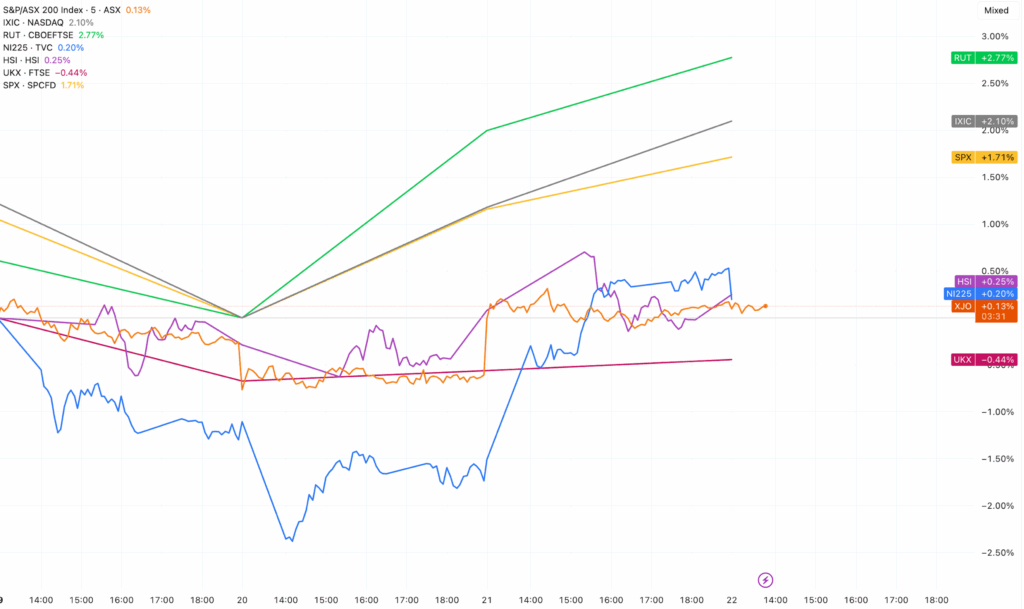

This week in the markets was characterised by a surge in volatility driven by escalating geopolitical tensions, the lingering threats to Federal Reserve independence and spikes in bond yields. Precious metals rallied to fresh highs, and the de-dollarisation trade featured heavily earlier in the week. Under the surface, small/mid-caps gathered pace, with the Russell 2000 hitting fresh highs on Thursday. The Russell 2000 has outperformed the S&P 500 daily now for almost three weeks at the time of writing – an impressive streak and one we have called earlier, recommending options for Members to participate. Our bullish call on precious metals (gold/silver/platinum, etc) has continued to pay off, with overweight positioning across our fund management portfolios and heavily featured in our research offerings. More on those and other current investment ideas later!

The week’s volatility was sparked by a classic “New Age of Empires” move. President Trump’s escalating demands over Greenland culminated in tariff threats on key European partners, and markets responded the way they usually do when policy uncertainty jumps. Risk came off quickly, and defensiveness returned in a hurry.

With US markets closed on Monday, the initial reaction showed up elsewhere first with soft trading in other global markets. When Wall Street reopened on Tuesday, the S&P 500 fell -2.1%, the Nasdaq slid -2.4%, and the Dow dropped -1.8%, with tech taking the brunt. The stress was not confined to equities: the dollar weakened against major currencies, while Treasury yields pushed to fresh highs as investors repriced risk premiums. The script flipped midweek after Trump suspended the planned tariffs following talks with NATO’s Mark Rutte, while also dialling back the most extreme rhetoric. That de-escalation triggered an immediate risk-on rotation and improved breadth—yet, notably, precious metals still pushed to fresh highs, reinforcing our view that gold retains secular support even as the tape steadies.

This week’s most useful lens came from Marko Papic’s “Age of Empires” framework.

A contrarian strategist, Marko Papic of BCA Research (who has made some bold calls in recent years), says that President Trump is predictable and that the Fed was never independent. The BCA Research global strategist is often at odds with more conventional and consensus views in the markets and often finds grounds for stark disagreement on the outlook for currencies, politics, stocks and bonds. Mr Papic is known for not holding back on opinions and rarely sits on the fence.

Mr Marko Papic is the lead global macro strategist at BCA Research, which provides insights to many institutional investors and hedge funds.

In plain terms, it argues that markets are entering a more multipolar phase where economic power, trade policy, and strategic resources are increasingly used as tools of leverage. That matters for investors because it shifts what drives risk appetite day-to-day, changes which assets behave as portfolio “anchors,” and increases the odds that policy surprises – not earnings – set the tempo when politics and markets collide.

In a wide-ranging interview recently with MarketWatch, Mr Papic expressed concern about the Fed’s autonomy, but noted that “the Fed was never independent anyway.” He also has different views on DJT and disagrees with what many believe is a chaotic approach to government. Mr Papic maintains that “Donald Trump is very, very predictable.”

Marko Papic said that markets were caught off guard by the ‘Liberation Day’ tariffs (as we were) despite Trump promising protectionist measures repeatedly throughout his electoral campaign. That is a fair point – and last year, many investment bank strategists did not believe extreme tariffs would be imposed. The BCA strategist also “violently disagrees” with the consensus that the ousting of Venezuelan President Nicolas Maduro is bearish for oil. (I have similar views on crude markets this year).

Mr Papic believes the US dollar could decline another 20% over the next few years (which is a view we share) and contends the Supreme Court will almost certainly uphold the legality of Trump’s tariffs this month. He also has a tactical underweight call on US equities and a bearish view on US bonds. (Mr Papic would certainly fit in at Fat Prophets)

One of Mr Papic’s major calls is a bearish view on the US dollar. He sees mounting pressure on the Fed to lower rates as ultimately weighing on the dollar and that the US is “skating on thin ice” if it resorts to monetary policy to stimulate the economy in advance of midterm elections come November, and in this environment “something has to break: the dollar.”

