Key themes and stocks discussed today:

- Financial markets had a monumental day on Wednesday. Two important central bank decisions triggered huge rallies in equities, bonds, and commodities and a selloff in the US dollar against the yen. Geopolitical tensions surged in the Middle East between Iran and Israel, boosting Comex gold futures up to near-record highs.

- Fed Chair Jerome Powell gave the “green light” for rate cuts, mentioning September multiple times at the press conference. Only a seismic shock will get in the way of rate cuts now, and I continue to see a solid case for three by year-end. This was catnip to the markets with a big rally in equities. The Nasdaq came roaring back, and Meta Platforms reported a beat after the market closed.

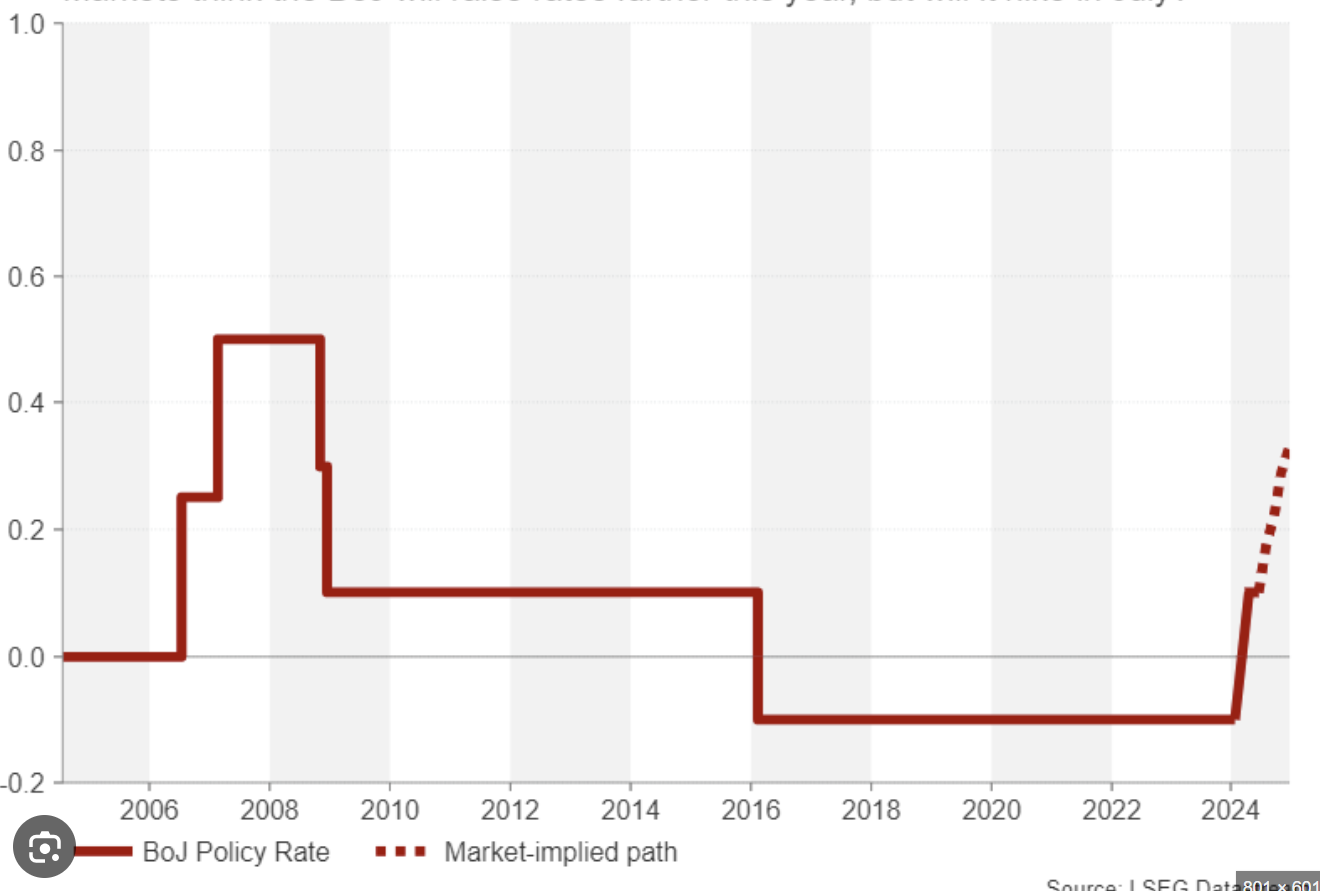

- The BOJ raised rates for the second time since 2007 (both times were this year), which was the catalyst for a large drop in the dollar/yen. Australia also had good news on the inflation front, and Commonwealth bonds rallied strongly after yesterday’s print, which boosted equities.

- Goldman Sachs CEO David Solomon has changed his mind about no rate cuts this year – and now sees two as consumer spending habits change.

