Key themes and stocks discussed today:

- The major US benchmarks closed mixed on Monday ahead of the key FOMC decision tomorrow. A rate cut is all but a certainty; the only question is by how much. Fed funds futures are pricing in a 59% chance for a 50 bp cut. The US dollar continued to weaken into the decision, which propelled gold to a new record high, with the other PGMs also having a decent catch-up rally. Commodities are also looking firmer following the “risk-off” move in the past few weeks. The “risk-off” move seen in early September might be already over.

- Morgan Stanley’s Mike Wilson believes the Fed might want to cut by 50 bps, given the bond market indicates that monetary policy is behind the curve (if interest rates stay higher for longer, they risk rupturing something in the economy). Wednesday could be a pivotal one for the markets.

- Conservative tech billionaire Peter Thiel, who co-founded PayPal and was the first outside investor in Facebook made an unusual prediction on the upcoming election “and that the outcome will not be close”. Theil sees either the Kamala bubble bursting or Trump voters getting really demotivated and not showing up. “One side is simply going to collapse in the next two months.”

- The bull market in precious metals is reasserting. Citibank is looking for $3000oz for gold and $45oz for silver under their bull case scenario. Rising retail and institutional flows into ETFs could be the next key driver.

- The New York Empire State Manufacturing Index jumped in September to its highest since April 2022, surprising analysts who had expected a decline.

- UK house prices rose, while the manufacturing sector was mixed. London benchmarks edged higher. The BoE reports later in the week and is expected to make no change. European benchmarks mostly tilted slightly lower in a cautious mood ahead of the Fed, BoE, and BOJ rate decisions.

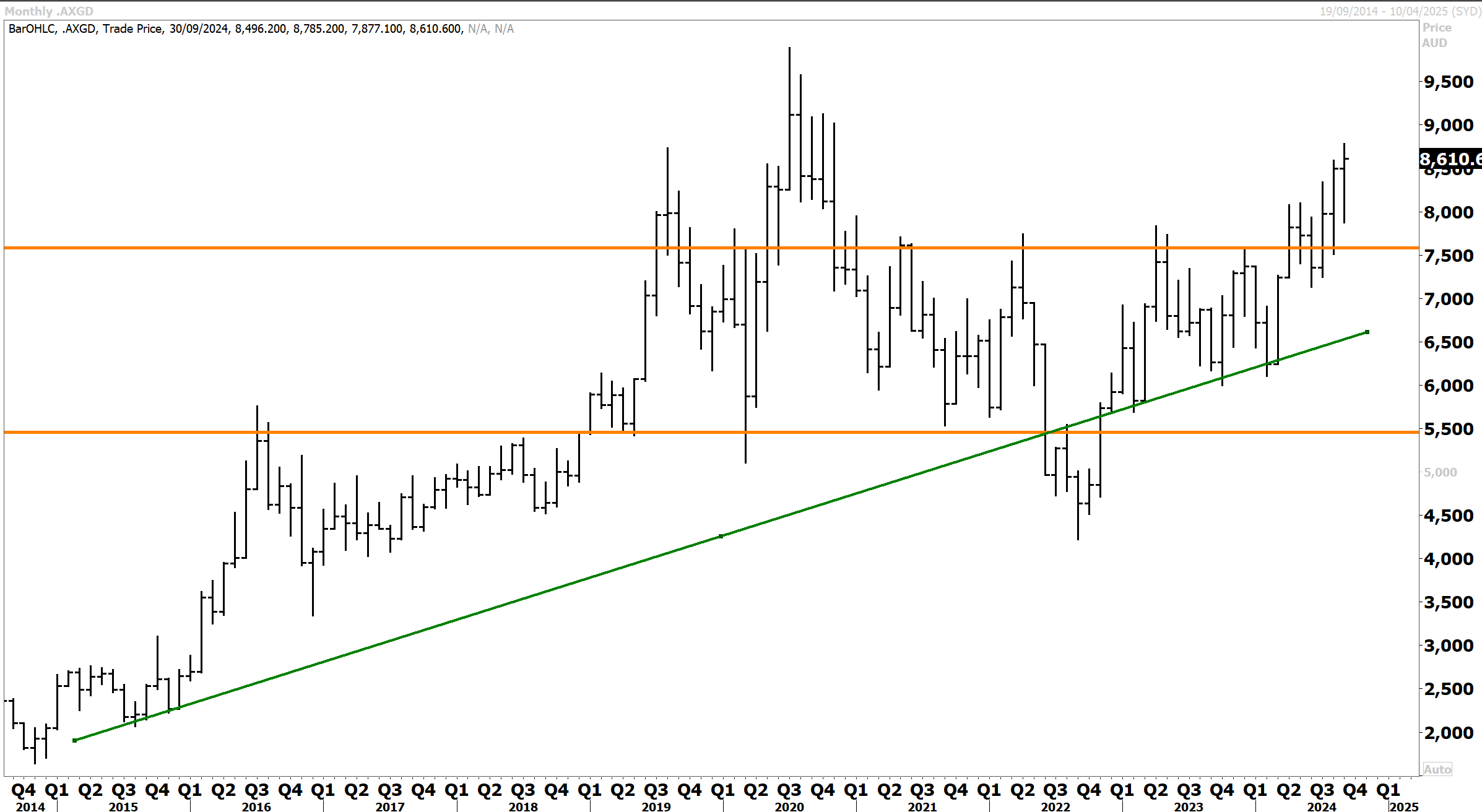

- The ASX 200 crept upward to a record closing high, albeit down from intraday highs. Interest rate-sensitive sectors provided support, with bank and gold mining stocks standing out. After breaking out, the All Ordinaries Gold Index looks set to challenge the record highs.

