The Fed is widely expected to cut interest rates this week, but as foreshadowed, this could prove to be a risk-off event for markets with investors “selling the news”. This week will therefore be significant with the FOMC set to be influential over stocks, bonds and the US dollar if it’s perceived to be accompanied by the undermining of Fed independence, given elevated inflation, slowing growth and a deteriorating labour market.

On this front, JP Morgan chief global strategist David Kelly of the Asset Management division believes there is also risk around the FOMC decision if the political pressure exerted on the Fed doesn’t align with the central bank’s forecasts for the economy. Mr Kelly said in an update to clients that “investors over a resumption of Fed rate cuts should instead take a cautious stance and look to diversify after the recent rally.”

Mr Kelly said this week that “to the extent that the Fed’s decision this week is seen as a capitulation to political pressure, a new layer of risk is being added to US financial markets and the dollar. Markets are frothy and easing now is more likely to weaken demand than increase it, and “ultimately be negative for stocks, bonds and the US dollar.” Other strategists, including Morgan Stanley and Oppenheimer Asset Management, have also warned that a more cautious tone may replace the bullish mood as investors focus instead on a potential economic slowdown.

I continue to see risks being high of a correction ensuing into October, but one that will likely prove to be short in duration and likely relatively shallow. Periodic risk-off events are normal and typical during bull markets. These are healthy events and serve to remove some of the froth and correct overbought conditions, which we are seeing now. “Battening down the hatches” before the upcoming meeting makes sense. Trimming portfolio and removing relative underperformers is logical now, given that a risk-off correction could ensue soon, given frothy and overbought conditions.

While JPM’s Kelly agrees with the market’s pricing of Fed easing, he sees little evidence in the Fed’s own forecasts for growth and inflation to justify the decision. “In their updated quarterly projections, also to be released Wednesday, officials are likely to only downgrade growth and the labour market slightly, while their inflation forecast will remain over the central bank’s 2% target into 2027. By the fourth quarter of this year, inflation could be 120 bps above the Fed’s target and rising, while unemployment would be just 30 bps above their target and stable. If this is the outlook, why should the Fed cut at all?”

Mr Kelly makes a fair point, and given Fed Chair Jerome Powell is leaving the central bank when his tenure is up next May, I fully expect him to be quite cognisant of his legacy. Mr Powell doesn’t want to go down in history as the Chair who succumbed to political pressure. Arthur Burns did exactly this during the 1970s, when President Nixon put him under pressure to cut, which then saw inflation take off and push the US into recession.

There is no upside for Mr Powell to completely cave into the Trump Administration, and therefore, the press conference that will follow the FOMC meeting is shaping up to be one of the most important in decades, given Fed independence is at stake. The bottom line is there’s a chance that financial markets won’t exactly get to hear what it wants to hear.

DJT has been relentless this year in pressuring Mr Powell for months to cut rates, which we are seeing manifest in a notably weaker US dollar. On Sunday, Mr Trump told reporters he expects a “big cut” this week and has often labelled the Fed Chair as being “too late”. However, all this pressure has served to undermine the perception of US independence, which is not good for financial markets over the longer term. And we have also seen the US dollar take one of the sharpest falls in decades this year, as foreign investors have voted with their feet.