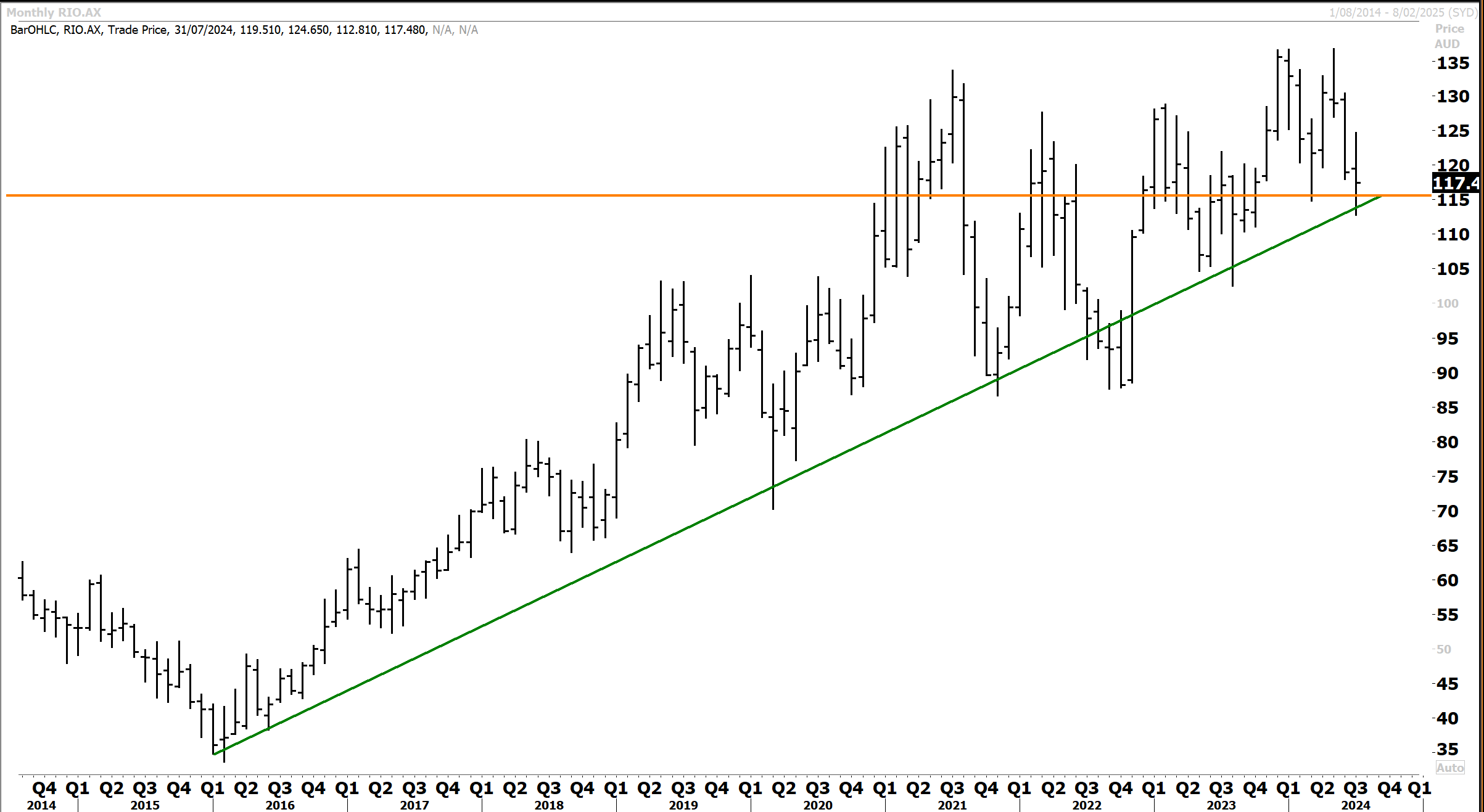

- Rio’s CEO was upbeat on China in an interview yesterday with the AFR and sees the economy continuing to hold together. Steel demand in the ailing housing market is being replaced by other sectors. BHP has also gone again to expand copper production, which is telling so soon after the failed Anglo bid.

- While overshadowed by the Fed decision and commentary, the data released on Wednesday suggested the US labour market cooled in July, bolstering the case for a rate cut in September.

- The ASX 200 enjoyed a broad rally on Wednesday, reaching an all-time high of 8092. Screens glowed bright green as CPI data was cooler than expected. Traders quickly shifted bets, with rate hikes off the table now and growing hopes for rate cuts before year-end. Bonds and equities staged the best rally in months while the A$ fell. Meanwhile, A$ spot gold is testing record highs on ME instability.

- The BOJ came out swinging on Wednesday, hiking rates and announcing a gradual reduction of bond buying. Equities climbed even as the yen firmed dramatically. Financials, including banks, were stellar performers on the day, leaping +4% to 5%.

- Benchmarks in China and Hong Kong posted firm gains after soft PMI data, bolstering hopes for more policy support from Beijing.

- UK benchmarks gained, supported by corporate results and hopes the BOE will cut tomorrow.

- Higher-than-expected headline inflation in Europe dampened hopes that the ECB would cut again at its next meeting. Regional bourses closed mixed.

- Notable charts and stock mentions today include S&P500, Dollar/Yen, Dollar Index, Gold, A$ spot gold, Copper, Iron ore, Van Eck Junior Gold Miners ETF GDXJ, Hang Seng, Meta, Nvidia, Microsoft, AMD, Arista Networks, Starbucks, Kraft Heinz, Global X Uranium ETF, VanEck Junior Gold Miners ETF, Glencore, Anglo American, Rio Tinto, CBA, Harvey Norman, Charter Hall, Chalice Mining, Origin Energy, SiteMinder, Nomura and HSBC.

Good morning,

Financial markets had a monumental day on Wednesday. Two important central bank decisions triggered huge rallies in equities, bonds, commodities and a selloff in the US dollar, notably against the yen. Geopolitical tensions also surged in the Middle East between Iran and Israel. The Fed left rate settings unchanged, but Chair Jerome Powell mentioned September multiple times in the press conference, which was taken as a green light for when easing commences.

The BOJ raised rates for just the second time since 2007 (the first was ending NIRP in March), which was the catalyst for a large drop in the dollar/yen. Australia also had good news on the inflation front, and Commonwealth bonds rallied strongly after yesterday’s print, which boosted equities.

The Nasdaq Composite led the indexes higher with a gain of 2.64%. The S&P 500 gained 1.58% to 5,522 but was down on intraday highs. The Dow Jones and Russell 2000 lagged with rises of +0.24% and 0.51%. Meta delivered a beat on earnings after the market closed and was higher in the aftermarket. In Asia, the ASX200 was higher after a lower CPI print that was the catalyst for a big rally in bonds. Japan added +1.5% after the BOJ hiked the benchmark rate to “around 0.25%,” the highest since 2008. The previous range was 0-0.1% after the BOJ ended NIRP in March. The BOJ move notably lifted the financials. China and Hong Kong benchmarks also surged on stimulus hopes after weak PMI data.

The bull market reasserted on Wednesday, with the S&P500 rebounding off the primary uptrend. The Fed met the markets’ expectations on Wednesday, leading to a broadening in the US stock market rally, and the big rally in bonds, record highs above 5,600 on the S&P500 now look vulnerable.

Jerome Powell said an interest-rate cut “could come as soon as September” after the Fed left the fed funds target rate unchanged at 5.25/5.5%. Mr Powell said that “the question will be whether the totality of the data, the evolving outlook, and the balance of risks are consistent with rising confidence on inflation and maintaining a solid labour market. If that test is met, a reduction in our policy rate could be on the table as soon as the next meeting in September.”