- China’s economic data over the weekend highlighted ongoing struggles, which spurred hopes for more stimulus from Beijing. This buoyed the Hang Seng, although stock markets on the mainland were closed for a holiday.

- Japanese stock markets were also closed, although the yen firmed sharply in the FX market due to the prospects of narrowing interest rate differentials between the Fed and the BOJ.

- Notable charts and stock mentions today include the S&P500, Dollar Index, VIX, Philadelphia Gold & Silver Miners Index, Gold A$, Silver, Australian All Ords Gold Index, Copper, Apple, Zillow, Micron Technology, Coeur Mining, Auto Trader, Shell, Diageo, Gold Road, Alcoa, Austal, Paladin Energy, St Barbara, Meituan, Yum China & Rio Tinto.

The major US benchmarks closed mixed on Monday ahead of the key FOMC decision tomorrow. A rate cut is all but a certainty; the only question is by how much. According to CME, Fed funds futures are pricing in a 59% chance for a 50 bp cut. The US dollar continued to weaken into the decision, which propelled gold to a new record high, with the other PGMs also having a decent catch-up rally. Commodities are also looking firmer following the “risk off” move in past weeks. The risk-off move seen in early September might be already over.

The S&P 500 gained 0.13% to 5,633, the Nasdaq Composite was 0.52% lower, while the Dow Jones rose 0.55%. The Russell 2000 added 0.35%. Technology was the weakest sector, with the S&P technology index down by 1%.

Up until last Friday, the odds were tilted towards a 25-bp cut. However, reports by the Wall Street Journal and the Financial Times cited comments from former New York Fed President Bill Dudley arguing for an outsized cut late last week. This triggered a pivot in market expectations, which were anchored at 25 bps. On Monday, Mr Dudley reiterated his stance on the need for the Fed to do a big cut on Wednesday. In an opinion piece on Bloomberg News, he said “the Fed’s dual mandate of price stability and maximum sustainable employment has become more balanced, which suggests monetary policy should be neutral, neither restrictive nor boosting economic activity.Yet short-term interest rates remain far above neutral. This disparity needs to be corrected as quickly as possible.”

Whether the Fed goes with 50 or 25 bps, it doesn’t really matter. I expect the markets to focus on where the Fed Funds rate is going, and on this front, 100 bps are priced between now and December. I don’t expect Fed Chair Powell to contradict that narrative. Volatility could return if the Fed runs with a 50 bp cut where concerns could quickly mount that the FOMC has some information that investors don’t have and that recession risks are more likely than currently priced in. A 50 bp cut couched in language that assures the markets that the US is tracking towards a soft landing is, therefore, my base case for Wednesday.

On this front, Morgan Stanley’s chief US equity strategist Mike Wilson wrote in a note this morning that a 50 bp cut would be the best possible outcome for stocks. Still, the caveat is that this would only be provided no concerns emerge on economic growth. In the very short-term, we think the best case scenario for equities this week is that the Fed can deliver a 50bp rate cut without triggering either growth concerns or any remnants of the yen carry trade unwind ahead of macro data that is assumed to stabilize.” In Mike’s view, the Fed might want to cut by 50 bps given the bond market indicates that monetary policy is behind the curve (if interest rates stay for higher for longer, they risk rupturing something in the economy). Wednesday is shaping up as a pivotal one for the markets.

The S&P500 corrected into the first few weeks of September, but quickly found support at 5400. The recent run back to the record highs has occurred quickly as markets have recalibrated a larger rate cut probability for Wednesday. The technical setup now favours a topside breakout in coming weeks and months. The worst of the August/September volatility could now be potentially over.

Depending on how Wednesday goes, we might have already seen the lows in the risk off move that got underway a few weeks ago.

Most of the short yen trade has been unwound now, whilst cash and liquidity levels are once again elevated for seasonal September/October volatility and uncertainty around the election.

We have commenced putting cash back to work last week. The recent spike in volatility has quickly receded with the VIX now back below 20 and I still maintain we won’t see a return to levels anywhere near those reached in August. The markets still have to navigate the US election. The second assassination attempt over the weekend is a harbinger of what is going to be the most polarised election in decades.

Conservative tech billionaire Peter Thiel, who co-founded PayPal and was the first outside investor in Facebook made an unusual prediction on the upcoming election “and that the outcome will not be close”. During a recent summit, Mr Thiel acknowledged this year’s race is “basically a 50-50 in terms of who wins. However, my one contrarian view on the election is that it’s not going to be close. You know, most presidential elections aren’t. 2016 and 2020 were super close, but two-thirds of the elections aren’t. Either the Kamala bubble will burst or maybe the Trump voters get really demotivated and don’t show up. One side is simply going to collapse in the next two months.”

Bonds rallied with the 2yr falling 2.5 bps to 3.56% while the 10yr was lower 3.5 bps to 3.62%. The bond market has priced in around 100 bps of cuts through to December, and another 100 bps next year. The US dollar was again notably weaker. FX markets are pricing in a rapid narrowing of interest rate differentials that have favoured the US over the rest of the world. Just as the Fed put rates up higher than most nations, they will now bring them down.

The Dollar Index has retested the big support level just above 100 on three occasions since mid August. Near term risks a rebound (possibly after the FOMC meeting on Wednesday if the Fed runs with a more hawkish 25 bp cut, but any strength is likely to be capped at 102. The base case technical setup favours a break below the psychological 100 level in coming weeks and months.

