Any Market Shakeout Will Likely Be Short & Shallow After the FOMC

Any shakeout in the market over the coming weeks is likely to prove short in duration and likely limited to a 5% to 7% drawdown at best. I see the market quickly getting back on its feet post the FOMC meeting – if a correction ensues. Morgan Stanley’s Mike Wilson noted this week that “evidence is growing that the rolling recovery is underway, and we continue to lean toward our 7200 bull case by the middle of next year. Near-term risk is centered on the tension between lagging, weak labor data and the Fed’s response that may not meet the markets’ “need for speed.” This is a good point, and the FOMC meeting is “loaded” tomorrow and could prove to be the catalyst for a “sell the news” event given the level of expectation that has now been backed into financial markets.

Mike Wilson also emphasised this week stating that “the other key variable is the Fed’s reaction function. As we have discussed in recent weeks, the tension between the weakening labor data and the associated monetary policy response is a near-term risk for markets given the Fed’s continued focus on inflation and markets’ growing expectation for rate cuts. While this could lead to some consolidation in equity indices in a weak seasonal period over the next 6-8 weeks, we’re buyers of dips into year-end and continue to lean toward our S&P 500 bull case of 7200 through the middle of next year. This view is driven by better and broader than expected earnings growth.”

Investors will likely quickly see through any disappointment if it arises post the FOMC meeting tomorrow. A pullback in the stock market would be healthy given the big run over recent months. Equities also appear to be near term overbought. However, there is plenty of cash and liquidity on the sidelines that is positioned to “buy any dip” if it arises, and so any corrective selloff could be over quickly.

The Trump Administration is seemingly determined to bring down interest rates at the cost of ignoring any potential inflationary repercussions. This is an environment that should drive equities higher into year end and throughout 2026, with the bull market likely to roll on. I also believe that international equities and emerging markets, commodities and precious metals will benefit from a lower US dollar and abundant global liquidity into next year. Inflation could become a problem in the US if the Fed eases aggressively (which is likely) but this won’t stop the stock market in the foreseeable future.

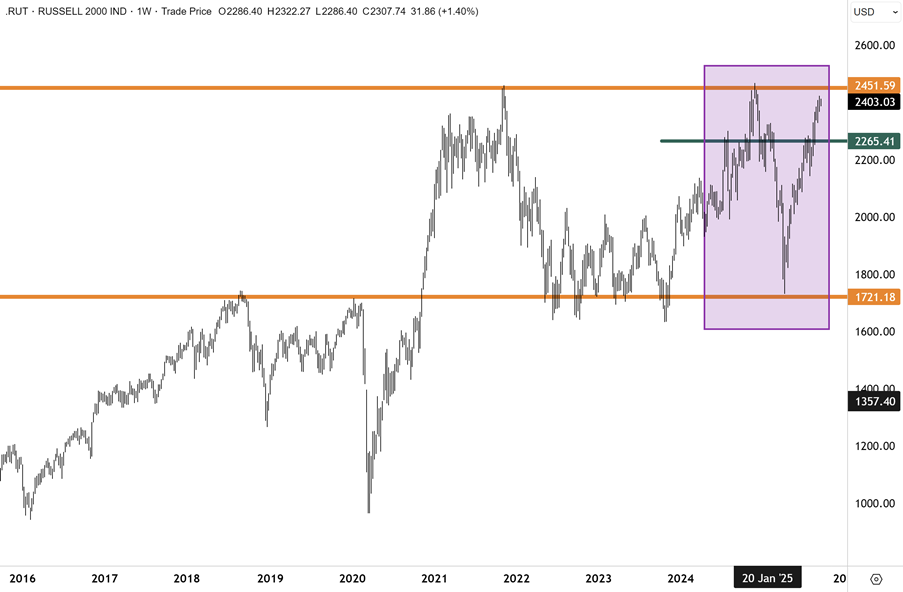

Mr Wilson highlighted that “It’s also worth pointing out that the current administration appears ready to let the economy “run hot”…This could mean higher tolerance for inflation as well as rate cuts at the same time.” This is going to be key, and on this front, I would expect the US bull market to broaden out over the coming year. The Russell 2000 could surprise on the upside with a significant catch up rally to the other indices. A topside breakout to new record highs on the Russell could therefore come before December.

Any shakeout in the market over the coming weeks is likely to prove short in duration and likely limited to a 5% to 7% drawdown at best. I see the market quickly getting back on its feet post the FOMC meeting – if a correction ensues. Morgan Stanley’s Mike Wilson noted this week that “evidence is growing that the rolling recovery is underway, and we continue to lean toward our 7200 bull case by the middle of next year. Near-term risk is centered on the tension between lagging, weak labor data and the Fed’s response that may not meet the markets’ “need for speed.” This is a good point, and the FOMC meeting is “loaded” tomorrow and could prove to be the catalyst for a “sell the news” event given the level of expectation that has now been backed into financial markets.