The focus now turns to the upcoming non-farm payrolls data and unemployment data due on Friday, but even if this comes in higher than consensus, the Fed is “locked and loaded” and ready to go with the first cut next month. A weaker data set will likely see the market begin to factor in three cuts before the end of the year. And confidence is growing that the Friday print will be soft. Data released early Wednesday showed July US private payrolls increased far less than expected, pointing to a softening labour market. The unemployment rate has inched up in each of the past three months, reaching 4.1% in June, the highest level since 2021. Friday’s labour print is going to be influential.

Bonds had a huge day which was kicked off by a big rally in Australia following the lower-than-expected CPI print. Australian bond yields tumbled across the curve, with the 2yr down 22 bps to 3.87%, and the A$ fell sharply. US bonds rallied after the press conference with the 2yr and 10yr down 9 bps to 4.27% and 4.05%. The 5yr yield fell below 4% to 3.95%. Aside from growing conviction the Fed will now ease quickly, escalating tensions between Israel and Iran also likely had something to do with the move.

The yield on the US 5yr now has a 3% handle after falling below 4%. Since breaking the uptrend, the 5yr bond has continued to rally with the yield now likely to settle into a lower range with a floor at 3.3%. I believe similar fate awaits the 2yr and 10yr with Friday’s key labour print being the next important catalyst.

In FX markets, the Bank of Japan hiked rates for the first time in over a decade, with the short-term policy rate lifted from 0 to 0.25%. The yen surged against the dollar by over 3% in a massive intraday move. Short positions are being unwound at a rapid clip. The BOJ will also halve monthly bond buying, which will keep upward pressure on the 10-year yield. Japanese stocks surged, but this was led by the Banks, which had their best session in some time. The major Japanese banks soared between 4% and 5%. Governor Ueda did not rule out another rate hike this year and will “keep raising rates” if inflation remains on track.

The Bank of Japan’s Policy rate was lifted to the highest level since 2008, triggering a big surge in Japanese banks and financials, which outpaced the broader market yesterday by a significant degree.