WTI and Brent both rebounded 2.75% and 2% to $70.53 and $73. Lower oil prices are removing inflationary pressures globally and cementing in the disinflationary trend – which is encouraging. We also saw new record highs in gold which surpassed the $2600 level this week for the first time. Silver added +1% to $31.10. Copper added 1% to $4.26 while the soft ag complex was stronger across the board.

A weaker US dollar is supporting commodities and precious metals, which will, in my view, drive the next leg of a bull market. I expect imminent new highs in gold and silver and for other commodities, including copper, to soon reassert their topside. Whilst AI and mega cap tech names have dominated the market, the “bull could become golden” if lagging precious metal miners soon play significant catch-up.

Silver’s recent breakout above near-term resistance following a multi-month consolidation above the high primary resistance level at $26 is very encouraging from a technical perspective. The setup now favours upside extension and new multiyear highs above $33oz into year end. Silver has actually outperformed gold this year, which in itself is one of the best performing asset classes.

While silver is a precious metal and store of value, it has many industrial applications and is used in producing solar panels and electric vehicles. Citibank remains a fervent bull on silver and holds a $US35 an ounce price target and $US38 next year. In a recent note Citibank’s global head of commodities Maximilian Layton highlighted that “the time is right to get even louder about silver. We believe that the set-up in silver is presently the strongest it has been in decades.”

Aside from rising industrial demand, Mr Layton said that silver prices could benefit against “a backdrop of massive deficits of around 15% to 20% of consumption, which can only be met by physical holders selling. Silver has been in deficit since 2019 and we estimate that silver bar and coin holders need to sell around 1% of their total holdings per month to meet excess demand for the metal”. Citibank’s bull case price target which has a 30% per cent probability, could see silver hit $US45 an ounce by the end of next year. This is plausible in my view, particularly if the dollar weakens next year which is our base case.

Gold has performed strongly in recent weeks, rising above $2600 for the first time in history. A lot of the positive price action is being driven by expectations of Fed rate cuts, with further cuts likely to follow into year end. Whilst central bank buying has done much of the heavy lifting in recent years, I believe that financial flows from retail and institutional investors are likely to soon accelerate. ETF’s of physical gold and precious metal shares have been under pressure with outflows for much of this year, but this could be on the cusp of reversing.

In a recent note, Goldman Sachs said, “Western investors, whom have been largely absent as buyers in recent years, could soon enter the market. In this softer cyclical environment, gold stands out as the commodity where we have the highest confidence in near-term upside.” Goldman has a $US2700 price target by early next year.

Financial inflows into precious metal ETFs and precious metal miner ETFs are accelerating after years of outflows. This is bullish for the sector.

Where China’s central bank, the PBOC has paused physical gold buying over the past four months, this has been replaced by retail demand within the world’s second largest economy. Citibank noted that “activity across the two primary forms of gold trading in wholesale markets – over-the-counter and on exchanges – have recently spiked. OTC gold demand soared 50% to 329 tonnes in the 2nd quarter compared to a year earlier – the highest quarterly print since the outbreak of the pandemic in 2020. Gold exchange-traded-fund holdings are up 3% for a 4th month of gains.” That’s a major turnaround, given ETF investors have been largely net sellers over the past three years. Citibank has a $3000oz price target for next year.

