Moving On

The S&P 500 are close to wrapping up the best earnings season in four years. Most corporates in the index have beaten earnings estimates at the highest rate since the third quarter back in 2021. However, the forward PE is now stretched to near 23X, which is high by historical standards. Investors are anticipating earnings growth to continue, driven by lower rates, a still resilient economy, AI efficiency and productivity gains, now that tariffs are behind the economy. The weaker US dollar is also providing a lift for multinationals with significant offshore revenues.

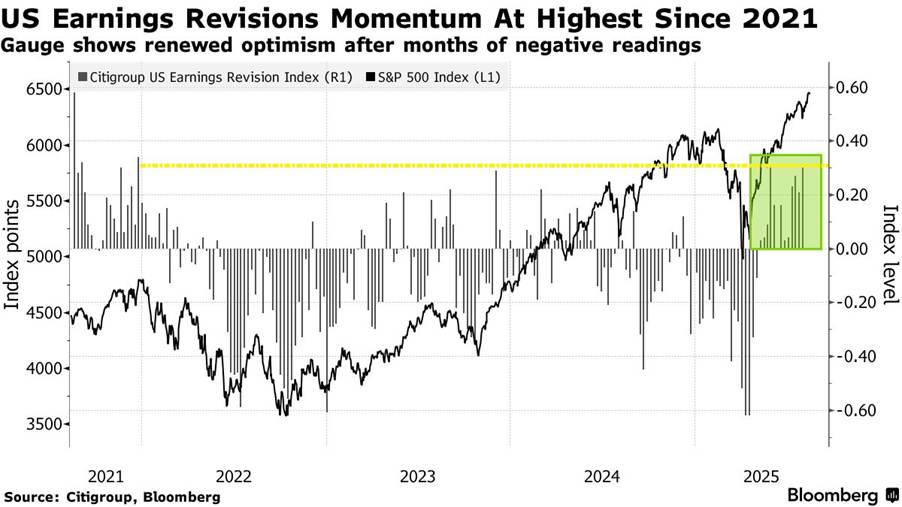

Goldman Sachs chief US equity strategist David Kostin said in a note over the weekend, “the quarter has been marked by one of the greatest frequency of earnings beats on record.” Meanwhile, Wall Street has ratcheted up earnings estimates for the current quarter at the fastest pace in nearly four years. A Citigroup Inc. index that tracks the relative number of US earnings-per-share estimate upgrades versus downgrades is at its highest since December 2021.

The combination of robust and improving corporate fundamentals and relentless technical momentum is continuing. Many hedge funds have been aggressive buyers in recent weeks, and now have to address significant underweights in equities from outsized cash positions that resulted from the April selloff. There are not insignificant risks that the seasonal selloff that typically appears in September/October may not arrive this year.

Should the S&P500 correct lower in the coming weeks, the technical support level at 6,155, which marked and defined the March line before ‘Liberation Day’, would likely be vigorously defended. Many investors became underweight in the market back in April and are waiting for an opportunity to deploy cash. Any selloff, if it materialises, is likely to be short and shallow as liquidity jumps on any setback opportunity. Additionally, the Fed is getting closer to an aggressive easing cycle, no matter the outcome at Jackson Hole later this week. Most investors will not want to fight the Fed.