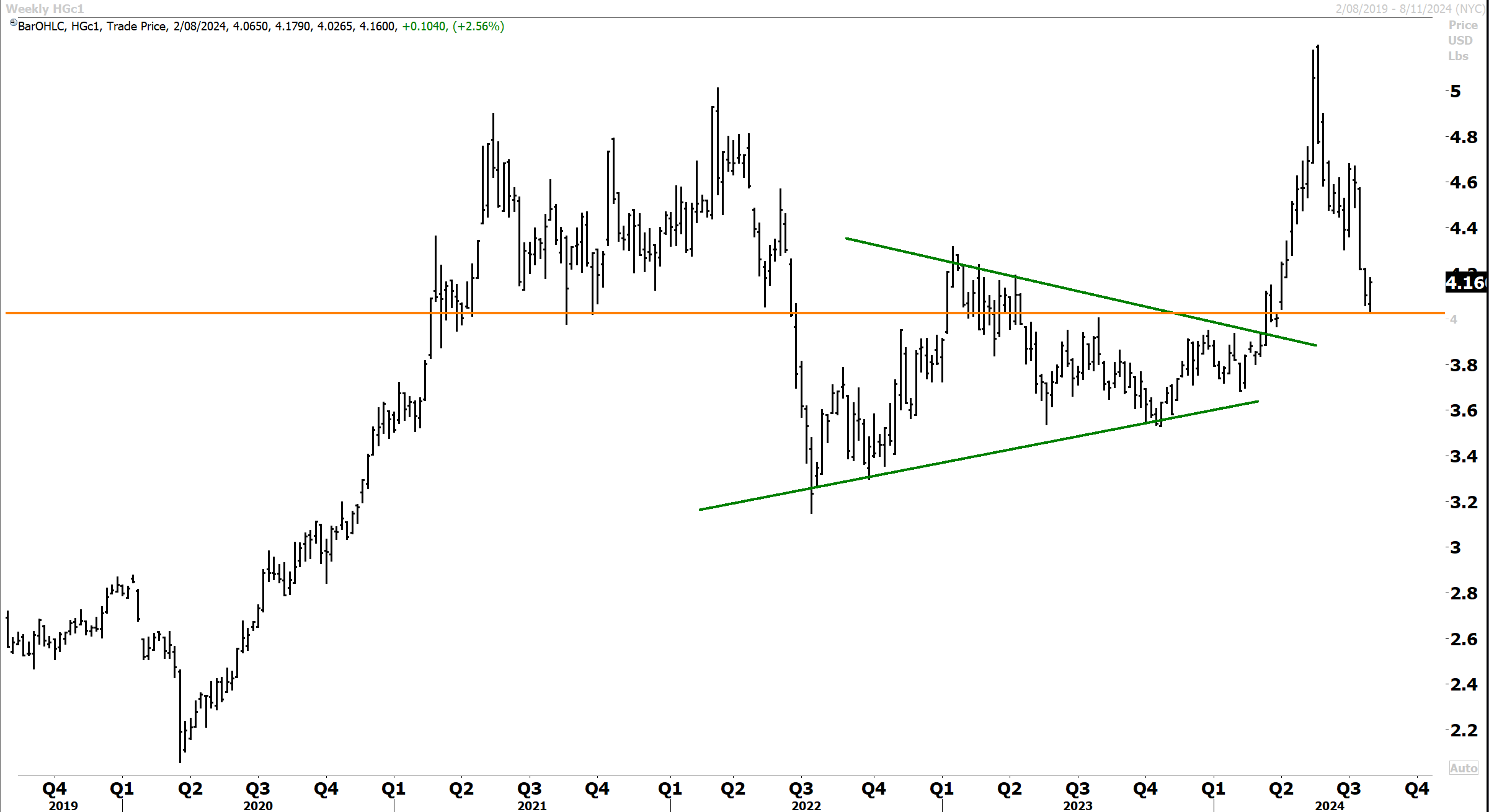

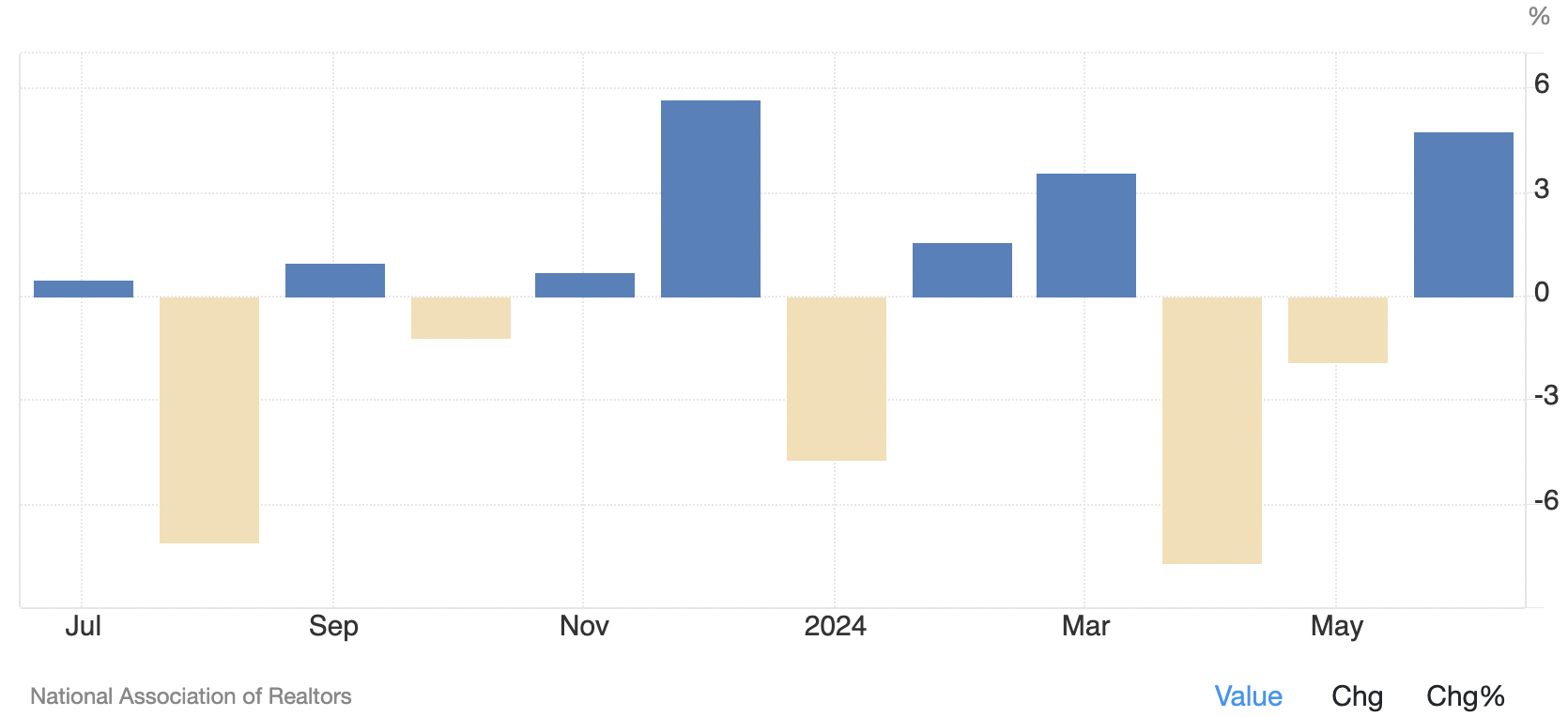

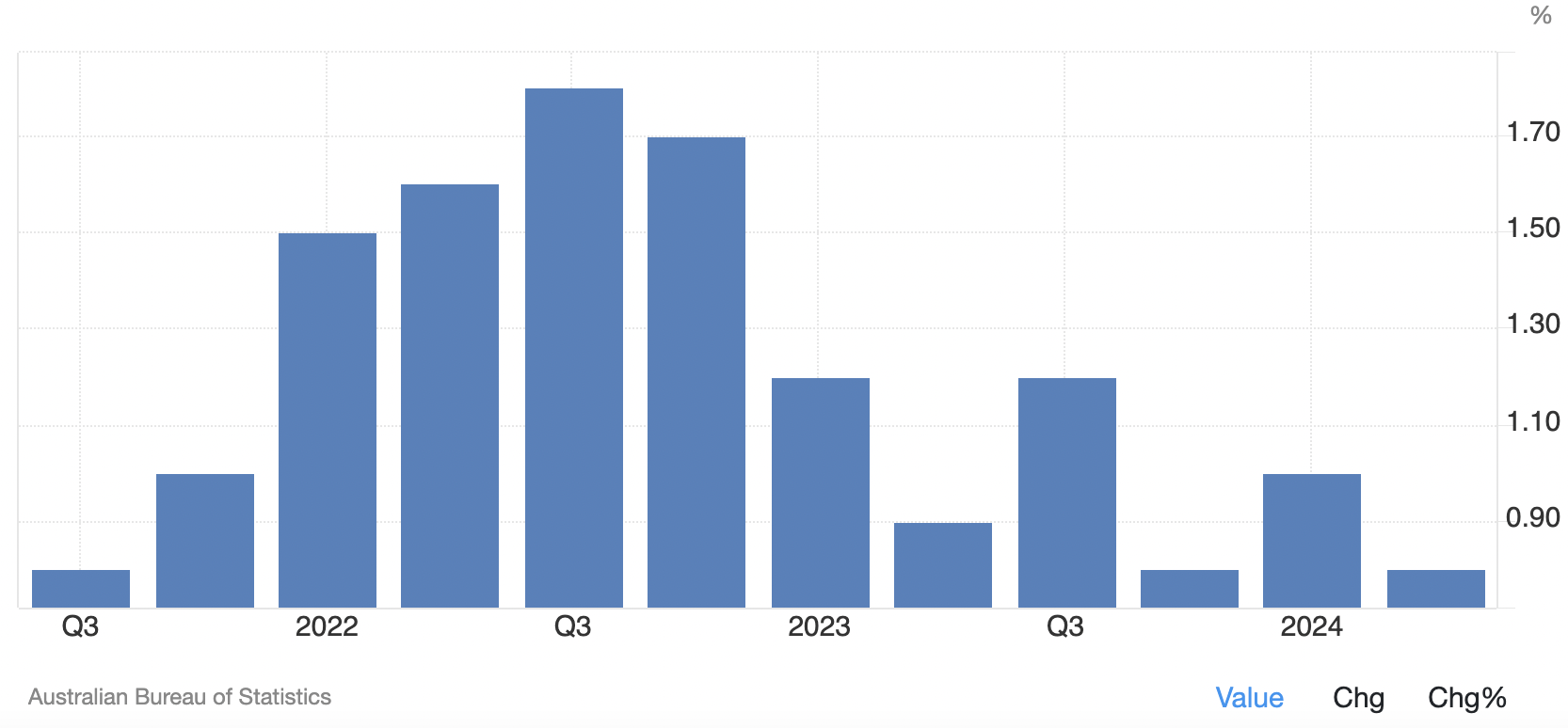

The dollar/yen had one of the largest intraday moves in a year, The dollar/yen had a huge decline in July, breaking below the key Y152 support level and testing the primary uptrend. Whilst a near-term rebound is probable, the dollar yen is likely headed lower with the BOJ and US Fed now heading in opposite directions… The US dollar index also came under pressure, with the primary uptrend being tested at 104. I continue to have high conviction that the US dollar is set to weaken markedly over the second half of the year. A confluence of factors, including a resurgent yen, narrowing rate differentials, and a stronger euro and pound, will likely be the catalysts behind the move. Looking further out over the longer term, there are a host of other factors that will weigh on the dollar. The weaker dollar was good for commodities, and notably copper which surged +2.6% to 419. But what really stood out was the big rise in oil and precious metals after Iran threatened a retaliatory strike on Israel, in a clear sign that the conflict is escalating. WTI surged +5% to $78.50 while Brent was +2.7% higher at $80.72. – Comex gold futures +1.73% to $2494 while spot prices added 1.54% to $2,447. Australian spot gold touched $3750 and is close to making new historic highs. Silver, platinum and palladium added between 2% and 4%. The VIX fell by close to 8% to 16.5. A weaker US dollar was one catalyst for the move in gold. But escalating tensions between Iran and Israel also played a role in Wednesday’s move. According to reports in the New York Times, Iran’s leader Ayatollah Ali Khamenei has ordered a direct strike on Israel in retaliation for what it said was the assassination of Hamas’ top leader while in Tehran. Iran is fuming that this occurred on their back door. If carried out, a direct strike risks further tilting the region toward a wider conflict. The NYT report said that Iranian commanders are considering a combination of drones and missiles on military targets around Tel Aviv and Haifa. In terms of price action, spot gold has broken out above near-term resistance and has extended higher to retest the record highs. With the US dollar now weakening and looking sluggish against the major currencies, the stage is set for potentially new record highs. Financial flows (as opposed to central bank buying, which has been the primary driver over the past few years) into the sector could soon provide the impetus for the next leg higher and bull market advance. Meanwhile, as a sector, gold and precious metal mining equities remain significantly underowned and are also due a rally. Moving on, Goldman Sachs CEO David Solomon reversed his position in a CNBC interview on Tuesday. He has long said that the Fed was unlikely to cut rates at all in 2024. Now he’s predicting one or two cuts into the end of the year as economic data becomes more aligned. “I’ve been more cautious about interest-rate cuts all year than the general consensus. When I now look at the data and the way things are setting up, I think the perspective of one or two cuts in the fall seems more likely.” I would argue there could be three cuts, and we will know more after Friday’s labour report, which could come in quite weak. Mr Solomon highlighted that his position had changed following recent changes in consumer spending habits in response to inflation. “There’s no question there are some shifts in consumer behaviour, and the cumulative impact of what’s been kind of a long inflationary pressure, even though it’s moderating, is having an effect on consumer habits.” While two rate cuts are now consensus, there is scope for three if the unemployment rate were to push up above 4.1%. Weaker labour market data will, going forward, place downward pressure on the US dollar. Meanwhile, the US earnings season continues to roll on and deliver, pointing to a still resilient economy. According to Factset, prior to the June reporting season, expectations were for revenues to grow at c4.5% and earnings to grow at c8.5%. With 41% of the SPX reporting, revenue growth is closer to 5%, and earnings growth is closer to 10%, according to Factset. Net profit margins have also improved to 12.1% vs 11.8% in the previous quarter, which is above the five-year average of 11.5%. Surprisingly, the notable sectors are Financials (15% EPS growth vs. 4.3% survey) and Energy (-80bps EPS growth vs. +13.3% survey). Overall, this is shaping up to be the best quarter since 4th quarter of 2021 in terms of absolute growth. This is encouraging and will underpin the bull market run into the end of the year. Turning to China and the large diversified miners (with BHP and Rio being notably weak this month), yesterday’s AFR featured an insightful interview with Rio CEO Jakob Stausholm. Given the weakness in iron ore spot prices and uncertainty around China, it is always interesting to hear what the big mining CEOs have to say about Australia’s largest customer and the biggest global consumer of raw materials. The AFR cited yesterday that “given the obvious issues confronting China – a property bubble that’s popped, extreme volatility in financial markets, a deflationary malaise and a new and worrying bubble building in the bond market – the Rio boss is remarkably sanguine about the risks to growth from a country that accounted for 58.1% of Rio’s sales in the June half, well ahead of the US on 16%.” The AFR reported Mr Stausholm saying “China