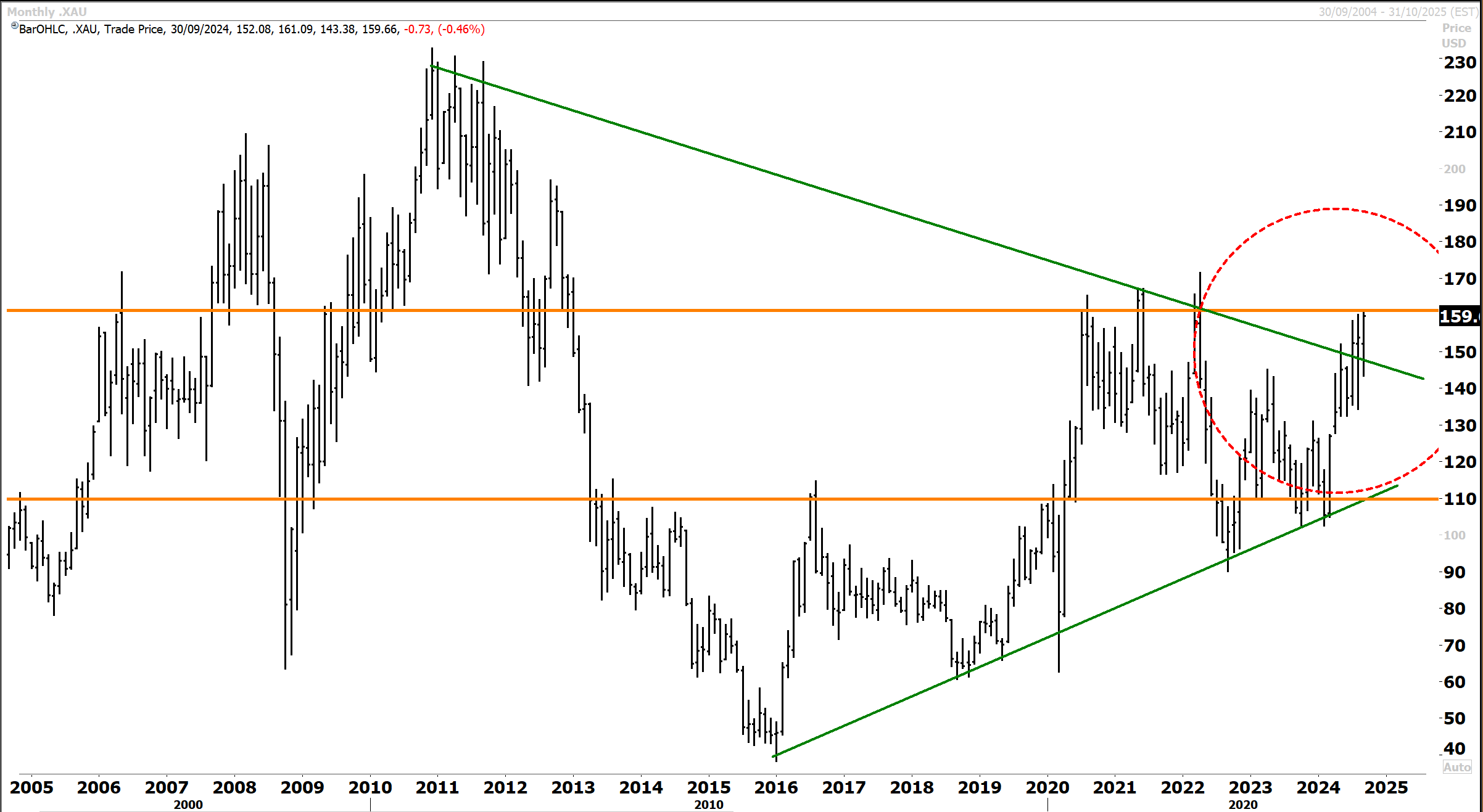

The Philadelphia Gold & Silver Miners index (of North American producers) is on the cusp of an important breakout above historical resistance at 160. With the primary downtrend now broken (green line) a breakout above 160 for the Index looks imminent, and likely to be accompanied by accelerating financial inflows into the sector.

The recent risk off correction in copper also now looks complete. In a recent interview with the Financial Times, BHP’s Chief Financial Officer Vandita Pant said that a “rising copper shortage is set to intensify as artificial intelligence boosts demand for the red metal by as much as 72% in the coming decades. Ms Pant told the FT that “AI data centres will account for 6% to 7% of copper demand by 2050.” These centres currently make up less than 1%, but there is increasing buildout requiring more metal.

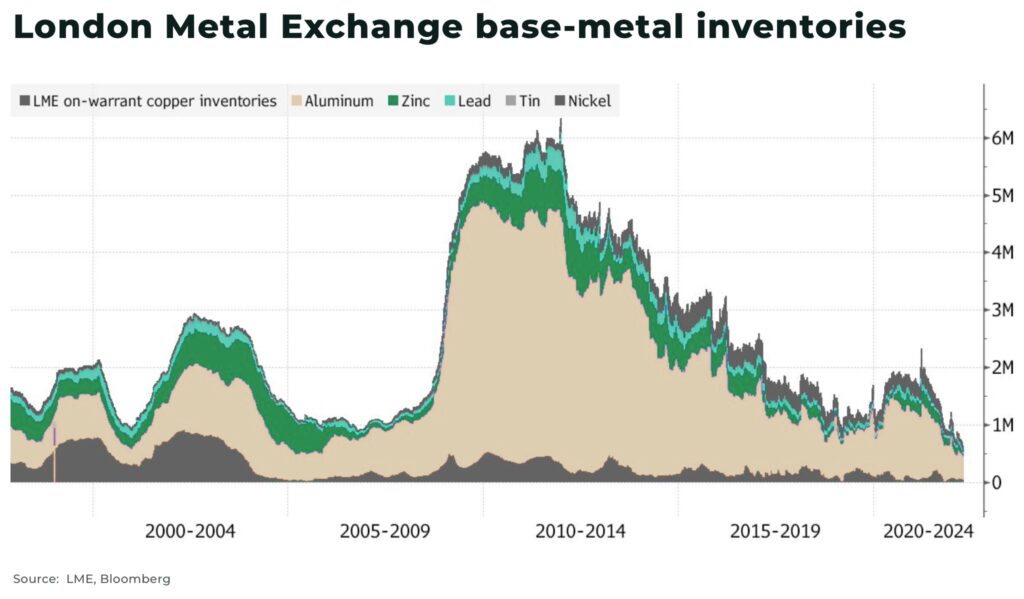

By another measure, BHP “expects global demand for copper to rise 52.5 million tons a year by the mid-century, compared to 30.4 million tons in 2021. A growing a shortfall in copper production and lack of new mine supply coming online could see spot prices retest the record highs next year. Global copper inventories hit the lowest levels since 2008, with existing projects failing to keep up with demand. Meanwhile, new mines are not coming online fast enough — it typically takes 15 years to opena new mine.

Major copper producer Rio Tinto looks to have completed a correction from the record highs above $135. Support is now being encountered at the primary uptrend which is being consistently respected. An upward dynamic and resumption of topside momentum looks imminent.