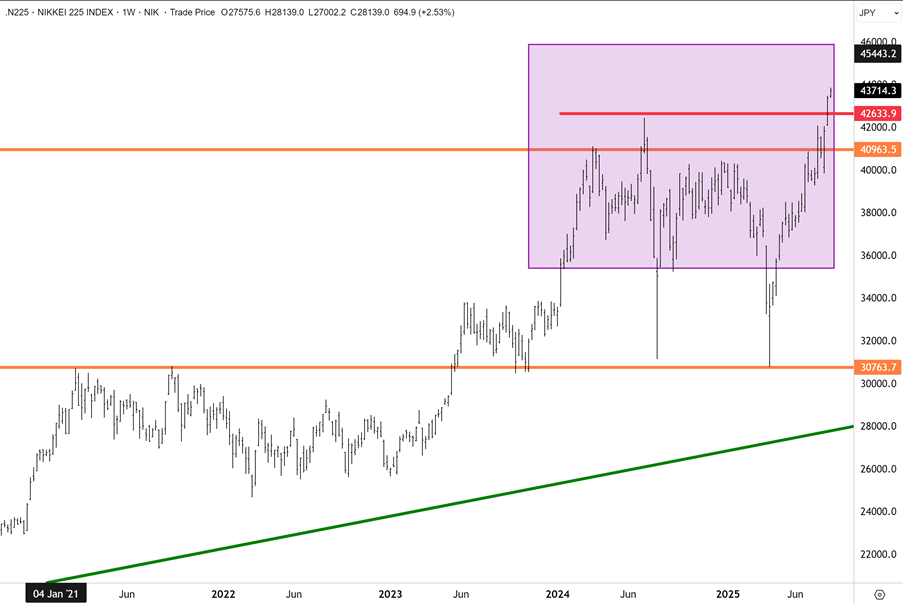

Japanese equities have also reached record highs, but some strategists and analysts are concerned that the continued breakout is not guaranteed, with short-term correction risks remaining prominent. JP Morgan said in a note yesterday, “while the market has rallied sharply, technical indicators and seasonal patterns suggest the possibility of a near-term pullback. Therefore, it would be premature to assume a sustained breakout. Nonetheless, expectations for domestic political developments and the strength of the tech sector are likely to support large-cap, highly liquid stocks, making it difficult to dismiss the rally as a mere technical rebound.”

The Nikkei has extended sharply since convincingly hurdling above key resistance at the 41,000 highs in ’24. The scope is open for additional upside extension over the coming year, with the 45,000/46,000 technical levels attainable in my view. Near term, any pullback could prove short and shallow, given that many have missed the breakout rally.

Fundamentals around Japan are improving rapidly. JP Morgan noted this week that “policies related to tariffs—posed headwinds to corporate earnings. However, since early July, the passage of US tax cut legislation and the agreement in US-Japan tariff negotiations have significantly reduced uncertainty surrounding corporate performance. Although Q1 earnings declined year-on-year, results overall exceeded consensus expectations.” Japan has a powerful tailwind that is coming from improving returns on equity and growth.

However, while in the US corporations do not refrain from giving strong guidance when the economic backdrop warrants it, in Japan, management can be much more cautious and conservative. JPM noted this week that “while corporate guidance has remained largely unchanged, more so than in typical years, some companies have revised their outlooks upward, citing milder-than-expected impacts from tariffs. The negative effects of US tariff hikes on earnings appear to have been less severe than initially anticipated, and the equity market seems to have priced in much of this impact.” I think there is more to go given that Japanese corporates were looking at a fairly dire outcome on tariffs just a few months ago, which has now been dialled back.

JPM noted on earnings that “in fact, the stronger-than-expected Q1 results are likely to prompt upward revisions in analysts’ earnings forecasts, which could lead to a rise in consensus EPS. In addition, we expect a combination of factors—including political optimism and a resilient tech sector—to continue supporting large-cap, highly liquid stocks…seasonal patterns suggest the potential for a year-end rally. Corporate actions such as share buybacks and the unwinding of parent-subsidiary listings may also provide support to the index. Therefore, it would be difficult to dismiss the recent surge in Japanese equities as a mere technical rebound.”

The rally in Japanese equities has legs in my view, and despite the PE being relatively high (still much lower compared to US benchmarks), Japan’s stock market could be on the cusp of a significant PE multiple expansion in the year ahead as corporate earnings accelerate. I would be a buyer of Japanese stocks (and financials and banks) on any weakness.