has recognised the problems in its property sector, which has caused annual steel demand from the industry to fall by 100 million tonnes over the past three years. But infrastructure, manufacturing and heavy investments in industries linked to the green transition are filling the gap; demand from the green transition is now 40 million tonnes a year. China’s annual economic growth target, is still 5 per cent a year. While European industrial production has softened, this is not the case in China or the US.” These are all fair points made by Mr Stausholm, and whilst iron ore has been weak, it hasn’t fallen off a cliff. The rollout of AI and the renewable energy transition are going to require an enormous amount of raw materials in my view, that could underpin a secular bull market in commodities for some time. A weaker US dollar could also drive demand and prices higher over the coming year. Aside from all the negative sentiment around China’s economy in the media, Mr Stausholm’s view provides a clearer window into what is really going on in the world’s second largest economy. With China’s property market stabilising, it is likely only a matter of time before consumer spending returns with gusto, which could provide the next leg higher in what is still very cheap and depressed equity market. According to JP Morgan, iron ore “is currently resting on the cost curve, where there material supply is likely to curtail should spot drop much lower. Further, as we outlined in our recent iron ore review, we don’t see a material change to the shape of the cost curve until Simandou enters the later stage of its ramp up in 2027/28 (assuming it’s delivered on time). This provides a multi-year window where iron ore prices should remain elevated.” Iron ore prices continue to respect the primary long-term uptrend, which is encouraging. The technical setup favours a decent rebound off support and the uptrend in the second half of the year. Elsewhere, BHP is spending US$2.1bn to form a 50/50 JV with Lundin Mining to hold both the Filo del Sol and Josemaria copper projects in Argentina. This will be done via BHP & Lundin agreeing to acquire Filo Mining, and Lundin then selling a 50% stake in Josemaria to BHP for $690m. The fact that BHP has moved so soon after the failed Anglo bid earlier this year – is telling about the world’s largest copper miner and their bullish view on where prices are headed! Copper has staged a decent rebound and upward dynamic off key support this week, which is encouraging. More consolidation will likely ensue, but an advance back above $4.40 would be a positive sign that upward momentum is returning. Turning to the Fed decision and commentary, the data released on Wednesday suggested the US labour market cooled in July, bolstering the case for a rate cut in September. Mr Powell clearly said this was the case in his press conference, saying that if data provides the Fed confidence inflation continues to cool, “a reduction in our policy rate could be on the table as soon as the next meeting in September.” Meanwhile, the FOMC statement was slightly more dovish than in prior months. On the data, the ADP employment report showed private sector employers added 122K jobs in July, well below the 155K in June and below expectations of 150K. Pay rises also slowed. Annual pay hikes cooled to 4.8%, the slowest in three years and down from 4.9% in June. For job switchers, pay growth eased to 7.2% from 7.7%. Separately, pending home sales increased 4.8% monthly in June, marking the first increase in a few months. Slightly lower mortgage rates provided a boost. Pending home sales change – likely to continue improving from here as mortgage rates decline Source: Trading Economics This bodes well for the broader housing ecosystem, including home builders like D.R. Horton -0.3%. Although trading at record highs, the valuation is undemanding and margins impressed even amid the recent headwinds. In my last comment on DHI, I noted: “DHI has rebounded dynamically off the key $130 support level and reasserted to the upside. The bullish technical outlook on DHI remains firmly intact.” This has clearly been the case, with DHI rallying over 35% to make a new record high. Mega-caps drove the benchmark indices higher on Wednesday. Treasury yields declined, and AMD’s commentary helped renew AI optimism, for chipmakers at least. Meanwhile, Morgan Stanley named Nvidia as their top American chip pick and the semiconductor goliath surged +12.8%, rebounding from recent weakness. Competitor AMD gained +4.4% after a solid quarterly beat and upbeat forecast. The element of the results and guidance that excited investors the most was AI-related. Data Centre sales more than doubled (+115%) to $2.8 billion, and management lifted related sales guidance. The iShares Semiconductor ETF rallied +6.7%. Although Nvidia stood out, most Mag 7 names gained, including impressive advances from Tesla +4.8%, Amazon +2.9% and Meta +2.5%. Microsoft was the exception, dipping -1.1%. I wrote about Microsoft’s quarterly report yesterday. Group numbers beat, but traders were underwhelmed by slower-than-expected growth for the cloud business, casting doubts on the tech titan’s massive AI-related spending. Meta extended gains in after-hours trading after a beat-and-raise quarter. Revenue grew 22% to $39.1 billion, above the $38.3 billion consensus. Ad revenue is faring well, suggesting market share gains. Net income jumped 73% to $13.47 billion as the company laid off thousands, and capex was below expectations. The wave