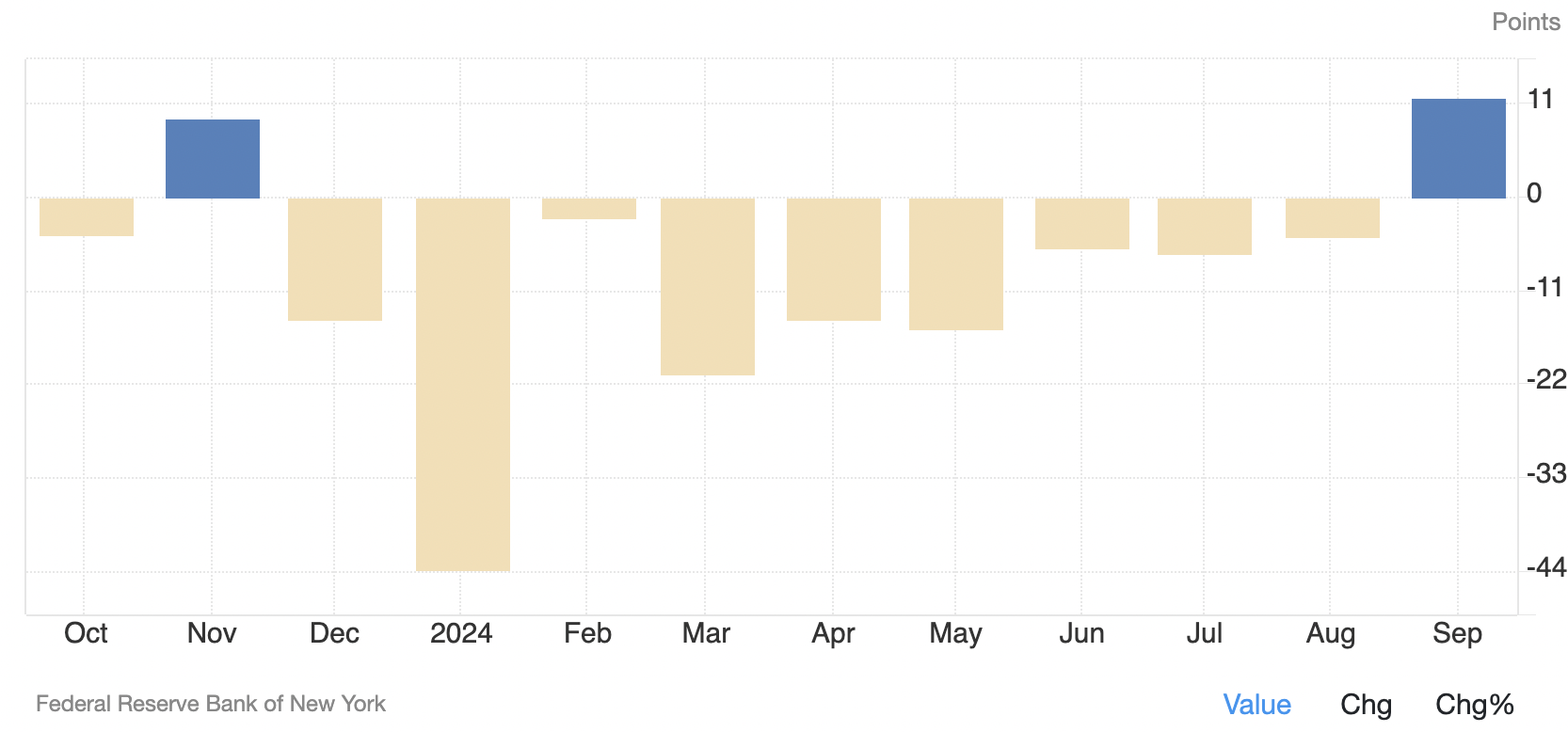

On a quiet day for economic data, the New York Empire State Manufacturing Index jumped to +11.5 in September (from -4.7 in August), the highest level since April 2022, surprising analysts who had expected a decline. This marked the first expansion in nearly a year, driven by increased new orders and shipments. Supply conditions improved, with steady delivery times and inventories levelling off. However, labour market conditions remained soft as employment continued to contract. Input and selling prices showed little change. Firms were more optimistic about the future, with business expectations rising to 30.6.

NY Empire State Manufacturing Index rebounds

Mega-caps were a drag overall, as declines from Apple -2.8%, Nvidia -2%, Tesla -1.5% and Amazon -0.9% outweighed advances from Meta +1.7%, Alphabet +0.4% and Microsoft +0.2%. Apple shares fell on reports of sluggish demand for its latest iPhone models. Well-regarded Apple analyst Ming-Chi Kuo noted a 12% drop in iPhone 16 sales compared to the iPhone 15’s launch, with JPMorgan and Bank of America pointing to potential weak demand for the more expensive Pro models.

Meanwhile, Micron Technology dropped over -4% after Morgan Stanley cut its price target, citing concerns about its growth prospects. Intel shares surged over 6% to the top of the S&P 500 table on a Bloomberg report that it qualified for up to $3.5 billion in grants to manufacture chips for the Pentagon. Oracle +5% extended gains from last week, which has seen chairman and co-founder Larry Ellison pass Jeff Bezos in the wealth rankings.

Bausch + Lomb rallied more than 14% following a Financial Times report that the contact lens provider is exploring a potential sale. The company is reportedly working with Goldman Sachs advisors and drawing interest from private equity firms.

Alcoa +6% mirrored its move in the Australian market after agreeing to sell its 25% stake in the Saudi Arabian Ma’aden joint venture for US$1.1 billion.

Zillow climbed almost 5% to a 52-week high after Wedbush upgraded the stock to “outperform,” citing falling mortgage rates and growth in its software and services business. Zillow is the US’s largest online real estate advertising portal and stands to benefit from falling mortgage rates. Zillow has broken out above key overhead resistance, which confirms an inflection following a multiyear consolidation. The scope is now raised for a big recovery in the year ahead.

Gold was steady, while precious metal exposures mostly saw some profit-taking after a big rally late last week. Coeur Mining -3.6% and Barrick Gold -1.5% declined but have still surged over the past week.

The ASX 200 began the week on a cautiously upbeat note as investors looked ahead to key central bank decisions, which the Fed’s decision mid-week will headline. Despite a retreat from intraday highs, the benchmark still posted a +0.27% advance to post a record closing high of 8,121. Interest rate-sensitive sectors provided support, with bank and gold mining stocks standouts, although some soft Chinese economic data over the weekend weighed on iron ore and energy stocks.