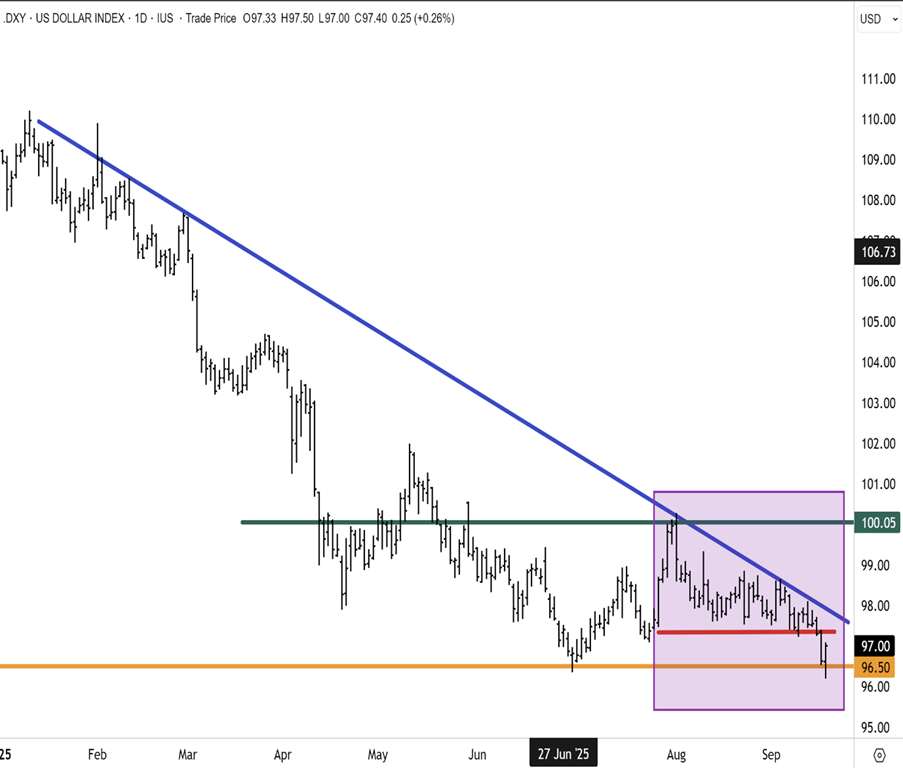

The Dollar index’s key support at the primary uptrend is set to be put to the test this week. A downside break, if it ensues, could usher in a new phase of severe weakness in my view. This outcome would likely be bullish for commodities, gold, precious metals and emerging markets.

The Fed has presently become divided this year, with official Christopher Waller leading the dissenters who believe the rate cuts should have been implemented at previous FOMC meetings. Mr Waller is in the box seat to become the next Fed Chair to replace Jerome Powell. Mr Kelly summed up and concluded that “If FOMC members could truly ignore pressure from both the administration and their colleagues, there would likely be multiple dissents on both sides of this decision.” This won’t be a good outcome for the financial markets, which like consistency at the Fed and mainly unanimous decisions. There is a lot at stake in terms of Fed independence this week, which will shape the direction of the dollar and bonds for some time to come.

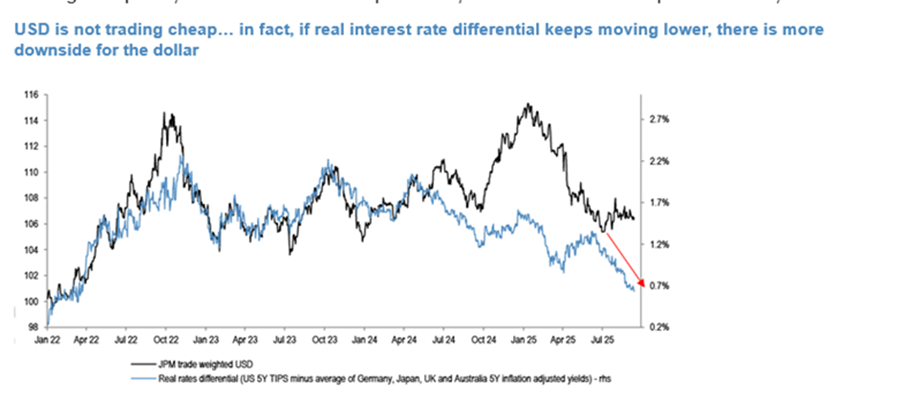

JPM strategists highlighted this week that “bond yields tended to move lower into the easing, and keep moving down post the resumption of easing. We keep our long-duration call. USD tended to be softer into, and after, the resumption of easing. We think that the July-Aug stabilization in USD might not last, and could give way to more weakness down the line. Our FX team sees DXY falling 4-5% over the next 6 months. The USD is far from trading cheap; in fact it is above where the fundamentals would suggest, and the real interest rate differential is breaking lower.” I concur with this outlook and would not be surprised if the Dollar Index fell another 5% to 7% towards 90 – if the primary uptrend is definitively broken – over the next six to twelve months.