of corporate results continued. Arista Networks shares jumped more than 11% after the networking company’s second-quarter results surpassed market expectations. Match Group rallied +13% after 2Q numbers beat and plans to streamline some services. Starbucks warmed up +2.7% despite a revenue miss as China same-store sales dived 14%. Earnings matched expectations. Activist investor Elliott Management recently joined the share register. Kraft Heinz gained after the company reported better-than-expected second-quarter adjusted earnings, although revenue came in below expectations. Chemical giant DuPont de Nemours advanced after 2Q figures beat. Pinterest shares plunged over 14% after the social media company’s forward guidance fell short of estimates. That overshadowed a 2Q earnings and revenue beat. Vistra’s stock surged nearly +15% following the Nuclear Regulatory Commission’s approval to continue operating the Comanche Peak Nuclear Power Plant, extending its operations through 2053. That helped boost uranium-related exposures, like the Sprott Physical Uranium Trust +4.6% and Global X Uranium ETF +3.9%. Elsewhere, precious metals exposures rallied as gold prices shone. The VanEck Junior Gold Miners ETF (US:GDXJ) rose +3%. GDXJ is reasserting to the topside after several months of consolidation above key support. A retest of the highs above $48 and breakout are probable in coming months, with gold reasserting and gold miners generally under-owned by investors. On Wednesday, the ASX 200 leapt 139 points, adding +1.75%, to reach a new all-time high of 8092. I am convinced that Australian equities are in a new bull market, and yesterday’s inflation data helped. While some commentators continue to see a rate hike, I believe fervently that is very much off the table, and the next move will be downward in the cash rate. It was a big day in the Australian financial markets. The A$ spot gold price is testing historic record highs above A$3750 following a big drop in the Aussie dollar following the CPI release – more below. Australian bonds had one of their best days with big rallies across the yield curve. The 2yr and 5yr bond yield dropped over 22 bps. As foreshadowed earlier, the Australian 2-year bond yield has broken down below the primary uptrend and fell dynamically below 4% to 3.88% yesterday. The downside break marks an important reversal pattern for the Australian 2yr and other bond maturities. Yields are likely to fall markedly over the coming six months in my view, as the RBA prepares to ease monetary policy later this year. Yesterday’s rally marked the best daily percentage increase since November 2022, and the index closed at the high, indicating strength. Gains were broad-based, with all sectors climbing. In the broader ASX 300, only 18 stocks fell, while 262 gained. The catalyst was cooler-than-expected inflation data, which squashed the likelihood of rate hikes from the RBA and saw money market bets jump for a first rate cut by Christmas jump. I believe there is a chance the RBA might even move before then. SPI futures are pointing to a 0.21% gain on the open. The RBA’s preferred inflation measure (trimmed mean inflation) declined to an annual 3.9% in the June quarter, down from 4%. Investors were even happier that the quarter-on-quarter rate came in at 0.8%, down from 1%, and better than expected, to be unchanged or 0.9%, depending on the survey. Trimmed mean CPI (QoQ) – Investors breathed a sigh of relief. Separately, retail sales increased by 0.5% in June, well above expectations for a 0.2% increase and almost matching the four-month high of 0.6% growth in May. All eleven broad ASX sectors glowed green, with rate-sensitive stocks rallying hard after the recalibration of interest rate path expectations. Technology +2.52%, energy +2.47% and consumer discretionary +2.28% led the gainers. The least strong advancers were utilities +0.15%, healthcare +0.75% and consumer staples +0.76%. While gains were broad-based in the tech space, Xero +2.9%, Technology One +5.2% and Audinate +3.8% outperformed. Wesfarmers +2.8%, JB Hi-Fi +4.3%, Kogan +6.6%, Nick Scali +4.7% and Harvey Norman +5.3% featured in the consumer discretionary group. The prospect of some interest rate relief will certainly be welcome for retailers, and the June retail figures showed resilience. Energy stocks benefited from a rebound in crude oil prices, which climbed on geopolitical tensions. Woodside Energy rallied +2.7%, and Santos increased +2%. Among coal miners, Whitehaven Coal edged up +1.2%, while New Hope Corporation gained +3.6%. Uranium stocks also saw positive movements, with Paladin Energy up +3.1%, Boss Energy rising +4.6%, and Deep Yellow surging +5.7%. The materials sector gained +2.2%, taking fourth place on the sector table. Lower rates spur economic activity. Higher iron ore prices offered support, with BHP climbing +1.8%, and Fortescue rebounding +3.2% following a sharp decline earlier in the week. Rio Tinto gained +2.5% after reporting a solid set of half-year metrics. Underlying revenue topped expectations, EBITDA matched and underlying NPAT was a slight beat. The interim dividend was a modest disappointment, remaining unchanged at 177cps compared to expectations for 179cps. Debt came down and guidance was maintained. A solid result overall and Rio has some growth projects going to chip in over the next few years. See above for more comments on Rio’s CEO and view of how China’s economy is performing. In our last technical update on Rio in mid-July, we noted that, “Our base case