plenum, when China’s government convenes on the economy and firms up the next five-year plan, could also deliver upside surprises.

I would expect China to announce more supportive measures for the economy, but also possibly the property sector, through wide-ranging fiscal measures. A key adviser to China’s central bank, Mr Huang Yiping, has urged Beijing to assist a traditional growth driver while fostering new industries. In an influential article this week in the International Economic Review, a framework was outlined for steadying growth by coordinating industry policies with macroeconomic measures.

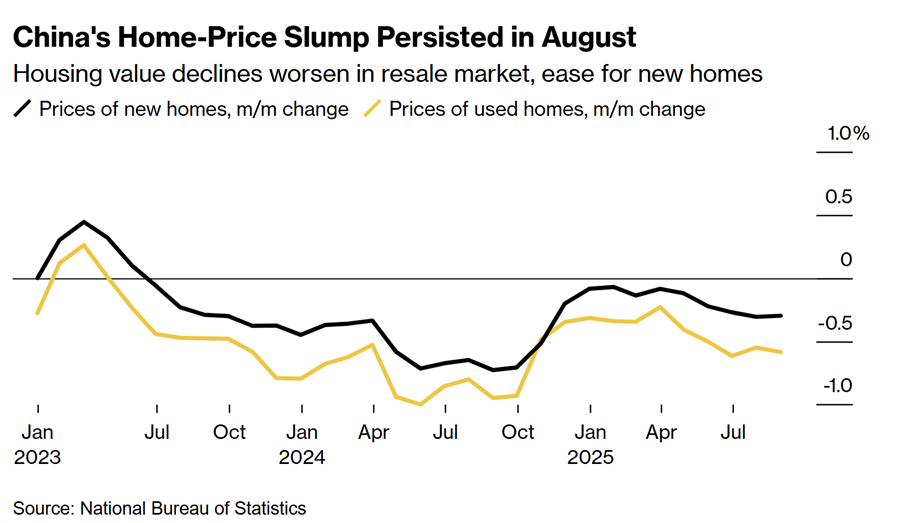

“While supporting emerging industries across the economy, fiscal policy should, in the meantime, ‘stabilize important traditional sectors’ to help them evolve and “adjust in an orderly manner”. These measures might involve targeting the housing market, which has struggled to shake off deflation and falling prices over the past five years.

Mr Yiping, a member of the monetary policy committee of the PBOC, China’s central bank, said that “for the current real estate sector, fiscal support should focus more on optimizing existing assets and building a public housing system, rather than inflating housing prices again or stimulating ineffective investment.” This is a fair point, and the last thing China needs is another bubble in housing, which the government will avoid at all costs. But shoring up the sector to the point where the inventory overhang clears and prices stabilise would go a long way in providing confidence to consumers and getting them spending again.

Source: Bloomberg

Other prominent economists, including ones I follow at several key investment banks, have called for the same approach. I believe the Chinese government is now finally listening to these economists – and could act decisively next month with supportive measures that could finally break the negative feedback loop that housing has on the economy and consumers. Therefore, key Chinese property developers such as Longfor merit watching closely for signs of important technical inflections.

China’s housing market has around four years of inventory overhang.

Mr Huang said on China housing that “given the systemic impact of the real estate sector on macroeconomic fluctuations, stabilizing this industry is crucial for sustaining upward momentum in the broader economy. Local governments have, to date, been reluctant to buy existing homes from developers and reduce the inventory overhang currently running at around four years. However, perceptions around this could change soon if more supportive measures are introduced.

Economists such as Morgan Stanley’s Robin Xing are expecting the central government to offer cash to purchase existing homes by using its own balance sheet and converting them into affordable housing. Mr Xing, who has long advocated this, might soon be right with Beijing finally showing signs of listening. Mr Xing believes that China’s government could provide 1 trillion yuan ($141 billion) annually over a period of three years to buy 1.5 million homes, with the goal of bringing housing inventory down to healthy levels to turn around expectations in the market.

Mr Huang concluded, “The construction and real estate sectors will remain important components of China’s economy in the future, although the period where they were the primary drivers of economic growth may have passed.” There is no question that housing, while still an important driver of China’s economy, is giving way to other industries and catalysts. But it is still at the centre of most consumer balance sheets and thus reinvigorating the housing sector could help drive a faster turnaround in the broader economy than the equity market has currently priced in.

China’s real estate crisis, which has played out over the past several years (George Soros was very prescient and warned of this back in 2022), has, without doubt, been the main cause for consumer caution and reluctance to spend. Falling prices and shrinking investment in new housing starts have damaged the confidence of households and businesses while worsening a deflationary cycle. The bottom line is that in breaking this cycle and negative feedback loop, the government will achieve its goal of unleashing and reinvigorating consumer spending. With $18 trillion tucked away in bank savings and cash deposits, this could become akin to “opening up Aladdin’s cave”. Any correction in China/Hong Kong benchmarks would therefore open a buying opportunity in my view, with the bull market likely to have much further to run.

The breakout on the Hang Seng above the primary downtrend in place since the 2017 highs defines an important inflection. Since pushing above key resistance at 24,600, the Hang Seng has extended upwards to make a four-year high near 26,500. The technical setup is bullish, pointing to a further advance over the coming year. However, near correction risks are elevated. Any sequential pullback should encounter strong support at the 24,600 breakout level and would open a buying opportunity in my view.

Finally, the Fat Prophets Global Contrarian Fund (ASX: FPC) updated the ASX this morning, which confirmed one of the best months since inception – and a new record high in the estimated pre-tax NTA. I want to personally thank all shareholders for their support of the Share Purchase Plan and Dividend Reinvestment Plan. With daily turnover lifting significantly in the FPC shares, I also want to welcome all new shareholders to the share register. I am also sorry to see some of our older shareholders go.

It has been encouraging this year to have some of our major themes, including gold and precious metals, Japanese financials, and China technology/AI, all finally coming together. As always, we remain fully committed at FPC and strive to achieve our goals and deliver for shareholders, albeit for some who bought in the float, it has been a longer ride. I really appreciate those shareholders who persevered and stuck by us – through thick & thin. Thank you.

The ASX release highlights were as follows:-

The ASX update highlighted that “To date in September, the Fund has sustained one of the best monthly advances since listing in 2017 with estimated pre-tax NTA increasing nearly 9%, to a new record high above $1.84. This calculation takes into account the payout of the recent 5c fully franked special dividend payment, and the issue of new shares under the Share Purchase Plan and Dividend Reinvestment Plan. Performance attribution has been across the board this month, with all key themes making a contribution.”

“Precious metal holdings have been prominent within the top ten contributors, with gold making a new record high, and platinum & silver reaching the highest levels in 15 years. The Fund’s gold and PGM miners all made a positive contribution to performance. Also featuring with strong gains in the portfolio were China listed technology firms Alibaba and Baidu. We continue to hold conviction that Chinese equities are now in a new bull market with considerable scope for further recovery over the coming year.”

Carpe Diem,

Angus

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.