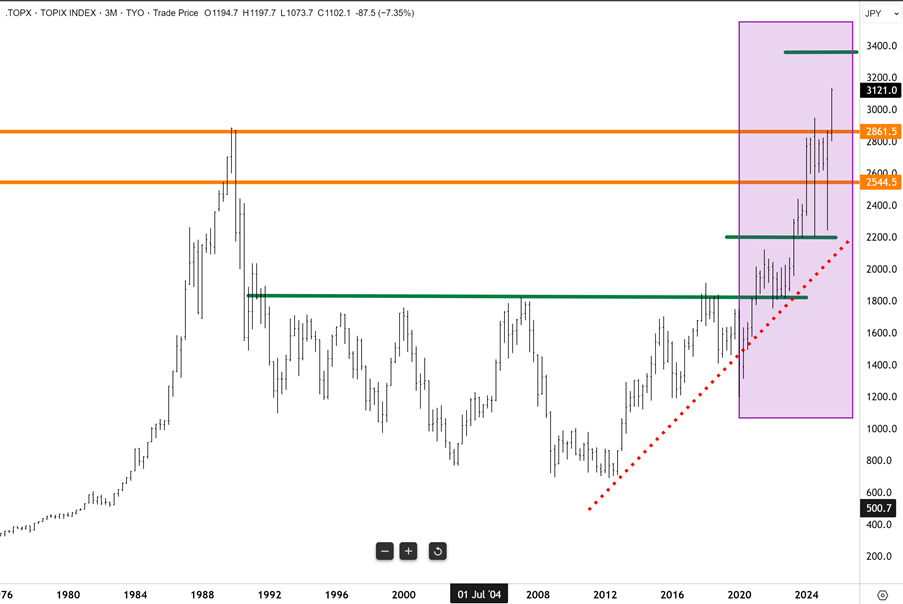

The TOPIX index has “moved on” and definitively broken out above the 1989 highs at 2900/3000. The breakout has seen the benchmark surge nearly +45% from the April lows – but a lesser c+10% from the 1989 highs. The two successful tests of key support at 2,200 will likely prove defining. I believe the technical and fundamental foundations are now in place for significant upside extension over the coming years, and see Japan joining China/Hong Kong benchmarks as being amongst the world’s best performing. We retain an overweight position in Japan across our portfolios.

JPM noted they believe the valuation adjustment potential for Japanese equities under a global soft-landing scenario should be assessed not only in comparison with Japan’s historical P/E levels, but also relative to the forward P/Es of other major equity indices.” Japan’s benchmarks are trading on a PE of about 16.4x, above the 10-year average of 15.0x.” JPM highlighted that “the gap with the US (S&P 500 forward P/E at 23.8x) is 7.4x—well above the 10-year average gap of 4.2x. If Japan’s undervaluation were to be corrected and the gap between TOPIX and US equities narrowed to the historical average (implying a 3.2pt increase in TOPIX’s P/E), then assuming EPS remains unchanged, TOPIX could rise to 3,630 points—nearly 20% above its August 13 closing level of 3,091 points. In that sense, Japanese equities still have substantial room for valuation adjustment.” I concur with this view and believe the Japanese stock market will continue rallying and outperforming with dip buying emerging on any corrective setback.

I am also optimistic that the bull market in mainland Chinese stocks will continue. On Friday, mainland Chinese investors bought around HK$4.6 billion of Hong Kong stocks, which is the most ever on record. The previous record was set back on April 9th, amidst the Liberation Day selloff, which also coincided with the tariff-induced market bottom.

The Hang Seng China Enterprises index (which comprises large-cap mainland Chinese companies listed in Hong Kong) has broken out above the primary downtrend to establish a new support base at the 8,500 breakout level. Despite the near doubling in the index since the double bottom lows that were established at 5,400 last year, I anticipate significant upside extension in the year ahead. The next cluster of resistance around 11,000 is a plausible price target for the index in my view.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.