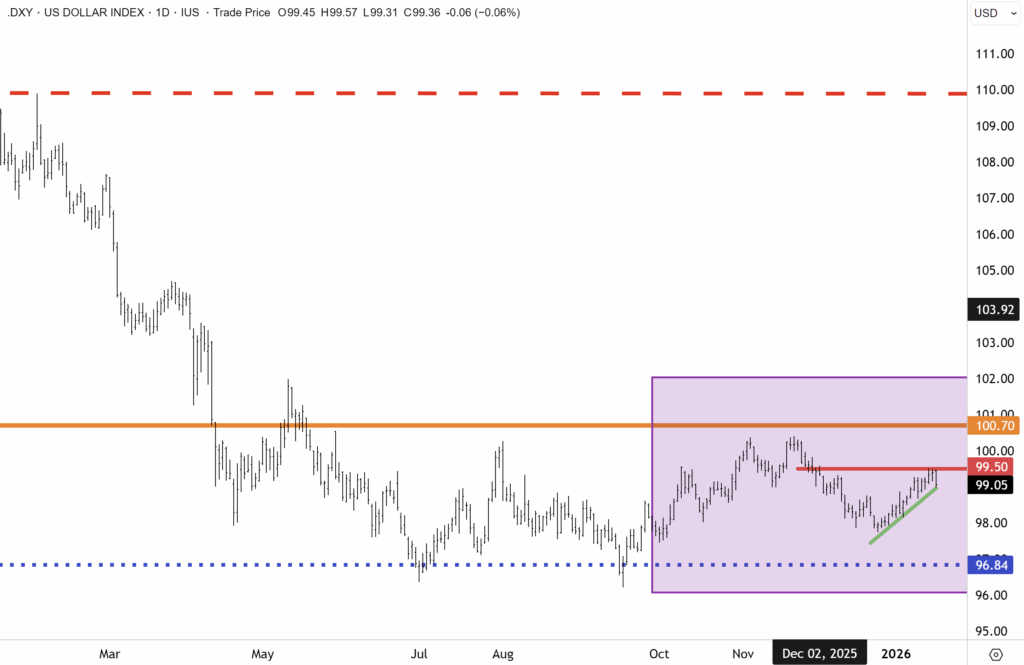

This is a view I concur with. We were amongst the first to have a prominent negative outlook in early 2025 for the US dollar, which has been maintained into this year. Recent debate in markets amongst economists and strategists has centred around Fed independence not being compromised this year, with the FOMC committee still able to make balanced decisions. However, I believe the FOMC is set to be disrupted and agree with Mr Papic that pressure will intensify on the Fed as we move closer to the US mid-term elections later in November.

For now, the dollar index remains range-bound after bottoming out last year at 96.5. A breakout and exit on the topside of the range above 100 would be a bullish signal that upward momentum was resuming in the DXY. However, this is not our base case. We believe the DXY will soon resume downwards and that at some point this year, the big support level at 96.5 will be retested.

Source: LSEG

Aside from the US dollar, Mr Papic’s other high conviction bet is a growing reluctance of foreign asset allocators to devote resources to US equities, and he is bullish on European and Chinese equities as well as the renminbi.

BCA anticipates a strong divergence between growth rates in the US and China and posits that “the rest of the world must offset the end of the US fiscal gravy train with domestic stimulus of its own.” Europe is now more on its own than ever, and will have to ramp up military spending sharply in the coming years. China has been doing this for some time, and with a sluggish domestic economy. China has an urgency to stimulate growth and get domestic consumption moving again.

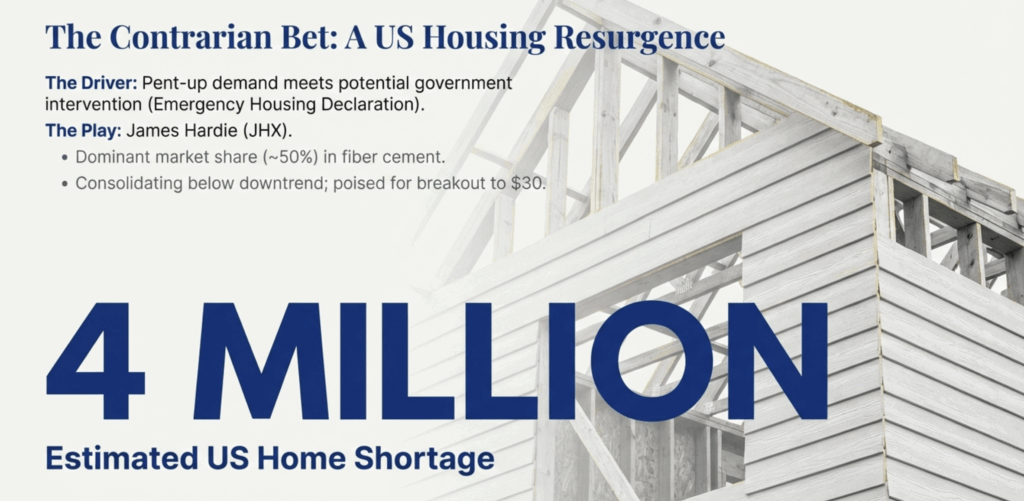

Mr Papic’s “playbook for 2026 has two theses, one of which has yet to develop much traction among investors, yet may well do as the political focus of Americans turns to elections later in 2026.” First is his notion that the White House may declare a housing emergency in 2026. Already, DJT has moved to block institutional ownership of homes, and the government said it’ll spend $200 billion on mortgage securities (which it has now done).

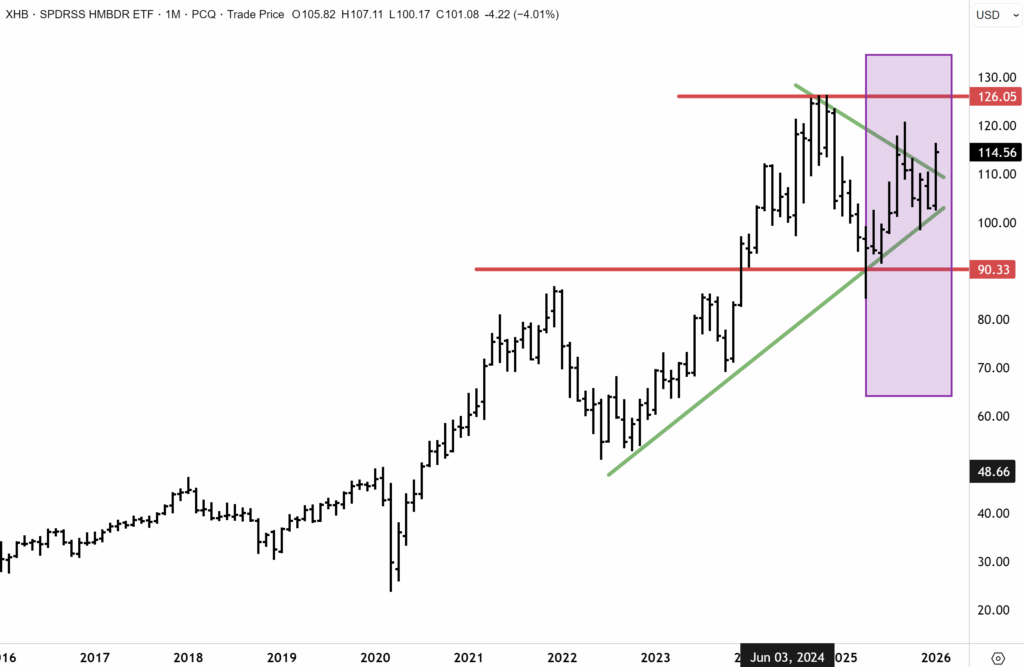

Mr Papic believes that Trump could soon use “macroprudential tools to suppress mortgage borrowing rates”, and widen the eligibility of mortgages and make housing an electoral issue and potential vote winner. “If the White House can force down interest rates on car loans and credit cards, this may be his way to reflate the economy – via the housing lever.” The upshot of this is that BCA Research and Papic are bullish on US homebuilders.