technical outlook for Rio remains unchanged. The stock remains within a consistent uptrend and has found support at $116 following the recent corrective pullback. The technical setup continues to skew to the bull side, with a resumption in upward momentum and an eventual retest of the resistance level at the record highs anticipated over the coming year.” If we are right in our technical and fundamental outlook that iron ore and copper are bottoming out and reasserting to the topside, then all things being equal, Rio should respect the consistent uptrend and soon reassert to the topside to challenge the record highs. Gold miners fared well on Wednesday, with the prospect of lower rates being catnip and shorts likely covering: Northern Star rose +1.4%, Newmont added +1.9%, and Evolution Mining advanced +1.6%. However, it was the small and mid-caps that posted firmer gains. St Barbara +7.1% and Genesis Minerals +3.5% closed firmly. Copper stocks also saw strong gains, with Sandfire Resources up +4.1%, 29Metals jumping +8.1%, and the Global X Copper Miners ETF increasing +2.6%. Following a multi-month consolidation this year, the A$ spot gold price has found support and reasserted to the topside to challenge the record highs above $3750. The bull market advance in spot A$ gold prices remains firmly intact. I expect new record highs and a possible test of the $4000oz this year. Meanwhile, domestic gold miners are not only under-owned by domestic investors (and notably institutions) but continue to screen very cheaply on valuation. The financial sector saw solid gains among the big four banks. Commonwealth Bank surged +1.1%, overtaking BHP as Australia’s most valuable company with a market capitalization of $230 billion. CBA’s inexorable rise has been a headscratcher for many due to its tag of being named the world’s most expensive bank. Yet, the stock has continued to power north. Westpac advanced +2.5%, NAB rose +1.8%, and ANZ gained +1.9% and the big four has been an important factor driving the benchmark higher YTD. On a quiet day for corporate news, Origin Energy slipped -1.0% as its quarterly update showed coal costs surged more than expected. SiteMinder gained +2.4% after solid subscriber growth, adding 2.9k subs in 2H24. Total subs increased 14% annually to 44.5k. The company’s solutions are designed to cater to a wide range of accommodation providers, from small boutique hotels to large international chains. Chalice Mining popped +8.5% on a Gonneville project site tour/presentation. In addition, the quarterly filed on Tuesday showed plenty of cash in the bank. Elsewhere, Charter Hall +6.9%, Stockland +3.6% and Qantas posted solid outperformance. Jupiter Mines -7.6%, Rox Resources -6.7% and Omni Bridgeway -3.3% glowed red. Turning to Asia, as noted earlier, the big news yesterday was in Japan. After the BOJ aggressively lifted the benchmark rate to 0.25% (previously 0-0.1%) and Governor Kazuo Ueda acknowledged that the yen’s weakness had played a role in the decision, the yen rallied hard. The Nikkei gained +1.49%, and the broader Topix advanced +1.45%. This was impressive as the moves coincided with the much firmer yen. Financials soared on the rate hike. The BOJ also announced it will gradually slow the pace of government bond buying to ¥3 trillion (US$20b) monthly by early 2026. Mr Ueda’s comments suggested the BOJ stands ready to hike again should the data move in line with the central bank’s forecasts. Another hike could be on the cards before year’s end. The yen surged against the greenback to around 150.9 in late afternoon trade (from 154.9 a day earlier). The 10-year JGB yield rallied 6bps to 1.055%. Banks, insurers and brokerages surged. Digital bank SBI Sumishin +8.8% rebounded, while Resona Holdings +6.7%, Mebuki Bank +6.4% and Concordia Financial +5.3% led the banking group. Japan’s largest brokerage, Nomura, gained +3.4% and recently exceeded consensus expectations in the latest 1Q earnings update. Net income tripled to ¥68.9 billion (vs expectations of ¥56.6b) on the back of robust momentum in wealth management – which reported an 84% jump in pretax profit. The strong stock market in Japan has been a major driver but the focus on Wealth Management, which has ‘stickier’ revenues, is also beginning to pay off. In our last technical update on Nomura back in early July, we noted “Since consolidating above Y900 and establishing a solid support base above this level, Nomura has good prospects of retesting the Y1000 resistance and breaking out in the coming months. Once the Y1000 level has been cleared on the topside, Nomura could quickly extend higher “and close the gap” to retest the Y1300 level which is near the target price of investment banks that include Morgan Stanley and JP Morgan.” Our technical outlook for Nomura remains the same. The base case is for a breakout above Y1000 to ensue in coming months, which would raise the scope for another leg higher and a retest of the next key resistance level at Y1300. Gains were broad-based in Japan, with heavyweight semiconductor exposures rallying after American chip firm AMD lifted its AI-related guidance after the market close on Tuesday. Tokyo Electron +7.4%, Screen Holdings +9.2% and Disco Corp +5.8% featured in the top gainers table. While advancers greatly numbered decliners, some companies that benefit from a weaker yen traded lower. They included Toyota -1.6% and department store Isetan Mitsukoshi -1.3%. It was a case of bad economic news being good for stocks day in greater China. The CSI 300 +2.16% tracking