We have key Australian unemployment data due out this week, with consensus expectations for 30,800 jobs added in August versus 58k in July. The unemployment rate is also expected to remain steady at 4.2%. Any miss on this front will place the RBA under pressure, and I would expect the case to be cemented for the first rate cut by year-end. Any deterioration in the labour market will also concern the government, given that an election is due next year. SPI futures are pointing to a 0.65% gain on the open.

While there were no major local economic releases, the weekend’s data showing more property sector woes in China dampened the commodities complex, but I continue to see the correction in the large diversified miners nearing an end.

Seven broad ASX sectors advanced, although the +0.03% move for industrials was marginal. Communications services +1.08%, financials +0.95%, consumer discretionary +0.52%, real estate +0.49% and tech +0.39% led the gainers, each sharing sensitivity to lower interest rates. The nearing pivot from the Fed has seen global bond yields shift lower. Even though the RBA continues to talk tough, bets are increasing that the RBA will begin to cut before Christmas, which is my base case.

The four declining sectors on Monday were healthcare -1.06%, utilities -1.03%, energy -0.46% and materials -0.28%. Telstra +1.3%, REA Group +1% and CAR Group +1% boosted the communication services sector. Financials posted a robust performance as the big four banks logged gains. Westpac led the pack, rising +2.15%, while NAB and CBA rose +1.3% and +0.95%, respectively. ANZ was the least enthusiastic of the group, ticking up just +0.16%. The insurers QBE, IAG and Suncorp posted advances of +0.4% to +1.7%. At the smaller end of town, BNPL firm ZIP stood out by gaining +4.3%.

The A$ spot gold price has made a new record high touching $3840. The $4000 level is now within sight as gold looks to reassert on the topside over the coming months.

China’s economic data weighed on the materials sector after showing new home prices fell further in August (more on that in the Asia section). This weighed on Fortescue -1.8%, Rio Tinto -0.6%, and BHP -0.1% to a lesser extent. Copper exposures had a mixed session, with Sandfire Resources dipping -1.3%, while 29Metals advanced +1.3%. A standout was Alcoa, which jumped +5.9% on plans to sell its stakes in a bauxite facility and aluminium plant in Saudi Arabia to Saudi Arabian Mining in a US$1.1 billion cash and stock deal. This is a good deal for streamlining and simplifying its business.

Meanwhile, gold miners extended their rally from Friday, underpinned by record gold prices, although Monday’s move moderated, with the sub-index advancing +0.3%. Evolution Mining led the gold sector’s charge, jumping 4.2% to hit a 52-week high, while Northern Star rose +1.5%, and Newmont added +1.2%. Several small/mid-caps fared better, with St Barbara +7.8% a notable riser. However, declines from some players, like Genesis Minerals -1.4%, Red 5 -1.5%, Gold Road -1.2%, and Westgold -4.2%, capped the sub-index’s advance. Weather events impacted Gold Road’s 1H numbers, but the Gruyere mine is a quality asset, and the laggard share price performance has the potential to play catch-up in the coming months.

In our last technical update back on 16th May, we highlighted that “Gold Road has remained in a primary uptrend since 2014, when a series of higher reactionary lows was established. Resistance above $2 is proving formidable, with a number of retests being rejected at this level since 2020. The technical setup favours another challenge at the $2 high this year, with a breakout at some point likely to ensue.”

Gold Road remains in a consistent primary uptrend on the big picture 20-year monthly chart below. A series of higher reactionary lows is encouraging, with our base case being for a significant topside breakout above the historical resistance level at $2. We must acknowledge that the $2 resistance level has proven to be a stubborn obstacle. Still, the rising trend of higher lows is constructive and underpins our technical view that a topside breakout is approaching.

The energy sector struggled as most stocks in the group fell. Woodside -0.6% and Santos +0.3% were mixed. Coal miners had a tough day, with Stanmore Resources falling -4.2%. Peers Whitehaven Coal -1.8% and New Hope Corporation -1.4% declined by a lesser percentage. Paladin Energy fell 1.8% after CGN, a substantial stakeholder in Fission Energy, contested Paladin’s acquisition of Canada’s Fission Uranium in the Supreme Court of British Columbia.

In corporate news, shipbuilder Austal was the standout performer, soaring +20.5% to the top of the ASX 200 table after securing a US$450 million contract with General Dynamics Electric Boat. The contract will fund an expansion of its submarine-related facilities in Alabama. Lendlease advanced +2.1% upon announcing the completion of divestment of its US East Coast operations.

Auckland International Airport was placed in a trading halt and announced a large $1.4 billion equity raising to fund expansion and redevelopment initiatives.

Elsewhere, Domain Holdings +4.3%, Paradigm Biopharmaceuticals +4.2%, Fiducian +2.4% and SRG Global +2.4% outperformed. Cetire -10.1%, Telix Pharmaceuticals -6.5% and Sky Network Television -3.9% underperformed.

Shifting to Asia, Mainland China and Japanese stock markets were closed for public holidays. I note that the yen firmed sharply against the greenback on Monday, which will be a headwind for Japanese stocks today. The move in the dollar/yen below 140 for the first time in a year reflects the market pricing in a higher probability of a 50 bp rate cut from the Fed this week, while the BOJ is expected to stand pat on rates.

With key support now broken at 140, the dollar/yen could fall to between 136 and 128 over the coming year. Most of the short yen carry trade now appears to have been unwind.

Meanwhile, the Hang Seng reversed earlier losses to post a third straight gain on Monday, closing +0.31% higher at 17,422. Weak Chinese economic data spurred hopes for more stimulus from Beijing and buoyed Hong Kong stocks, as did expectations that the Fed will begin its pivot on Wednesday.