The SPDR Homebuilders ETF (US: XHB) has definitively cleared topside resistance and is resuming upward momentum. I anticipate a defining topside breakout ahead in the coming months and new record highs in XLB as a new housing cycle gets underway in the US.

Source: LSEG

We have been bullish on US homebuilders since last year, and hold the view that a defining rebound and upswing is coming in the housing cycle. There has been significant pent-up demand since the post Covid inflationary outbreak and after the Fed raised rates, which saw many US mortgage holders staying put with low rates locked on house loans. The US also has a shortage of new homes, which is around 4 million nationally.

Mr Papic also has a similar view and believes stocks associated with home appliances and home improvements will do well, along with the homebuilders, and to watch housing starts closely.

Source: BCA Research

We are playing this theme via James Hardie, which declined over half from last year’s peak following a merger and after earnings came in lower than expectations. However, despite this, I believe there is significant recovery potential this year for James Hardie, which enjoys a dominant US market share position of around c45% in both fibre cement cladding and engineered timber decking. We hold James Hardie across all our Australian managed account portfolios and the Fat Prophets Global Contrarian Fund.

James Hardie ADRs (US: JHX) are presently consolidating below the downtrend, which now intersects at $24. We anticipate a breakout and exit from the downtrend in the coming months, which is our base case. Once a breakout has been sustained, we believe significant recovery potential will ensue for JHX over the course of this year.

Source: LSEG

The other major theme that Marko Papic recommends this year is that investors exploit a boom in industrial commodities. “A multipolar geopolitical environment is a boon for capex and investments. Countries will try to increase their resilience to the new paradigm, which is what he calls “The Age of Empires”. Papic reckons global powers will begin hoarding physical commodities as they try to build out infrastructure, create new energy sources and new transportation networks and recommends investors increase exposure to industrial metals like copper, nickel and palladium. We certainly share this view, and I outlined the coming commodity super cycle late last year in my 2026 key predictions.

“Industrial metals are the new oil”. Mr Papic also “vehemently disagrees with the notion that the intervention in Venezuela is bearish for oil prices. I have doubts Venezuela brings on any new supply in 2026, and expects the Saudis will, at some point this year, yield to domestic financing pressures and “reverse the max-production OPEC+ policy.” Mr Papic’s strategy has initiated a long position on Brent futures and also oil services and energy equipment companies.

Capital Wars

Ray Dalio revived the idea of “capital wars” this week: when trade frictions rise, and deficits persist, the next battlefield is funding – who finances the system, on what terms, and with what leverage.

Mr Dalio said, “On the other side of trade deficits and trade wars, there are capital and capital wars. If you take the conflicts, you can’t ignore the possibility of the capital wars. In other words, maybe there’s not the same inclination to buy at US debt and so on.” We saw that dynamic playout in spades on Tuesday as investors dumped holdings of longer dated US treasuries and sold the dollar and equities.

The hedge fund vet is also concerned about the US deficit and rising national indebtedness, which comes at the same time as the government is issuing large volumes of new bonds, which Dalio believes will create a “problematic situation if confidence weakens on either side”.

“We know that both the holders of US dollars are denominated … and those who need it, the US, are worried about each other. Right? So…if you have other countries who are holding it, and they’re worried about each other, and we’re producing a lot of it, that’s a big issue”.

US longer dated bonds dropped sharply on Tuesday as investors weighed renewed tariff threats from Washington that revived fears of a trade war with Europe and spurred a flight away from US assets. The de-dollarisation trend could intensify if DJT does not soon reign rhetoric on Greenland and follows through on the latest threats to impose tariffs on Europe.

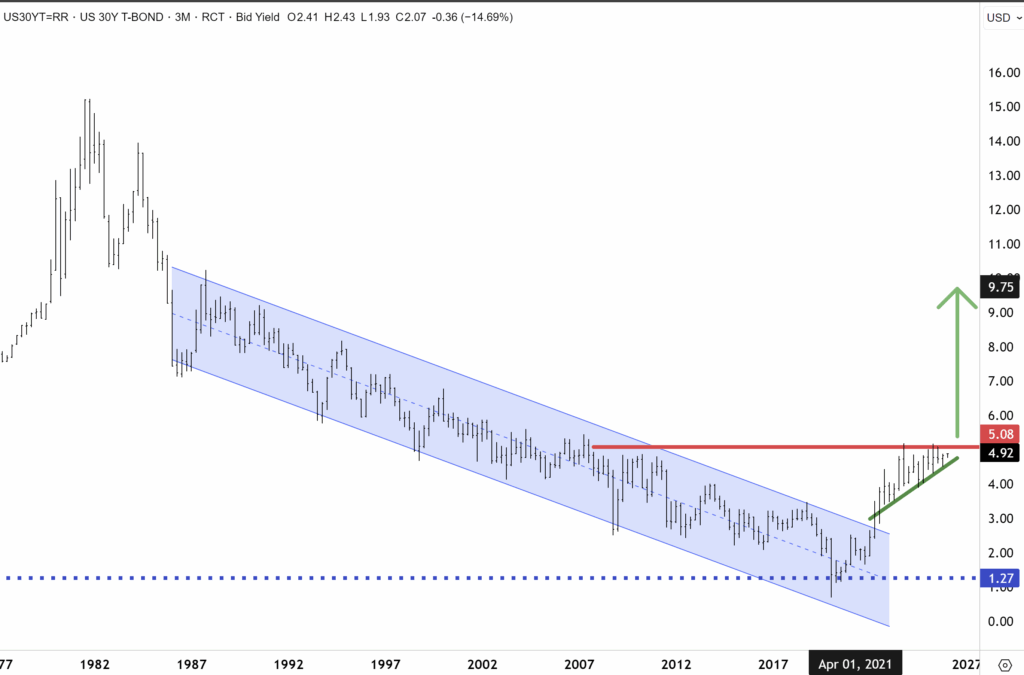

The US30yr is knocking on the door of 5%, and I warned about this late last year. If the US30yr cracks above the resistance ceiling at 5.1%, then I would expect the yield to rise rapidly towards 6%. This outcome could happen if foreign owners of US treasuries begin selling en masse and dumping on the open market.