Source: JP Morgan

JP Morgan also reiterated their bullish view on emerging markets (which have led global benchmarks this year). JPM believes that “we think EMs will benefit from the backdrop in which the Fed is easing, EM central banks are easing, and USD is generally trading light. EM equities tended to perform better as Fed cuts resumed. At the end of July we revisited the attractiveness of EM space, and China is an important element of this. We note that China equities, both A and H shares, are making fresh highs, up 15% and 33% YTD, respectively. While we have been bearish on EMs & China for years, one of the reasons behind us turning positive on EM this year was the more constructive policy stance, both fiscal as well as in terms of liquidity.”

On this front, China’s stock market has staged a big rally this year, and some are calling for the advance to come to a halt, given a still sluggish economy. However, stocks are looking ahead and pricing in an improving economy. We are seeing earnings amongst mainland large-cap technology stocks such as Alibaba and Tencent notably improve, and it is likely a matter of time before this trend broadens out to other sectors in the market. Whilst key China benchmarks could also correct in line with international equities, I expect the bull market to quickly get back on its feet.

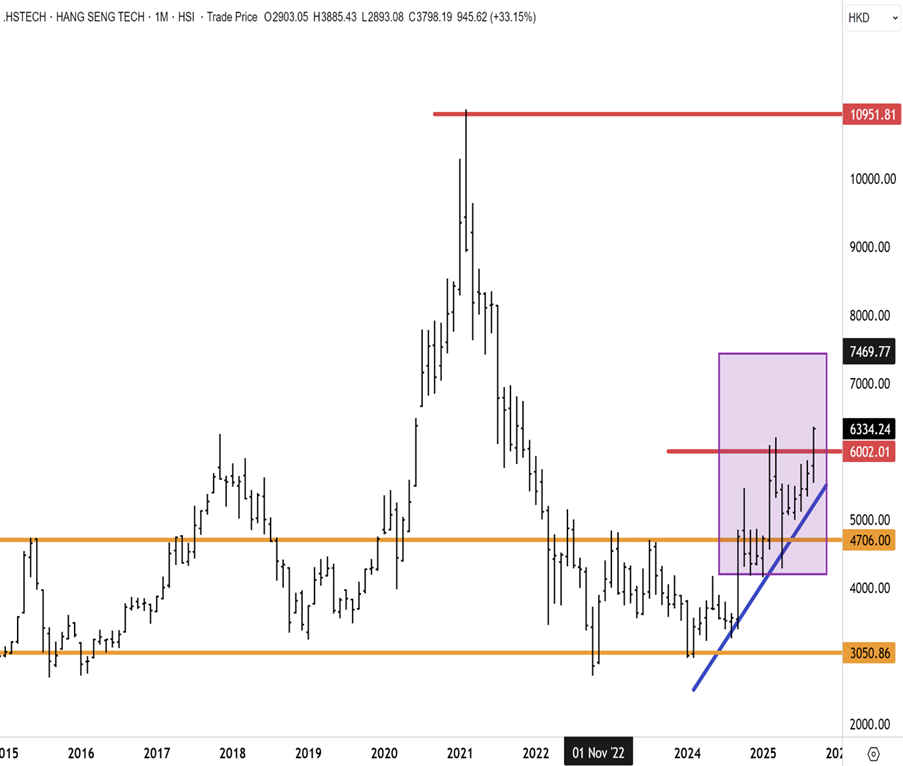

The Hang Seng Tech Index has broken out above key resistance at 6,000, which raises scope for upside extension in the months ahead. Support appears well defined at the primary uptrend in place since the bear market terminated, and the lows were confirmed last year.