Over the weekend, Chinese economic data revealed that August’s industrial production, retail sales, and fixed-asset investment all fell short of expectations. Additionally, credit growth slowed due to reduced demand from households and companies, as shown by last Friday’s data.

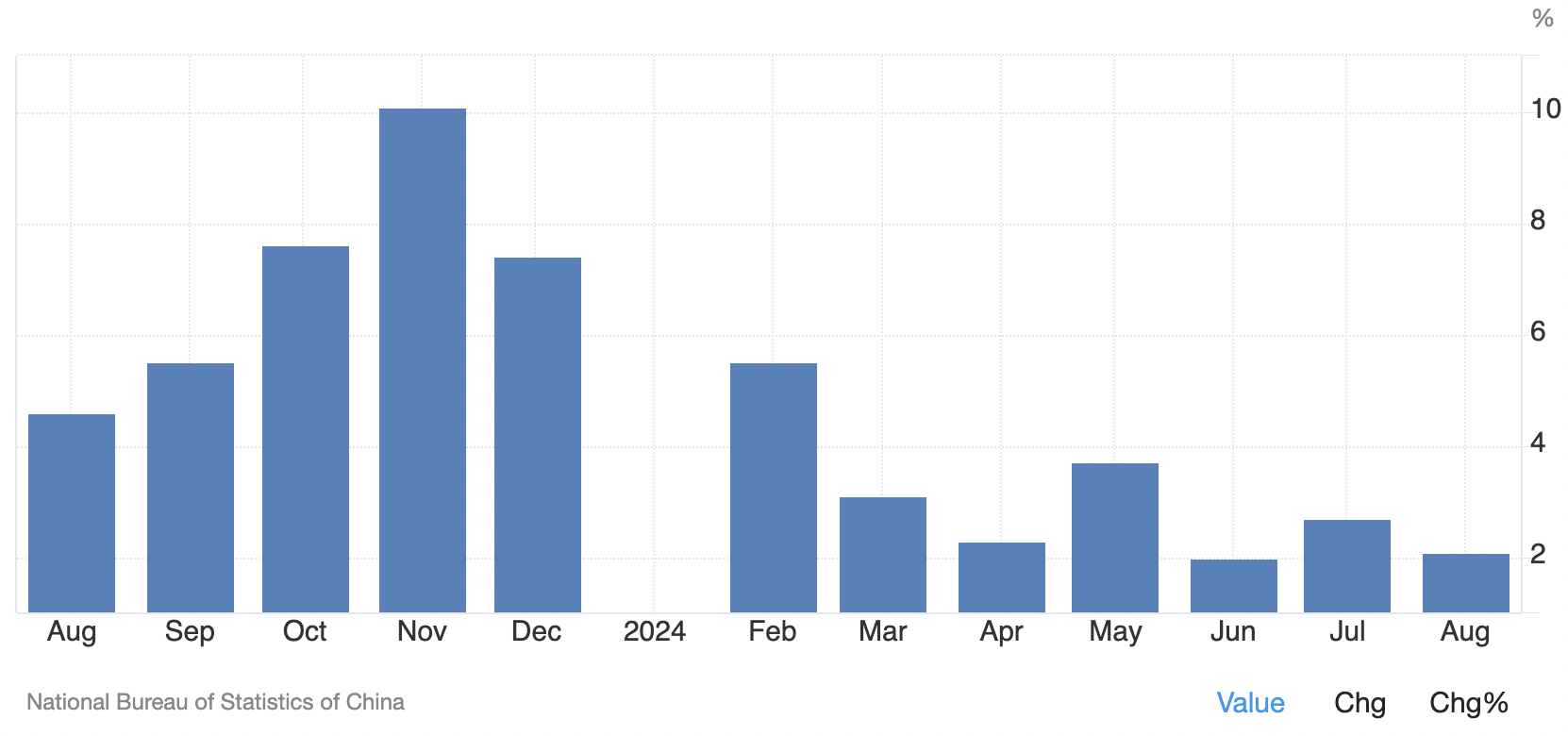

Economic data about the Chinese economy released over the weekend highlighted ongoing struggles. China’s property market slump deepened in August, with average new home prices in 70 major cities dropping 5.3% year-on-year, the sharpest fall since May 2015. Monthly, prices slipped 0.7% for the fourth month. Industrial production expanded 4.5% in August, missing forecasts and slowing from July’s 5.1% pace.

Retail trade was flat month-on-month and increased 2.1% year-on-year in August, slowing from the 2.7% pace in July and below the 2.5% forecast.

Retail sales were lacklustre in August as consumers close their wallets.

Meanwhile, pent up savings have soared, where China is now the superpower. The challenge for Beijing will be to get consumers spending again.

In Hong Kong trading, there was some notable divergence between stocks. In the big tech space, Kuaishou Technology +4.6% and Meituan +2.8% posted solid gains, while NetEase -1.2% and Alibaba -0.9% fell.

Hong Kong-focused property developers saw gains, with New World Development rallying +5% and Wharf Real Estate adding +1.6%, as investors looked ahead to the Fed’s rate decision. Mainland developers fell after the soft housing price data, with Longfor Group -2.4% and China Vanke -2.3% among those in the red.

Record gold bullion prices lifted gold miner Zhaojin +3.4%. Budweiser APAC +2.9% and KFC/Pizza Hut operator Yum China +2.2% advanced, as did the Macau casino operators MGM China +2.7%, Sands China +1.9% and Wynn Macau +1%.