Source: LSEG

Mr Dalio said history offers multiple examples of similar episodes in which economic conflict escalated beyond trade into capital flows and currency disputes. “When you have conflicts, international geopolitical conflicts, even allies do not want to hold each other’s debt. They prefer to go to a hard currency. This is logical, and it’s factual, and it’s repeated throughout world history.”

One reason I respect Ray Dalio is that he is one of the best historians of financial markets and has a forensic understanding of previous cycles and drivers. History may not always rhyme – but it often repeats.

Once again on CNBC this morning, Mr Dalio reiterated the importance of diversification, arguing that investors should not rely too heavily on any single asset class or country. He highlighted gold as a key hedge in periods of financial stress, recommending it make up between 5% and 15% of a typical portfolio. “It does very well when other assets don’t do well. It is an effective diversifier.” I obviously concur, but would emphasise the importance of holding international equities outside the US, which I see beating the S&P500 this year.

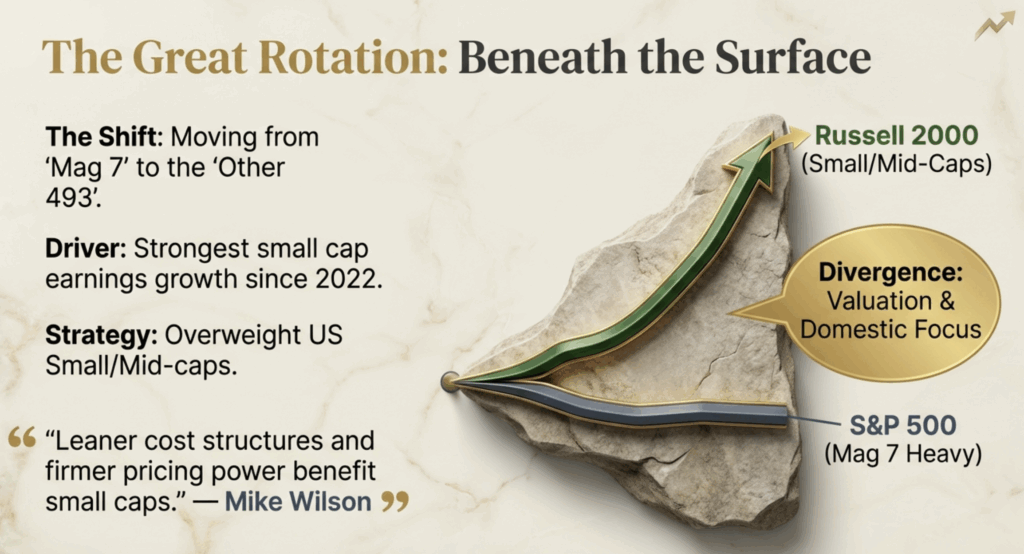

Mike Wilson wrote in his note this week that “small cap earnings growth is at its strongest level since 2022 (+8% Y/Y; up from -8% a year ago). Importantly, earnings revisions breadth versus large caps accelerated further last week as the group broke out of a multi-year relative performance downtrend. At the heart of this turn in fundamentals is the positive operating leverage dynamic …In short, leaner cost structures and firmer pricing power benefit small caps, in particular. In our view, this reinforces the idea that the relative strength in small caps since November is fundamentally driven, a setup we have not seen since the last time we were OW the group for a sustained period, between 2020 and early 2021.”

One reason I have conviction that the US equity bull market continues this year is that rotation is going on beneath the surface. The benchmarks are being driven less by Mag 7, tech and AI-related names, which have expensive valuations. The rally this year has been powered more by the other 493 companies in the S&P500 and Small/Midcaps that have much lower PE multiples. This is exactly what we need to see for the US bull market to sustain an upside trajectory. I would also add that I concur with Mike Wilson and agree that the US earnings backdrop is improving and that the rally is occurring on solid fundamentals. We also upped our weighting to US small/midcaps late last year in our Separately Managed account portfolios (reach out to patrick.ganley@fatprophets.com.au for more information).

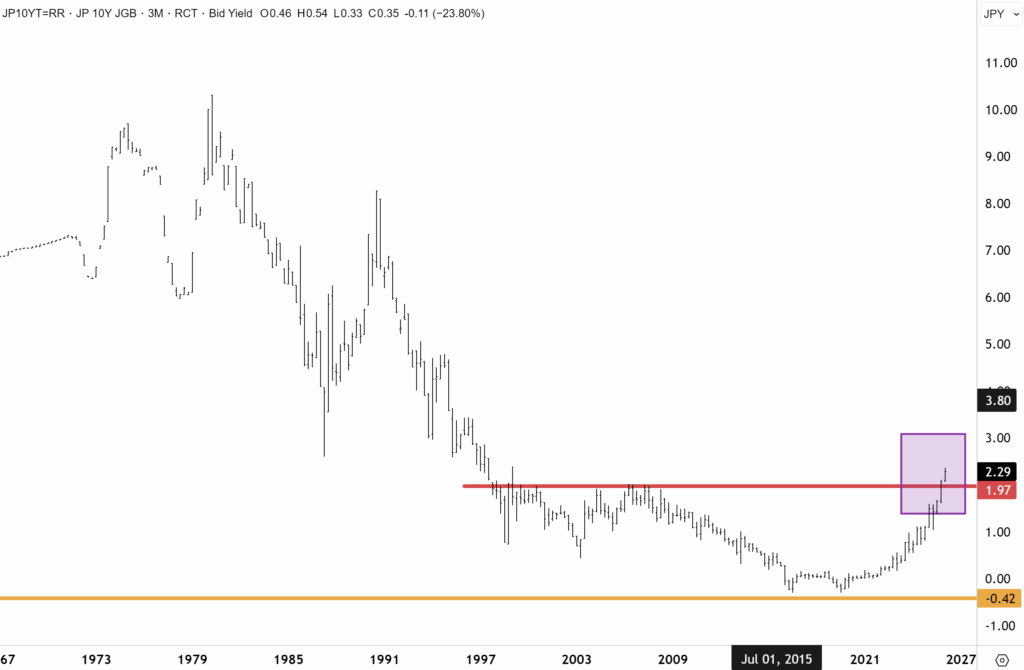

Citadel boss, Ken Griffin, said in an interview on Bloomberg at the Davos forum that “heavy selling of Japanese government bonds this week should serve as an ‘explicit warning’ to US politicians to improve the nation’s finances. Mr Griffin said that “bond vigilantes can come out and extract their price. What happened in Japan is a very important message to the House and to the Senate: You need to get our fiscal house in order.” He is totally right on this.