The US dollar also appears to be breaking down against the offshore Chinese yuan. The CNH is testing the primary uptrend against the dollar that has been in place since 2022. The primary uptrend appears to have been breached this week, and if the CNH sustains the rally against the USD, I would expect further strength in the yuan.

The rally has occurred despite the fact that China has cut interest rates. The Government appears to be relaxed about appreciation in the yuan and has let the currency (which is still fixed) strengthen alongside other major currencies. A stronger yuan is positive for Chinese stocks and should influence global fund managers to upgrade and increase allocations (from a low base) into the market in the year ahead.

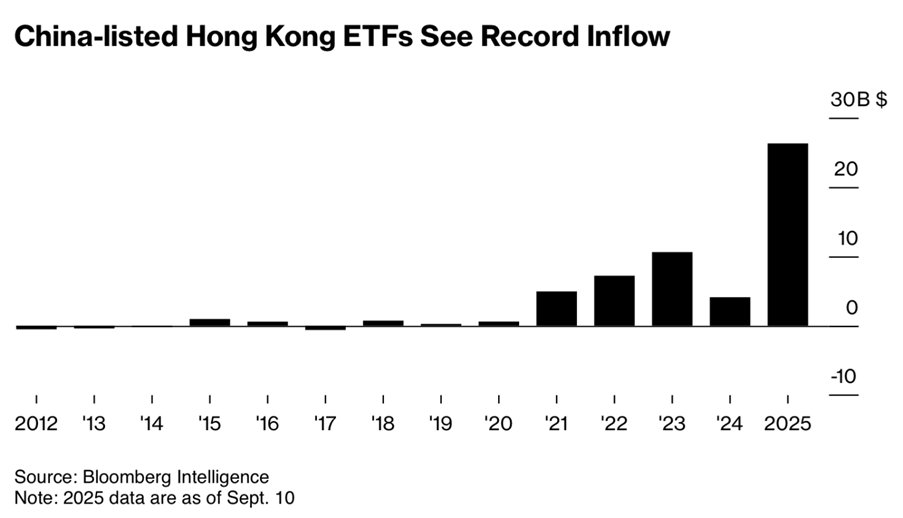

Chinese retail investors stampede into Hong Kong ETFs

Bloomberg reports that Chinese investors are piling into onshore-listed ETFs tracking Hong Kong stocks, with inflows surpassing US$26 billion so far this year and momentum building since June. This is likely just the tip of the iceberg, given that Chinese households are sitting on some US$18 trillion in savings and term deposits.

Popular themes like artificial intelligence and biotech are fuelling the rush, as mainland retail traders chase the strong performance of Hong Kong shares and take advantage of a growing array of accessible products. Analysts point to a new generation of investors using fintech apps such as Alipay, making ETF investing seamless and bypassing the need for traditional brokerage accounts. The trend is expected to continue as more investors seek quick, tech-driven exposure to Hong Kong’s strongly performing market.

The Hang Seng Index has surged +32% YTD, twice the pace of gains in China’s CSI 300. According to Bloomberg, Chinese retail investors are embracing sector-specific ETFs for fast rotation into thematic trades, while institutions stick with broader trackers. Reportedly, despite accounting for just 10% of China’s ETF assets, Hong Kong equity ETFs have attracted more than half of all inflows in 2025, as retail investors seek a simpler, lower-barrier route to access the city’s market. Analysts expect this migration to continue as onshore ETFs offer a fast track for investors. The momentum can be self-supporting.

The Hang Seng index has surged past overhead resistance to make a fresh five-year high above 26,400. I see scope for further upside extension in the year ahead, with a retest of the record high above 32,800 not implausible through to December 2026. The bear market has really only just ended, and a new bull phase is underway. Meanwhile, valuation for the HS index still screens cheap relative to international markets.