large caps in mainland China and Hang Seng +2.01% gained after weak PMI data spurred hopes of additional stimulus measures being forthcoming from Beijing. Manufacturing activity in mainland China contracted for the third consecutive month, as the official PMI dropped to 49.4 from June’s 49.5. The services PMI dipped to 50.2 from 50.5, although remained marginally in expansion. The soft data prompted hopes that Beijing will step up to the plate with more policy support measures over coming months. Wednesday’s advance pared the Hang Seng’s monthly loss to 2.1%, and some technical indicators suggest the index is hovering around oversold levels. Yesterday’s upward dynamic for the Hang Seng was encouraging. We need to see further follow-through on the upside in coming weeks, but our base technical case of an early-stage bull market is holding up, in my view. New bull markets are born on despair, which is certainly the case regarding sentiment around the China/Hong Kong economy. In Hong Kong trading, HSBC Holdings jumped 4.6% after unveiling a US$3 billion buy-back plan and reporting stronger-than-expected earnings. On the other hand, the smaller Hang Seng Bank fell 5.8% after reporting a rise in its non-performing loans ratio, stemming from troubled commercial real estate. China Oilfield Services +5.2% and China Petroleum +3.7% benefited from a rebound in oil prices on geopolitical tensions. Higher gold prices lifted precious metals miner Zhaojin +4.3%. Big tech stocks enjoyed firm bids, with Sunny Optical +5.15%, Kuaishou +4%, Meituan +2.7% and NetEase +2.5% leading the group. London’s equity benchmarks closed on a positive note, with the FTSE 100 rising by +1.13% to 8,367.98 points and the FTSE 250 climbing +0.78%. The market’s robust performance was supported by gains in the mining and energy sectors, tracking a rise in copper and oil prices. There were no major local economic releases, but traders seemed cautiously upbeat about the prospects for a first rate cut from the BOE tomorrow. That was despite a surprise uptick in Eurozone inflation (more on that shortly). Rio Tinto added +1.8% following a solid set of 1H numbers and as copper prices rose. The latter lifted Antofagasta +4.6%, Anglo American +3.2% and Glencore +3.2%. Glencore reported declines in 1H24 production as coal production fell by 7% due to scheduled mine closures and rail constraints in South Africa. Copper, nickel, zinc, and cobalt production also saw slight declines. The positive market response likely stemmed from management keeping FY24 guidance unchanged and saying news on the potential demerger of its coal and carbon steel materials business is expected next week. In our last technical update on Glencore back in June, we noted that “Turning to the charts, while rangebound, Glencore has found support above 450p…The technical setup favours a retest of the top of the range and resistance at 500/510p level. Given the favourable setup for commodities and copper, Glencore is well placed for an eventual topside breakout.” Glencore did, in fact, break below the 450p support level to quickly retest the primary support level at 400p. The stock needs to reclaim the 450p level and break above 500p to have conviction that the multi-year consolidation is at a close. Whilst higher commodity prices (our base case) will be supportive of this, Glencore needs to clear big resistance at 500p to have conviction of an inflection and that upward momentum is returning. The technical setup for competitors Rio and BHP screens more bullish. BP +1.6% and Shell +2.7% tracked higher oil prices that were buoyed by geopolitical concerns in the Middle East. Shell reports on Thursday. HSBC Holdings was a standout performer, gaining +4% after announcing a $3 billion share buyback and reporting better-than-expected interim profits. Just Eat Takeaway surged +8.4% after backing its 2024 guidance and announcing a £150 million share buyback. Taylor Wimpey edged up +0.5% despite reporting a drop in first-half profits as this was overshadowed by a favourable upward revision of its full-year completions forecast. On the downside, GSK slipped -2%, despite raising its annual forecast and delivering strong second-quarter results. The fall was attributed to an underwhelming performance in its Vaccine arm and disappointing Shingrix sales. InterContinental Hotels Group dropped 3.0% after peer Marriott International cut guidance and warned of softer trading conditions in China and North America. On the continent, headline Eurozone inflation rose slightly more than expected in July, increasing to an annual rate of 2.6%, up from 2.5% in June. This was higher than the anticipated 2.4% and will probably give the ECB pause at their next meeting. Core inflation remained steady at 2.9% for the third consecutive month. Services and food inflation eased slightly. Separately, Germany saw a higher-than-expected rise in unemployment in July, indicating ongoing economic struggles. Regional bourses were mixed. At the close, the pan-European Stoxx 50 was up +0.66%, Germany’s DAX added +0.53%, while France’s CAC 40 grew +0.76%. Italy’s FTSE MIB retreated -0.43%, while Spain’s IBEX 35 declined -1.23%. Carpe Diem! Angus Disclosure: Fat Prophets and its affiliates, officers, directors, and employees may hold an interest in the securities or other financial products relating to any company or issuer discussed in this report. Fat Prophet’s disclosure of interest related to Investment Recommendations can be provided upon request to members@fatprophets.com.au.