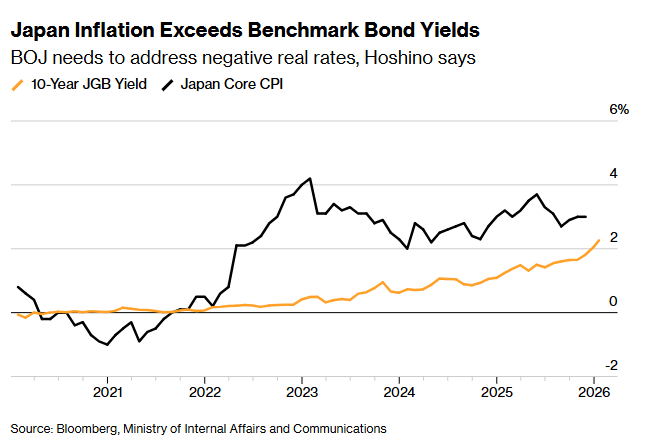

This week, the Japanese bond market came under acute pressure with the incumbent government likely to win the upcoming election and embark on fiscal stimulus policies, which will add to Japan’s debt burden. One factor to keep in mind, however, is that Japanese bond yields are still well below those in the US. Inflation is elevated above the BOJ’s 2% threshold. Monetary policy in Japan is normalising following decades of deflation and financial repression. Thus, the steepening yield curve is to be expected, and we will likely spur further rate hikes from the BOJ not before too long.

Ken Griffin said the US is in a different position than Japan and “is probably not in immediate danger. The US has so much wealth that we can maintain this level of deficit spending for some period of time. But the longer we wait to change direction, the more onerous the consequences will be of that change.”

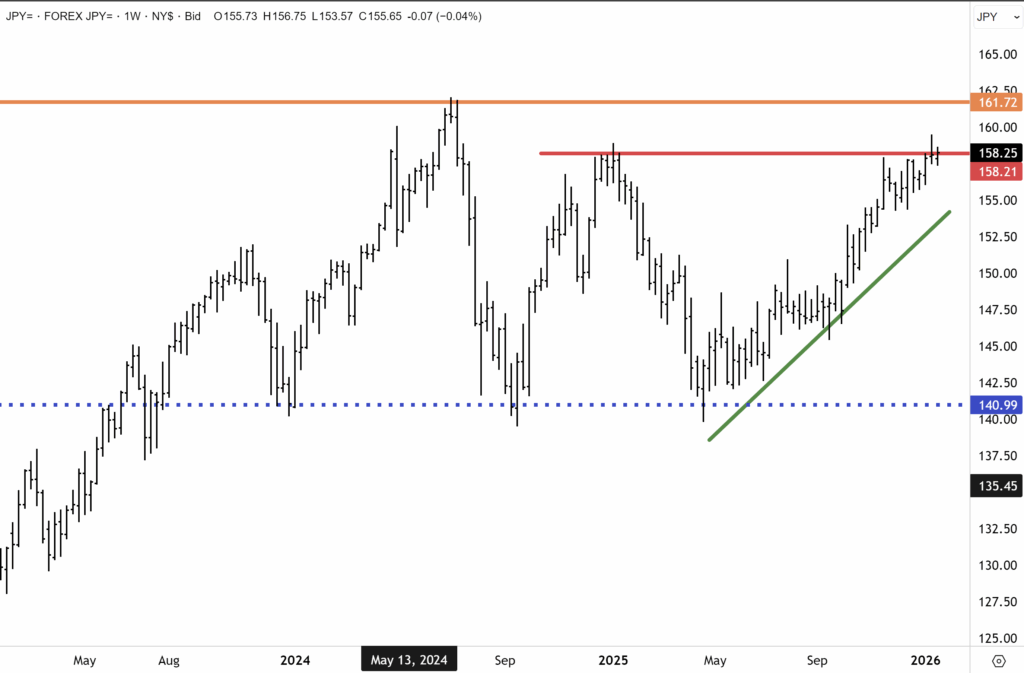

Mr Griffin makes a fair point, however, and Japan has been able to effectively increase the debt pile (and print money) for many years, due to benign inflation. However, the government is going to be forced by the bond market to rein in fiscal stimulus and reduce the debt-to-GDP ratio. I would also argue that, similar to the US, the government will have to inflate the debt away, and on this front, the yen could weaken further this year against the dollar and other major currencies.

Debt monetisation is also an option for the BOJ and the government. This won’t necessarily hurt the stock market, which is at record highs. And in fact, equities tend to do very well in an inflationary environment, and a lower yen will lift Japanese exporters while higher rates and a steepening yield curve will boost banks and financials.

Source: LSEG

Turning to Japan, the Bank of Japan could potentially raise interest rates three times this year to double the current level if the yen’s weakness persists, according to Citigroup strategists. In a recent Bloomberg interview, Citi strategists said that the dollar could rise above ¥160, which might then prompt the BOJ to lift the overnight call rate by 25 bps to 1% in April. Citi believes there is scope for another hike of the same size in July, and possibly a third by year-end if the Japanese currency stays low. I reckon that Citi will be correct on this view.

Citi Japanese strategist Akiro Hoshino said that “put simply, the yen’s weakness is being driven by negative real interest rates. The BOJ has no choice other than to address this if it wants to reverse the exchange rate’s direction”. He makes a very good point with Japan’s inflation rate now above the cash rate, pushing the real interest rate into negative territory. The BOJ needs to address negative real rates in my view, or risk much higher inflation.

BOJ officials are now paying increasing attention to the yen’s potential impact on inflation as consumers grow frustrated with rising prices – and risk falling behind the curve if they delay rate hikes for too much longer. Japanese banks are going to be the real winners here as net interest margins expand on their respective domestic loan books. Japanese bank valuations were crushed during the decades of deflation and financial repression when the BOJ kept rates at zero. The opposite is true today – and I expect Japan’s banks to become amongst the most profitable in the world as monetary policy normalises.

While the market expects the next rate hike to be several months away (likely in April), some economists expect the BOJ to act sooner if the yen continues to weaken. I am leaning into this and would see the yen taking out the 2024 highs above Y162 – as being a key technical threshold.

Source: LSEG

Japan had deflationary pressure for three decades. But a weakening yen is changing that narrative quickly, and the landscape in financial markets. Japanese institutions and domestic investors are likely to consider, for the first time since the 1990s, moving investments from offshore back into fixed-income assets if key interest rates such as the 10-year JGB bond yield start to exceed inflation. Citi believes this scenario will playout which I also agree with. During the decades of deflation, Japanese consumers and financial institutions accumulated around $8 trillion offshore in equities and savings. This capital could soon be repatriated and reinvested in domestic fixed income and equities.