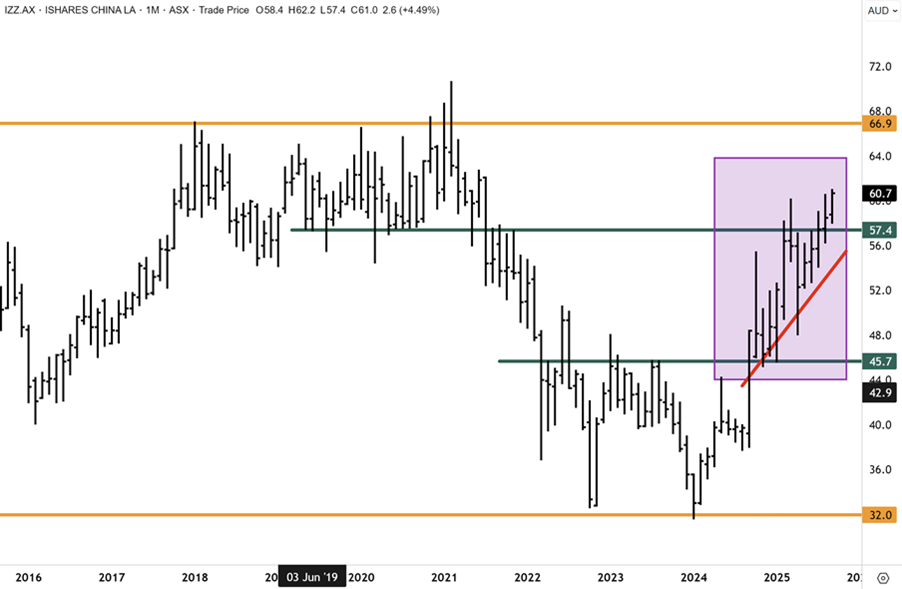

For Australian retail investors, the ASX-listed iShares China Large Cap ETF (ASX:IZZ) -0.15% provides a convenient, cost-effective way to obtain exposure to a basket of large, liquid Chinese companies trading in Hong Kong, including names like Alibaba, which we rate highly and trade at hefty discounts to their American peers.

On June 27th, we commented, “Similar to the technical setup for the Hang Seng Index, HS Tech Index, and China Enterprises Index, ASX-listed IZZ is testing important resistance at the five-year highs near $60. We have conviction that this resistance level will give way soon to further upside and a retest of the five-year level above $70 over the coming year, as China/Hong Kong shares are re-rated globally.”

We followed that up on August 1st, stating, “Resistance at the five-year highs near $60 looks to be giving way. With the breakout above the near-term downtrend, upward momentum in IZZ appears to be resuming. We have confidence that IZZ will make new highs in the months ahead.”

The iShares China large-cap ETF (ASX:IZZ) has surmounted overhead resistance at $57.40 and has extended higher. The scope is open for a retest of the record highs near $70 and possibly significant upside extension beyond this level in the year ahead, in our opinion. With the successful exit from a multi-year bear market last year, we have conviction that the path of least resistance remains on the topside for some time to come.

