Uranium prices have been trending higher again, likely, in part, boosted by the raft of recent AI-related news, with OpenAI and others inking a string of deals. While there is substantial doubt that OpenAI could ever meet all the obligations it has been signing, the hyper-scalers are forging ahead with massive data centre plans over the next few years and do have the financial firepower.

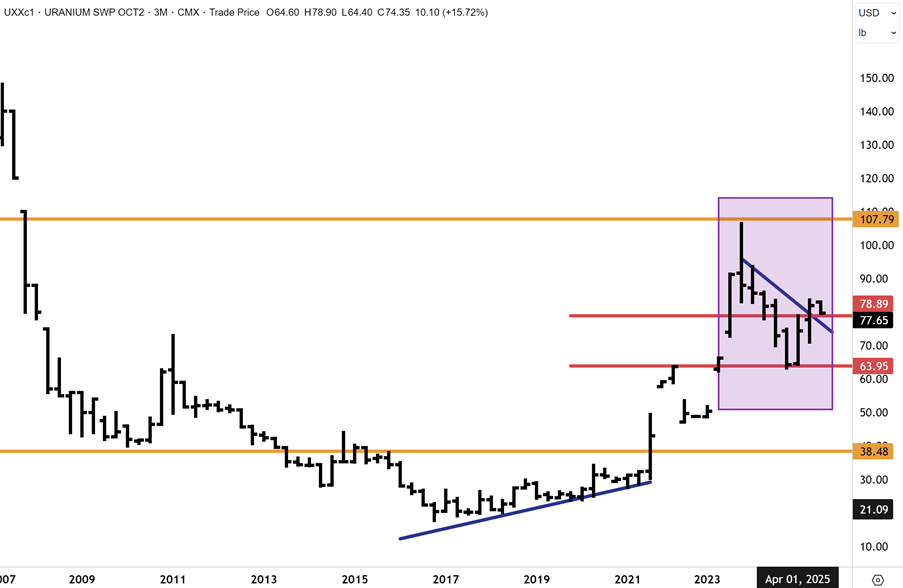

Uranium continues to have a bullish technical setup on the charts. Uranium contract prices look to have completed a correction from the highs near $110 pound and rolling correction underway for the past 18 months. The recent advance and breakout above the near-term downtrend at $75 points to upward momentum resuming. We anticipate uranium to retest the 2023 highs near $110 over the coming year.

Unlike previous uranium cycles driven by traditional utility planning, future demand will likely be propelled by inelastic and technologically advanced sectors that require clean, firm, 24/7 power. This dynamic looks supportive of the market’s long-term trajectory and could create a more robust foundation for growth. Further, in an increasingly fractured world, energy security is tightly linked with national security, compelling nations to pivot back to nuclear energy as a stable, sovereign source of power. This has ignited a new era of geopolitical competition in the nuclear sector, with global powers pursuing divergent but equally ambitious expansion plans. The US and China are both forging ahead on this front. Investment options for retail investors include buying individual miners (Paladin Energy) and ETF exposures. We have recommended the Global X Uranium ETF, trading under the ATOM ticker in Australia and URA in the US.

In early September, we noted, “We remain bullish in our technical outlook for ATOM. Encouragingly, the April lows were resoundingly rejected below $12. ATOM has since then managed to make a new record high near $22.50, but remains in a consolidation phase. ATOM has pushed higher towards resistance at the top end of the range in recent weeks, but further consolidation cannot be ruled out. Once overhead resistance is successfully cleared (which is our base case technical outlook), we envision upside momentum resuming and new record highs to follow.”

We remain bullish in our technical outlook for ATOM. Encouragingly, since our last technical update in September, ATOM has since managed to make a new record high above $26.50. The recent breakout above resistance at $26 marks the end of a recent multi-week consolidation and returning upward momentum. We envision upside momentum resuming and new record highs to follow – but buyers should be mindful of elevated risks for a broad-based correction in asset markets. Uranium like other asset classes would unlikely prove to be immune. A correction in financial markets could provide a superior entry point for ATOM.

Uranium stocks diverged: Paladin Energy gained +0.9% and Deep Yellow added +0.5%, while Boss Energy declined -1%.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.