One of our highest conviction ideas here is the Japanese banks. Japanese banks enter 2026 positioned at the epicentre of multiple structural tailwinds that create a compelling investment thesis for equity investors. After decades of zero or negative interest rates that compressed profitability, the Bank of Japan’s monetary policy normalisation cycle is fundamentally transforming the earnings power of the sector. The three megabanks – Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group – have raised their fiscal 2026 net profit forecasts to record levels.

The bull case rests on five pillars: (1) expanding net interest margins from continued Bank of Japan rate hikes, (2) sustained corporate lending growth fuelled by record M&A activity and strategic capital expenditure, (3) growing shareholder returns through buybacks and dividends supported by improving return on equity, (4) valuation rerating potential as Japanese banks trade at significant discounts to both domestic and international peers, and (5) structural corporate governance reforms that are unwinding decades of capital inefficiency.

Meanwhile, the Chinese tech titan, Alibaba, surged on Thursday after a report said the company is considering an initial public offering of the AI chip unit, T-Head. This is a similar strategy to Baidu. Alibaba is the biggest Chinese cloud player, and the Qwen AI models are hugely popular among the open-source community. Alibaba Cloud reported downloads of the Qwen model family surpassed 700 million as of January, underscoring rising interest from developers worldwide. According to the company, December downloads on Hugging Face (a popular open-source platform for AI software) outnumbered the combined total of the next eight most popular LLMs. Alibaba is rapidly evolving from a backend cloud infrastructure provider to a fuller AI stack.

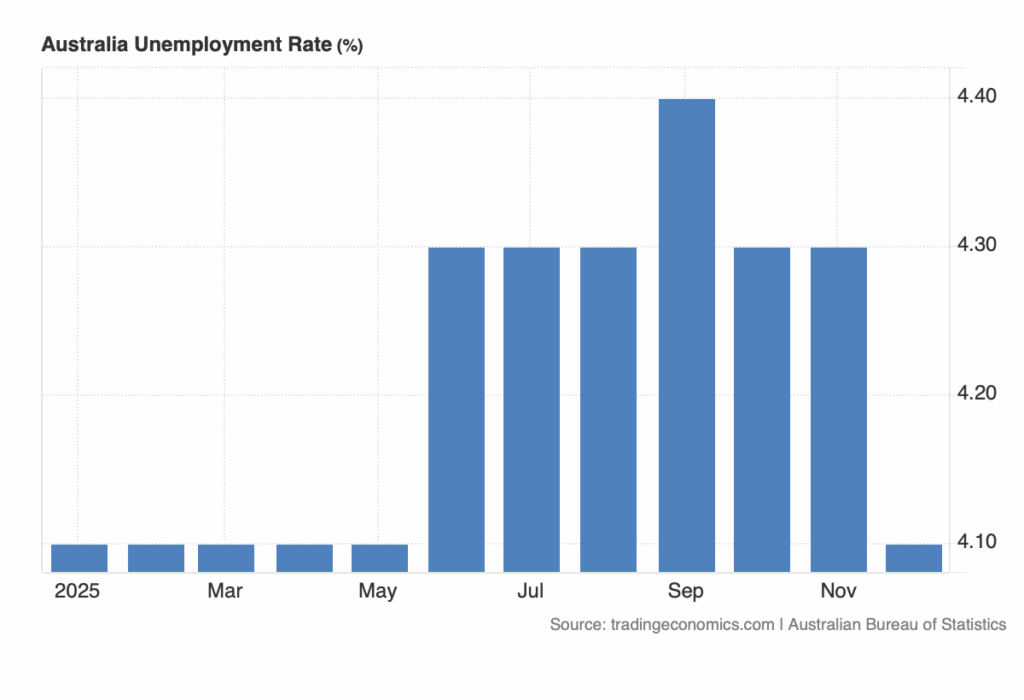

Back in Australia, the A$ soared Thursday on a strong jobs report – which effectively snuffs out the rate cut narrative this year – and could lead to hikes. The Australian dollar ripped to a fresh 15-month high at US68.4c after a blowout labour-market report forced traders to rapidly reprice the near-term path for the RBA. December unemployment fell to 4.1%, contrasting with the consensus call for a rise to 4.4%. Hiring also surprised sharply as the economy added 65,200 jobs, more than double the roughly 30,000 the market had pencilled in. The immediate market response saw bond traders lift the implied probability of a February rate hike to about 60%, up from around 30% before the data, and the broader curve now reflects two increases across 2026.

A lower-than-expected unemployment rate surprised traders on Thursday.

If the RBA has to run policy tighter, Australian government bonds screen relatively better against global peers, and capital flows tilt toward Australia, so the A$ catches a bid. Several economists moved quickly to flag a February move that would lift the policy rate to 3.85%. Others cautioned a February hike could be especially painful if the impulse is weak productivity and heavy government spending rather than a genuinely booming private economy. Inflation has eased, but it remains above target. The next CPI print is due to land next Wednesday.

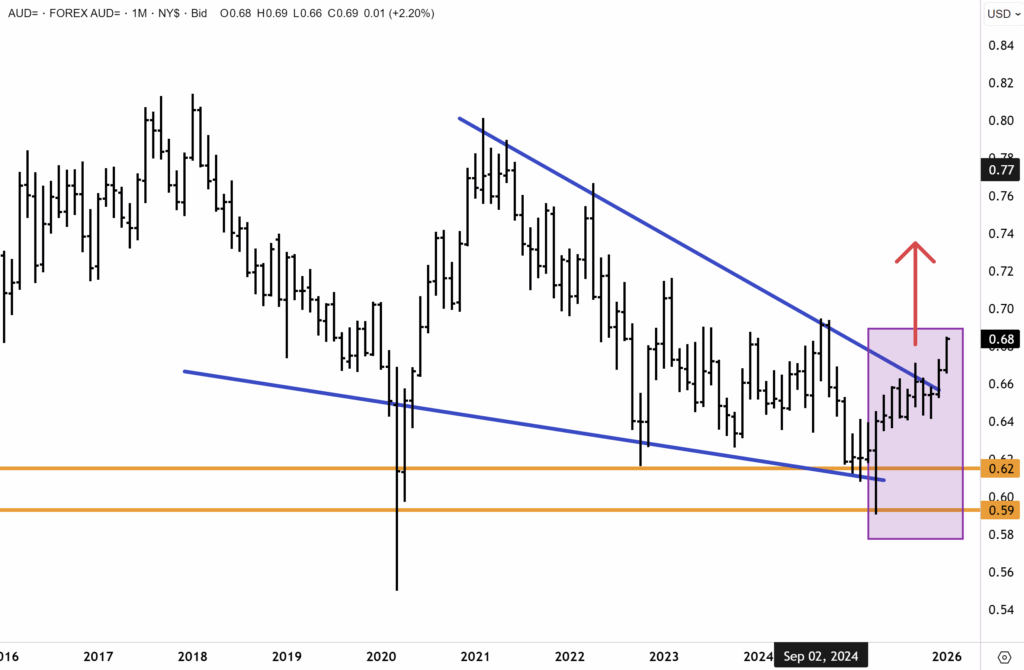

Meanwhile, the Aussie is also riding a powerful external tailwind, with booming metals and bulk commodities, plus softer sentiment toward the US dollar. Last year, I predicted the A$ would rise well into the mid-70c level in 2026 – which seems to be now playing out.