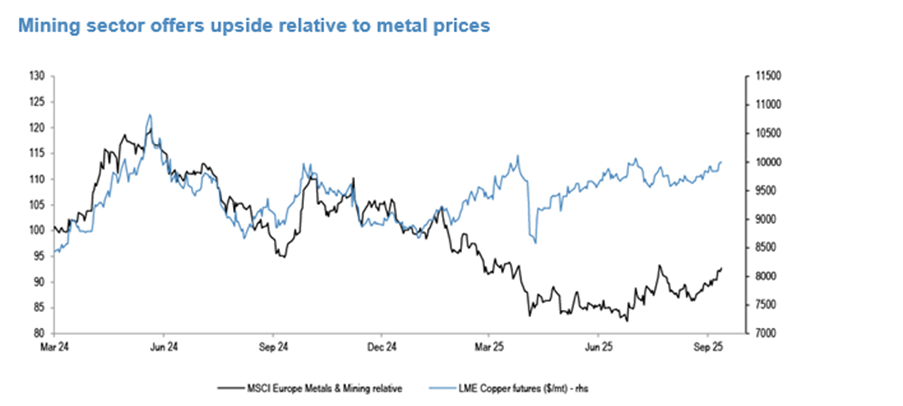

Other beneficiaries from a weaker dollar are commodities and precious metals. JP Morgan upgraded the mining sector on these grounds in recent months. JPM cited this week that “Mining is a sector which is related to the EM/China view, as well as to our USD view. We double upgraded it earlier in the year, after a prolonged bearish stance. As the bottom chart shows, Mining equities are continuing to show a gap with the spot metal prices. Like gold equities, which have rallied as spot rallied, we believe Miners will perform better, too.” I have had the same view all year, and still see significant scope for further upside in the resource sector as the US dollar has weakened. While the gold and PGM sector has run hard, there is significant catch-up potential for other lagging commodity miners within the broad resources sector.

Source: JP Morgan

4000

I was up extra early this morning and listened closely to the Fed Chair deliver the statement and press conference on CNBC this morning. Veteran bond hedge fund manager and billionaire founder of Double Line Capital, Jeff Gundlach, anchored the CNBC review of the Fed decision. I have a lot of regard for Mr Gundlach, whose views and market outlook are similar to ours. He reiterated his view that Fed independence is being undermined, and that ultra-easy monetary policy could have negative implications for the bond market and higher inflation.

Mr Jeff Gundlach on CNBC

Mr Gundlach also emphasised his long-held bearish view on the US dollar – and sees the greenback heading lower this year. He stuck to his price target on gold hitting $4000oz by December, advocating a 25% weighting in investor portfolios and didn’t see this as being excessive. Mr Gundlach also referenced the recent breakout in US gold mining stocks, saying retail and institutional investors are only just beginning to recognise the sector as a hedge for what is going on with US monetary policy – and his view that the dollar is set to decline further.

Mr Gundlach’s price target of $4,000oz for gold by December is entirely plausible in my view. The recent breakout has seen gold make a fresh record high above $3,740 on Wednesday, which raises the risk of a near-term pullback. I would expect gold to find strong support below $3,500oz before upward momentum carries spot prices up towards $4000oz by year’s end – which will likely coincide with another phase of US dollar weakness.

I also believe the dollar is headed lower. Key technical levels were breached this week, with the DXY breaking below the primary uptrend. Today’s modest rebound in the DXY only reinforces this view. Any weakness in gold and the PGMs over the coming weeks is therefore likely to be fleeting. I see the upward trend in precious metals reasserting into the year-end.

The rebound in the Dollar Index on Wednesday is unlikely to be sustained in my view. Overhead resistance at 97.50 is intensifying, and I think any rally will be sold. Additionally, with bearish positions on the dollar largely reduced, there is technical scope for downward momentum to soon resume with the greenback.

Mr Gundlach reiterated his anti-dollar theme (citing this as his number one high conviction call) into year-end and that US investors should diversify portfolios with international stocks. The veteran investor was worried about AI and a significant amount of forward growth already being priced in.

Interestingly, he compared AI stocks with shares of electricity companies at the turn of the last century. “Back in the early 1900s, electricity was perceived to change the world, which it did. However, following a bubble, electricity companies topped out in 1911 and fell sharply before the infrastructure got going and really changed the economy”. This is a fair point, and I would add we saw a similar parallel with internet and telecommunication stocks back in 2000.