London benchmarks closed slightly higher on Monday as investors took a cautious approach ahead of key interest rate decisions later in the week, including the BoE on Thursday, with no change expected. The FTSE 100 edged up +0.07% to 8,278 points, while the FTSE 250 rose +0.16%.

UK house prices saw an early autumn rebound in September. Rightmove’s +0.2% House Price Index reported that average new seller asking prices increased by 0.8% monthly to £370,759. Annually, prices were up 1.2%. The monthly price rise was roughly double the long-term average, supported by increased market activity. Rightmove noted that falling mortgage rates and more property choices prompted buyers to act. The news boosted some housebuilders, with Persimmon gaining 0.9% and Vistry up 0.5%.

In contrast, UK manufacturers faced a mixed start to the second half of 2024, according to a survey from Make UK and BDO. Factory output contracted for the first time since late 2020 in 3Q24, with the output balance dropping to -2% from +9% in the previous quarter. Domestic orders weakened to a balance of -4%, but export orders improved, rising to +11%, driven by solid demand from the EU. Despite the contraction in domestic performance, overall confidence in the manufacturing sector rose slightly, with the sentiment index increasing to 7.1 from 6.9. Manufacturers are optimistic for the next quarter, expecting the output balance to surge to +33%.

Marks & Spencer climbed 2.9% after RBC Capital Markets and Jefferies raised their share price targets. Kingfisher gained 2.2% ahead of its half-year results, while Auto Trader increased 0.6% following a ‘buy’ reiteration from Bank of America.

In our last technical update in early July, we highlighted, “Since the IPO in 2015, Auto Trader has consistently respected the primary uptrend on the monthly chart below. The recent breakout above resistance to new record highs is bullish for the online car sales platform. A retest of the breakout level at key support at 760p would open a buying opportunity. Auto Trader should continue to make new record highs over the coming year.” This scenario pretty much played out in recent months with AUTO overshooting, retesting and then rebounding sharply off the 680p support level to make new record highs above 840p. The scope is raised for upside extension over the coming year as AUTO rises consistently in an established uptrend channel.

Auto Trader did indeed retest the breakout level at 760p which we flagged as a buying level. The shares have since rebounded off the support level and extended upwards to make a new record high at 877p. Scope is raised for upside extension to new record highs over the coming year.

Shell +0.9% is set to slash up to 20% of its oil and gas exploration workforce, impacting offices in the U.S. and the Netherlands, as part of a broader cost-cutting initiative to save $2 billion to $3 billion by 2025. This restructuring, led by CEO Wael Sawan, comes amid Shell’s strategic pivot to improve shareholder value through increased efficiency and streamlined operations. Despite weaker gas prices and recent profit declines, Shell is doubling down on oil and gas production while scaling back on renewables.

In our 6th August technical update on Shell, we highlighted that “Despite the decline in profit and revenues and higher capex, Shell has managed to sustain the breakout above the historic highs at 2700p. This is technically encouraging and points to further upside extension to new record highs in the year ahead.”

Nothing has altered this view. Our base case technical outlook is that for Shell, the path of least resistance is to the topside following a successful retest of the breakout level at 2700p (being the big historical resistance level that capped the shares since 2018). We anticipate Shell to maintain an upward trajectory in the year ahead.”

Shell went on to make a new record high above 2900 following the breakout above the 2500p historic resistance level. The recent selloff has seen Shell correct back to support, which has coincided with weaker oil prices. This support level should hold, and a rebound is likely to ensue in the coming months.

Diageo +0.3% faced a tough year with full-year net sales dipping 0.6% to $20.3 billion, hit hardest by a 15% sales drop in its Latin America and Caribbean (LAC) region. Despite price hikes, volume declines, especially in premium brands like Scotch and tequila, dragged profits down 4.8% to $6 billion. Cash-strapped consumers in LAC reduced spending, leading to a 21% drop in regional sales, which took a big bite out of profits. Still, Diageo saw bright spots with strong growth from its premium tequila brand Don Julio in the US and Guinness emerging as the fastest-growing imported beer in the US.

In our early February technical update we noted that “Diageo has fallen back to support at the primary uptrend following the breakdown at 3300p last year. The stock should find support and hold at this level, which is now some 1/3 below the record high. A break below this support could see further downside towards 2500p. An advance above resistance at the 3200 would mark the resumption of upward momentum.

Diageo did, in fact, break below support at the primary uptrend earlier this year at the 3100 level. Further downside eventuated, with the shares only recently finding support at 2300p. This level needs to hold for a recovery to ensue. A breakout above near-term resistance at 2700p would add confidence of an inflection. Equally, a break below the support level of 2300p would raise scope for further downside to the next support level at 1900p.

Phoenix Group led the blue-chip fallers, dropping 5.3% despite reporting a 15% increase in operating profits for 1H. However, the sale of the SunLife division has been pulled, citing market conditions.

In the FTSE 250, Playtech surged +14% after settling a dispute with Mexico’s Caliplay and announcing better-than-expected trading in the first half of 2024. TI Fluid Systems jumped +14% after announcing it had rejected two takeover bids from Canada’s ABC Technologies. The company described the offers, which peaked at 176 pence per share, as significantly undervaluing its business and prospects. ABC Technologies stated that it remains interested in a potential deal and is reconsidering its position.

Most European markets opened the week with minor losses as investors scaled back risk ahead of the Fed’s policy decision. There were no major pan-regional European economic releases.

At the close, the pan-European Stoxx 50 was down -0.34%, Germany’s DAX dipped -0.35%, while France’s CAC-40 declined -0.21%. Italy’s FTSE MIB was flat, while Spain’s IBEX 35 added +0.35%.

Carpe Diem!

Angus

Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.

Chart Source: Thomson Reuters