We expect the A$ to rise towards 78c/80c this year.

Source: LSEG

As we noted earlier in the week, some major banks are moving ahead of the RBA meeting in early February. Some major lenders have delivered brutal repricing across fixed-rate mortgages, with Commonwealth Bank leading the charge last week. Australia’s largest bank jacked up fixed rates on mortgages by as much as 0.7%, almost the equivalent of three typical consecutive Reserve Bank hikes, in a savage move that will add hundreds of dollars to monthly repayments for new borrowers.

Gold is sparkling

Goldman Sachs lifted its gold forecast by +10% on the back of what it described as blistering private-sector demand, taking its revised target to US$5,400 per ounce. An important takeaway is why “high prices” do not necessarily cure “high prices” in gold. Supply cannot be turned on quickly, and flows matter more than the stock. Even if the above-ground inventory is large in absolute terms, only a small fraction is available at the margin at any given time. That means modest shifts in portfolio allocation—by institutions, households, or reserve managers—can keep the bid under gold elevated for longer than traditional commodity logic would suggest.

Goldman’s view also implies a useful “stop condition”: gold’s rally typically loses momentum only when demand weakens—when geopolitical tensions calm, central banks feel less need to diversify reserves, and the market no longer wants hedges against policy shocks. We are not yet seeing those conditions. As a result, we continue to treat gold less as a short-term fear trade and more as a regime asset that can coexist with risk-on phases.

Making Money while the Yellow Metal Shines

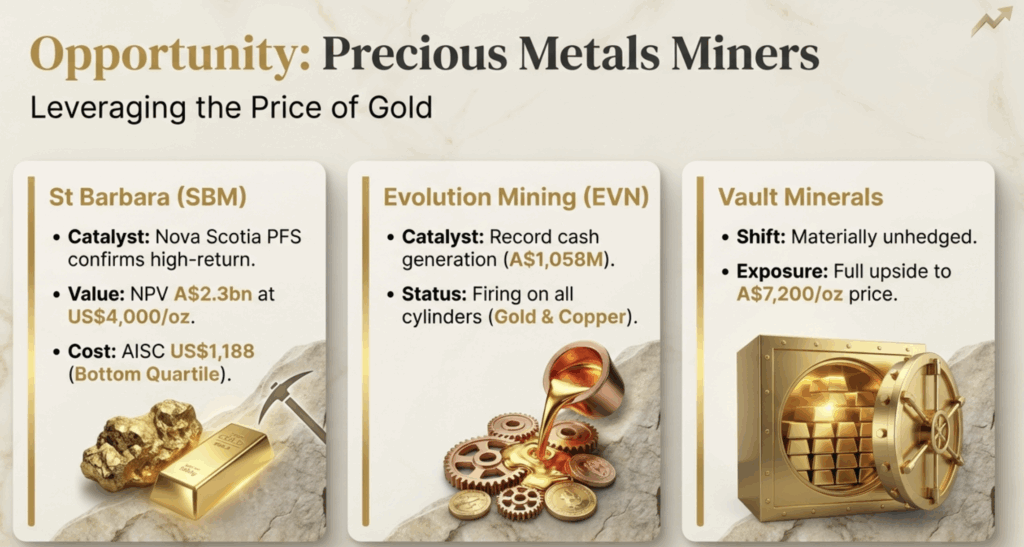

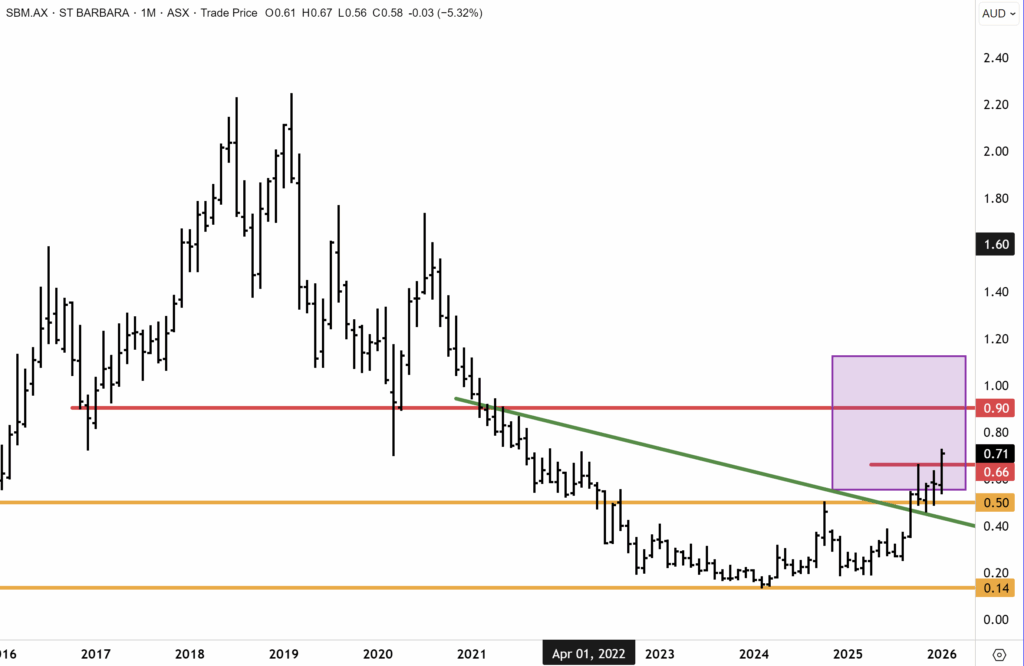

This week, we have seen several Australian gold miners report bumper numbers and other upbeat updates. Starring here was St Barbara, which surged +20% on Wednesday after releasing a well-received prefeasibility study (PFS) for its 15-Mile Processing Hub in Nova Scotia, Canada. The PFS confirmed the project as a high-return, capital-efficient gold operation with economics substantially enhanced by current gold prices exceeding US$4,800 per ounce – well above the US$3,000/oz assumption (base case and US$4,000/oz for the bull case) used in the study.