In terms of AI, we have chosen to focus on Chinese technology companies, which still trade at a significant valuation discount to similar US counterparts. In recent months, China’s technology sector has raised billions in new capital (primarily through bond issues) to advance its AI capabilities and build out digital infrastructure. China tech bellwethers Alibaba, Tencent Holding and Baidu have led a surge of bond issuances, raising more than $5 billion in September alone. We hold all three companies in the Fat Prophets Global Contrarian Fund (as previously disclosed to the ASX) and in our Asia and Global separately managed account portfolios (reach out to patrick.ganley@fatprophets.com.au for more information).

All three tech bellwethers have staged strong rallies this month, on the view that AI investment will re-ignite growth in the same way it has spurred growth in the US. Global investment in AI has been building since OpenAI’s ChatGPT platform was released to the public in 2022. Back in January, the Chinese took markets by surprise with a rapid advance in AI technology, which catapulted the major tech companies out of a multi-year bear market.

The funding boom has accelerated this year, particularly given China’s breakthrough on AI with DeepSeek, which is a much lower-cost model. China and the US are leading the world on AI and the rollout and development of infrastructure, and the DeepSeek announcement contested the notion of US tech supremacy. Whilst valuations have surged in US AI stocks, all the Chinese bellwethers, by contrast, remain well down on the record highs of four years ago.

Chinese tech giants now recognise that a similar growth opportunity lies ahead, which is why they are raising the billions needed to fund an aggressive expansion into AI. The Chinese tech sector is, however, not just targeting newer applications such as autonomous driving but also striving to enhance existing businesses from advertising to gaming and content.

The Hang Seng Tech Index has cleared overhead resistance at 6,000 to hit a four-year high above 6,300. The scope is open for further upside extension with the next resistance cluster around 8,000, a plausible price target over the next six months. The HS Tech index remains well down on the record high near 11,000, which was established back in 2021. I have conviction these highs will be retested within two years.

As mentioned, we are very well represented here with our portfolio exposures, which include Alibaba, Tencent, and Baidu, amongst several other key names. Bloomberg estimates that the collective capital expenditure on AI infrastructure and services amongst these three companies and others could top $32 billion in 2025, which is still well below US counterparts – but still a sizeable investment.

By contrast, the six largest US hyper-scalers, Meta, Microsoft, Amazon, Alphabet, Oracle and Apple are projected to spend more than $390 billion on technology this year, more than double the 2023 total. China tech is still spending significant sums, but possibly doing it much smarter than the US to achieve a similar outcome.

Alibaba leads the group and plans to invest $53 billion on cloud computing and AI infrastructure over the next three years. This is a big comeback from a few years ago when the PE multiple got down to 10X (we were buying then), following years of regulatory scrutiny, which pressured its core businesses. Alibaba has since put the throttle down and is aggressively rolling out AI, and this is coming through in earnings, which accelerated and was evident in the recent half-year earnings result.

China’s tech giants have one advantage over the US, in the cost of borrowing and locking in cheaper, longer-term funding in the bond market. In turning to the bond market to raise capital, Chinese tech companies can avoid the dilution of issuing more shares, which many are reluctant to do, given that valuations are still much lower relative to the US.

The AFR ran an interesting interview with GQG fund manager and founder Rajiv Jain, who has been “vocal about his contrarian view that the AI trade is running out of steam. As he fronted investors in the group last month to explain why GQG’s funds lagged the market by almost 20% in the 2025 financial year, Jain memorably labelled the AI boom “the dotcom bubble on steroids.” He might be right, but the AI train could have years to run – in the same way as the Dot Com bubble played out in the 1990s. I would also add that our emphasis on China AI tech is also sensible given that valuations across the sector are still very compressed, with Chinese benchmarks only just exiting a severe bear market late last year.

Mr Jain said, “We agree this time the outcome could be different – we believe it could be worse than the dotcom collapse.” Again, he might be right in the longer run, but for some companies, such as Alibaba, earnings are accelerating higher with a long runway. Mr Jain also conceded that GQG might be too early in betting against the AI boom.

Carpe Diem,

Angus

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.