Mike Wilson also emphasised this week stating that “the other key variable is the Fed’s reaction function. As we have discussed in recent weeks, the tension between the weakening labor data and the associated monetary policy response is a near-term risk for markets given the Fed’s continued focus on inflation and markets’ growing expectation for rate cuts. While this could lead to some consolidation in equity indices in a weak seasonal period over the next 6-8 weeks, we’re buyers of dips into year-end and continue to lean toward our S&P 500 bull case of 7200 through the middle of next year. This view is driven by better and broader than expected earnings growth.”

Investors will likely quickly see through any disappointment if it arises post the FOMC meeting tomorrow. A pullback in the stock market would be healthy given the big run over recent months. Equities also appear to be near term overbought. However, there is plenty of cash and liquidity on the sidelines that is positioned to “buy any dip” if it arises, and so any corrective selloff could be over quickly.

The Trump Administration is seemingly determined to bring down interest rates at the cost of ignoring any potential inflationary repercussions. This is an environment that should drive equities higher into year end and throughout 2026, with the bull market likely to roll on. I also believe that international equities and emerging markets, commodities and precious metals will benefit from a lower US dollar and abundant global liquidity into next year. Inflation could become a problem in the US if the Fed eases aggressively (which is likely) but this won’t stop the stock market in the foreseeable future.

Mr Wilson highlighted that “It’s also worth pointing out that the current administration appears ready to let the economy “run hot”…This could mean higher tolerance for inflation as well as rate cuts at the same time.” This is going to be key, and on this front, I would expect the US bull market to broaden out over the coming year. The Russell 2000 could surprise on the upside with a significant catch up rally to the other indices. A topside breakout to new record highs on the Russell could therefore come before December.

We could also see a correction in the gold and the PGMs which have run hard this month. Gold seems to be “front running” easier Fed conditions, but also another phase of renewed dollar weakness. Any reprieve in the dollar and upward reaction to tomorrows FOMC should prove short-lived, but precious metals and precious metal miners could also correct lower into October following the blistering rally this month. I would use any selloff to selectively add to positions within the sector.

Carpe Diem

Sign up to receive full reports for

the best stocks in 2025!

Where to Invest in 2025?

The market is full of opportunities—but which stocks will deliver real wealth-building potential?

At Fat Prophets, our expert analysts uncover the best Australian and global stocks to help you stay ahead of the curve. Whether you’re looking for growth, income, or diversification, our carefully curated portfolio gives you access to high-conviction stock recommendations backed by deep research and proven insights.

Subscribe now to get full reports of these stocks and get ready for the next big opportunities!

Over 25,000 customers worldwide

“Been a member for 3 years, after being recommended to this newsletter by a senior Fund Manager. I must say that the daily reports and specific shares reports are highly professional, detailed and much to learn from, far superior to many other newsletters that I have been subscribing to the pasts. If you have a serious position on the share market, then, the knowledge expressed daily by Fat Prophets is critical to forming a judgement of one's position in the market”

J D'Alessandro

“Subscribing to Fat Prophets for me has been advantageous for gaining insight and knowledge about investing. I'm not a huge investor by any means but I have followed their recommendations and so far so good! I've managed to get my portfolio back into profit territory. My days of blindly investing on a hunch are gone.”

Stuart Jenaly

“Wide-ranging and in depth information on financial markets, by email daily and at any time through the website. I have been a member for many years and recommend Fat Prophets to serious investors.”

Alan

Need a try? You’re first-time customer?

Enjoy our Welcome Gift with $500 OFF your Membership

Use code: FPWELCOME

FAQ’s

How much does a Membership cost?

We have a number of Membership options for the DIY investor. Our research services cover individual stock opportunities in Australia, as well as the UK, global markets, and a sector-specific report focussing on the mining space. Annual Membership prices start at $1395.

Do you offer execution services?

No we do not, and our research is independent in the sense that we are not conflicted by operating broking services alongside them. We also do not offer ‘sponsored research’ and are not financially incentivised by any of the companies that we recommend to Members.

Can I access any special offers?

Our introductory joining offers relate only to new Members. We do however offer ‘early bird’ discounts to existing Members who renew in advance of their Membership expiring.

Can I get tailored financial advice?

Our research products are ‘general advice’ in nature only, however we do categorise all our recommendations by the level of risk appetite which we believe is involved. Members looking for more direct advice can also make an inquiry to our wealth management team which offers a separately managed accounts service.

Do you offer a Money-Back guarantee?

Yes we do. Fat Prophets offers a 100% money back guarantee on annual subscriptions within 30 days of taking out a Membership.