All-in sustaining costs (AISC) of US$1,188 AISC positions the project in the bottom quartile of the global cost curve. With gold reaching new highs, the post-tax payback period is less than a year. The project has a post-tax NPV of A$2.3 billion at the higher US$4,000/oz gold assumption (SBM’s market cap is currently around A$860m). The project will be funded by cash flows from the company’s Simberi gold project in PNG and the Touquoy restart in Canada. The PFS highlights a game-changing project for SBM in an elevated gold pricing environment, which could endure for some time.

In our mid-December technical update, we said, “The upward dynamic in St Barbara yesterday likely marks the end of a recent consolidation since the shares traded at a three-year high near 68c and gold topped out at $4,500oz. We see upward momentum in SBM now resuming. A topside breakout above downtrend resistance, which intersects around 58c, would confirm an inflection. Our technical base case is for SBM to resume upward momentum towards the next key resistance cluster around 74c/90c. Greater recovery potential and technical upside reside over the coming year, in our opinion.”

Since our last update, our technical base has played out in St Barbara with upward momentum resuming, and a topside breakout above is now confirming an important inflection. Our technical base case remains in place, SBM to retest the next key resistance cluster around 90c. We have conviction that SBM has greater recovery potential and technical upside over the coming year, and possibly well above the 90c resistance cluster zone.

Source: LSEG

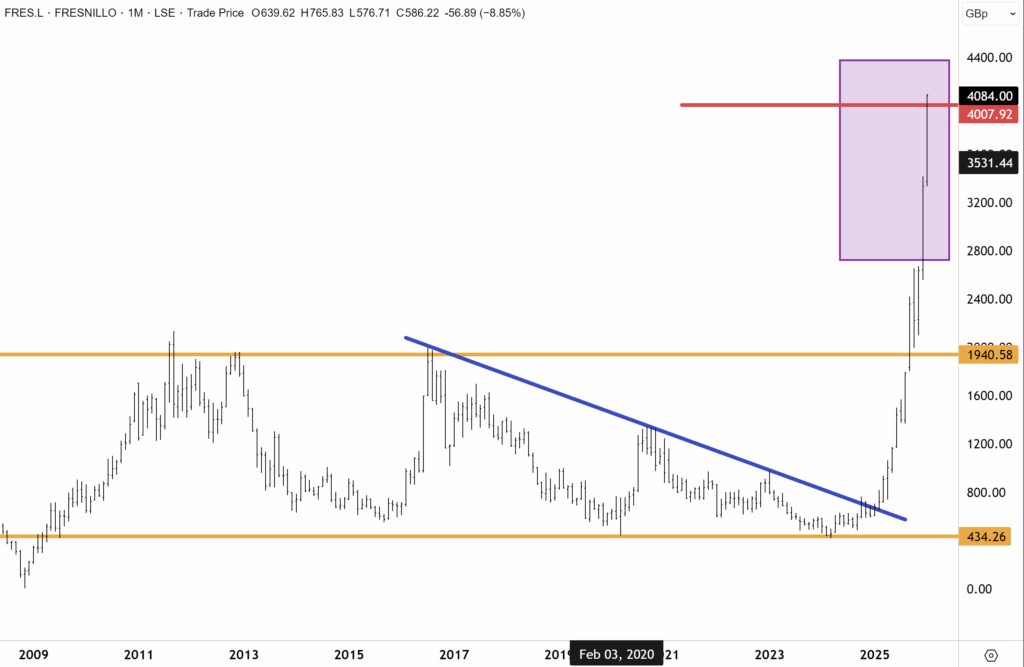

The research team also touched on other reporting stocks, available in the mining research service, including several others leveraged to this strong gold tape. Fresnillo was a conviction pick and recommendation for Members in 2025 and easily topped the FTSE 100 performance table. Over the past year, the stock has surged roughly +490%. Even now, a soaring silver price underpins the valuation.

In our last tech update on the 10th of December, we noted that “Fresnillo made a new record high above 2800p. The recent breakout above near-term resistance has catapulted the stock forward, which has been the top performer in the FTSE100 this year. Scope remains open for further upside extension in our view. ”

Fresnillo has certainly extended higher since our last technical update in early December, rising north of £40 this week. Fresnillo, on a twelve-month basis, retains its spot at the top of the FTSE100 table. The scope is open for further upside over the medium to longer term, given our bullish view on the silver price. However, we remain reticent on adding further exposure or buying at current prices, given the huge underlying move in the stock. There is a good chance that Fresnillo could now undergo a consolidation, which would be healthy. However, we remain committed to Fresnillo given our bullish view on silver (and gold). Silver spot prices could potentially rise much further this year.

Source: LSEG

Finally, the Fat Prophets Global Contrarian Fund (ASX: FPC) updated the ASX this morning, which revealed a cracking start to the year. Estimated pre-tax NTA confirmed a month-to-date increase of nearly 10%. Performance was driven across the portfolio and notably in precious metals, Chinese tech majors and Japanese financials. FPC shares also made a new record high, touching $1.60 for the first time. On this front, the discount of share price below the underlying estimated pre-tax NTA remains a sizeable c26%.

I know I am talking my own book – but the discount is perplexing given FPC has been one of Australia’s (and the world’s) best performing global macro hedge funds over the past year. Sometimes I wonder about giving up my day job! Jokes aside – I enjoy what I do, and there are not many days that go by that are unfulfilling. (I concede that when Japan’s stock market lost 25% in three days during 2024, when the yen/carry trade ruptured, it tested my nerves!).

I concede that performance since inception has been more modest, but the Fund has since 2024 certainly been travelling in the right direction with all three core themes contributing. Past performance, of course, is not a guide to future performance, and of course, there are always setbacks in the markets, but focusing on a few core themes has been a key change to the Fund’s strategy in recent years that seems to have made a difference.

I want to thank our many loyal shareholders who have stuck by us since the Fund’s launch, and also new shareholders joining the share register. On this front, FPC’s top 20 shareholders are little changed in recent years. (Disclosure: We own 10% of the Fund directly and are the largest shareholder).

Key excerpts from the ASX release were as follows: –

“…Performance has been boosted this month by strong returns from gold, silver and platinum, which have all made new record highs. We believe that last year’s trend of a weaker dollar and ‘de-dollarisation’ will continue in 2026. On this front, the recent geopolitical events around Greenland and likely other future events could further reduce demand for US assets as the global world order undergoes a seismic shift.”

“We are also focusing closely on the recent turmoil in the global bond market, where we see continued rising demand for gold and precious metals as a hedge. Whilst central banks have dominated the gold market in recent years, demand appears to be diversifying towards retail and institutional investors and sovereign wealth funds.”

Have a great weekend.

Carpe Diem!

Angus

Sign up to receive full reports for

the best stocks in 2026!

Where to Invest in 2026?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.